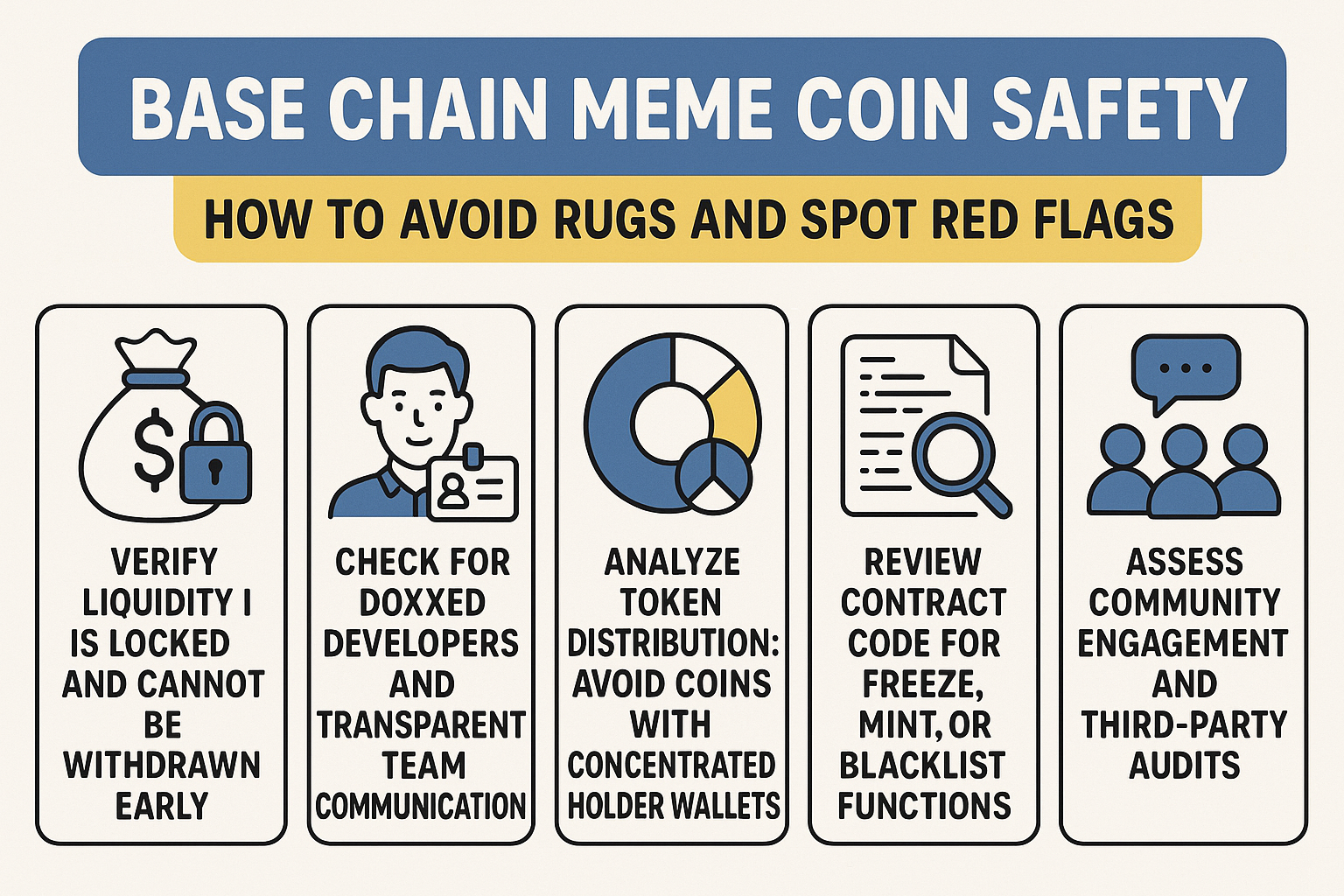

The Base chain meme coin ecosystem is booming, but with every new token comes the lurking risk of scams and rug pulls. If you’re eager to explore the wild world of Base memecoins, your best defense is a sharp eye for red flags and a clear checklist of safety strategies. Let’s break down the most actionable steps you can take to protect your funds and spot trouble before it strikes.

