In 2026, as Base chain memecoins surge in popularity, $TOSHI remains a standout at $0.000220, down -0.1385% over the past 24 hours with a high of $0.000265 and low of $0.000209. This feline-inspired token, drawing from Coinbase CEO Brian Armstrong’s cat and nods to Satoshi Nakamoto, offers more than meme appeal; it thrives in Base’s efficient layer-2 environment. Bridging to Base chain unlocks low-cost trades and potential airdrops, but success demands precision. This guide equips you with a conservative strategy to bridge safely and acquire $TOSHI without unnecessary risks.

TOSHI Memecoin Price Prediction 2027-2032

Professional forecasts for TOSHI on Base chain, showcasing growth potential and dominance in memecoin plays amid market cycles

| Year | Minimum Price | Average Price | Maximum Price | YoY % Change (Avg) |

|---|---|---|---|---|

| 2027 | $0.000150 | $0.000400 | $0.001000 | +82% |

| 2028 | $0.000250 | $0.000700 | $0.002500 | +75% |

| 2029 | $0.000400 | $0.001200 | $0.004000 | +71% |

| 2030 | $0.000600 | $0.002000 | $0.006000 | +67% |

| 2031 | $0.001000 | $0.003500 | $0.010000 | +75% |

| 2032 | $0.001500 | $0.005500 | $0.015000 | +57% |

Price Prediction Summary

TOSHI Memecoin is projected to see robust growth from its 2026 price of $0.000220, with average prices climbing to $0.005500 by 2032 (over 25x increase). Bullish maxima reflect memecoin hype and Base adoption, while minima account for bearish corrections and competition.

Key Factors Affecting TOSHI Memecoin Price

- Expansion of Base chain ecosystem and Coinbase integrations

- Memecoin hype cycles tied to broader crypto bull markets

- Strong community engagement and viral marketing potential

- Possible airdrops, DEX listings, and liquidity improvements

- Regulatory clarity favoring layer-2 solutions

- Competition from peers like BRETT, balanced by TOSHI’s unique branding and utility

Disclaimer: Cryptocurrency price predictions are speculative and based on current market analysis.

Actual prices may vary significantly due to market volatility, regulatory changes, and other factors.

Always do your own research before making investment decisions.

Why $TOSHI and Base Chain Tokens Dominate 2026 Memecoin Plays

Base chain tokens like $TOSHI exemplify smart risk allocation in crypto portfolios. Launched in early 2024, $TOSHI has woven playful origins into tangible utility on Base, Coinbase’s Ethereum layer-2 scaler. At $0.000220, it trades with liquidity that supports strategic entries, unlike flash-in-the-pan memecoins. Community vigilance is key: focus on verified contracts, active engagement, and strict position sizing to cap downside.

Market cycles favor Base memecoins 2026 due to negligible fees and seamless Ethereum interoperability. $TOSHI’s resilience, even amid a -0.1385% daily shift, signals maturity. Yet, I advise against FOMO; allocate no more than 5% of your portfolio here, treating it as a high-beta play on Base’s growth trajectory.

