Crypto-backed rewards cards are rapidly changing how users interact with digital assets in daily life. The Coinbase One Card, launching in fall 2025, is set to be a game-changer for Base chain users and anyone interested in earning Bitcoin rewards through everyday spending. With up to 4% bitcoin back on every purchase, this Visa card is designed for those who want to integrate crypto seamlessly into their financial routines. Let’s break down how you can maximize these rewards as a Base user.

How the Coinbase One Card Stands Out for Base Chain Users

Unlike traditional cashback cards, the Coinbase One Card offers direct exposure to Bitcoin – a strategic advantage for those bullish on digital assets. The card is exclusive to Coinbase One members, requiring an active membership (starting at $49.99 per year). What makes it particularly compelling for Base network participants is its integration with Base-specific benefits, such as monthly sponsored gas credits, which further reduce friction when interacting with decentralized applications.

Key Takeaway: The more assets you hold on Coinbase, the higher your bitcoin back rate, ranging from 2% up to 4%. This tiered structure rewards loyalty and active engagement within the Coinbase ecosystem.

Step-by-Step: Getting Started With Your Coinbase One Card

The process of earning crypto cashback on your purchases is straightforward but requires some initial setup:

- Join Coinbase One: You’ll need an active subscription. This unlocks eligibility for both the card and additional perks like priority support and zero trading fees on select transactions.

- Apply for the Card: Once subscribed, apply directly through your account dashboard. Approval depends on standard creditworthiness checks and other eligibility criteria.

- Select Rewards: Opt-in to receive bitcoin back as your preferred reward type. While other crypto options may be available in the future, Bitcoin remains the headline incentive at launch.

This structure allows you to leverage everyday spending, groceries, travel, subscriptions, into meaningful Bitcoin accumulation over time.