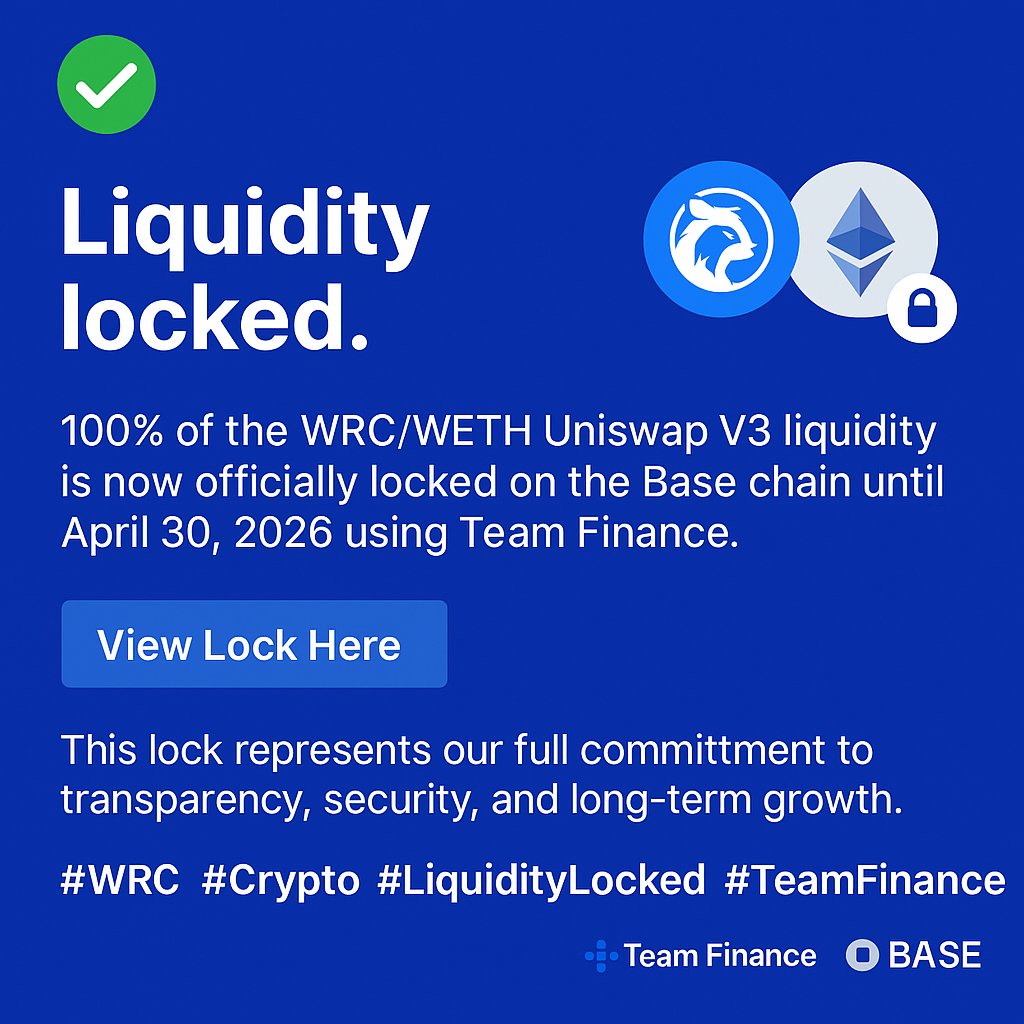

1. Verify Liquidity is Locked and Cannot Be Withdrawn Early

Liquidity is the lifeblood of any decentralized token. Without it, trading grinds to a halt—or worse, developers can drain the pool, leaving holders with worthless tokens. Always check that the project’s liquidity is locked in a reputable smart contract locker (like Unicrypt or Team Finance) for a substantial period. If developers can access or withdraw liquidity early, that’s an instant red flag.