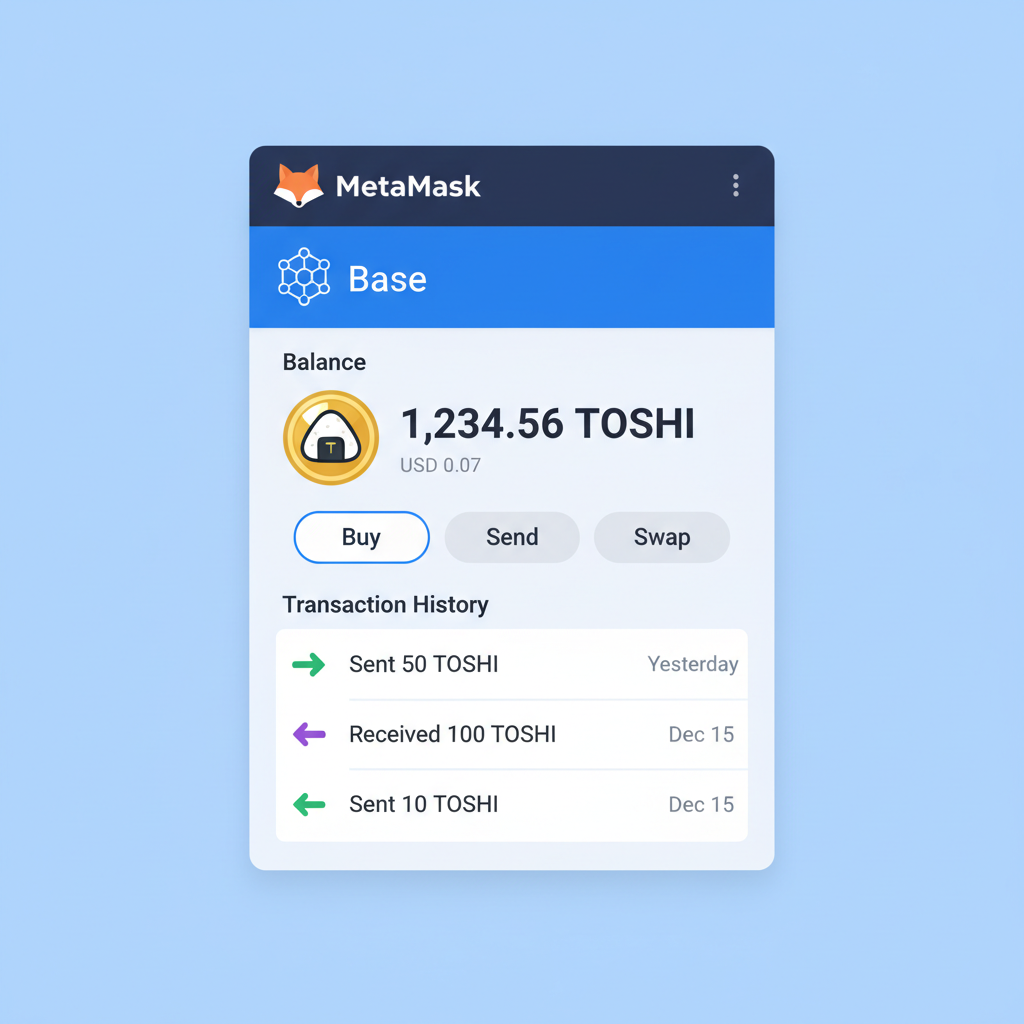

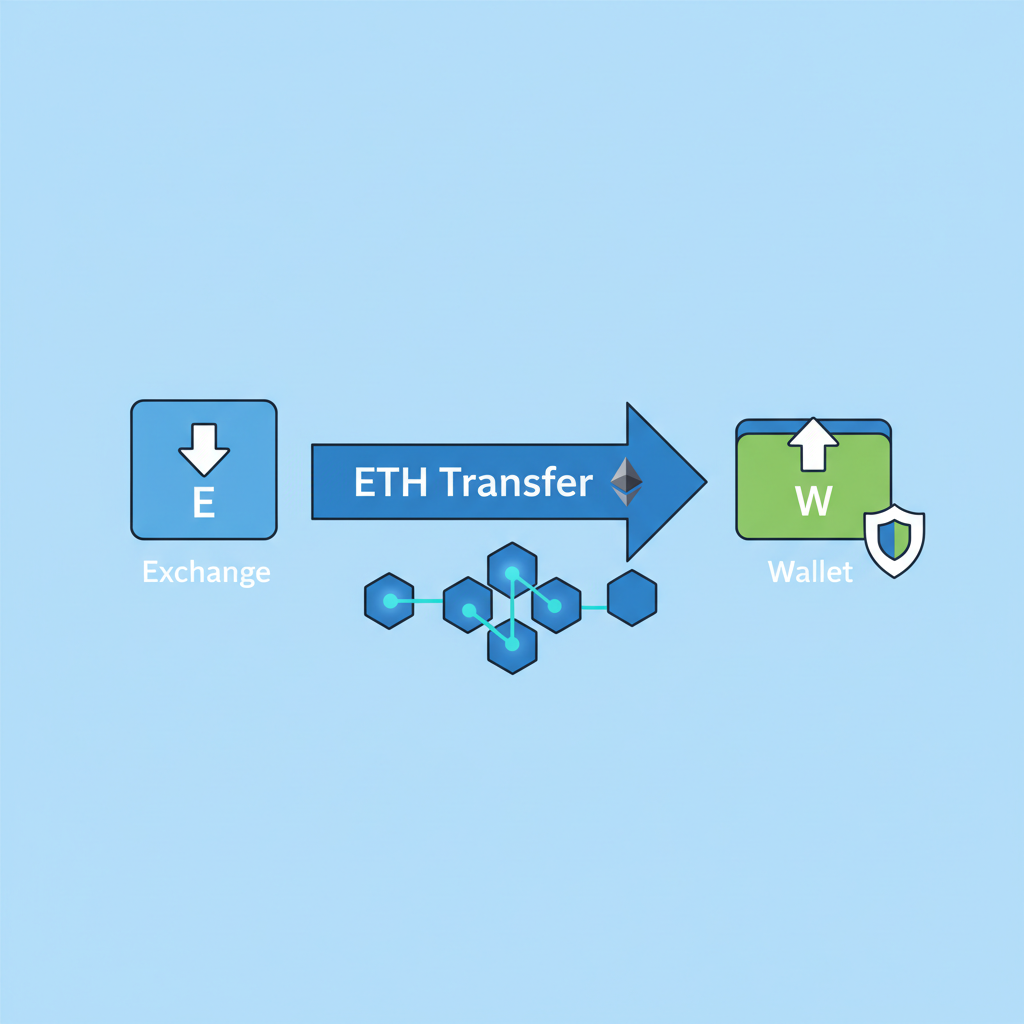

Essential Wallet Setup Before Bridging to Base

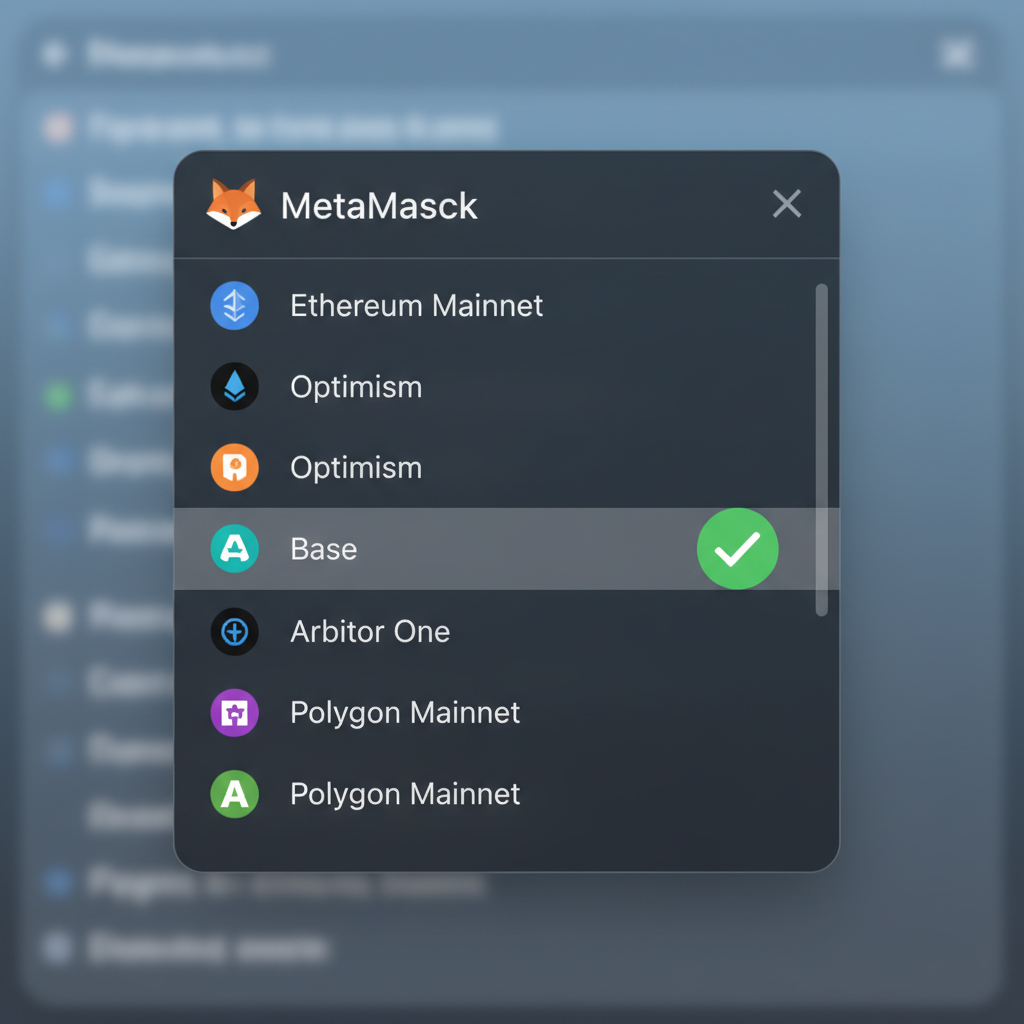

Before diving into how to bridge to Base chain, fortify your foundation with a compatible wallet. MetaMask reigns supreme for its Base integration, but Rabby or Coinbase Wallet add security layers. Download from official sites, create a new wallet or import via seed phrase, and enable Base network manually: Chain ID 8453, RPC https://mainnet.base.org.

- Fund your Ethereum wallet with ETH via exchanges like Coinbase or Binance. Aim for 0.01-0.05 ETH to cover bridging and gas.

- Secure your seed phrase offline; use hardware like Ledger for larger sums.

- Test small: Send 0.001 ETH to verify setup.

This preparation mitigates 90% of newbie errors. In my 17 years analyzing multi-asset risks, I’ve seen sloppy setups wipe out gains faster than market dips. Treat your wallet as portfolio HQ.

