Hey traders, ETH is holding steady at $1,961.24 right now, with a tiny bump of and $23.86 over the last 24 hours. If you’re eyeing those wild Base memecoin pumps, bridging your ETH over is the move that unlocks low-fee frenzy trading without the Ethereum mainnet gas gouge. Base chain tokens and memecoins are where the momentum lives in 2026, and this low-fee guide gets you in fast.

Memecoin hunting on Base isn’t just hype; it’s a swing trader’s dream with transactions costing pennies and speeds that let you snipe entries before the herd. Forget the discontinued official Base bridge; third-party options like deBridge and Orbiter Finance have stepped up with sub-second transfers and fees under 0.001 ETH. I’ve ridden these trends, and respecting the risk means starting small while chasing those reversals.

Why Base Chain Dominates Memecoin Momentum in 2026

Base isn’t some sidechain afterthought; it’s Coinbase’s L2 powerhouse, optimized for high-volume plays like memecoin flips. Gas fees? Laughably low compared to Ethereum’s spikes. Speeds? Near-instant, perfect for front-running pumps. Right now, with ETH at $1,961.24, bridging lets you deploy capital where liquidity pools swell and tokens like top Base memecoins 10x overnight. Traders love it because you can ride trends without watching fees eat your profits. Security audits on these bridges keep things tight, but always test with $50 first. This setup screams actionable edge for swing plays.

From my six years calling shots, Base’s ecosystem flipped the script on L2 wars. Arbitrum and Optimism are solid, but Base’s memecoin meta draws degens and institutions alike. Bridge ETH to Base chain today, and you’re positioned for the next reversal rally.

Ethereum (ETH) Price Prediction 2027-2032

Forecasts amid Base chain adoption surge and memecoin trading growth (baseline: $1,961 in early 2026)

| Year | Minimum Price (USD) | Average Price (USD) | Maximum Price (USD) |

|---|---|---|---|

| 2027 | $2,200 | $3,500 | $5,200 |

| 2028 | $2,800 | $4,800 | $7,300 |

| 2029 | $3,500 | $6,400 | $9,800 |

| 2030 | $4,400 | $8,500 | $13,200 |

| 2031 | $5,500 | $11,200 | $17,400 |

| 2032 | $6,900 | $14,800 | $23,000 |

Price Prediction Summary

Ethereum is set for robust growth from 2027-2032, with average prices rising over 4x from $3,500 to $14,800. Bullish maximums reflect Base L2 adoption, low-fee bridges, and scaling upgrades; minimums account for potential bearish cycles or regulatory hurdles. Overall CAGR ~33% on averages, positioning ETH for $1T+ market cap potential.

Key Factors Affecting Ethereum Price

- Surge in Base chain usage for low-fee memecoin trading

- Efficient third-party bridges (deBridge, Orbiter, Across) reducing costs

- Ethereum L2 scaling (Dencun, future upgrades) boosting TVL

- DeFi and memecoin ecosystem expansion on Base

- Favorable regulations and institutional inflows via ETFs

- Market cycles with 2028-2029 bull phase

- Competition from Solana/Base but ETH’s smart contract dominance

Disclaimer: Cryptocurrency price predictions are speculative and based on current market analysis.

Actual prices may vary significantly due to market volatility, regulatory changes, and other factors.

Always do your own research before making investment decisions.

Prep Your Wallet: Seamless Base Network Addition

Before bridging ETH to Base, dial in your wallet. MetaMask, Rabby, or any EVM-compatible? Head to Chainlist. org, search “Base, ” and smash “Add to MetaMask. ” Boom, RPC details auto-populate: Chain ID 8453, explorer base. org, etc. Verify Base shows in your networks dropdown. Fund with ETH from an exchange if needed, but keep at least 0.01 ETH for gas. This step-by-step ritual takes 60 seconds and avoids newbie snags.

- Grab MetaMask or your wallet extension.

- Hit Chainlist, select Base Mainnet.

- Connect and approve addition.

- Switch networks, confirm balance view.

