DeFi is still the Wild West in 2025, but the stakes have never been higher. With Ethereum holding steady at $3,847.47 (down 5.58% in the last 24 hours), protocol security is front and center for every builder, investor, and user. We’ve seen too many projects lose millions overnight to exploits that could have been prevented with the right safeguards. If you’re serious about DeFi, these are the seven best practices you can’t afford to ignore.

1. Comprehensive Smart Contract Audits by Multiple Independent Firms

Let’s face it: a single audit just doesn’t cut it anymore. The most resilient protocols now engage multiple independent security firms to audit their smart contracts before launch and after every major upgrade. Why? Because no one team catches everything, and fresh eyes spot what others miss. Even with formal verification tools getting more powerful, human review is irreplaceable. If your DeFi protocol isn’t getting stress-tested by several top-tier auditors, you’re rolling the dice with user funds.

2. Continuous On-Chain Monitoring and Automated Threat Detection

Security isn’t a one-and-done deal. With exploits evolving faster than ever, real-time on-chain monitoring is non-negotiable. The best teams run automated threat detection bots that watch for suspicious activity 24/7, think flash loan attacks, price manipulation, or abnormal contract calls. When an anomaly pops up, these systems can trigger circuit breakers or freeze contracts to prevent a full-blown hack. It’s like having a digital security guard on duty at all times.

