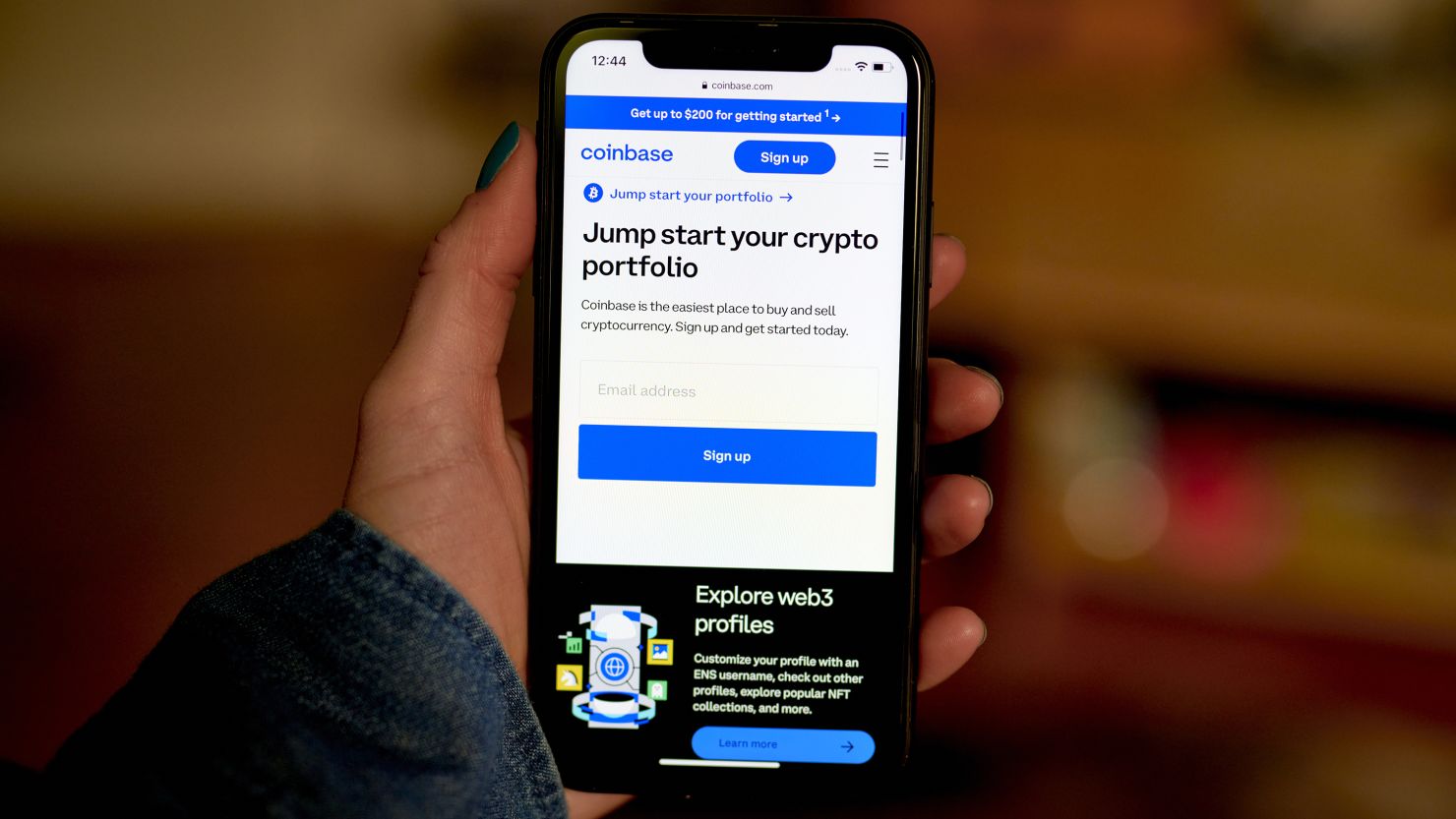

Trading Base chain tokens has historically required a patchwork of wallets, bridges, and decentralized exchanges (DEXs). But with Coinbase’s latest integration, U. S. users (excluding New York) can now trade newly launched Base-native tokens instantly, without ever leaving the Coinbase app. This marks a major milestone for mainstream access to decentralized finance (DeFi), simplifying what was once a multi-step process into just a few taps.

