In the rapidly evolving world of decentralized finance, AerodromeFi and the Base chain have emerged as a powerhouse duo, fueling an unprecedented surge in spot FX trading volumes. As of August 2024, Aerodrome’s Total Value Locked (TVL) has soared past $1 billion, accounting for nearly half of all assets on the Base network. This explosive growth is not a coincidence but the result of strategic innovation, robust liquidity incentives, and seamless integration with Coinbase’s retail ecosystem.

AerodromeFi: The Liquidity Engine Behind Base Chain’s Spot FX Boom

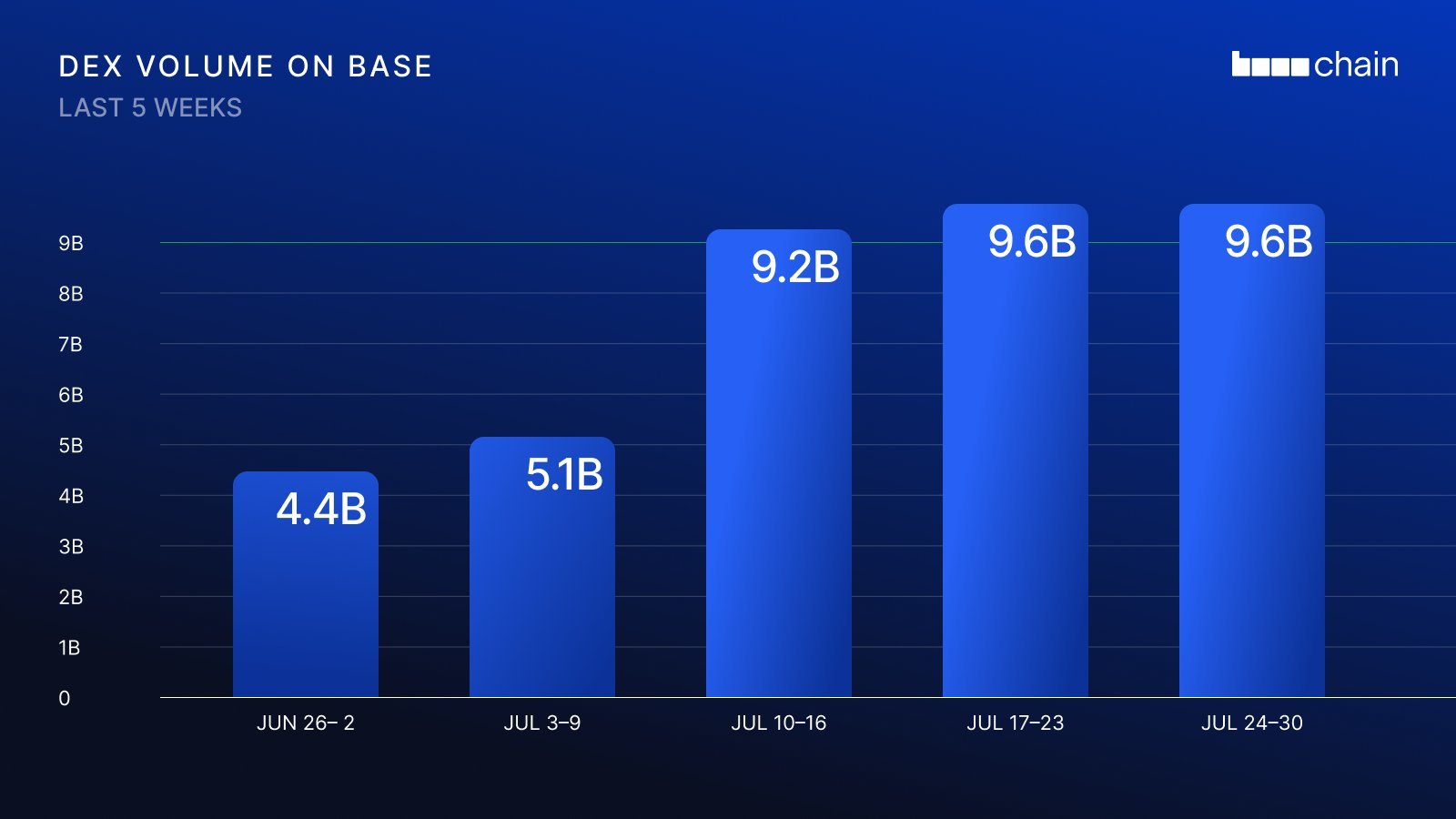

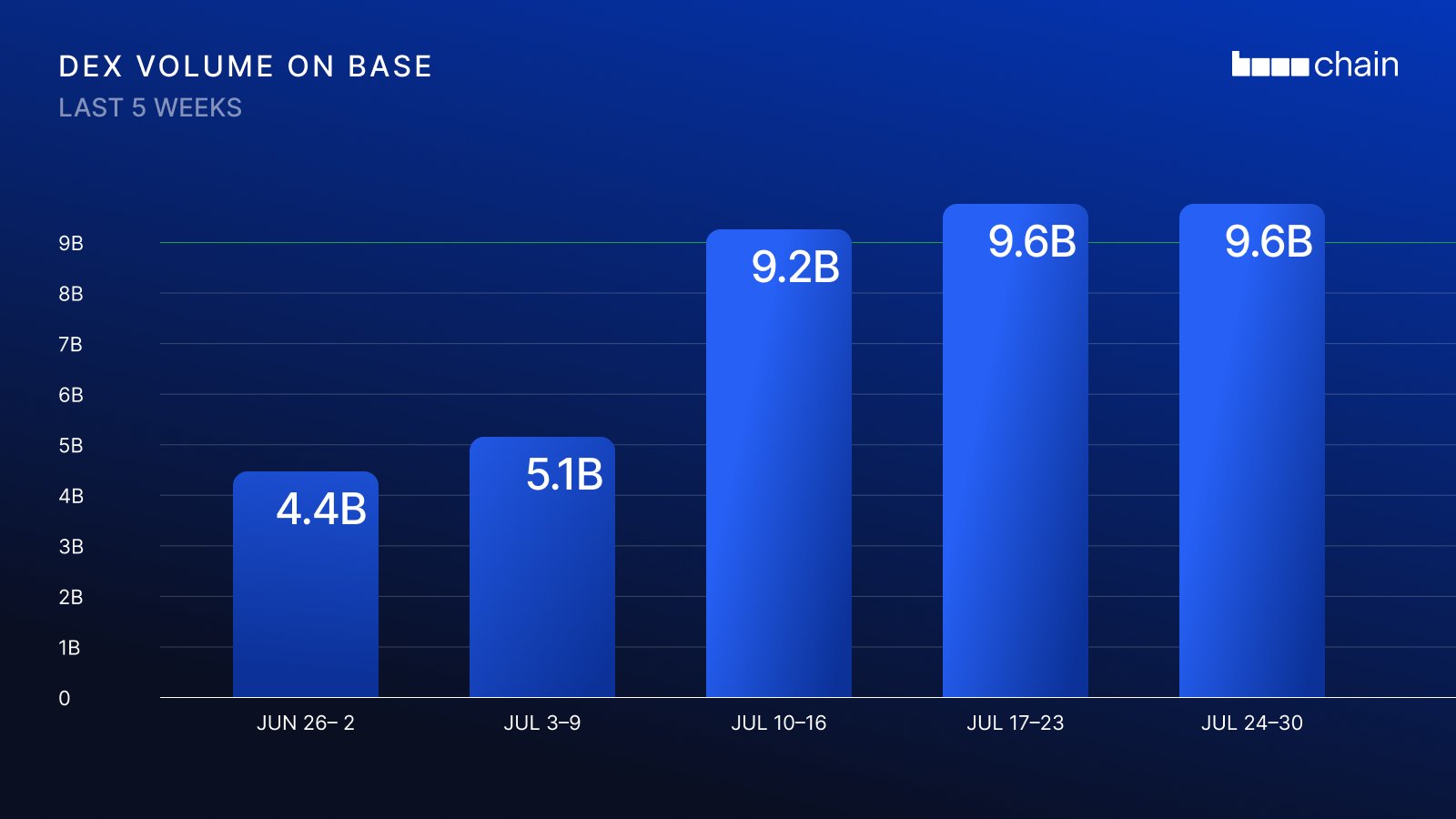

Aerodrome Finance is not just another decentralized exchange (DEX) – it is the central liquidity engine of the Base chain. With 274 coins and 392 trading pairs currently listed (CoinGecko), Aerodrome offers traders and liquidity providers a vast playground for spot FX trading. Over the past month alone, Aerodrome processed $9.02 billion in trades, rivaling top Solana-based DEXs and cementing its dominance within Base’s DeFi landscape.

