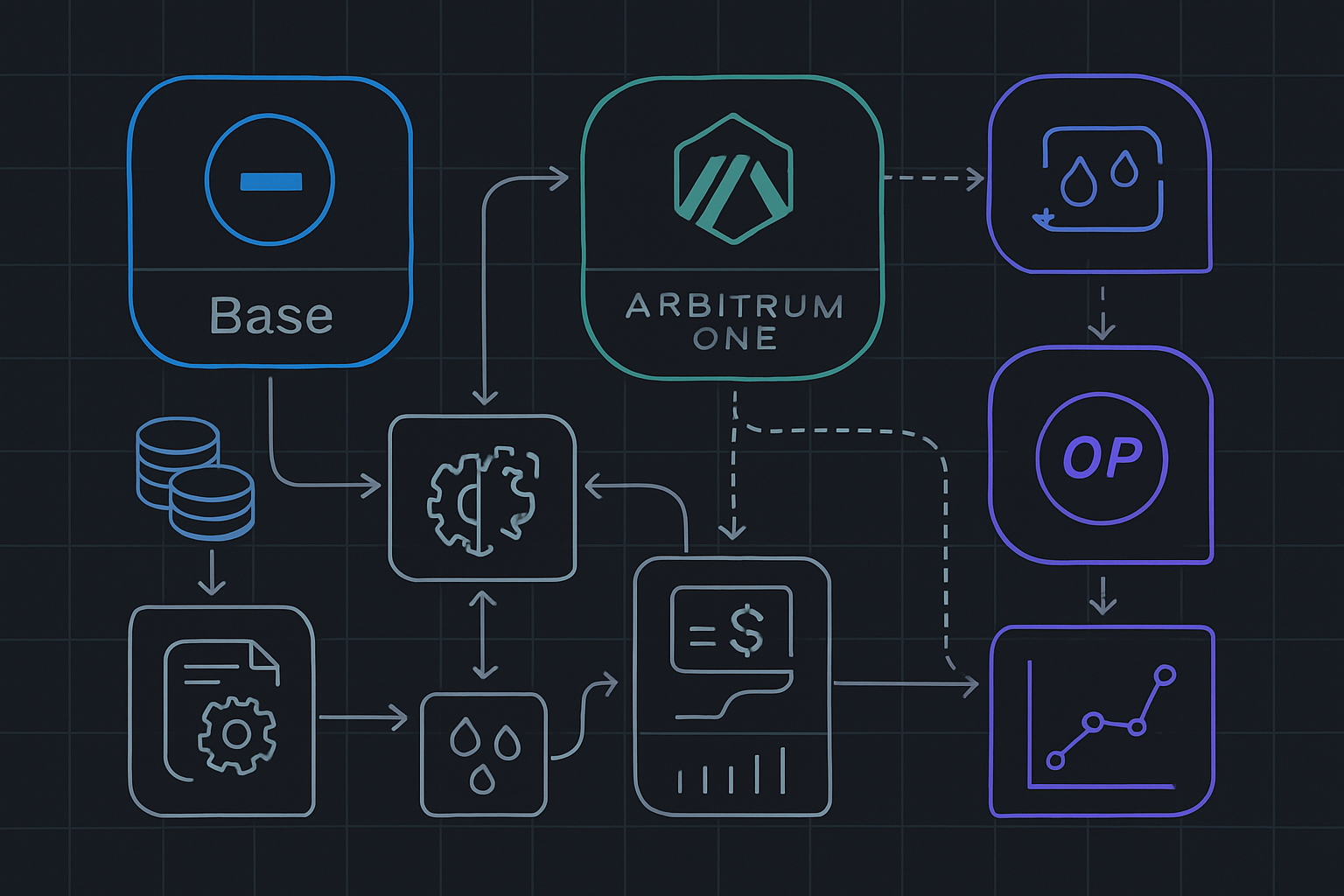

Ethereum’s Layer 2 scene is straight-up electric in late 2025, and the battle for L2 supremacy feels like a three-way meme war between Base, Arbitrum One, and Optimism. These aren’t just buzzwords you see on Crypto Twitter, they’re the backbone of billions in TVL and the foundation of every spicy new dApp launch. Whether you’re a DeFi degen, NFT flipper, or just here for the memes (no shame), knowing the differences between these L2 titans is essential if you want to ape smart in 2025.