Coinbase DEX Trading: Instant Access to New Base Tokens

The recent update brings DEX trading directly into the core Coinbase experience. Instead of waiting for centralized listings, users can now buy and sell tokens as soon as they’re live on-chain. This is especially relevant for those tracking Base memecoins or hunting early-stage projects that debut exclusively on Base before wider exchange adoption.

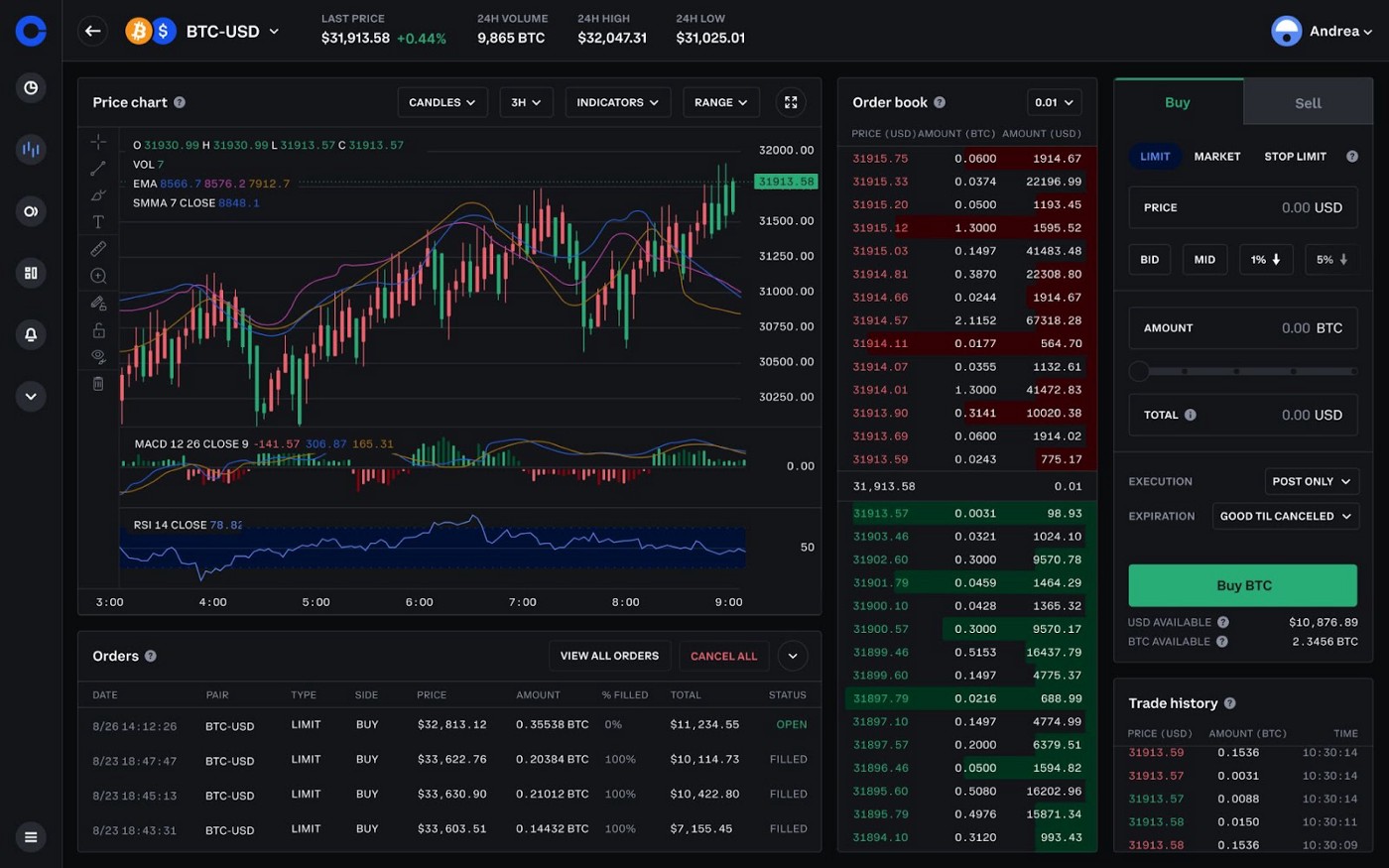

Coinbase routes trades through leading DEX aggregators like 0x and 1inch, which source liquidity from top platforms such as Uniswap and Aerodrome. The result: optimal pricing, deeper liquidity, and access to thousands of assets previously out of reach for most retail users. Even better, Coinbase covers network fees for these transactions, removing one of the biggest pain points in DeFi trading.

