Hey, Base Radar squad! SOL’s chilling at $123.09 after dipping 2.90% over the last 24 hours, with a high of $126.77 and low of $117.55. But here’s the real momentum play: bridging your Solana tokens to Base via Aerodrome in 2026. Forget clunky old methods; Jumper. Exchange taps Aerodrome’s liquidity for lightning-fast, low-fee transfers of SPL tokens straight into Base’s DeFi playground. We’re talking seamless access to Base memecoins and high-yield pools. Ride this interoperability trend, but respect the gas fees, folks.

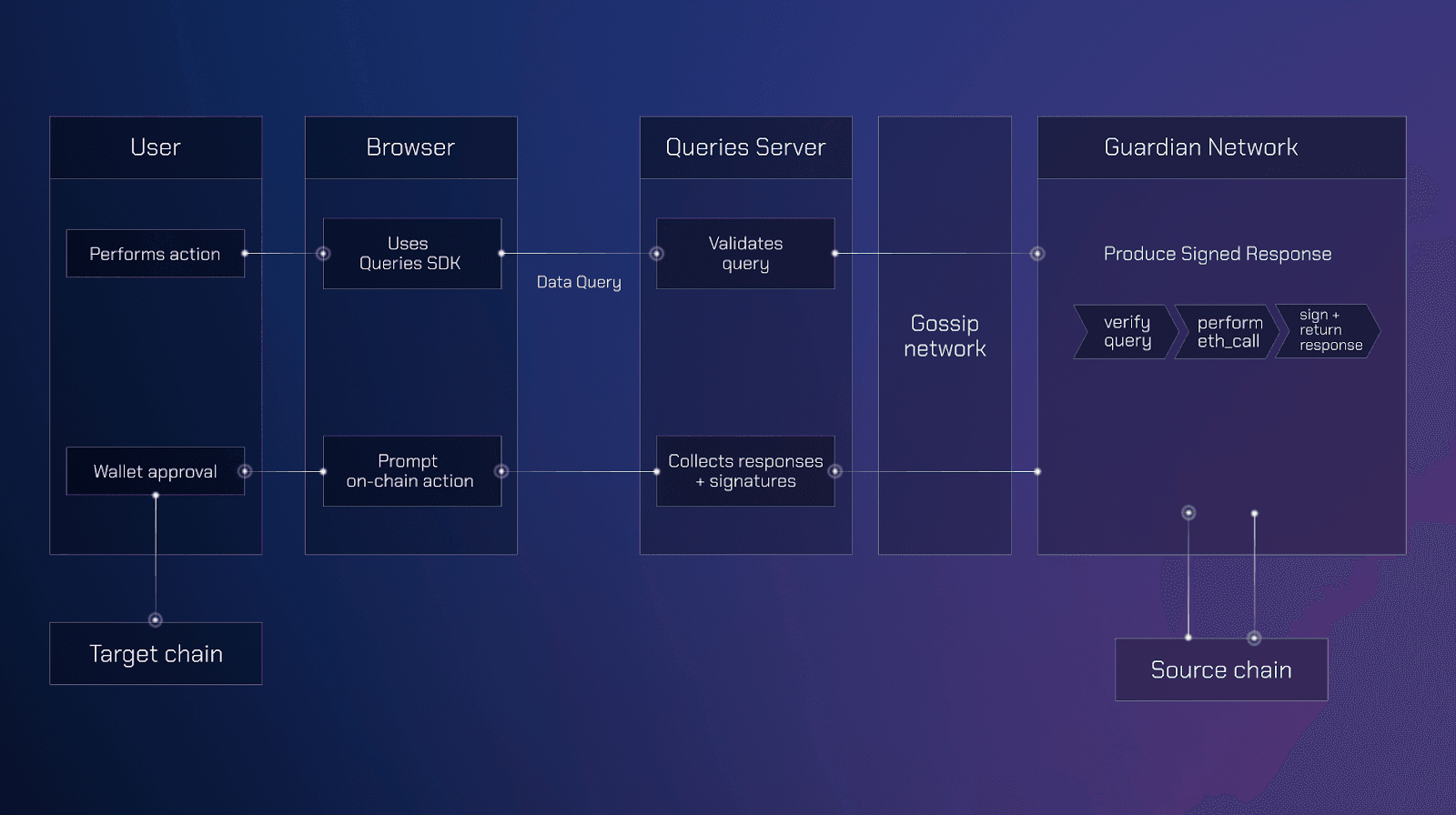

As of January 2026, the Solana-Base bridge powered by Chainlink CCIP makes bridge solana to base a no-brainer. Transfer SOL or SPL tokens in seconds, land on Base, and dive into Aerodrome for swaps. I’ve swung trades across chains for years, and this setup crushes it for momentum chasers eyeing Base’s explosive ecosystem.