Base: Coinbase’s L2 Powerhouse Hits $4.32 Billion TVL

Let’s start with Base, Coinbase’s not-so-secret weapon. Since launching in August 2023, Base has gone from “wait, another L2?” to flipping Arbitrum’s TVL by mid-2024. As of October 23,2025, Base sits pretty at $4.32 billion locked up, a number that even OGs didn’t see coming this fast (source). The secret sauce? Seamless onboarding for Coinbase’s massive user base, we’re talking millions of retail users and institutions who can bridge to Base with a couple of taps.

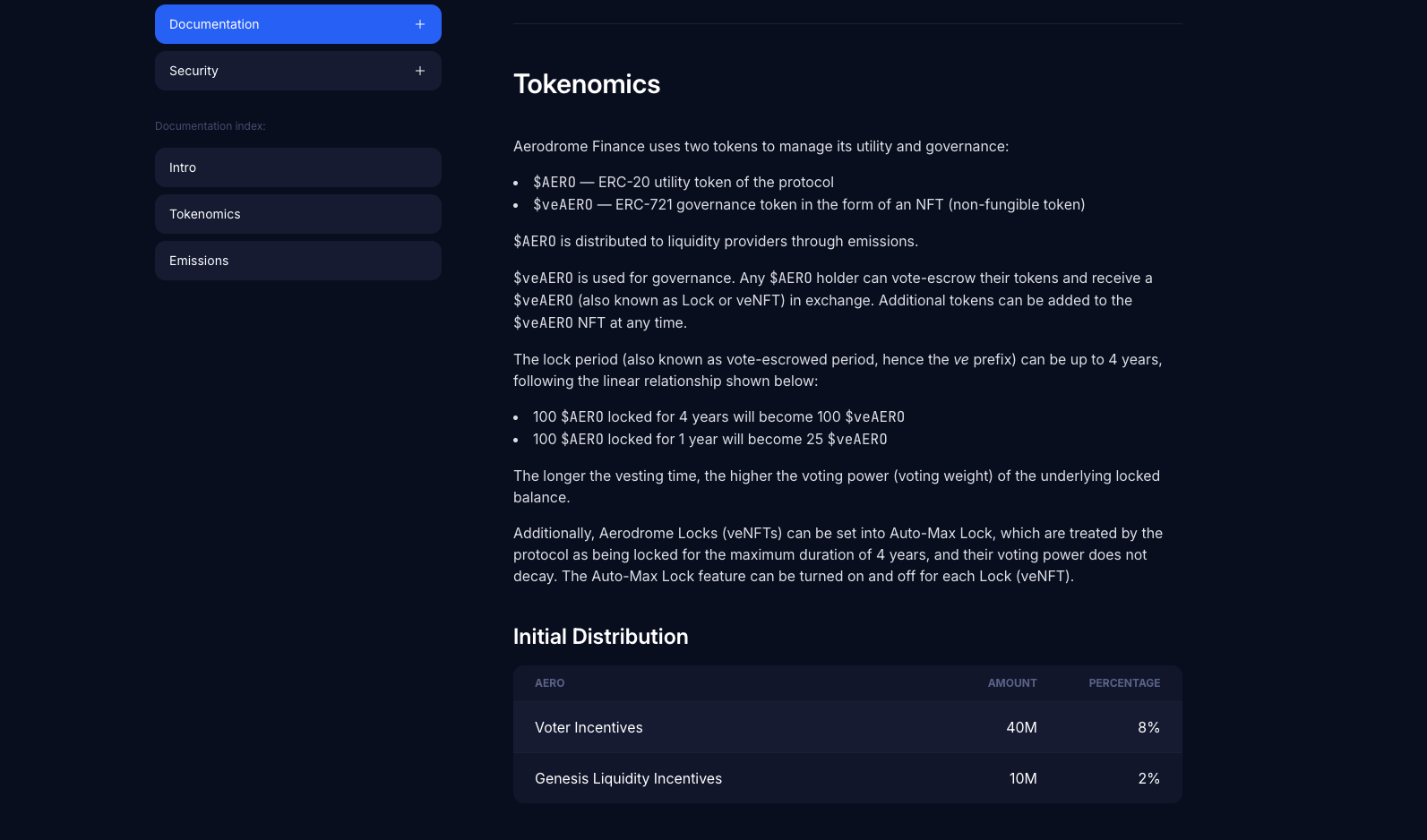

The tech side is no slouch either: lightning-fast transactions and micro-fees have made Base the go-to chain for everything from memecoins to blue-chip DeFi protocols. Aerodrome DEX is thriving here, but what really stands out is how easy it is for normies to get started. If your grandma can send ETH on Coinbase, she can use Base, that’s mass adoption magic.