Earning Bitcoin Back: Practical Considerations

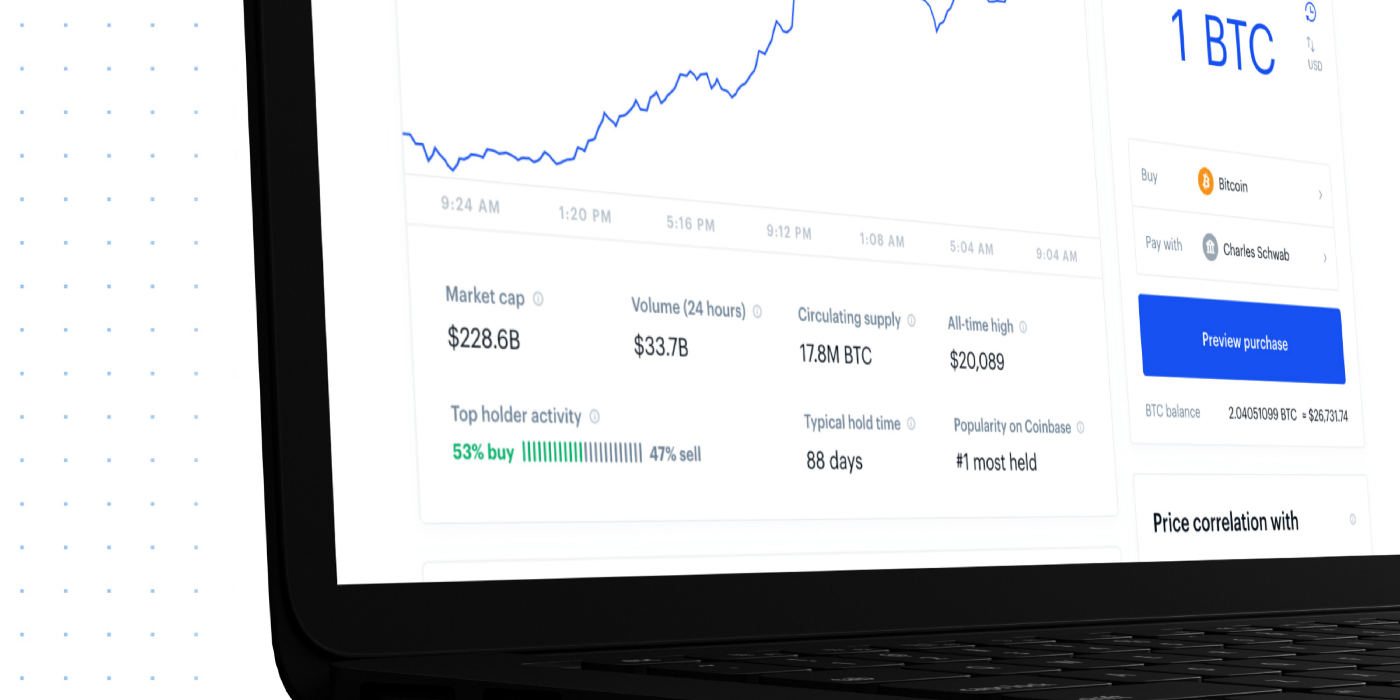

The actual percentage of bitcoin back you earn is dynamic. It depends on your total asset holdings within Coinbase at any given time, a model that incentivizes holding funds within their platform. For instance:

What Purchases Qualify (and Don’t) for Bitcoin Back

-

Everyday retail purchases — Most transactions at grocery stores, restaurants, gas stations, and retail shops using your Coinbase One Card typically qualify for up to 4% bitcoin back.

-

Online shopping — Purchases made at major e-commerce platforms like Amazon, Walmart.com, or Target.com are generally eligible for bitcoin rewards.

-

Travel and transportation — Airline tickets, hotel bookings, and ride-sharing services (such as Uber or Lyft) commonly qualify for bitcoin back.

-

Recurring bills and subscriptions — Payments for streaming services (like Netflix or Spotify) and utility bills often earn bitcoin rewards when paid with the Coinbase One Card.

-

Cash equivalents and money transfers — ATM withdrawals, wire transfers, cash advances, and payments to services like Venmo or PayPal (for peer-to-peer transfers) do not qualify for bitcoin back rewards.

-

Gambling and lottery transactions — Purchases at casinos, online betting sites, and lottery ticket sales are excluded from earning bitcoin back.

-

Tax payments and government services — Payments to the IRS, state tax agencies, or government offices typically do not earn bitcoin rewards.

-

Business or commercial purchases — Transactions flagged as business-related (such as wholesale suppliers or B2B services) may not be eligible for bitcoin back rewards under consumer card terms.