3. Implementation of Multi-Signature Governance for Protocol Upgrades

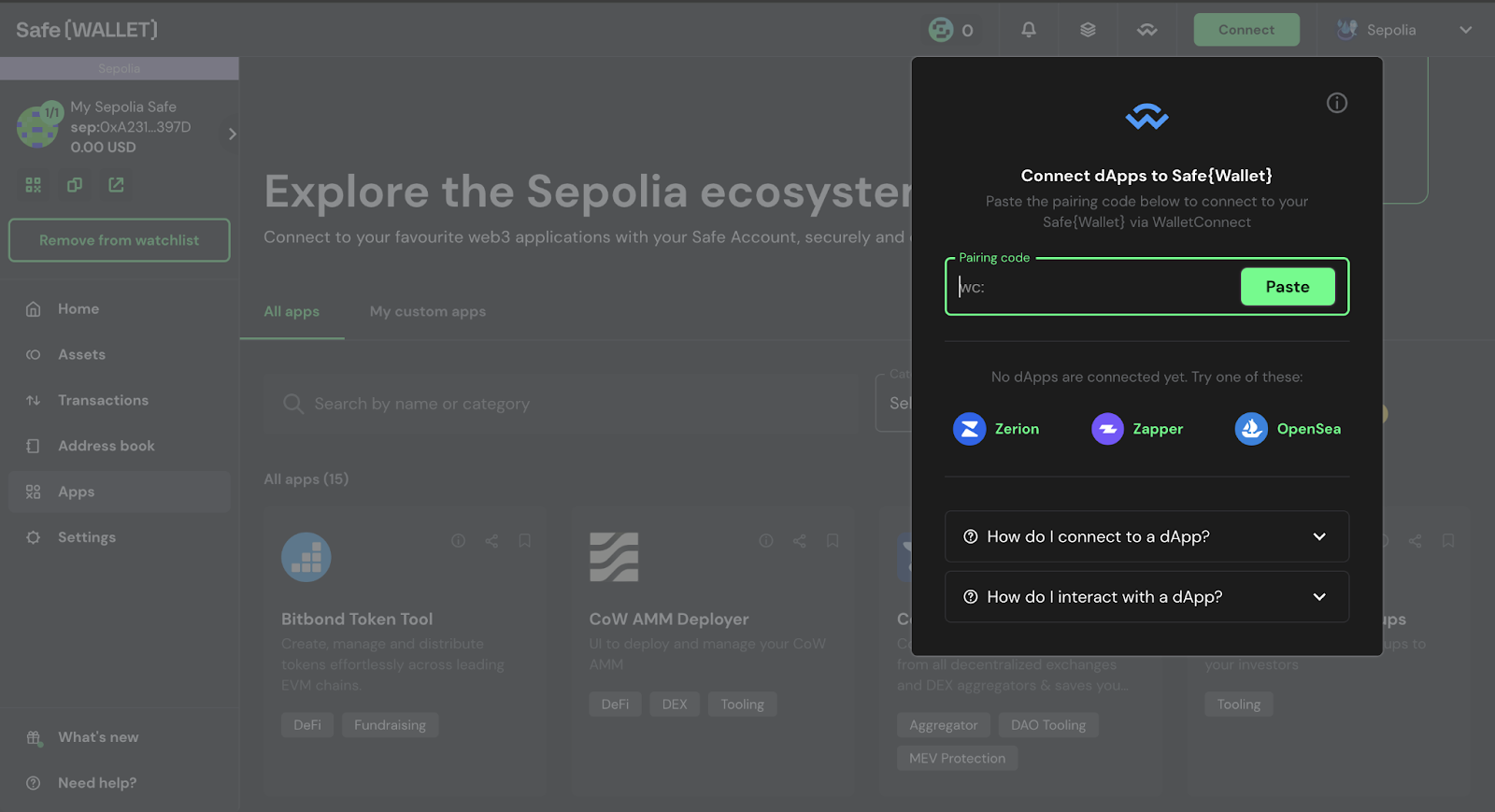

Single-signature admin wallets are a relic of the past, and a hacker’s dream. Modern DeFi protocols rely on multi-signature (multi-sig) governance for any upgrades or critical operations. This means no single person can push through a change or drain funds; instead, a group of trusted signers (often including community reps) must approve every action. It’s a simple step that dramatically reduces the risk of rogue actors or compromised keys causing chaos.

Ethereum (ETH) Price Prediction Table: 2026–2031

Comprehensive ETH price outlook incorporating DeFi security best practices and evolving market scenarios (baseline: $3,847.47 as of October 2025)

| Year | Minimum Price | Average Price | Maximum Price | % Change (Avg, YoY) | Scenario Insights |

|---|---|---|---|---|---|

| 2026 | $3,100 | $4,250 | $5,800 | +10% | Continued DeFi adoption, incremental security improvements, moderate regulatory clarity. Downside risk if a major DeFi exploit occurs. |

| 2027 | $3,400 | $4,800 | $7,200 | +13% | Layer-2 scaling and cross-chain interoperability boost network growth. Upward momentum if ETH staking remains attractive. |

| 2028 | $3,900 | $5,600 | $8,900 | +17% | Mature DeFi security standards and insurance adoption drive higher institutional participation. Mild correction possible if global regulations tighten. |

| 2029 | $4,500 | $6,300 | $10,500 | +13% | ETH as a base layer for tokenized assets and real-world applications expands utility. Competition from alternative L1s could limit upside. |

| 2030 | $5,000 | $7,200 | $12,000 | +14% | Decentralized governance and advanced monitoring reduce high-profile hacks, fostering mainstream confidence. Bearish case: persistent macroeconomic headwinds. |

| 2031 | $5,500 | $8,200 | $14,500 | +14% | Widespread DeFi integration, robust on-chain security, and cross-industry adoption. Max scenario assumes global regulatory harmonization and breakthrough dApp innovation. |

Price Prediction Summary

Ethereum is projected to maintain a steady upward trajectory from 2026 to 2031, with average prices rising from $4,250 to $8,200. The implementation of advanced DeFi security best practices is expected to bolster user trust and institutional adoption, although risks from regulatory shifts and competitive platforms remain. Price ranges reflect both bullish adoption scenarios and potential setbacks from security incidents or market corrections.

Key Factors Affecting Ethereum Price

- Adoption of DeFi security best practices (audits, bug bounties, insurance)

- Layer-2 and cross-chain scalability improvements

- Regulatory clarity and global policy alignment

- Institutional entry and real-world asset tokenization

- Competition from other smart contract platforms (Solana, Avalanche, etc.)

- Macro-economic environment and crypto market cycles

- Advances in on-chain monitoring and anomaly detection

- User confidence following reduced high-profile hacks

Disclaimer: Cryptocurrency price predictions are speculative and based on current market analysis.

Actual prices may vary significantly due to market volatility, regulatory changes, and other factors.

Always do your own research before making investment decisions.