How Does It Work? The Visual Flow Inside the App

If you’ve used Coinbase’s standard trading features, you’ll find this new flow refreshingly familiar but enhanced with DeFi power under the hood. Here’s what sets it apart:

Key Benefits of Coinbase’s DEX Integration for Base Tokens

-

Instant Access to Newly Launched Tokens: Trade Base-native tokens immediately upon their on-chain creation, without waiting for centralized exchange listings.

-

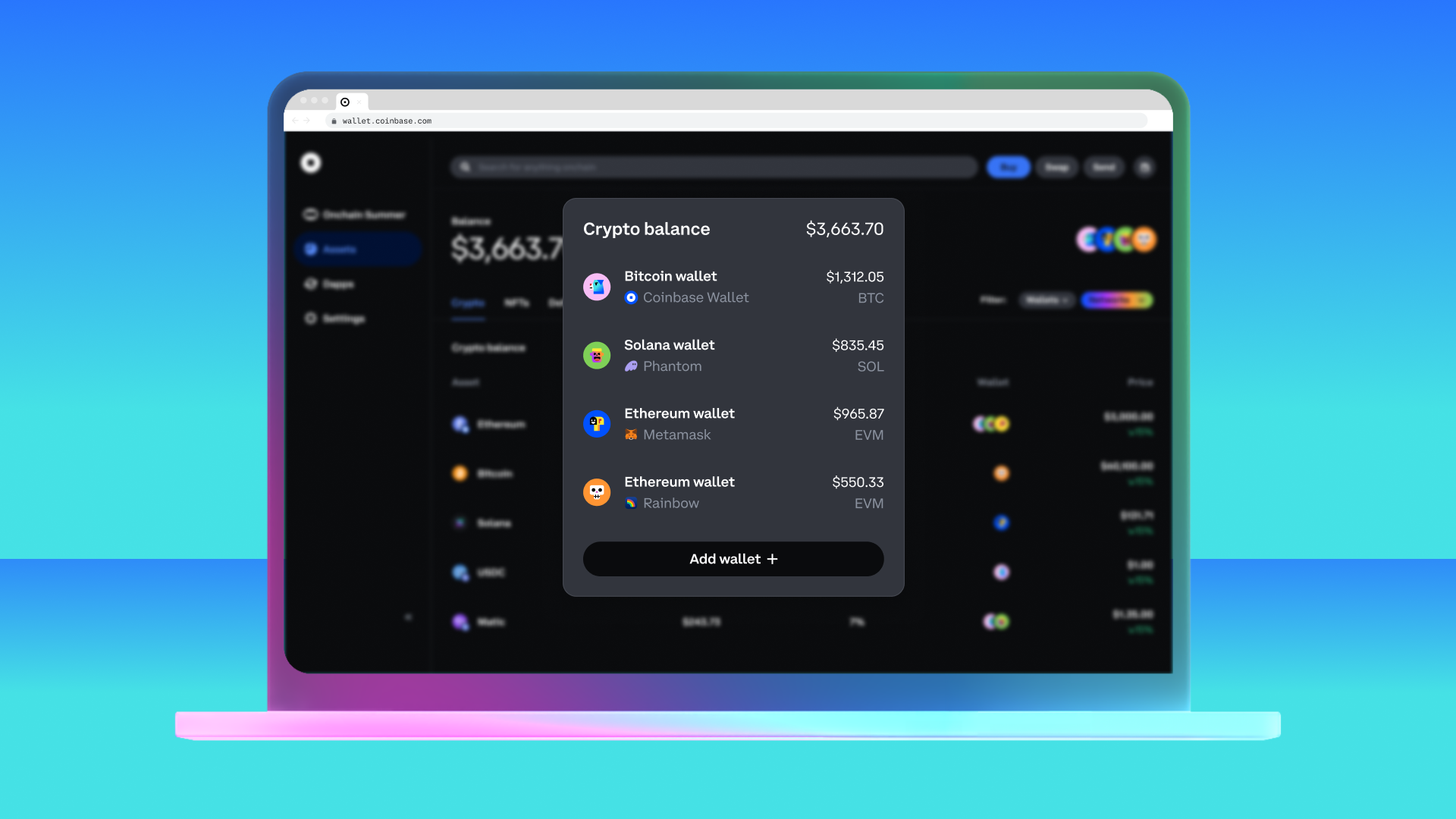

Seamless In-App Experience: Buy and sell Base chain tokens directly within the familiar Coinbase app interface—no need to use external wallets or platforms.