Arbitrum One: DeFi Veteran Still Holds Strong at $3.85 Billion

Arbitrum One isn’t going anywhere either. As one of the first movers in the L2 space, Arbitrum has built up serious street cred among devs and DeFi whales alike. With a TVL of $3.85 billion as of October 2025 (source), it remains a juggernaut thanks to its robust EVM compatibility and multi-round fraud-proof system, fancy words for “it works great with Ethereum stuff. ”

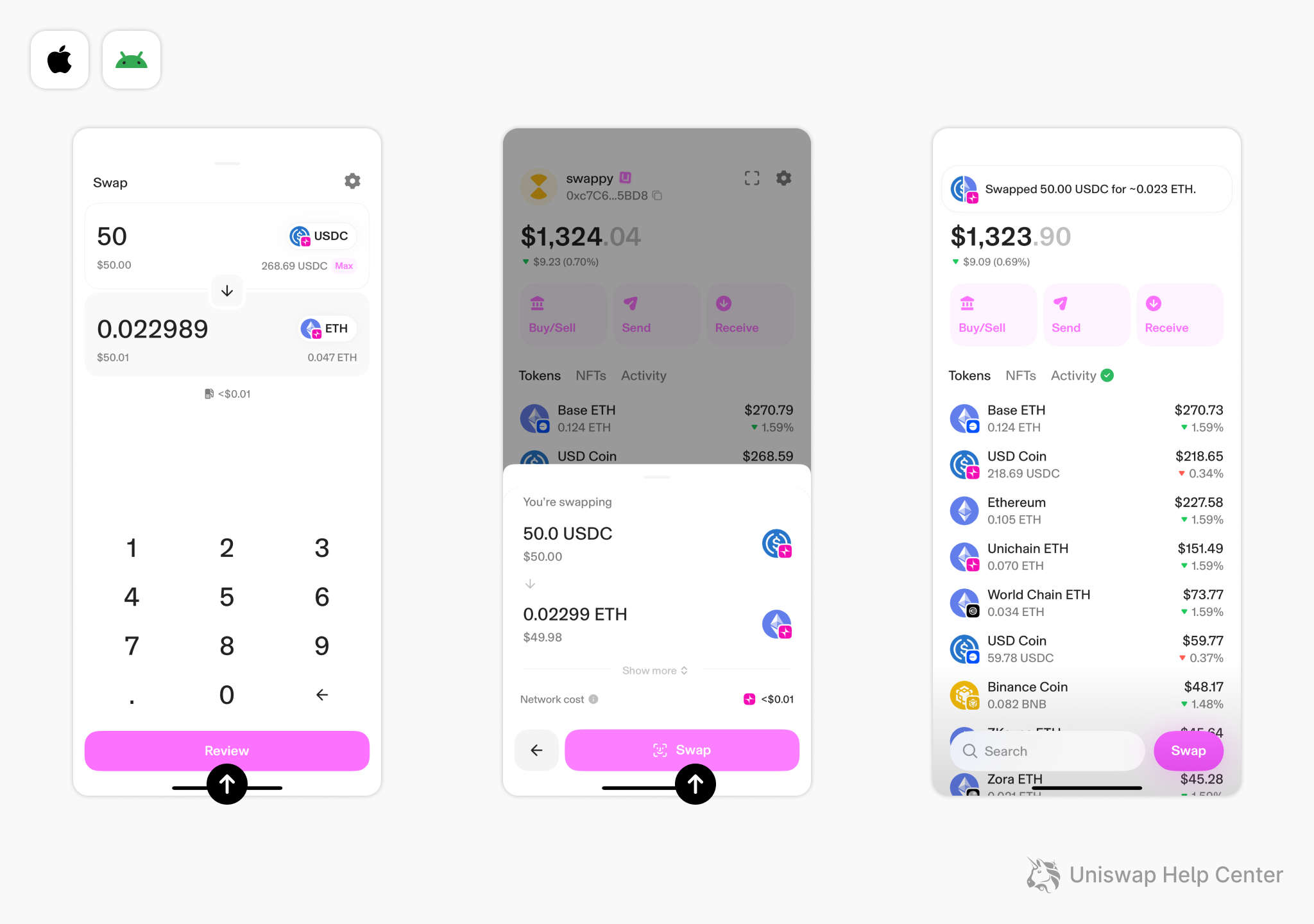

If you’ve ever used Uniswap or Aave on an L2, chances are you’ve touched Arbitrum without even realizing it. The developer experience here is basically plug-and-play; porting over your favorite dApps from mainnet takes minimal effort. That means more protocols, more liquidity, and more action for everyone involved.