4. Mandatory Bug Bounty Programs with Transparent Disclosure Policies

If you want hackers on your side, pay them to find your bugs before the bad guys do. Mandatory bug bounty programs are now standard for any serious DeFi project. The key? Set clear rules, offer meaningful rewards, and make your disclosure process transparent so white-hats feel safe reporting issues. This crowdsourced approach uncovers edge-case vulnerabilities that audits sometimes miss, and fosters a security-first culture around your protocol.

Top 7 DeFi Protocol Security Best Practices (2025)

-

Comprehensive Smart Contract Audits by Multiple Independent Firms: Engage reputable auditors like ConsenSys Diligence, Trail of Bits, and OpenZeppelin for thorough, independent code reviews. Multiple audits help uncover hidden vulnerabilities and ensure robust smart contract security.

-

Continuous On-Chain Monitoring and Automated Threat Detection: Leverage platforms like Forta and Chainalysis for real-time transaction monitoring, anomaly detection, and automated alerts to quickly respond to suspicious activity or exploits.

-

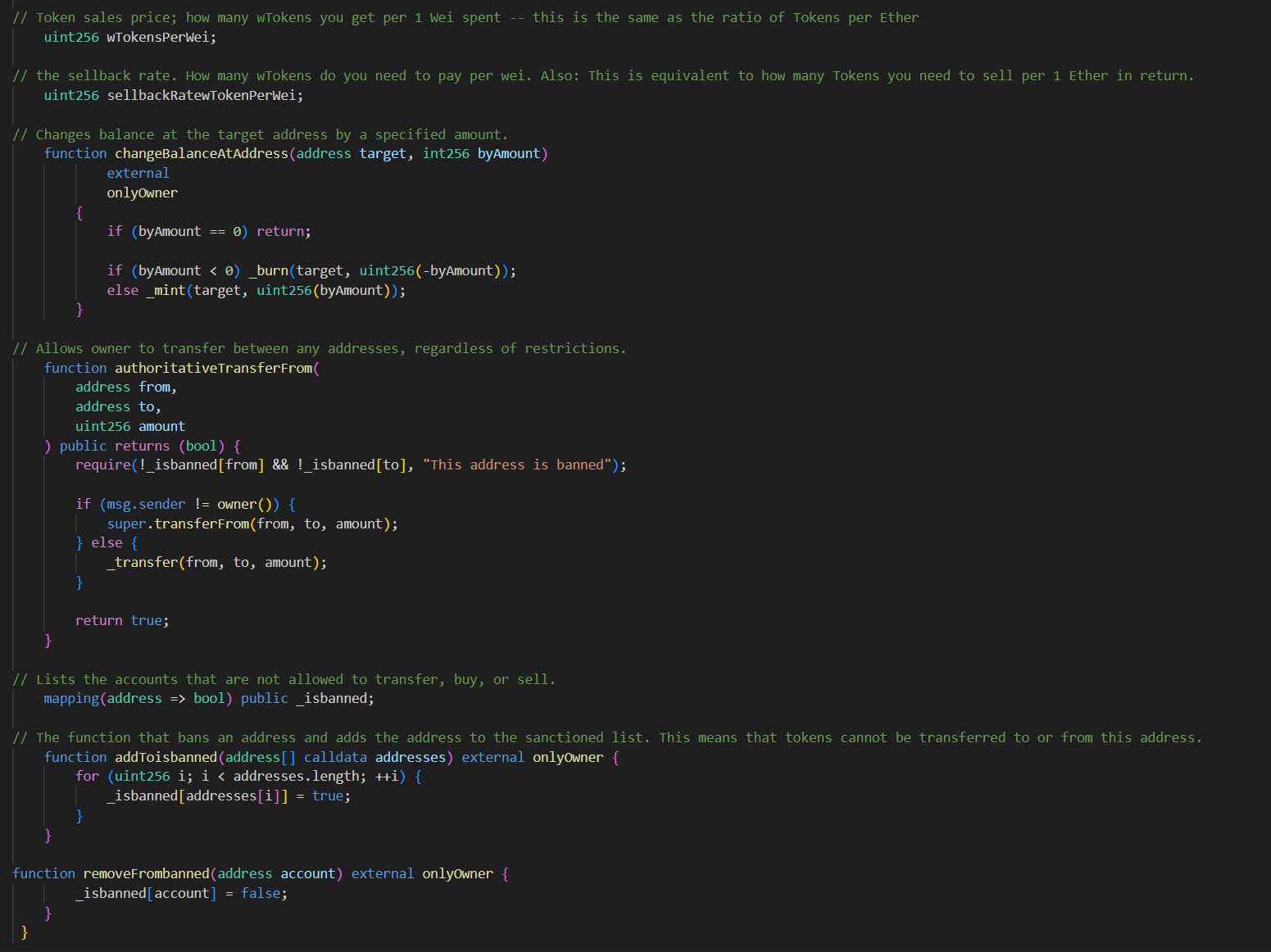

Implementation of Multi-Signature Governance for Protocol Upgrades: Use established solutions such as Gnosis Safe to require multiple independent approvals for protocol changes, reducing single points of failure and improving upgrade security.

-

Rigorous Access Control and Privilege Management: Implement role-based access controls using tools like OpenZeppelin Contracts to strictly manage who can deploy, upgrade, or interact with critical protocol functions.

-

Regular Dependency and Library Updates to Patch Vulnerabilities: Stay current by updating to the latest audited versions of libraries such as OpenZeppelin Contracts and monitoring for advisories from sources like GitHub Security Advisories.

-

User-Facing Security Education and Phishing Prevention Tools: Integrate educational resources and tools like MetaMask’s phishing detection and Chainabuse to empower users against scams and social engineering attacks.

Why These Practices Matter Right Now

The market’s volatility, like today’s sharp ETH drop to $3,847.47, reminds us just how quickly fortunes can change in DeFi. Protocols that cut corners on security are tempting fate, risking user trust and their own survival. In the next half of this guide, we’ll break down three more must-have strategies: rigorous access control, dependency management, and user education tools that make phishing attacks a thing of the past.

5. Rigorous Access Control and Privilege Management