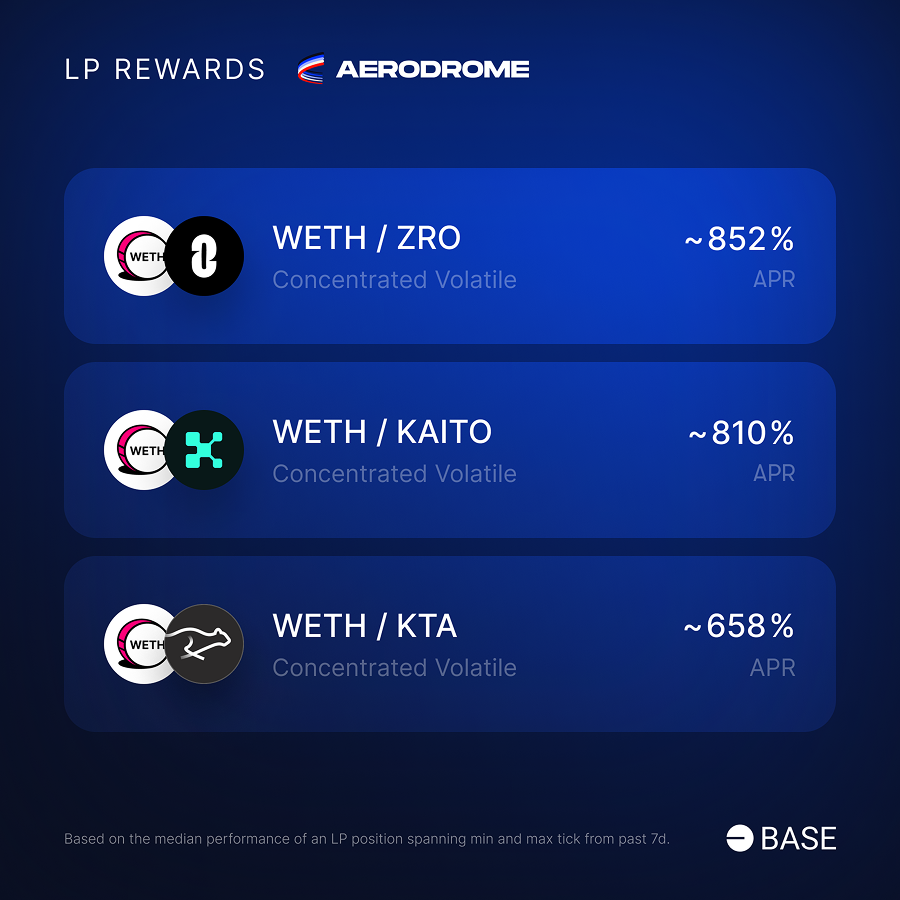

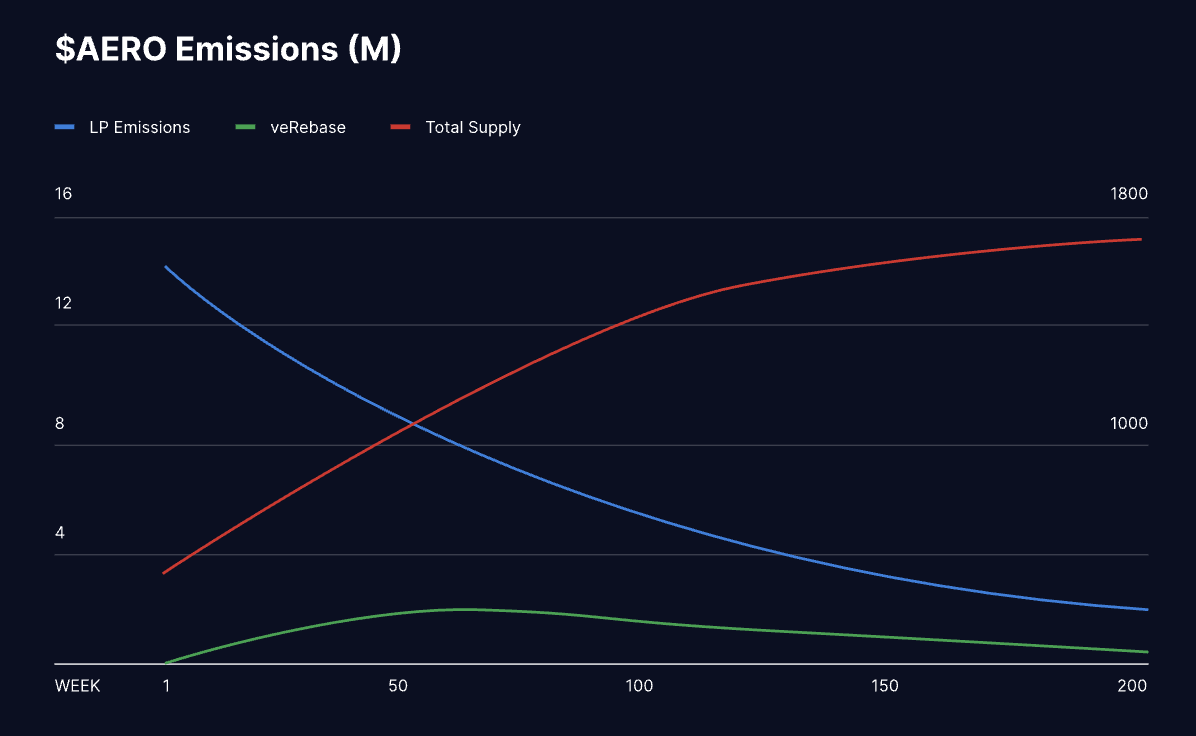

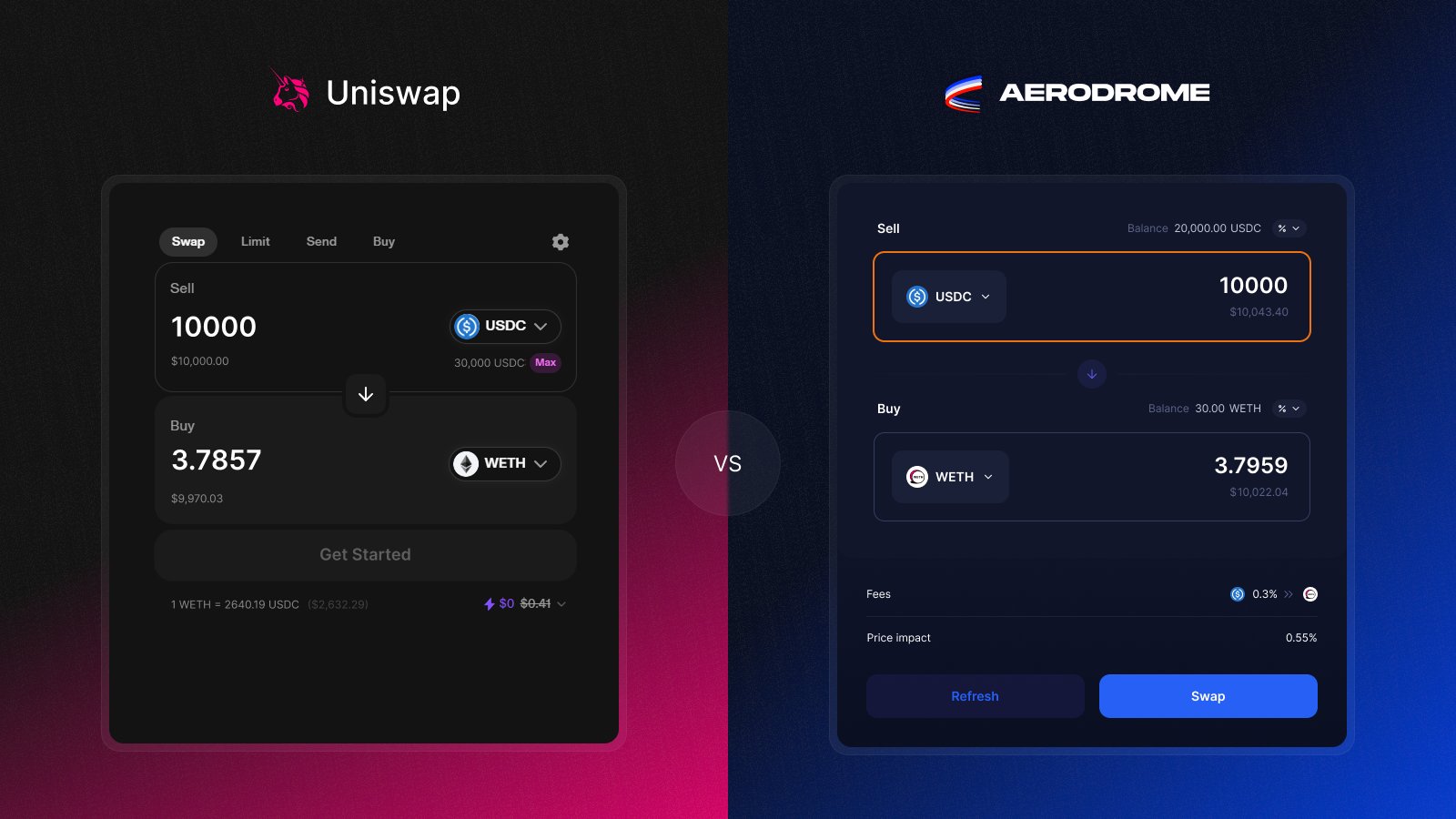

The recent introduction of the Slipstream upgrade, which enables concentrated liquidity pools, has been pivotal. This upgrade allows liquidity providers to allocate capital more efficiently within specific price ranges, resulting in tighter spreads and lower slippage for traders. The result? A dramatic uptick in both volume and user engagement.

“Spot FX volume on Base continues to go vertical. Over $173 million in spot volume last week. Most of this volume takes place on @AerodromeFi. ”