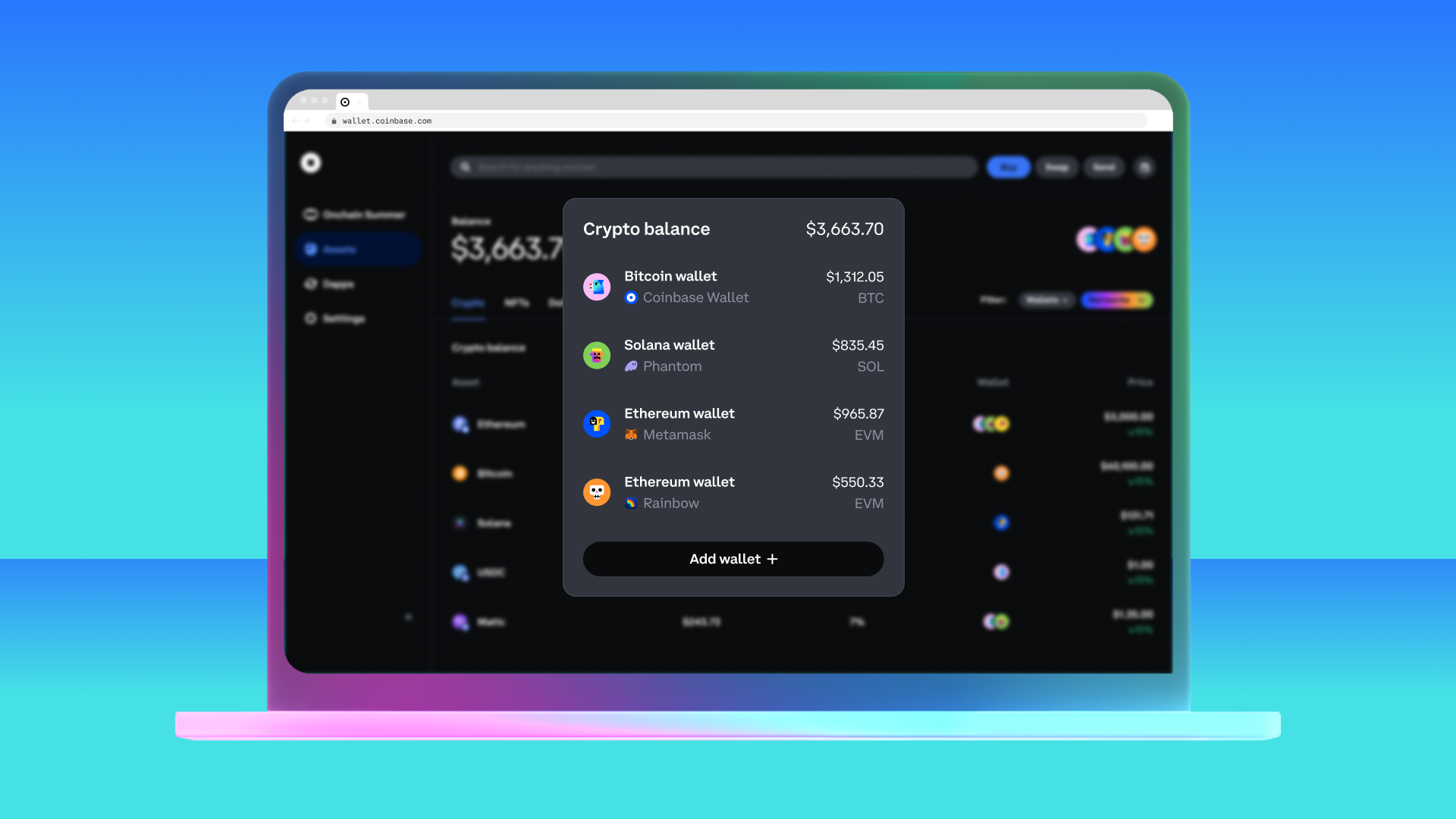

Your earned Bitcoin is credited directly to your Coinbase Digital Asset Wallet, typically when eligible purchases post. However, it’s important to remember that certain transactions (such as cash equivalents or gambling) are excluded from earning rewards. Additionally, if a purchase is refunded or reversed after earning Bitcoin back, expect a “Rewards Adjustment Charge” matching the fiat value of those credited rewards at that time (see official terms).

The Advantage of Using Your Card With Base Network DApps

If you’re an active participant in DeFi or NFT ecosystems on Base chain, using your Coinbase One Card comes with extra incentives, like $10 per month in sponsored smart wallet gas fees (details here). This benefit directly lowers your transaction costs when interacting with dApps or moving assets across chains via Base.

For Base users, this synergy is especially valuable. Not only do you earn up to 4% bitcoin back on real-world spending, but you also enjoy a smoother, less costly experience when bridging or transacting on Base-powered applications. The sponsored gas credits can effectively subsidize your on-chain activity, making it easier to experiment with DeFi protocols, mint NFTs, or swap Base chain tokens without worrying about incremental transaction fees eating into your rewards.

Another practical point is tracking your rewards. The Coinbase app provides a transparent breakdown of pending and posted Bitcoin rewards, letting you monitor accumulation in real time. For those accustomed to traditional credit card points systems, this is a paradigm shift: instead of airline miles or gift cards, you receive direct digital asset exposure, potentially appreciating over time as Bitcoin’s price evolves.