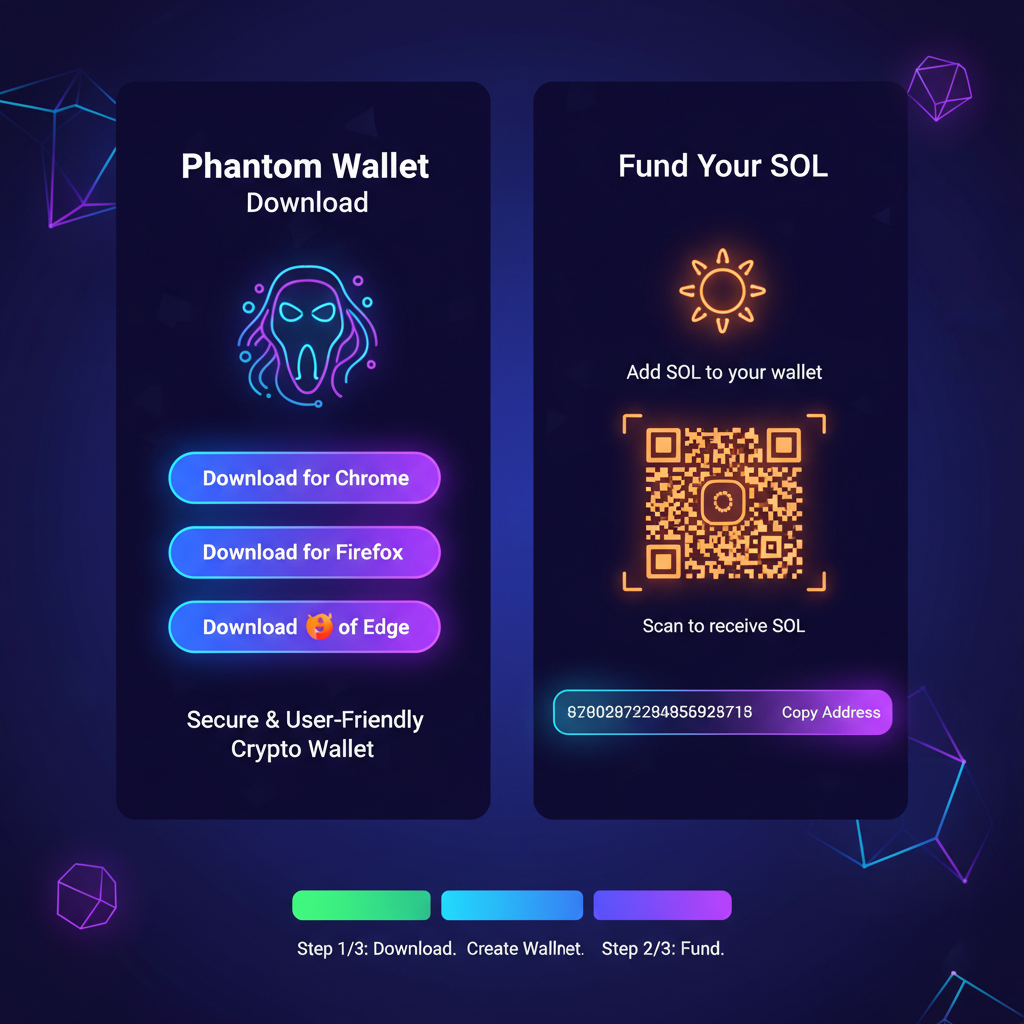

Prep Your Wallets: Phantom and MetaMask Mastery

First up, nail the foundations. Step 1: Install and fund your Phantom wallet. Grab the extension, whip up a new wallet or import your seed, then shoot over at least 0.05 SOL for fees plus your target SPL tokens from spots like Jupiter or Raydium. Pro tip: Double-check balances; nothing kills a bridge vibe like insufficient funds mid-tx.

