With Ethereum (ETH) currently priced at $3,049.07, the L2 landscape is more competitive than ever. Among the contenders, Base – Coinbase’s Layer-2 solution – has quickly emerged as the fastest-growing L2 in 2025. This meteoric rise is no accident. It’s the result of a confluence of technical innovation, strategic partnerships, and an unmatched onboarding experience that leverages Coinbase’s massive user base. Let’s explore why Base is capturing so much attention and capital this year.

Seamless Coinbase Integration: The Gateway Advantage

Base isn’t just another optimistic rollup or scaling solution. Its unique edge comes from its deep integration with Coinbase, one of the world’s largest crypto exchanges. With over 100 million accounts, Coinbase acts as a trusted gateway for millions of retail and institutional users entering Web3 for the first time. By embedding Base directly into Coinbase’s wallet and app experiences, users can bridge assets, swap tokens, or interact with dApps on Base without ever leaving familiar interfaces.

This frictionless onboarding removes many of the hurdles that have historically kept newcomers out of DeFi and on-chain activity. Suddenly, earning yield or trading NFTs on Base feels as simple as sending USDC from your Coinbase account to a friend.

Ultra-Low Fees and Lightning-Fast Transactions

Another pillar behind Base’s explosive growth is its unmatched transaction efficiency. By implementing technologies like Flashblocks, Base has slashed block times to just 200 milliseconds. Average transaction fees hover around $0.004. This level of affordability and speed is transformative for both developers and end users.

For comparison, Ethereum mainnet gas fees can spike above $5 during periods of congestion – sometimes much higher during NFT mints or DeFi launches. On Base, microtransactions become viable again: think gaming rewards, social tipping, or high-frequency DEX trading without worrying about prohibitive fees eating into profits.