Optimism: Superchain Visionary (and Governance Trailblazer)

Optimism might not have the highest TVL at $338.99 million, but don’t count it out just yet (source). Its real flex is the “Superchain” framework, an ambitious push toward modularity and cross-chain interoperability that’s already processing over 60% of all Ethereum L2 transactions (source). In plain English: Optimism wants every chain to play nice together while letting communities govern themselves.

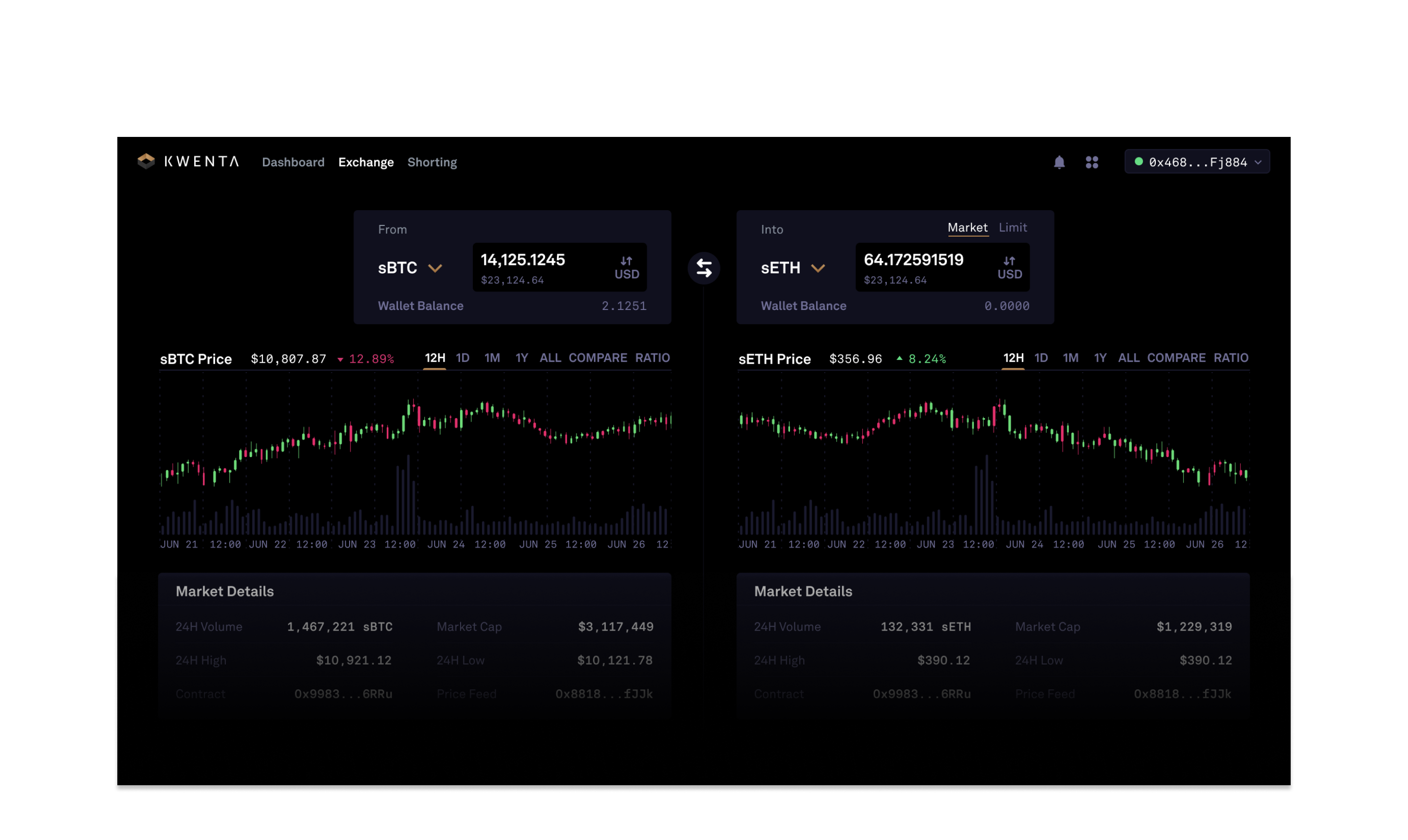

The result? Projects like Synthetix and Kwenta are building natively on Optimism while governance nerds geek out over decentralized decision-making. If you care about where Ethereum scaling tech is headed next (and want a say in it), Optimism deserves your attention.