Pro tip: OKX Wallet or Coinbase Wallet shine here too, with built-in Base support. Now you’re primed for low-fee Base memecoin bridge guide action.

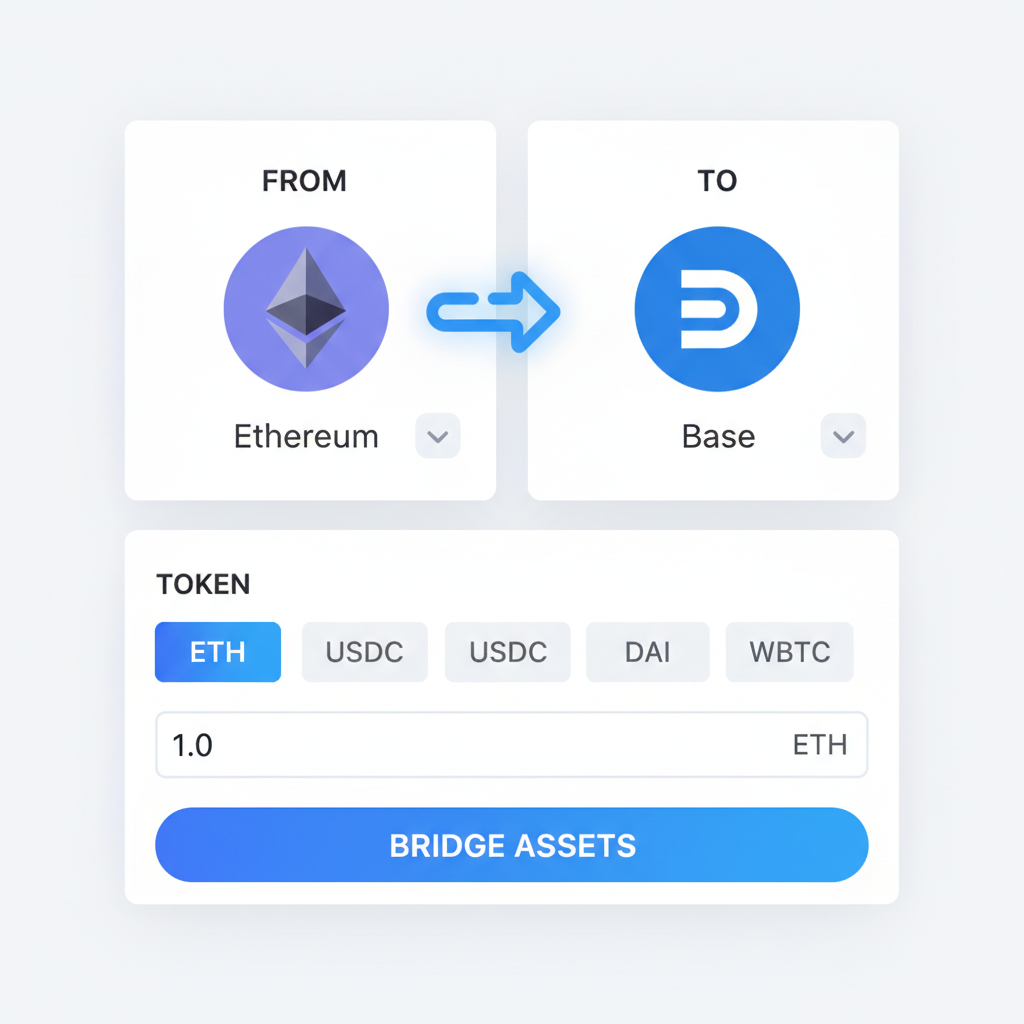

deBridge: Your Instant, Ultra-Low Fee ETH-to-Base Rocket

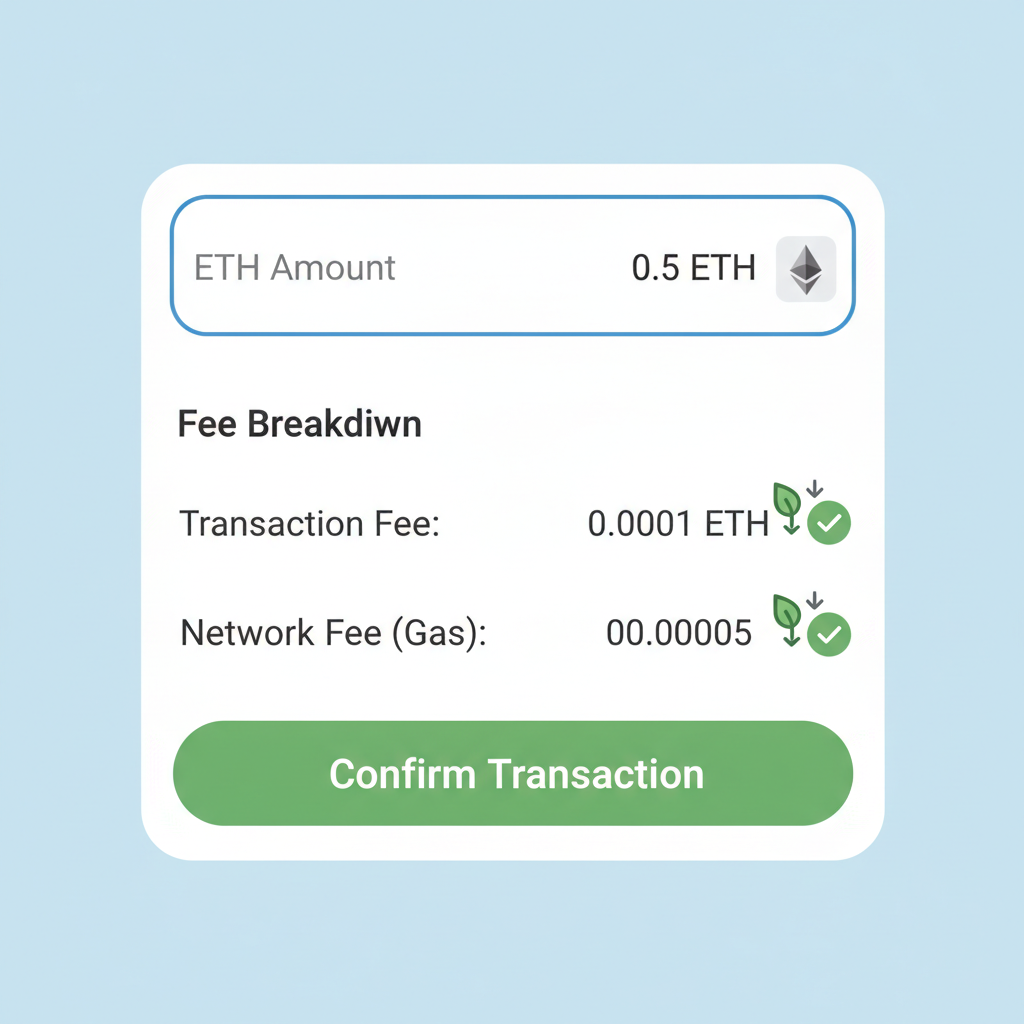

Top pick for 2026? deBridge. This beast zaps native ETH from Ethereum mainnet to Base in seconds, fixed fee at 0.001 ETH plus whatever gas Ethereum demands that day. Swing traders dig it for zero slippage and EVM wallet plug-and-play. Here’s the flow: Hit debridge. finance, pick Ethereum source, Base destination, ETH asset. Connect wallet, punch amount (start with 0.1 ETH test), review fees, sign tx. Watch it land faster than a memecoin dump.

Gas fees fluctuate, so check ethgasstation or bridge site during lulls. I’ve bridged hundreds this way; it’s reliable for momentum entries. Security? Battle-tested audits. Next up in low fee Base bridge tutorial: Orbiter for even cheaper routes via Arbitrum hops.