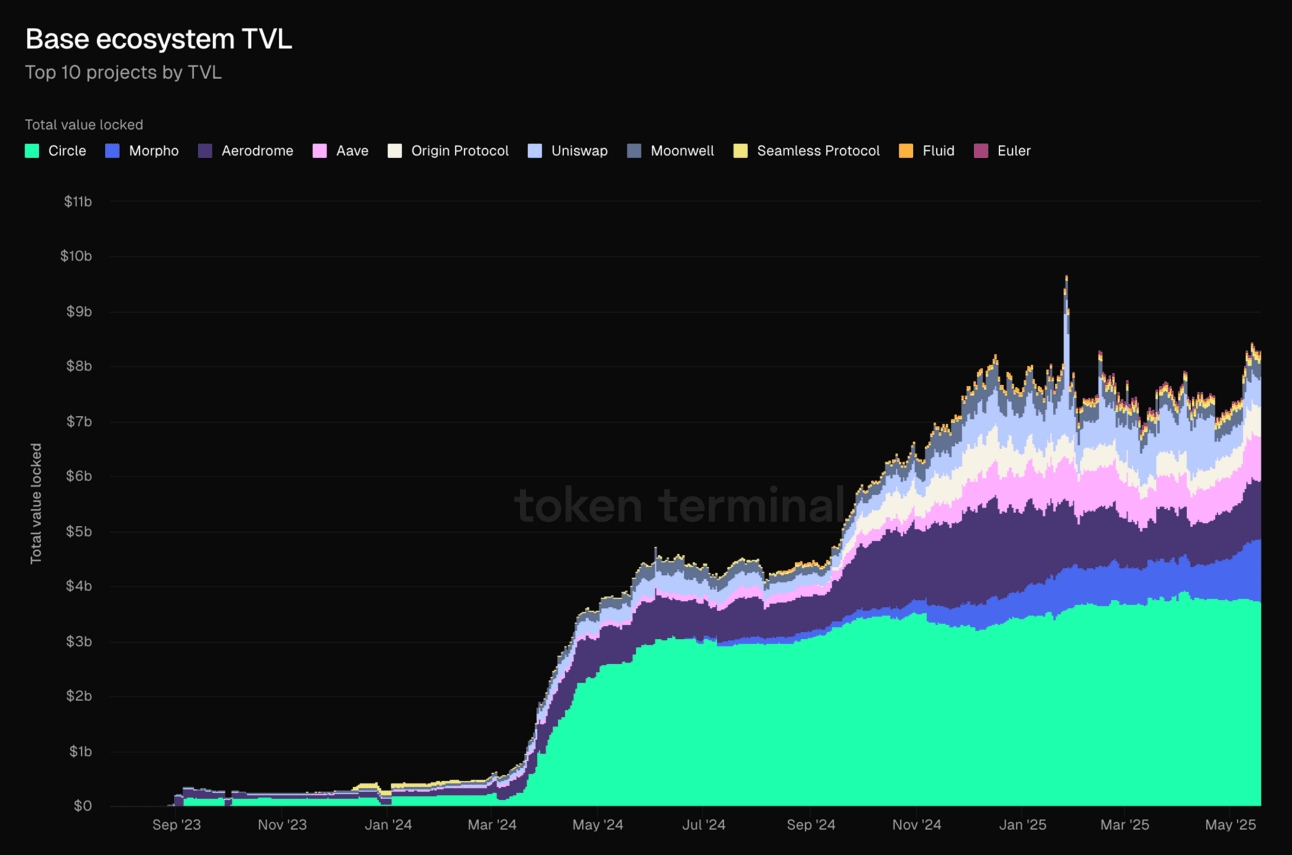

Explosive Growth in TVL and User Engagement

The numbers don’t lie: by mid-2025, Base’s Total Value Locked (TVL) soared past $11.4 billion, accounting for more than 22% of all L2 TVL across Ethereum scaling solutions. Just as impressive are its 21.5 million active users, a testament to its widespread adoption by both retail participants and institutions alike.

This surge is not just about speculation; it reflects real usage across DeFi protocols, NFT platforms, social apps, and even enterprise pilots with blue-chip partners like J. P. Morgan and Shopify.

Base (BASE) Price Prediction 2026-2031

Professional outlook based on current 2025 market leadership, adoption trends, and Layer-2 sector dynamics

| Year | Minimum Price (Bearish) | Average Price | Maximum Price (Bullish) | Estimated % Change (Avg, YoY) | Market Scenario Insights |

|---|---|---|---|---|---|

| 2026 | $2.10 | $3.25 | $4.60 | +35% | Continued strong adoption; TVL growth sustains price momentum, but macro uncertainty may cause volatility. |

| 2027 | $2.85 | $4.10 | $5.95 | +26% | BASE solidifies as a top L2; increased DeFi and NFT activity; regulatory clarity in US boosts institutional flows. |

| 2028 | $3.30 | $5.05 | $7.50 | +23% | Ecosystem matures with more dApps and partnerships; ETH 3.0 upgrade enhances L2 utility, driving further growth. |

| 2029 | $4.00 | $6.20 | $9.40 | +22% | Mainstream e-commerce and TradFi integrations expand; competition from new L2s limits upside, but BASE maintains leadership. |

| 2030 | $4.80 | $7.30 | $11.20 | +18% | Macro bull cycle for crypto; BASE benefits from Coinbase user funnel and new DeFi primitives; regulatory risks remain. |

| 2031 | $5.20 | $8.10 | $13.00 | +11% | Market matures; growth moderates as L2 sector saturates, but BASE remains a top-3 L2 by TVL and user base. |

Price Prediction Summary

Base (BASE) is poised for strong, sustained growth through 2031, driven by leading adoption metrics, integration with Coinbase, and continuous ecosystem expansion. While volatility and competition will persist, BASE is expected to remain a dominant Layer-2 solution, with its price reflecting both bullish innovation cycles and periods of consolidation.