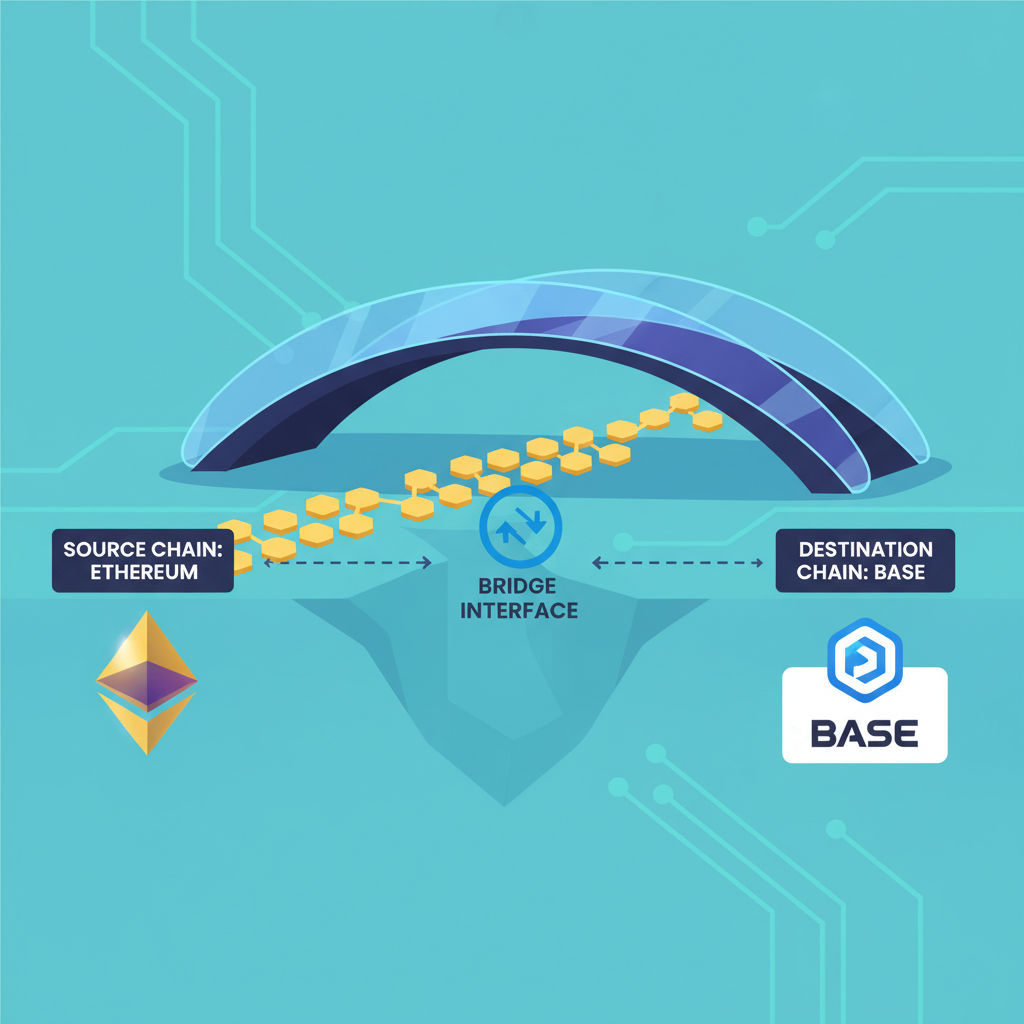

Selecting the Safest Base Bridge for $TOSHI Acquisition

The safest Base bridge prioritizes audited protocols over speed. Official options like Base Bridge (bridge. base. org) or third-party stalwarts such as Across. to and Hop Protocol shine for security and efficiency. Avoid unproven aggregators; stick to those with TVL over $100M and clean audit histories.

Why conservative bridging matters: Bridges are hack magnets, but Base’s ecosystem has matured by 2026, with insurance funds buffering losses. Expect 15-30 minute transfers, costing under $2 in fees versus Ethereum’s volatility.

Toshi (TOSHI) Price Prediction 2027-2032

Conservative estimates based on Base chain growth, memecoin cycles, and market volatility as of 2026

| Year | Minimum Price | Average Price | Maximum Price |

|---|---|---|---|

| 2027 | $0.000150 | $0.000350 | $0.000800 |

| 2028 | $0.000200 | $0.000500 | $0.001200 |

| 2029 | $0.000300 | $0.000800 | $0.002000 |

| 2030 | $0.000500 | $0.001500 | $0.004000 |

| 2031 | $0.000800 | $0.002500 | $0.007000 |

| 2032 | $0.001200 | $0.004000 | $0.010000 |

Price Prediction Summary

TOSHI price is forecasted to grow conservatively from an average of $0.000350 in 2027 to $0.004000 by 2032, fueled by Base ecosystem expansion and periodic memecoin rallies. Wide ranges account for bearish dips (regulatory pressures, market corrections) and bullish surges (hype cycles, adoption). Cumulative growth potential exceeds 1,000% from current levels (~$0.000220), but high volatility warrants caution.

Key Factors Affecting Toshi Price

- Base chain adoption and Layer-2 scaling improvements

- Recurring memecoin hype cycles tied to broader crypto bulls

- Regulatory clarity on memecoins and DeFi

- TOSHI community strength and marketing efforts

- Competition from other Base memecoins like BRETT

- Overall crypto market cap expansion and Ethereum ecosystem health

- Technological integrations enhancing TOSHI utility

Disclaimer: Cryptocurrency price predictions are speculative and based on current market analysis.

Actual prices may vary significantly due to market volatility, regulatory changes, and other factors.

Always do your own research before making investment decisions.