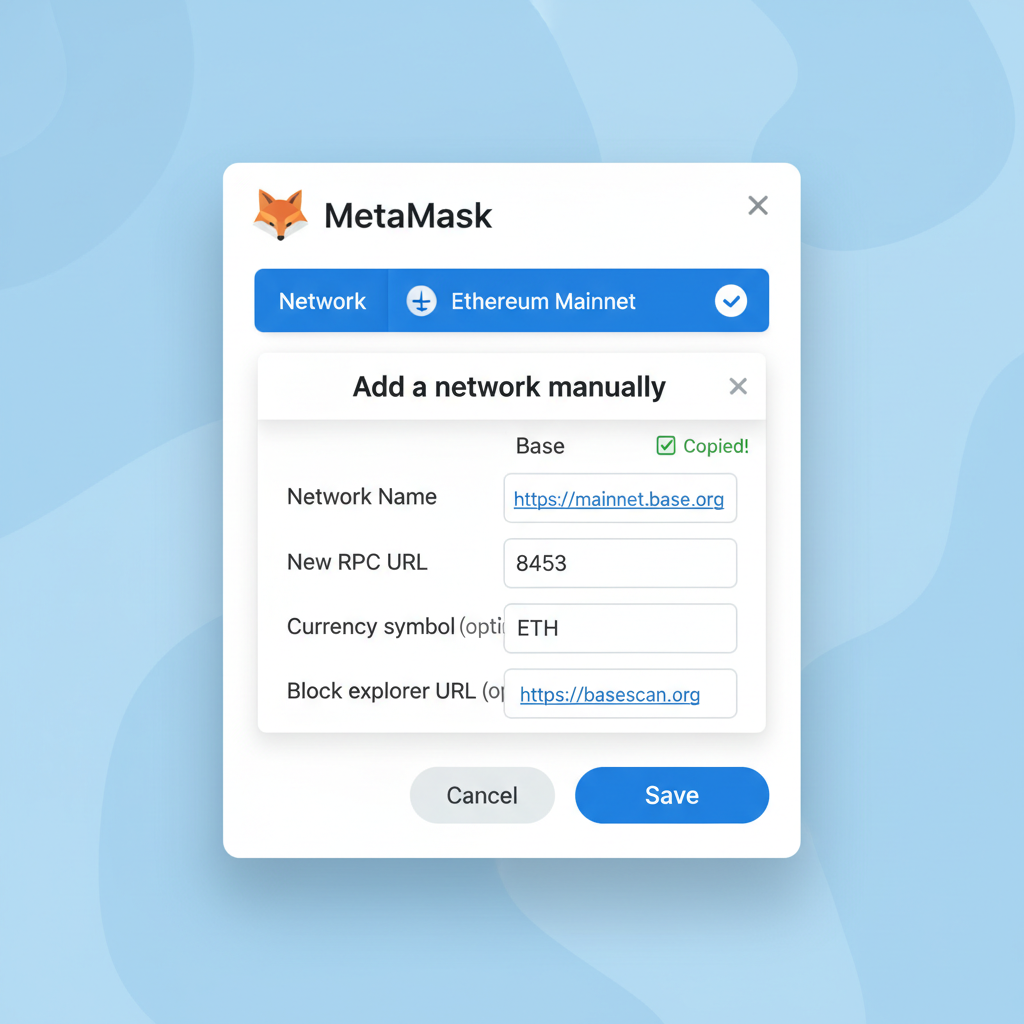

Step 2: Set up MetaMask for Base. Fire up the extension, add the Base network manually – Chain ID 8453, RPC https://mainnet.base.org, symbol ETH, explorer https://basescan.org. Fund it with a splash of ETH if needed for claiming, but Jumper handles most of the heavy lifting. Boom, you’re dual-chain ready. This duo unlocks the full aerodrome solana bridge flow without hiccups.