Key Factors Affecting Base Price

- Coinbase integration and massive user funnel

- Ultra-low fees and high throughput (Flashblocks, appchains)

- Growing TVL and active user base

- Strategic partnerships (e.g., Shopify, J.P. Morgan)

- Broader DeFi, NFT, and gaming adoption

- Potential regulatory headwinds or tailwinds

- Competition from other L2s and scaling solutions

- General crypto market cycles and Ethereum’s trajectory

Disclaimer: Cryptocurrency price predictions are speculative and based on current market analysis.

Actual prices may vary significantly due to market volatility, regulatory changes, and other factors.

Always do your own research before making investment decisions.

The Power of Ecosystem Diversity and Strategic Partnerships

A thriving ecosystem underpins any sustainable blockchain network – and here too, Base shines. With over 200 decentralized applications (dApps), including flagship DeFi protocols, innovative gaming projects, and next-generation social platforms, there’s something for everyone on Base.

The network has also attracted major partnerships that bridge traditional finance with on-chain utility: Shopify merchants now accept USDC payments natively on Base; J. P. Morgan has piloted USD-backed deposit tokens; countless DAOs have migrated their treasuries to leverage low fees without sacrificing security.

These collaborations signal a turning point in mainstream blockchain adoption. When established corporations and financial institutions choose Base as their L2 of choice, it sends a clear message: the infrastructure is mature, scalable, and ready for mass-market use. For developers and founders, this ecosystem diversity means more composability, projects can plug into a growing web of liquidity, users, and tools that accelerate innovation.

Base’s Cultural Momentum: Community-Driven Growth

Beyond raw numbers and technical prowess, Base has cultivated a vibrant community culture. From meme coin launches to hackathons and on-chain art collectives, the network pulses with creative energy. This cultural momentum is not just noise, it’s a magnet for new builders and users alike.

Grassroots initiatives like public goods funding rounds, NFT drops with real-world utility, or viral social campaigns have helped keep engagement high. The result? A feedback loop where growth fuels innovation, which attracts more users, which in turn drives further ecosystem expansion.

Security Without Compromise

In 2025’s high-stakes landscape, where billions are at play, security remains non-negotiable. Base leverages Ethereum’s robust security guarantees while implementing its own advanced monitoring systems to detect anomalies and protect user assets. Regular audits by top-tier firms combined with transparent bug bounty programs have instilled confidence among both retail participants and institutional players.

This focus on security is especially critical as the average transaction size on Base rises with institutional adoption. Users can interact with DeFi protocols or move large sums knowing their funds are protected by both Ethereum’s battle-tested consensus layer and Base’s own risk controls.

What Sets Base Apart: Looking Ahead

As we move through 2025, with Ethereum (ETH) trading at $3,049.07: the market will only become more discerning about where capital flows. Base’s unique blend of low fees, speed, seamless onboarding via Coinbase, ecosystem diversity, and institutional trust sets it apart from other L2 contenders.

The network is also well positioned for future innovations: modular upgrades like zk-proofs or custom appchains could further boost scalability without sacrificing decentralization or security. With each new integration or protocol launch on Base, the network effect compounds, making it ever harder for competitors to catch up.

Have you used Base for DeFi or NFTs in 2025?

With Base emerging as the fastest-growing Layer-2 on Ethereum—boasting over 21.5 million active users and ultra-low fees (averaging $0.004 per transaction)—we want to know: have you explored DeFi or NFTs on Base this year?

For anyone watching the evolution of Ethereum scaling solutions this year, or seeking new opportunities across DeFi, NFTs, gaming, or even enterprise blockchain, Base is impossible to ignore. Its momentum isn’t just hype; it’s grounded in measurable adoption metrics and forward-thinking partnerships that bridge Web2 familiarity with Web3 potential.

The story of 2025 may be one of many L2s vying for dominance, but right now, Base stands out as the fastest-growing Layer-2 network, setting the pace for what comes next in on-chain innovation.