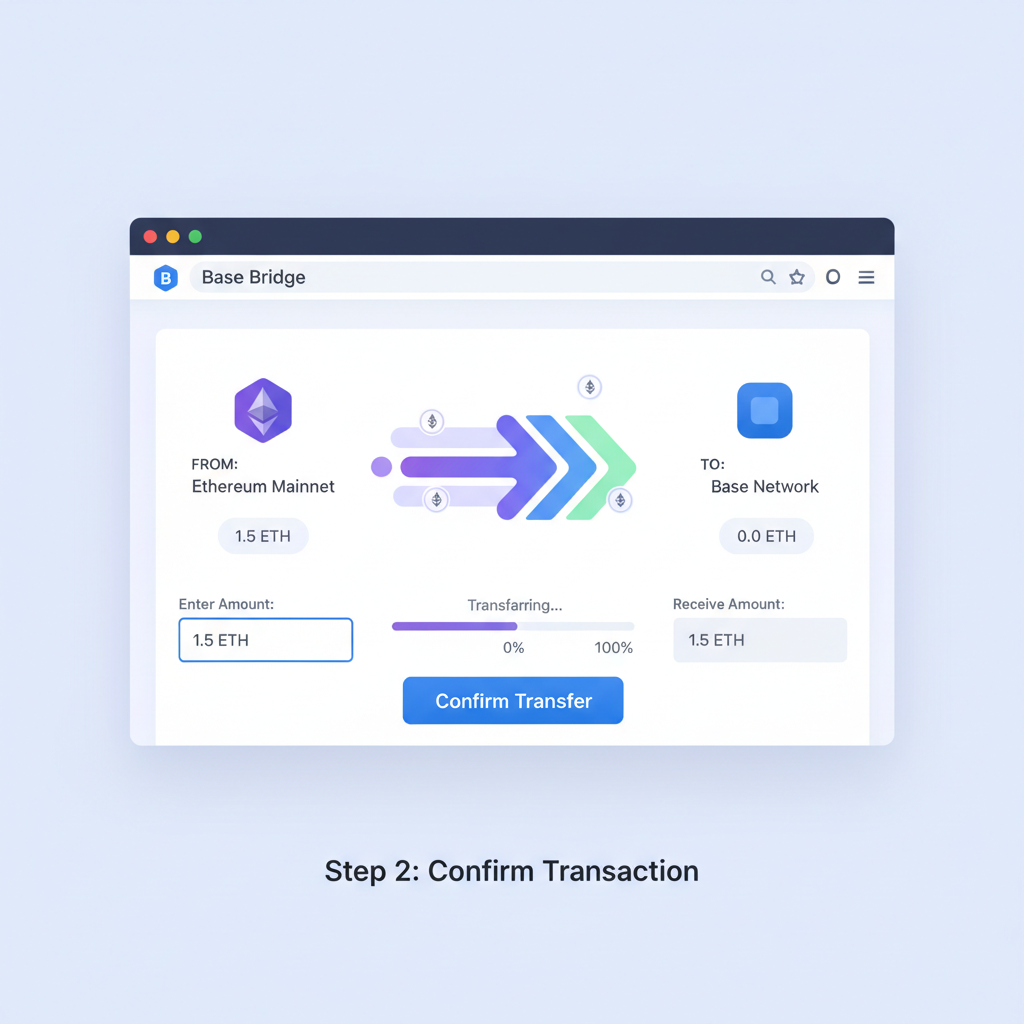

Strategic tip: Bridge during low congestion (UTC 00: 00-06: 00) for optimal rates. Monitor via Basescan. org for real-time confirmations. With ETH on Base, you’re primed for DEX swaps into $TOSHI at $0.000220.

Executing the Bridge: Step-by-Step Precision

Connect MetaMask to bridge. base. org. Select Ethereum as source, Base as destination, input ETH amount, approve, then bridge. Confirmations cascade: Ethereum L1 finality, then Base arrival. Track via Etherscan and Basescan.

- Double-check addresses; typos are irreversible.

- Use slippage protection on DEX previews.

- Post-bridge, verify balance before swapping.

Once your ETH lands on Base, switch to a DEX like Uniswap or Aerodrome, both optimized for Base chain tokens. These platforms aggregate liquidity, ensuring tight spreads for $TOSHI at its current $0.000220 price point. Conservative traders prioritize DEXs with proven track records; Aerodrome edges out for yield opportunities post-swap.