-

Optimal Pricing via DEX Aggregators: Trades are routed through leading DEX aggregators like 0x and 1inch, accessing liquidity from platforms such as Uniswap and Aerodrome for the best available prices.

-

Network Fees Covered by Coinbase: Coinbase covers network fees for Base token trades, making transactions simpler and more cost-effective for users.

-

Expanded Asset Selection: Gradual addition of new Base assets increases the variety of tokens available to trade, broadening investment opportunities.

-

Full User Control and Security: Users retain control of their assets through integrated web3 wallet support, aligning with decentralized finance (DeFi) principles.

The entire process is designed to be frictionless:

- Select ‘Trade’ in your Coinbase app

- Search or browse newly launched Base-native tokens

- Review real-time pricing sourced from multiple DEXs

- Confirm your order, Coinbase will handle routing and network fees automatically

This workflow means you no longer need to bridge funds manually or juggle multiple apps just to capture an opportunity on a fresh token launch.

The Power of Early Access: Why Trade New Tokens Instantly?

Speed matters in crypto, especially when it comes to emerging assets like Base memecoins or innovative DeFi protocols launching on Base. With instant token trading in the Coinbase app, you gain several advantages:

- No more waiting for centralized listings: Trade at the same time as everyone else on-chain.

- Simplified risk management: Use familiar tools like price alerts and portfolio tracking within your existing account.

- Diversification: Access a broader universe of assets without additional setup or technical hurdles.

This democratizes early-stage participation while maintaining the security standards expected from a regulated platform like Coinbase. As more projects choose Base as their launchpad, this feature could become essential for active traders and portfolio builders alike.