Tips to Check If Base Token Liquidity is Locked

-

Verify Liquidity is Locked and Cannot Be Withdrawn Early: Use trusted platforms like Team Finance or Unicrypt to check if a token’s liquidity is locked. Look for a lock duration and ensure the contract owner cannot withdraw funds before the lock expires.

-

Analyze Token Distribution: Avoid Coins with Concentrated Holder Wallets: Use blockchain explorers like Basescan to review token holder distribution. Be cautious if a small number of wallets control a large percentage of the supply.

On Base chain, where new meme coins launch daily, this step alone filters out a huge number of potential rugs. Don’t just take their word for it—look for proof via blockchain explorers or third-party dashboards.

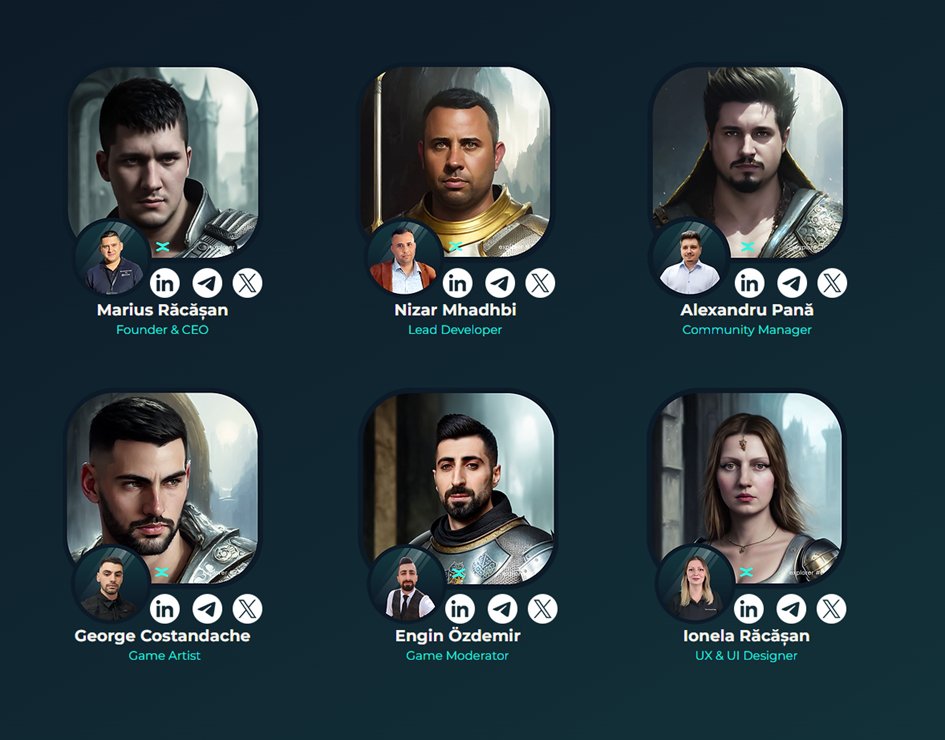

2. Check for Doxxed Developers and Transparent Team Communication

Anonymous teams are common in crypto, but real transparency goes beyond quirky pseudonyms and cartoon avatars. Look for projects where the developers are doxxed: names, LinkedIn profiles, past projects—anything that ties them to a real-world identity and reputation. Even better if they host AMAs or engage openly on social media.

If team members dodge questions or vanish from public channels after launch, consider it a serious warning sign. The more open and communicative the team, the safer you are as an investor.

3. Analyze Token Distribution: Avoid Coins with Concentrated Holder Wallets

A healthy meme coin has widely distributed tokens. If one or two wallets control 20% or more of supply—or if the top 10 wallets own most of the project—it’s an invitation for price manipulation (and sudden dumps). Always check holder distribution on-chain before investing.

This isn’t just about whales; sometimes even devs stash large amounts in stealth wallets. If you see suspiciously concentrated holdings, especially among wallets linked to deployers or team members, move on to safer pastures.