Orbiter Finance crushes multi-chain paths, letting you sidestep Ethereum gas by bridging from Arbitrum first. Select source (Arbitrum cheap), Base dest, ETH amount. Minutes later, funds hit. Fees? Cents. Ideal if you’re stacking sats on L2s already.

Across Protocol rounds out the trio for sub-minute confirms, fees dipping to pennies. Pick your poison based on speed vs cost, but deBridge owns for pure ETH mainnet plays. With ETH at $1,961.24, time your bridge off-peak and ride those Base trends hard.

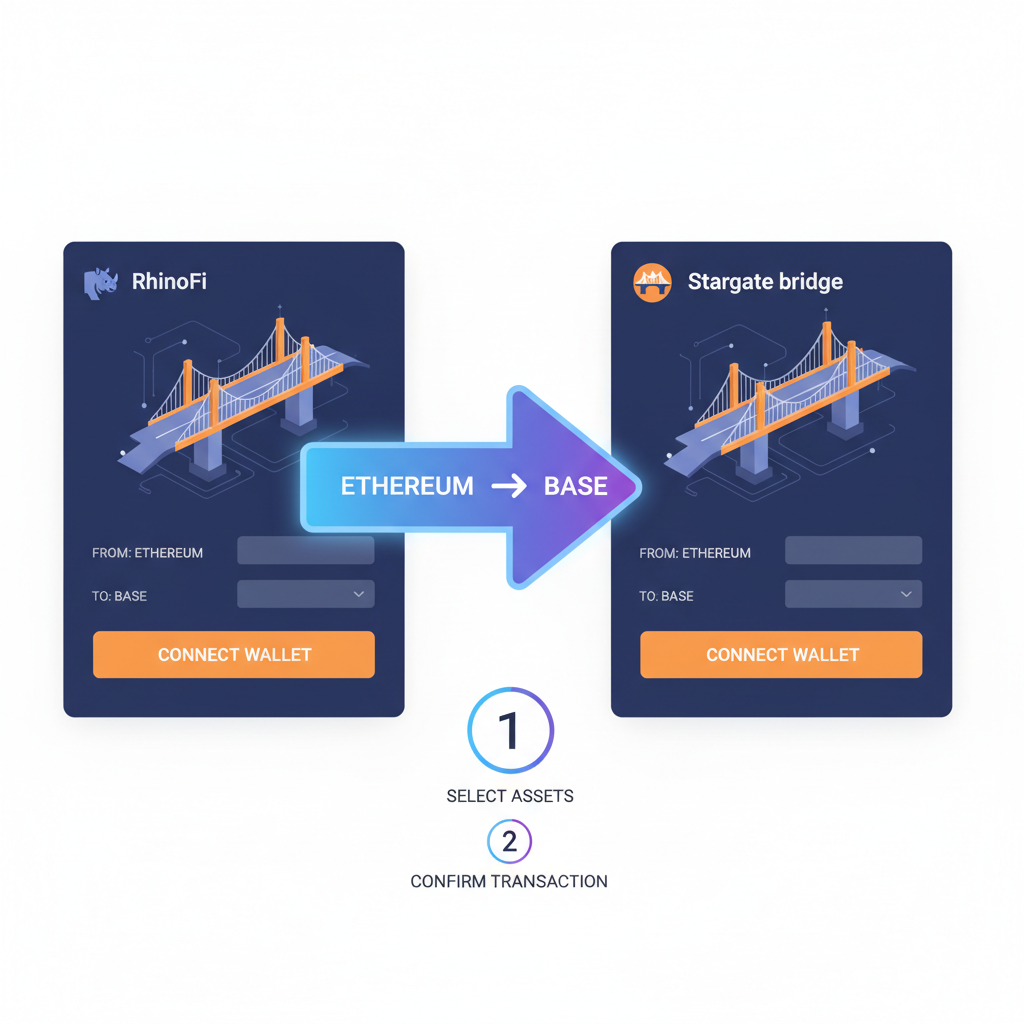

Let’s dive deeper into RhinoFi and Stargate, the dark horses rounding out your arsenal for bridging ETH to Base chain. RhinoFi’s interface is stupidly intuitive – connect wallet, pick Ethereum to Base, slide in your ETH amount (say 0.5 ETH at today’s $1,961.24 per coin), and hit confirm. Under 60 seconds later, you’re live on Base with fees maxing at 0.3%. I’ve used it for quick swings when deBridge queues up during hype.