Base Chain Trading Volume Analytics: Breaking Down the Numbers

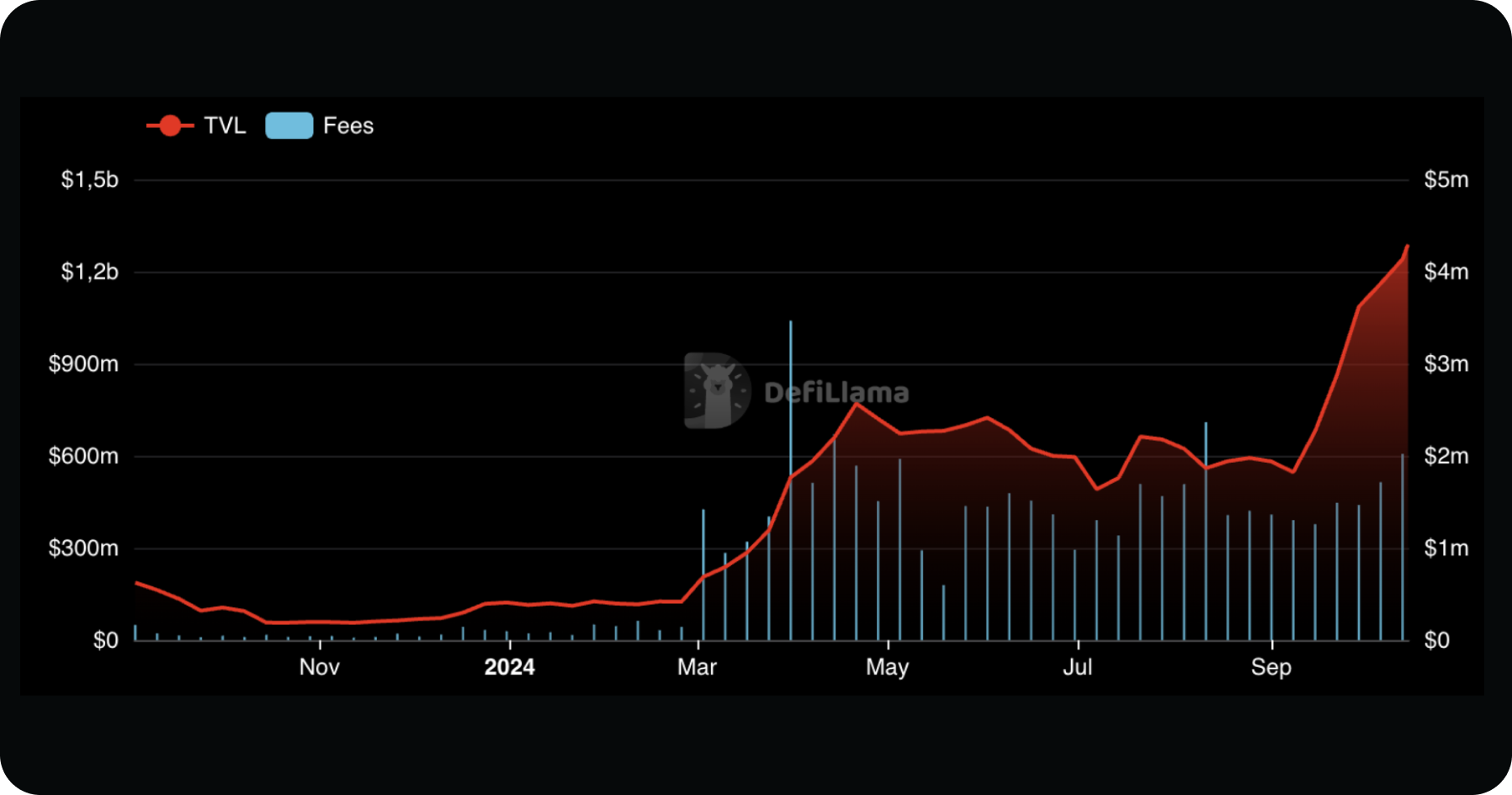

The numbers tell a compelling story. According to DefiLlama, Base chain generated $317,423 in fees over 24 hours and reported $1.32 million in app revenue. These figures reflect not only robust user activity but also healthy protocol economics that incentivize further participation from both traders and developers.

This momentum is mirrored by surging TVL figures: In January 2024, Aerodrome held just $120 million in deposits; by August 2024 it had surpassed $1 billion (The Block). Such rapid capital inflow is rare even among leading DeFi protocols and highlights users’ growing appetite for efficient on-chain spot FX markets.

Key Drivers of AerodromeFi’s Spot FX Growth

-

Massive Total Value Locked (TVL): Aerodrome Finance surpassed $1 billion in TVL by August 2024, accounting for nearly half of all assets on the Base blockchain. This substantial liquidity pool underpins deep, efficient spot FX trading.

-

Slipstream Upgrade for Concentrated Liquidity: The Slipstream upgrade introduced advanced concentrated liquidity pools, significantly improving trading efficiency and reducing slippage for spot FX pairs on Aerodrome.

-

Integration with Coinbase Retail App: Aerodrome’s seamless integration with Coinbase’s retail app has expanded its user base, making spot FX trading more accessible to millions of retail investors.

-

Dominant Share of Base Chain Activity: Aerodrome processes over $173 million in weekly spot FX volume and nearly half of Base’s total deposits, establishing itself as the leading DEX and liquidity hub on the chain.

-

Rapid User Base Growth: The Base network saw a 53% daily surge in users to a record 267,000, with Aerodrome capturing a significant share, further fueling trading activity and liquidity.