Essential Strategies for Safe Token Distribution Analysis

-

Verify Liquidity is Locked and Cannot Be Withdrawn Early: Use reputable platforms like Team Finance or Unicrypt to check if a token’s liquidity is locked. Locked liquidity helps prevent rug pulls by ensuring developers can’t suddenly withdraw funds.

-

Check for Doxxed Developers and Transparent Team Communication: Look for meme coins with publicly identified team members. Platforms like CoinMarketCap and CoinGecko often highlight projects with doxxed teams and active communication channels.

-

Analyze Token Distribution: Avoid Coins with Concentrated Holder Wallets: Use tools like Basescan to review holder distribution. Be wary if a few wallets control a large percentage of the supply, as this increases the risk of price manipulation or sudden dumps.

-

Review Contract Code for Freeze, Mint, or Blacklist Functions: Platforms such as Basescan and Cyberscope allow you to inspect smart contract code. Watch out for functions that let developers freeze trading, mint new tokens, or blacklist users.

4. Review Contract Code for Freeze, Mint, or Blacklist Functions

Even if a meme coin looks fun and the community is buzzing, a dangerous contract function can spell disaster. Always review the project’s smart contract (or seek out trusted analysis tools) for functions that let developers freeze trading, mint unlimited tokens, or blacklist wallets. These backdoors are a favorite of scammers—allowing them to rug pull or manipulate the market long after launch.

If you’re not fluent in Solidity, use automated scanners like TokenSniffer or ask for independent reviews from reputable auditors. No legitimate Base chain project should have hidden powers to halt trading or mint more coins at will.

Essential Strategies to Vet Base Meme Coin Contracts

-

Verify Liquidity is Locked and Cannot Be Withdrawn Early: Use platforms like Team Finance or Unicrypt to check if the token’s liquidity pool is locked. This prevents developers from removing funds and rug pulling users.

-

Check for Doxxed Developers and Transparent Team Communication: Look for teams who have verified their identities on platforms like CoinMarketCap or have active, transparent communication on social channels such as Twitter and Discord.

5. Assess Community Engagement and Third-Party Audits

A vibrant community and external validation are two of the strongest indicators of a project’s legitimacy. Look beyond follower counts—are people genuinely interacting in Telegram, Discord, and Twitter threads? Are questions answered promptly? Projects that foster open discussion and encourage skepticism tend to be safer bets.

Third-party audits by well-known security firms add another layer of confidence. While not every meme coin can afford an audit at launch, those that do (and publish their findings) show a real commitment to transparency and safety. Be wary of projects that claim audits but never share reports or only reference obscure firms.

Which factor is more important to you when investing in Base meme coins?

When choosing a Base chain meme coin, do you rely more on strong community engagement or on third-party audits for your safety and confidence?

Quick Reference: Spotting Red Flags on Base Chain Meme Coins

Key Red Flags in Base Chain Meme Coins

-

Verify Liquidity is Locked and Cannot Be Withdrawn Early: Ensure the coin’s liquidity is locked using reputable platforms like Team Finance or Unicrypt. Unlocked liquidity allows developers to remove funds, leading to rug pulls.

-

Check for Doxxed Developers and Transparent Team Communication: Look for teams that have publicly verified identities through platforms like LinkedIn or have undergone KYC with services such as Assure DeFi. Anonymous teams are riskier.

-

Assess Community Engagement and Third-Party Audits: Check for active discussions on platforms like Discord or Twitter, and see if the project has undergone audits by trusted firms such as Hacken or PeckShield.

The Base chain meme coin landscape is fast-moving—and so are the scams. By methodically verifying liquidity locks, demanding transparency from teams, analyzing token distribution, inspecting contracts for malicious code, and prioritizing strong communities with third-party validation, you dramatically reduce your risk of getting rugged.

Stay vigilant, trust your research over hype, and never invest more than you’re willing to lose in this volatile corner of crypto. The next viral Base memecoin could change your portfolio—or drain it overnight. Make sure you’re prepared for both outcomes.