| Platform | TVL (Oct 2025) | Key Features | Notable Integrations |

|---|---|---|---|

| Base | $4.32 billion 💙 | Low fees, Fast transactions, Coinbase integration |

Aerodrome DEX 🚀 |

| Arbitrum One | $3.85 billion 🟦 | EVM compatible, Robust DeFi support, Fraud-proof system |

Uniswap and amp; Aave 💧💸 |

| Optimism | $338.99 million 🔴 | Superchain framework, Governance focus, Modularity and interoperability |

Synthetix and amp; Kwenta ⚡️📈 |

L2 User Experience and Ecosystem Growth: Who’s Winning Hearts?

The numbers tell part of the story, but what about vibes? Here’s where things get spicy! (And yes, we’ll get into security models and bridging next. ) Stay tuned!

Let’s talk about user experience first, because let’s be real: nobody wants to pay $20 for a failed transaction or wait for an hour-long withdrawal. Base is crushing it here, thanks to the Coinbase connection. The onboarding is so smooth you could onboard your dog (not financial advice, but hey, dogs love memecoins too). Most users are just a couple of taps away from bridging assets straight from their Coinbase wallets into Base’s ecosystem. That frictionless experience has brought in an army of new users who might have never touched DeFi otherwise.

Arbitrum One, meanwhile, still appeals to the power users and DeFi OGs. Its EVM compatibility means devs can migrate protocols with minimal code changes, and the liquidity on offer is second only to mainnet Ethereum. If you’re farming yields or launching the next big DeFi primitive, Arbitrum is probably your first stop. But for pure UX? Base has edged ahead in 2025 by making onboarding painless and fees nearly invisible.

Optimism stands out with its modular “Superchain” approach. For dApp developers who want to experiment with governance modules or spin up custom chains that all talk to each other, Optimism offers a playground no one else can match. The trade-off? TVL isn’t as high as its rivals yet, but transaction throughput and community involvement are off the charts. If you’re bullish on DAOs and decentralized governance, this is where you want to hang out.

Top dApps on Base, Arbitrum One & Optimism (Oct 2025)

-

Base: Aerodrome DEX is the flagship decentralized exchange on Base, riding high thanks to seamless Coinbase integration, ultra-low fees, and a thriving retail user base. Aerodrome has become the go-to spot for swapping, liquidity pools, and yield farming on Base’s rapidly growing L2.

Security and Bridging: How Safe (and Easy) Is It?

No one likes rug pulls or bridge hacks, so how do these L2s stack up? Both Arbitrum One and Optimism use optimistic rollup tech at their core, but Arbitrum leans heavily on its multi-round fraud proofs for extra peace of mind. Optimism’s security model is battle-tested too, especially now that Superchain chains share security guarantees while letting communities self-govern.

Base, being built on the OP Stack (the same open-source framework as Optimism), inherits much of that security architecture but adds Coinbase-level compliance and monitoring. Bridging to Base feels familiar if you’ve ever used Coinbase, and that trust factor counts for a lot when onboarding millions of new users.

If you’re looking for speed and simplicity: Base wins hands-down for retail users. If you want granular control over your assets with maximum composability: Arbitrum One remains king. And if your goal is experimenting with new governance models or building modular dApps: Optimism’s Superchain ecosystem is calling your name.

2025 L2 Showdown: Which Chain Should You Ape Into?

The TL;DR? There’s no single winner, just chains evolving fast enough to keep us all entertained (and hopefully profitable). Here’s my meme-savvy take:

- If you want mass adoption vibes: Go Base. The $4.32 billion TVL isn’t just hype, Coinbase integration makes it stupidly simple for newcomers.

- If you want DeFi depth and dev firepower: Stick with Arbitrum One at $3.85 billion TVL, still home base for blue-chip protocols and whales alike.

- If you want bleeding-edge governance and modularity: Dive into Optimism’s Superchain experiment, even if TVL ($338.99 million) trails the others now, innovation here could pay off big time down the road.

The L2 wars are far from over, and honestly, that’s what keeps crypto fun! Whether you’re here for yield farming or just chasing memes across chains, there’s never been a better time to explore what each platform offers. Just remember: always DYOR (do your own research), keep those private keys safe. . . and may your gas fees be forever low!