User Growth and Onboarding: Coinbase Integration Supercharges Adoption

A critical catalyst behind this wave has been Aerodrome’s integration with Coinbase’s retail app. This move opened the floodgates for mainstream users to access DeFi directly from their familiar exchange environment, removing many friction points that previously kept traditional investors at bay (Bankless Times). As a result, the Base network saw its user base jump by an astonishing 53% in a single day to over 267,000 active wallets.

This influx has translated into higher liquidity depths across trading pairs and more competitive pricing for all participants, fueling yet another cycle of growth as word spreads through crypto communities.

With more users comes greater network activity, and the data backs up this thesis. Aerodrome’s 24-hour trading volume recently clocked in at $26,231,549.87, with a monthly average of $39.31 million according to the latest analytics (CoinGecko). This consistent throughput has made AerodromeFi a liquidity magnet not just for established tokens but also for new Base-native projects seeking deep markets and reliable execution.

The protocol’s ability to capture nearly half of Base chain’s total value locked is especially significant given the broader competition among Layer 2s. By combining concentrated liquidity pools, aggressive rewards programs, and seamless onboarding through Coinbase, AerodromeFi has created a feedback loop where more capital attracts more users, which in turn drives even higher trading volumes.

Spot FX Trading on Base: What Sets Aerodrome Apart?

What truly distinguishes AerodromeFi is its relentless focus on optimizing the spot FX trading experience for both retail and institutional participants. The Slipstream upgrade is just one piece of this puzzle, other features like real-time analytics dashboards, dynamic fee structures tailored to market conditions, and robust risk management tools have all contributed to its meteoric rise.

Moreover, with 392 active trading pairs, traders enjoy unparalleled flexibility in accessing both major crypto assets and emerging Base memecoins. This diversity not only supports speculative activity but also provides critical infrastructure for stablecoin swaps and cross-chain arbitrage strategies.

If we examine the current Base chain trading statistics, it’s clear that these innovations are paying off. The chain generated $4.16 million in app fees over 24 hours, a figure that rivals some established Ethereum-based protocols, while maintaining healthy spreads across even the most volatile pairs.

Key Benefits of Using AerodromeFi on Base Chain

-

Massive Liquidity and Trading Volume: AerodromeFi accounts for nearly half of Base’s $1 billion+ TVL, ensuring deep liquidity for spot FX trades and minimizing slippage.

-

Innovative Slipstream Upgrade: The Slipstream feature enables concentrated liquidity pools, boosting trading efficiency and improving price execution for traders.

-

Seamless Integration with Coinbase: Direct integration with Coinbase’s retail app expands user access and simplifies onboarding, driving higher trading volumes and accessibility.

-

Low Fees and High Revenue Generation: With $4.16 million in daily app fees and efficient Base chain infrastructure, traders benefit from competitive transaction costs and robust platform incentives.

-

Dominant DeFi Position on Base: AerodromeFi’s dominance as the leading DEX on Base provides traders with a reliable, established platform backed by consistent growth and high trading activity.

The Road Ahead: Sustaining Growth Amid Intensifying Competition

The challenge now is sustainability. As other Layer 2s race to replicate Aerodrome’s success, maintaining this breakneck pace will require ongoing product innovation and community engagement. The team behind AerodromeFi appears well aware of this imperative, recent updates hint at further integrations with leading DeFi protocols and deeper support for advanced order types aimed at professional traders.

Still, for now, Aerodrome stands as a case study in how thoughtful design choices can unlock new levels of liquidity and participation within on-chain FX markets. Its symbiotic relationship with the Base network means that as one grows stronger, so does the other, a dynamic that could reshape DeFi trading well into 2025 and beyond.

“Decentralized exchanges like Aerodrome are proving that deep liquidity and efficient price discovery are possible without sacrificing user ownership or transparency. ”

The numbers don’t lie: with $1 billion and TVL, daily volumes exceeding $26 million, and an ever-expanding user base thanks to Coinbase integration, AerodromeFi is setting the standard for spot FX innovation on Base, and making a compelling case for where DeFi is headed next.