Solana (SOL) Price Prediction 2027-2032

Short-term predictions post-Base bridge surge in 2026

| Year | Minimum Price | Average Price | Maximum Price |

|---|---|---|---|

| 2027 | $95.00 | $165.00 | $295.00 |

| 2028 | $130.00 | $235.00 | $425.00 |

| 2029 | $175.00 | $325.00 | $585.00 |

| 2030 | $240.00 | $450.00 | $810.00 |

| 2031 | $330.00 | $620.00 | $1,110.00 |

| 2032 | $440.00 | $800.00 | $1,360.00 |

Price Prediction Summary

Following the 2026 Base-Solana bridge surge via Aerodrome, SOL is forecasted to experience steady growth amid enhanced interoperability and DeFi adoption. Conservative estimates show averages rising from $165 in 2027 to $800 by 2032, with bullish maxima reaching $1,360, reflecting market cycles and technological advancements.

Key Factors Affecting Solana Price

- Enhanced cross-chain liquidity from Base-Solana bridges (Aerodrome, CCIP)

- Solana’s high-speed DeFi ecosystem attracting more users

- Crypto market cycles with potential bull runs in late 2020s

- Regulatory clarity improving institutional adoption

- Solana network upgrades for scalability and security

- Competition from L2s but Solana’s unique positioning

- Overall market cap expansion and macroeconomic factors

Disclaimer: Cryptocurrency price predictions are speculative and based on current market analysis.

Actual prices may vary significantly due to market volatility, regulatory changes, and other factors.

Always do your own research before making investment decisions.

