Base chain’s explosive growth in 2024 has transformed it into a hotbed for memecoin innovation. While Ethereum and Solana still dominate headlines, Base’s low fees and robust developer ecosystem have incubated a new generation of tokens—many with viral meme appeal and surprisingly strong communities. But how do you actually find the best Base memecoins before they moon, and what sets this ecosystem apart from its rivals?

Why Base Memecoins Are Gaining Traction

At first glance, memecoins may appear as speculative assets driven by hype. However, on Base, these tokens are evolving into more than just jokes. The Base network offers ultra-low transaction costs (often under $0.01), which is crucial for traders who want to move in and out of positions without losing profits to gas fees. Additionally, the Base community is known for its collaborative ethos—many projects are open-source or community-led, fostering rapid iteration and viral growth.

This environment has given rise to a unique flavor of memecoins: tokens that combine irreverent branding with innovative tokenomics or utility features. Some even offer staking rewards, NFT integrations, or governance mechanisms that rival more “serious” DeFi projects on other chains.

How To Identify High-Potential Memecoins on Base

The sheer volume of new launches can be overwhelming. To separate signal from noise, you need a clear framework:

Key Factors for Evaluating Base MemeCoins

-

Liquidity: High liquidity ensures you can buy or sell memecoins without significant price slippage. Look for projects with substantial trading volume and deep order books.

-

Community Activity: An active, engaged community often signals strong project support and potential for growth. Analyze social media channels, forums, and community events.

-

Developer Transparency: Transparent teams regularly update the public with development progress, audits, and roadmaps. Favor projects with doxxed teams and open communication.

-

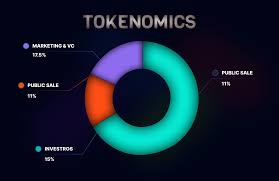

Tokenomics: Well-designed tokenomics prevent excessive inflation and ensure fair distribution. Review supply caps, vesting schedules, and allocation breakdowns.

-

Security Measures: Projects with audited smart contracts and robust security protocols reduce the risk of hacks and exploits. Always check for third-party audit reports.

Pay close attention to liquidity: thin order books can make it easy for whales to manipulate price action. Community engagement is another leading indicator—look for active Discords or Telegrams where real discussion happens (not just bots). Finally, check if the project’s smart contracts have been audited or if the team is at least partially doxxed; while anonymity is common in crypto, some level of transparency inspires more confidence.

The Most Talked-About Base Memecoins Right Now

Certain tokens have already achieved cult status within the Base ecosystem:

- BALD: Infamous for its wild price swings and meme-driven narrative.

- TOSHI: Named after Coinbase CEO Brian Armstrong’s cat; boasts strong liquidity and an engaged following.

- MOCHI: Combines doge-style branding with experiments in NFT staking.

- DEGEN: Airdropped to early users; now serves as a tipping token across multiple social platforms.

These coins may seem whimsical on the surface but often serve as entry points for users exploring DeFi on Base for the first time. Their success highlights how meme culture can drive real adoption—and sometimes even utility—on emerging Layer 2 networks.

Navigating Risks: What Every Trader Should Know

No discussion about memecoins would be complete without addressing risk management. Rug pulls remain an ever-present danger—especially on new chains where oversight lags behind innovation. Even some high-profile launches have ended abruptly due to developer malfeasance or security flaws.

You should always use tools like RugDoc, Basescan Explorer, and contract verification services before committing funds. When in doubt, start with small amounts until you’re confident in both the project’s legitimacy and your own understanding of how it works.

What matters most to you when choosing a Base memecoin?

With so many Base memecoins out there, everyone has their own priorities. Which factor is your top pick?

The next section will dive deeper into bridging strategies for accessing these tokens safely—and reveal lesser-known gems flying under the radar right now.

Bridging to Base: Fast, Safe Access for Memecoin Hunters

To participate in the thriving Base memecoin ecosystem, you’ll need to move assets from Ethereum or other chains onto Base. The process is straightforward but requires attention to detail. Using reputable bridges like Base’s official bridge or third-party options such as Orbiter Finance ensures your funds arrive safely and quickly. Always verify bridge URLs—phishing sites are rampant during periods of high activity.

Once bridged, your ETH (or other supported assets) can be swapped for memecoins on decentralized exchanges like Baseswap or Uniswap (with Base network selected). Confirm you’re interacting with the correct token contract address—imposters frequently appear moments after a project launches.

Hidden Gems: Where Alpha Seekers Are Looking Now

While established tokens like BALD and TOSHI dominate headlines, savvy traders are constantly scanning for early-stage projects with asymmetric upside. Tools such as DexTools, DexScreener, and emerging alpha groups on Twitter and Discord can help surface new listings before they gain traction.

Here are some promising approaches:

- Monitor new liquidity pools: Fresh deployments with rapidly rising volume often signal organic interest.

- Track developer activity: Frequent GitHub commits or transparent roadmaps indicate ongoing commitment.

- Dive into community sentiment: Early memes, fan art, and organic engagement can precede explosive growth.

- Avoid FOMO traps: If a token is trending solely due to influencer hype without substance, proceed with caution.

The most successful Base memecoin hunters combine technical diligence with cultural awareness—understanding not just which coins are surging, but why the narrative is resonating right now.

Top Tools for Tracking New Base MemeCoin Launches

-

Dextools: A leading platform for real-time Base chain token analytics, providing charts, liquidity data, and trending memecoin launches.

-

Birdeye: Offers comprehensive token tracking on Base, including price alerts, volume spikes, and new listings for memecoins.

-

DexScreener: Delivers live charts and filters for newly launched Base tokens, helping users spot emerging memecoins quickly.

-

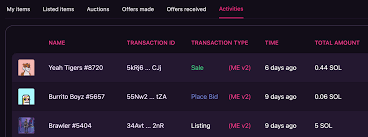

BaseScan: The official Base blockchain explorer, essential for verifying new token contracts and tracking memecoin transactions.

-

TokenSniffer: Analyzes Base memecoins for contract safety, audits, and potential scams, crucial for risk assessment before investing.

Real-World Lessons from Recent Rallies (and Crashes)

The rapid-fire pace of Base means fortunes can change overnight. For every moonshot story, there’s a cautionary tale of holders left holding illiquid bags after a rug pull or coordinated dump. Study recent cycles: what set apart sustainable rallies from flash-in-the-pan pumps? Often it’s a blend of active founders, creative meme campaigns, and robust liquidity management that sustains momentum beyond the first hype wave.

If you’re seeking long-term gains rather than quick flips, look for projects that reinvest in their ecosystem—whether through NFT collaborations, staking programs, or cross-chain partnerships. These signals often precede broader adoption and price stability even as market sentiment shifts.

Checklist Before You Ape In

No matter how enticing the memes or how viral the chart looks on Crypto Twitter, always run through a disciplined checklist before committing capital. This will help you avoid costly mistakes and keep your portfolio healthy in volatile conditions.

Looking Ahead: The Next Wave of Memecoins on Base

The intersection of meme culture and Layer 2 tech is just beginning to play out on Base. As Coinbase continues to support developer tooling and mainstream onboarding ramps up, expect even more sophisticated—and sometimes downright bizarre—memecoin experiments in the coming months. Stay plugged into trusted communities like the official Base Discord, follow leading analysts on Twitter/X, and leverage real-time data feeds to stay ahead of the curve.

Your edge comes not just from spotting trends early but understanding their underlying mechanics—the blend of narrative virality, technical innovation, and social proof that turns an obscure token into a household name overnight. With discipline and curiosity, you’ll be well-positioned to navigate the next cycle—and maybe even mint some legendary memes along the way.