One compromised admin, and it’s game over. That’s why rigorous access control is non-negotiable for every DeFi protocol in 2025. Limit who can deploy, upgrade, or pause contracts, and use granular privilege management to ensure each role has only the minimum permissions required. Rotate keys regularly, keep sensitive credentials offline, and audit admin activity logs for any red flags. This isn’t just about keeping out hackers, it’s about protecting users from insider mistakes or malicious actors, too. If you’re not treating access control like a potential single point of failure, you’re leaving the door wide open.

6. Regular Dependency and Library Updates to Patch Vulnerabilities

DeFi protocols don’t exist in a vacuum, they rely on open-source libraries and dependencies that are constantly evolving. Every week brings new vulnerabilities to light, and outdated code is a hacker’s playground. The best teams have automated processes to track, audit, and update dependencies as soon as patches are released. Don’t just set it and forget it: monitor critical libraries for upstream security advisories, and test updates in staging before deploying to mainnet. A single unpatched bug in a third-party dependency can undermine even the best-audited codebase.

7. User-Facing Security Education and Phishing Prevention Tools

Let’s be real: even the most secure protocol can’t protect users from themselves if they fall for phishing scams or approve malicious transactions. That’s why leading protocols now invest heavily in user-facing security education: think interactive guides, scam alert pop-ups, and built-in transaction simulators that flag suspicious activity before it happens. Some projects even offer browser extensions that warn users if they’re visiting fake sites or signing risky messages. Empowering your community to spot threats is just as important as bulletproofing your contracts.

Putting It All Together

The protocols that thrive through bear markets and black swan events are those that treat security as an ongoing process, not a checklist item to tick off before launch. Comprehensive smart contract audits by multiple independent firms, 24/7 on-chain monitoring, multi-sig governance, mandatory bug bounty programs with transparent disclosure policies, rigorous access controls, regular dependency updates, and relentless user education: these aren’t optional extras anymore, they’re table stakes for anyone serious about DeFi in 2025.

If you want to build trust and stay relevant while ETH bounces around $3,847.47, make these best practices your north star.

For a deeper dive into implementing these strategies or to see how top protocols are putting them into action right now, check out our full resource at /defi-protocol-security-best-practices-in-2025. Stay sharp out there, security is the ultimate alpha.