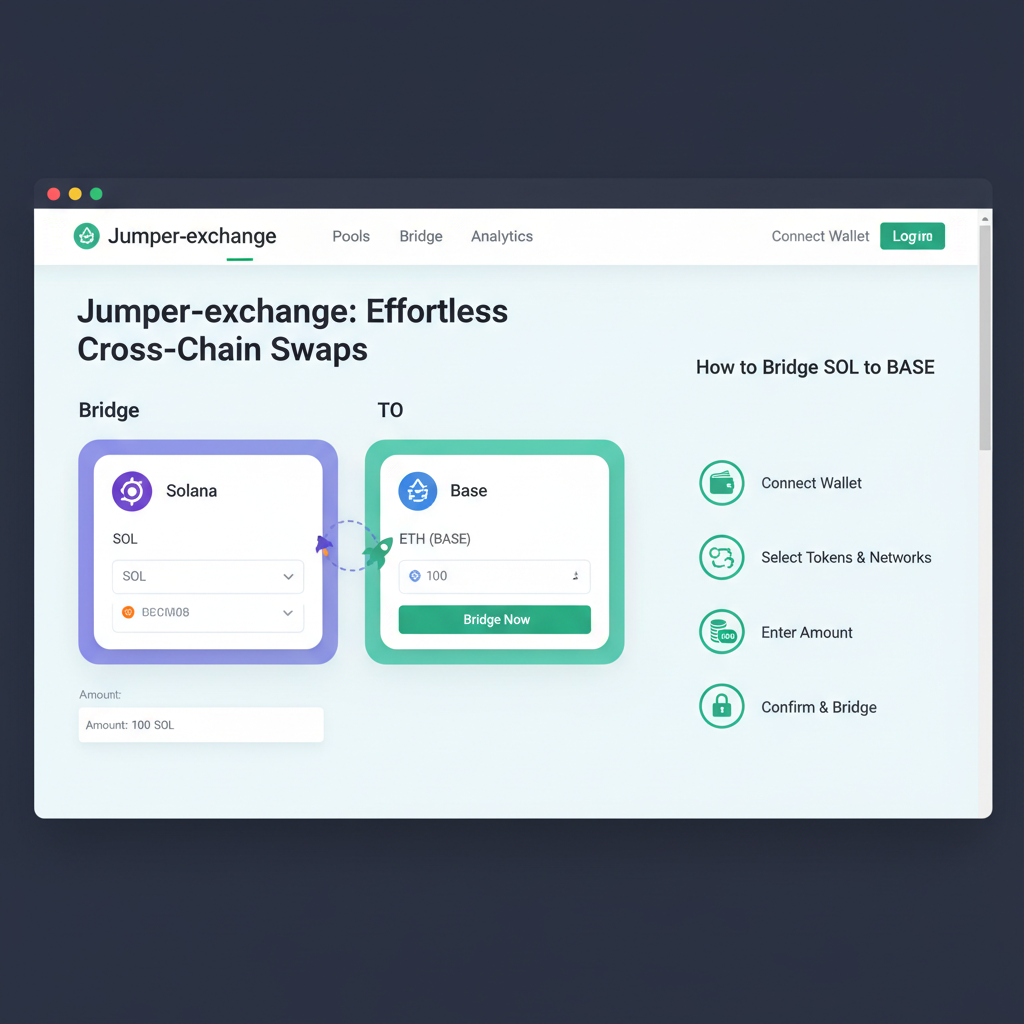

Launch into Jumper. Exchange: The Smart Aggregator Choice

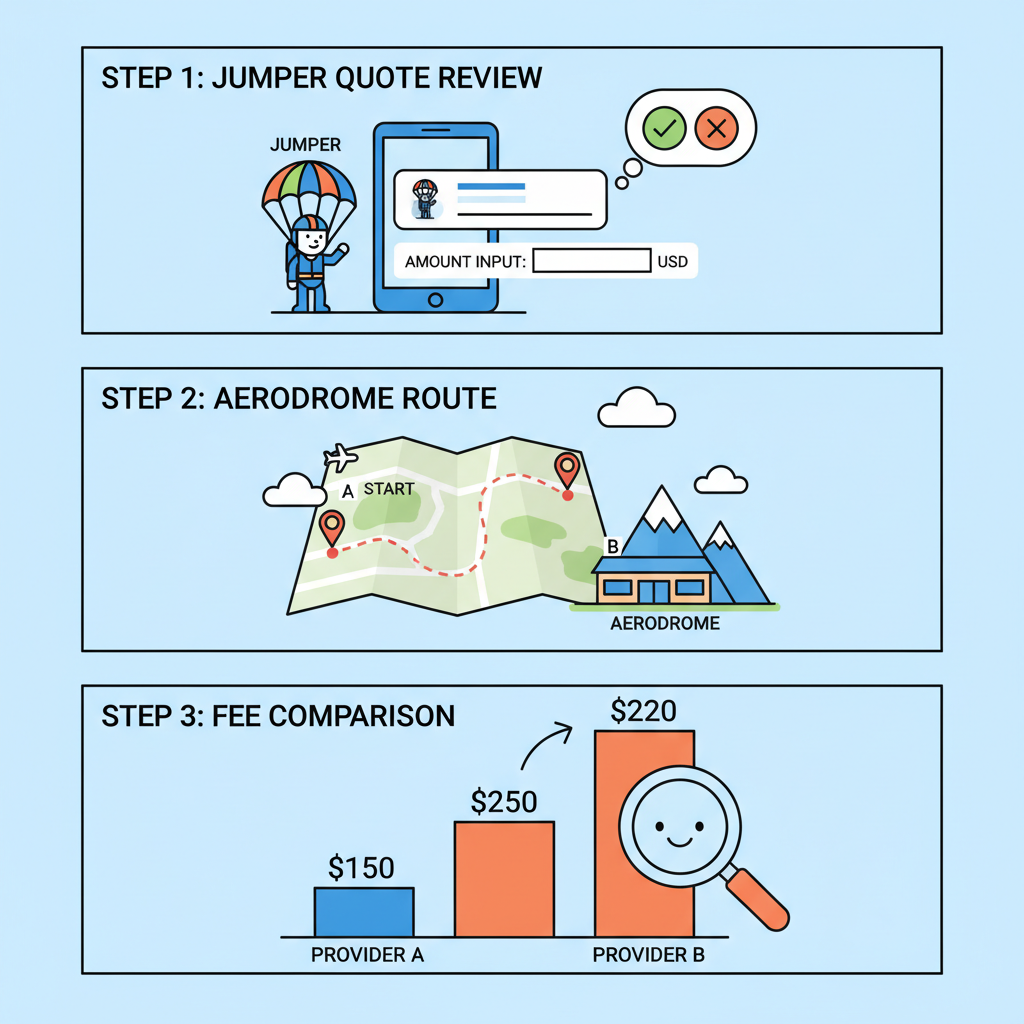

Step 3: Hit https://jumper.exchange/, the undisputed king for solana spl to base routes. It scans dozens of bridges, prioritizing Aerodrome liquidity on Base for killer rates and speed. No more guessing games – Jumper finds the optimal path every time.