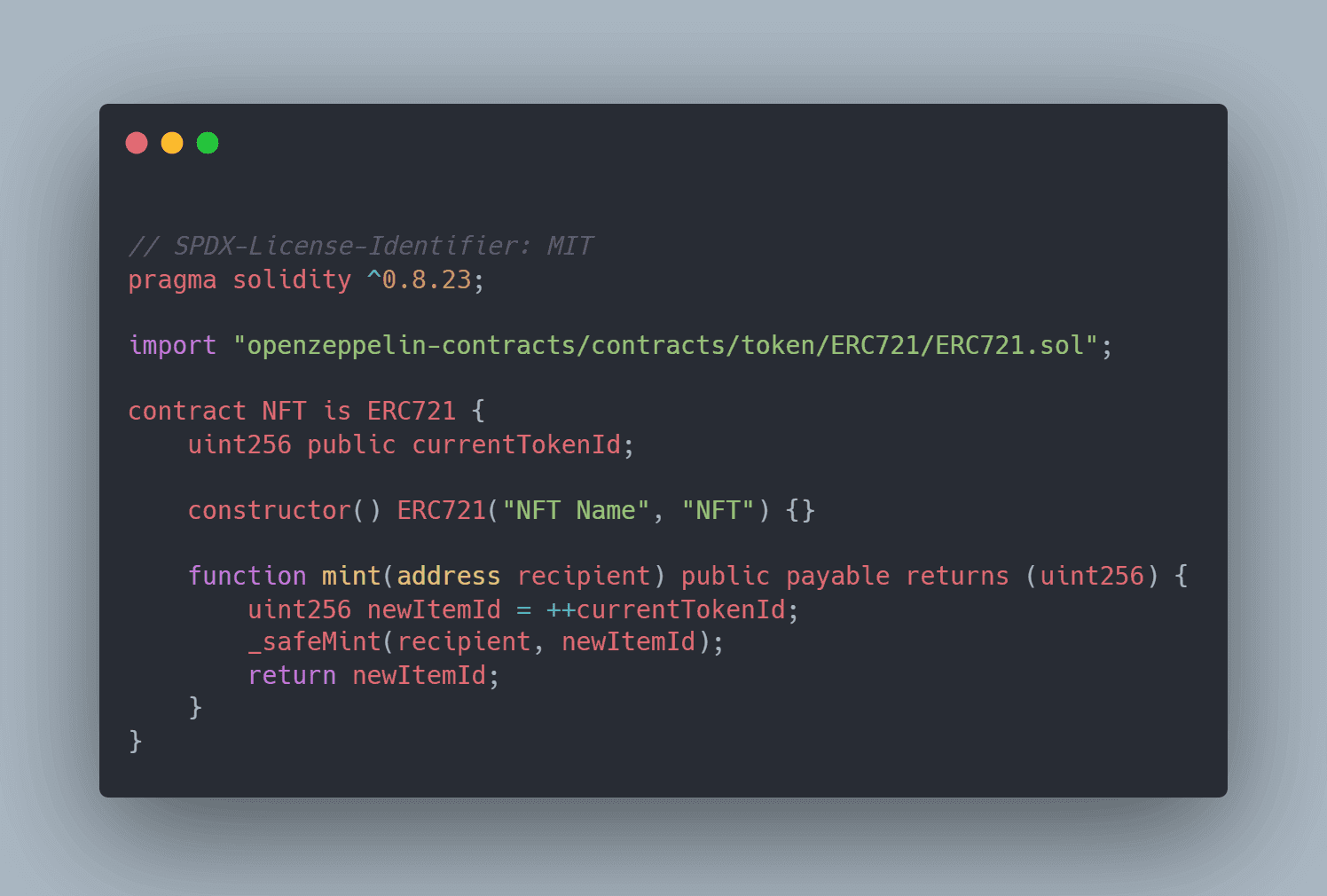

Of course, with greater access comes the need for heightened diligence. While trading Base chain tokens instantly can offer first-mover advantage, it also exposes users to volatility and the risks inherent in unvetted projects. Not every new token will succeed, and some may experience dramatic price swings within minutes of launch. It’s crucial to research each asset, review its contract address, community traction, and project fundamentals, before committing capital.

Security remains paramount. Even though Coinbase manages network fees and routing behind the scenes, you retain custody of your assets through your connected wallet. This hybrid approach blends DeFi flexibility with centralized protections like two-factor authentication and withdrawal whitelists. For those new to DEXs or Base tokens, this can offer peace of mind without sacrificing access.

Tips for Trading Base Tokens Responsibly

Top Tips for Safely Trading Base Tokens in Coinbase

-

Verify Token Authenticity: Always double-check the token contract address before trading. Use trusted sources like BaseScan or the official project website to confirm you’re selecting the legitimate Base token in the Coinbase app.

-

Understand DEX Integration: Coinbase routes trades through reputable DEX aggregators like 0x and 1inch, sourcing liquidity from platforms such as Uniswap and Aerodrome. Familiarize yourself with how DEX trading works within the app for greater control and transparency.

-

Check Supported Regions: DEX trading for Base tokens in the Coinbase app is currently available to U.S. users (excluding New York). Ensure your region is supported before attempting to trade.

-

Review Network Fees and Slippage: While Coinbase covers network fees for Base DEX trades, always review the estimated slippage and final price before confirming a transaction, especially with newly launched tokens.

-

Enable Security Features: Protect your assets by enabling two-factor authentication and using a strong, unique password for your Coinbase account. Consider using Coinbase Wallet for additional control over your private keys.

Consider setting stop-losses or using portfolio tools within Coinbase to monitor your exposure. If you’re experimenting with Base memecoins, limit positions to amounts you’re prepared to lose. And remember: while instant token trading opens up new opportunities, it’s no substitute for portfolio discipline and ongoing education.

Visual Guide: Placing Your First Trade

Whether you’re a DeFi veteran or just exploring Base for the first time, Coinbase’s DEX integration strips away much of the technical friction that has historically kept newer users at bay. The process is now as simple as selecting your asset and confirming your order, no bridges or third-party wallets required.

What’s Next? The Future of Instant Token Trading

This rollout is just the beginning. As more projects launch on Base, and as additional assets are added to the supported list, expect even broader access to innovative protocols and communities directly from your main exchange interface. For traders seeking speed, security, and simplicity when buying into emerging trends like Base memecoins or DeFi primitives, this is a game changer.

For further details on how this works under the hood or how to get started with web3 wallets on Base, check out CoinDesk’s coverage and CryptoBriefing’s explainer.

The landscape for instant token trading is evolving fast, and with Coinbase bridging traditional finance and decentralized rails, accessing new opportunities on Base has never been easier.