Tips to Maximize Your Crypto Cashback Strategy

Top Tips to Maximize Bitcoin Back with Coinbase One Card

-

Maintain a High Asset Balance on CoinbaseHolding more assets on Coinbase increases your Bitcoin back rate, with rewards ranging from 2% up to 4% back on every purchase. Aim to keep a higher balance to unlock the maximum rate.

-

Use the Card for Everyday PurchasesMaximize your Bitcoin rewards by using your Coinbase One Card for daily spending at merchants accepting Visa® debit cards. Everyday expenses add up quickly, boosting your total Bitcoin back.

-

Monitor Eligible Transactions CloselyNot all purchases qualify for Bitcoin back. Review Coinbase’s eligible transaction list regularly to ensure your spending earns rewards and avoid excluded categories like cash equivalents or gambling.

-

Leverage Base Network PerksAs a Base user, take advantage of $10/month in sponsored smart wallet gas on Base, reducing your transaction costs and increasing your net rewards.

-

Track and Redeem Rewards PromptlyKeep an eye on your Coinbase wallet for credited Bitcoin rewards, which may take up to 30 days to appear. Redeem or reinvest your rewards strategically to maximize growth potential.

-

Maintain Active Coinbase One MembershipYour card and rewards depend on an active, paid Coinbase One membership. Ensure your membership doesn’t lapse to avoid account closure and loss of Bitcoin back benefits.

-

Stay Updated on Reward Program ChangesCoinbase may adjust reward rates or eligible categories. Regularly check Coinbase’s official updates to optimize your earning strategy and avoid surprises.

To get the most out of your Coinbase One Card:

- Consolidate Spending: Use the card for all eligible purchases, groceries, dining, subscriptions, to maximize monthly bitcoin accruals.

- Maintain Asset Levels: Since your reward rate scales with assets held on Coinbase, consider keeping a portion of your portfolio in your account to secure higher rates.

- Leverage Base Chain Perks: Take advantage of sponsored gas credits by using smart wallets and dApps within the Base ecosystem.

- Avoid Ineligible Transactions: Familiarize yourself with exclusions (cash equivalents, gambling) to ensure all spending qualifies for rewards.

- Monitor Reward Timing: Note that it may take up to 30 days for rewards to post after purchases, plan accordingly if you’re targeting specific accumulation goals.

If you’re new to crypto cashback cards or want a comparative perspective, the Coinbase One Card stands out by offering exposure to Bitcoin rather than stablecoins or platform-specific tokens. For users bullish on long-term crypto appreciation, and especially those active in the Base network, the combined effect of ongoing bitcoin accumulation plus subsidized gas fees can be significant over time.

What Sets This Card Apart From Other Crypto Rewards Cards?

The market has seen several crypto cards promising cashback in various digital currencies. However, few tie their reward rates so directly to asset holdings and integrate seamlessly with an L2 like Base. This dual incentive structure encourages both holding and active participation across centralized (Coinbase) and decentralized (Base chain) environments, a rare alignment that benefits power users and newcomers alike.

The requirement for an active Coinbase One membership does add an annual fee layer ($49.99 per year), but this can be offset quickly if you’re maximizing both purchase volume and taking advantage of Base-specific perks like monthly gas credits. For many users already engaged in DeFi or NFT activities, or simply seeking a more direct way to earn Bitcoin from daily life, the value proposition is compelling.

Final Thoughts: Integrating Crypto Into Everyday Life

The launch of the Coinbase One Card signals another step toward mainstream crypto adoption, particularly for those deepening their involvement with innovative chains like Base. By combining traditional Visa acceptance with dynamic crypto rewards and ecosystem-specific bonuses, it blurs the line between fiat finance and decentralized opportunity.

If you’re already invested in the Base network or looking for ways to make your everyday spending work harder through Bitcoin accumulation, this card deserves serious consideration. As always, review all terms carefully (official details here) before applying, and remember that prudent portfolio management should guide how much capital you keep on any single platform.