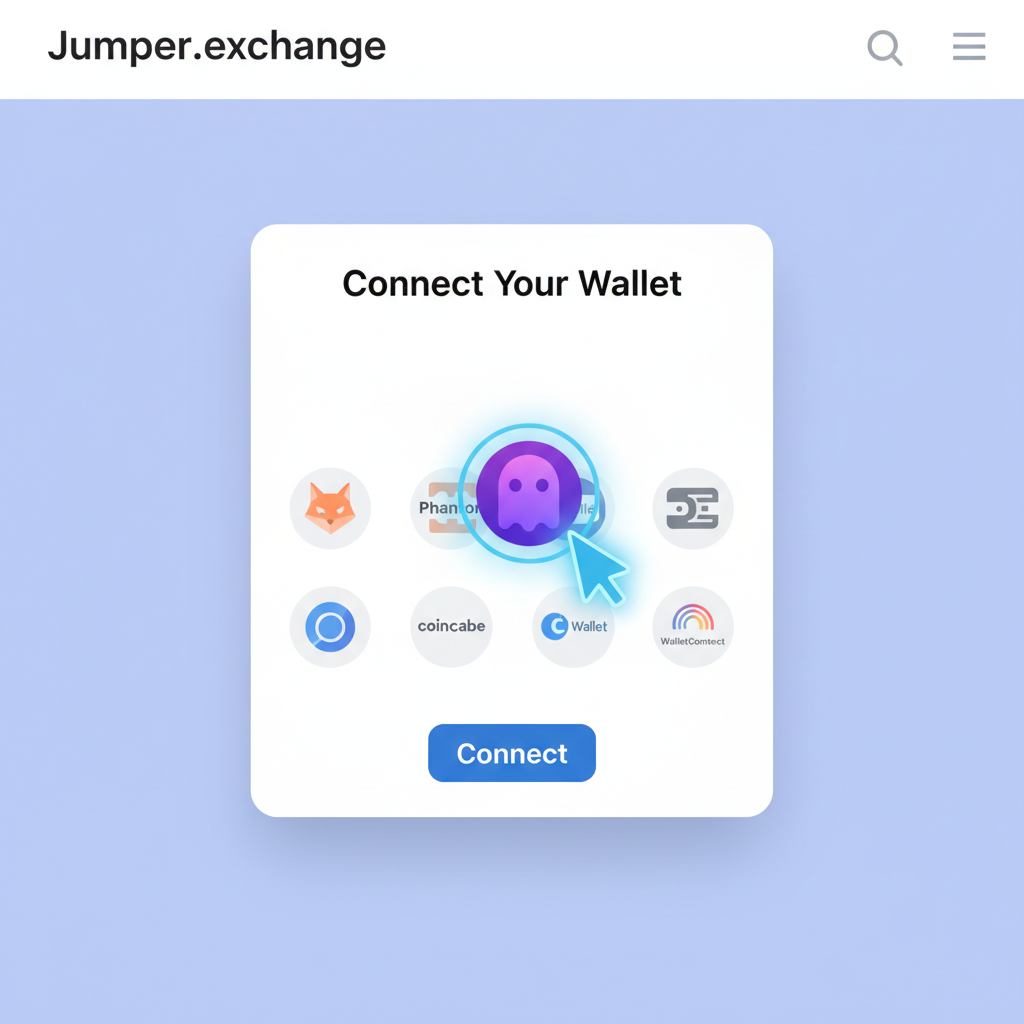

Step 4: Connect your Solana wallet. Smash ‘Connect Wallet’, pick Phantom, and authorize. It’ll prompt for Phantom approval; greenlight it. Now you’re linked, staring down a clean interface primed for action. I’ve tested aggregators galore, and Jumper’s edge on Aerodrome pools makes it my go-to for these cross-chain swings.