Stargate? LayerZero magic means no wrapping hassles, perfect for chunky transfers without liquidity hiccups. Source Ethereum, dest Base, ETH token, amount, swap. Low fees, instant feels. Swing traders like me stack these for multi-chain momentum plays, hopping from Base pumps back to mainnet if needed.

Bridge Comparison: Pick Your Low-Fee Weapon

Comparison of Top Base Bridges for Memecoin Trading (2026)

| Bridge | Fees | Speed | Supported Assets | Best Use Case for Memecoin Traders |

|---|---|---|---|---|

| deBridge | 0.001 ETH (≈$1.96) + gas | Seconds ⚡ | Native ETH | Instant low-cost transfers for sniping new memecoins |

| Orbiter Finance | Low (route via cheaper L2s) | Minutes | ETH from Arbitrum/Binance etc. | Cost-saving for high-volume traders bridging from L2s |

| Across Protocol | As low as a few cents | <1 minute ⚡ | ETH & L2 assets | Ultra-fast confirms for time-sensitive pumps |

| RhinoFi | 0% – 0.3% | <60 seconds | Tokens across 20+ networks | User-friendly zero-fee options for quick flips |

| Stargate | Low (LayerZero pool) | Quick/Instant | ETH & major tokens (no wrapping) | Large transfers for whale memecoin plays |

Glance at that table and deBridge leads for mainnet purists, Orbiter for fee ninjas via Arbitrum. Gas is the real killer – Ethereum’s at decent levels now, but peek at basescan. org or ethgasstation. info pre-bridge. Off-peak? Midnight UTC often slashes costs 50%. Test every bridge with 0.01 ETH first; I’ve seen weird delays teach harsh lessons.

Security’s non-negotiable in this game. Stick to audited bridges like these, double-check URLs (debridge. finance, not some phishing clone), and never approve funky contracts. Base explorer verifies arrivals quick. With ETH steady at $1,961.24, your bridged stack positions you for memecoin mania without capital bleed.

Post-Bridge Blitz: Snipe Base Memecoins Like a Pro

Funds landed? Time to hunt. Base’s DEX kings – Aerodrome and Uniswap V3 – host the memecoin nurseries. Swap ETH for hot tokens via DEX Screener or Dextools for live charts. Spot volume spikes, rug-check contracts on basescan (locked liquidity? Renounced ownership?), then ape in small. Swing play: Enter on reversal candles, trail stops at 2x, exit on euphoria dumps.

- Scan Dexscreener. com/base for top gainers – filter 1h/6h pumps under $1M MC.

- Connect wallet to Aerodrome. finance, swap ETH for target memecoin.

- Set slippage to 5-10% for volatile entries.

- Monitor Twitter/Dextools for dev sells or hype builds.

- Take profits in stages: 50% at 3x, rest on moon.

This flow’s crushed it for me on Base flips. Respect risk: Never more than 1-2% portfolio per trade. Volatility’s the thrill, but overleverage flips wins to wipes.

Base memecoin bridge guide wouldn’t complete without warnings. Bridges can glitch during congestion – I’ve waited 10 mins max on these. Back to Ethereum? Reverse via same bridges or Superbridge. Track everything in Zerion or Debank for portfolio swings. With ETH’s subtle and 0.0123% 24h nudge to $1,961.24, momentum favors bold bridges into Base’s low-fee ecosystem.

You’re set: Wallet prepped, bridges mastered, trades queued. Ride those trends, stack those reversals, and keep risks tight. Base chain tokens wait for no one – bridge ETH to Base chain now and claim your slice of 2026’s memecoin surge.