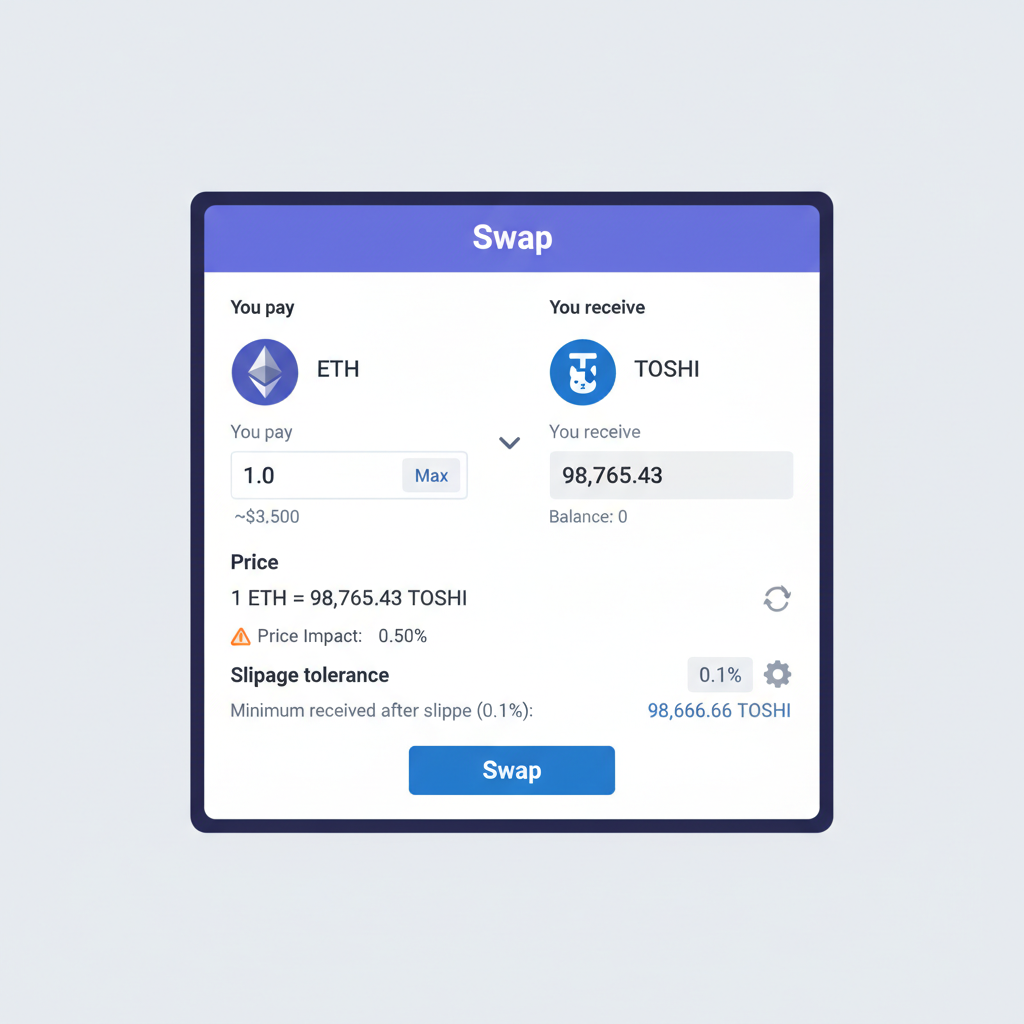

Swapping ETH for $TOSHI: DEX Execution with Risk Controls

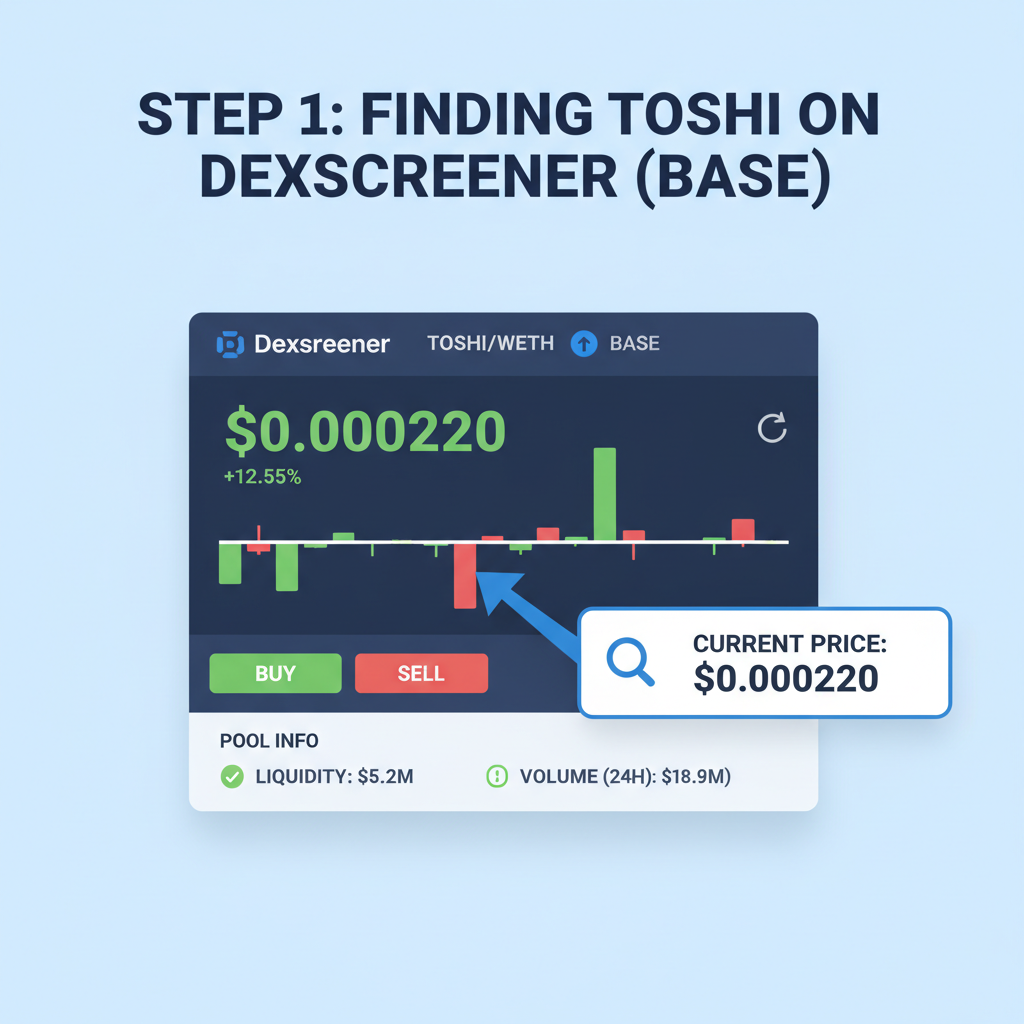

Head to app. uniswap. org, connect your wallet, and switch the network to Base. Paste $TOSHI’s verified contract address, sourced from Dexscreener or official channels, to import the token. Input ETH amount, set slippage to 0.5-1% max, and review the output: expect $TOSHI yields reflecting its $0.000220 valuation amid -0.1385% daily flux.

- Approve ETH spend; gas stays pennies on Base.

- Confirm swap, monitoring for front-running via MEV protection tools.

- Verify $TOSHI balance on Basescan. org post-transaction.

In volatile memecoin waters, this methodical swap sidesteps impulse buys. I’ve advised portfolios through three cycles; rushing DEX trades amplifies losses when liquidity thins, as seen in $TOSHI’s 24-hour low of $0.000209.

Risk Management Checklist for Base Memecoins 2026

$TOSHI shines among base memecoins 2026, but unchecked exposure courts ruin. Diversify beyond hype: pair with stablecoins, set stop-losses at 20% drawdown, and harvest profits incrementally. Base’s low fees tempt overtrading; resist by journaling every position.

Community signals amplify $TOSHI’s edge. Active Telegram and X chatter, minus paid shills, forecasts staying power. Yet, at $0.000220, it’s no blue-chip; view as 2-5% portfolio spice, betting on Base’s scaling triumphs over Ethereum congestion.

Post-Purchase Strategy: Holding and Exit Tactics

With $TOSHI secured, strategize holds. Stake via Aerodrome pools for yields, or bridge back to Ethereum for centralized safety. Monitor metrics: volume spikes past daily highs of $0.000265 signal momentum; dips to lows demand reassessment. Tax implications loom, track basis meticulously for 2026 filings.

Base chain tokens thrive on ecosystem tailwinds, from potential airdrops to Coinbase integrations. $TOSHI, blending meme lore with utility, positions savvy holders for asymmetric upside. My macro lens spots parallels to early Solana plays: low entry, high conviction, disciplined exits.

Bridging to Base chain and snapping $TOSHI demands this blend of precision and patience. In a field littered with rug pulls, your thorough setup yields the smart moves that compound over cycles. Scale positions as conviction builds, always with eyes on that $0.000220 anchor and broader market breaths.