Configure and Crush the Bridge Route

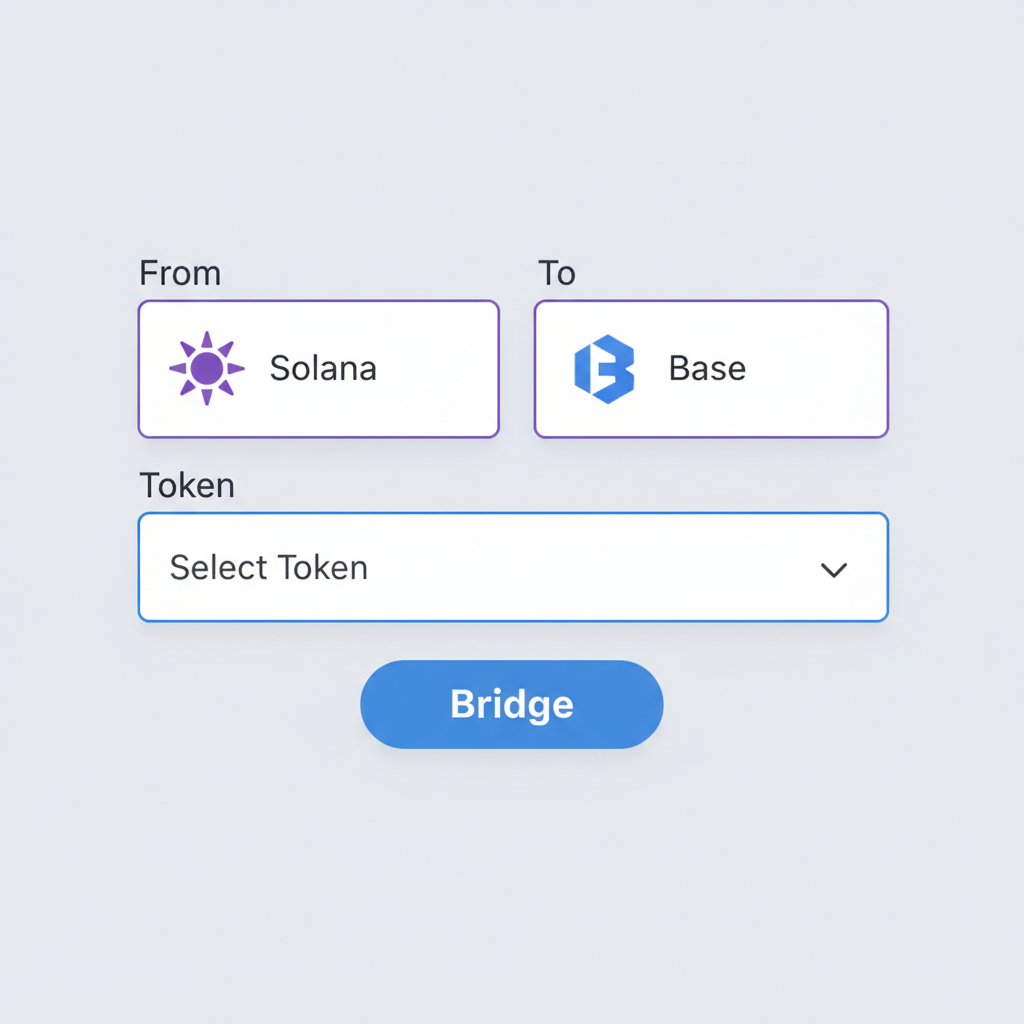

Step 5: Dial in your bridge settings. Set ‘From’ to Solana, snag your SPL token – Jumper auto-swaps unsupported ones via Jupiter if needed. Flip ‘To’ to Base, target the ERC20 equivalent like USDC, or direct if available. Precision here avoids wrapped token headaches later.

Step 6: Punch in the amount and dissect the quote. Scrutinize for the lowest fees and quickest route – always favor those leveraging Aerodrome pools on Base. Expect 1-5 minute completion times in 2026’s optimized setup. Review slippage, total cost, and output; if it smells off, tweak and requote. This is where you respect the risk – small test transfers first if you’re stacking big.

With SOL at $123.09, bridging now positions you perfectly for Base’s momentum. Jumper’s aggregator magic ensures you’re not just transferring; you’re optimizing for DeFi alpha. Stay tuned as we hit execute and claim next – your Base memecoin hunts await.

Ride the trend, respect the risk. – Owen Vickers

Step 7: Time to pull the trigger – execute and claim those assets. Approve the transactions popping up in Phantom; you’ll see a couple for the swap and bridge initiation. Confirm the bridge, pay the SOL fees (usually under $0.50 total), and sit tight for 1-5 minutes. Jumper’s magic routes it through Aerodrome liquidity, so no liquidity droughts on the Base side. Once complete, switch to MetaMask – funds auto-land or hit ‘Claim’ if prompted. Boom, your solana spl to base transfer is live on Base, ready for action.

Pro move: Head straight to aerodrome. finance post-bridge. Swap your fresh USDC or whatever into Base memecoins or park in high-APY pools. Aerodrome’s veAERO staking cranks yields, and with SOL at $123.09 bridging over, you’re primed for those trend reversals I live for. I’ve flipped bridged assets into 3x gains on Base pumps – liquidity here is thick, fees microscopic.

Post-Bridge Power Plays: Aerodrome DeFi Domination

Now that your tokens are on Base, don’t sleep on the ecosystem. Aerodrome isn’t just a pit stop; it’s the velocity hub. Dive into their pools for base chain bridge tutorial pros – provide liquidity on hot pairs like AERO/USDbC and earn veAERO votes for governance alpha. Or hunt memecoins; Base’s meme meta exploded in 2026, fueled by these seamless transfer solana assets to base inflows.

Watch gas: Base stays under 1 cent per swap, but peak hours spike. Use Basescan. org to track your tx hash from the bridge – transparency builds trust. If slippage bit you, next time dial it tighter in Jumper’s advanced settings. This flow’s my swing trader secret for chaining Solana speed with Base’s cheap DeFi firepower.

Risks? Always bridge what you can afford to tweak – CCIP secures it, but DeFi’s wild. Test small, verify addresses twice (copy-paste, no typos), and enable 2FA on exchanges funding Phantom. In 2026, with Chainlink CCIP locking it down, downtimes are rare, but markets move fast. SOL’s 24h dip to $117.55 low screams buy-the-news on Base bridges.

Scaling up? Batch bridges via Jumper for efficiency, or lock into Aerodrome farms for compounded returns. I’ve ridden similar interoperability waves from ETH to L2s; Solana-Base is next-level. Your edge: Act now while liquidity builds. Fund Phantom, smash Jumper, claim on Base, conquer Aerodrome. That’s the actionable path to cross-chain wins.

Ride the trend, respect the risk. – Owen Vickers