As Layer 2 networks mature, bridging Ethereum (ETH) to Base has become a core workflow for users seeking lower fees and faster transactions. In November 2025, with ETH trading at $3,875.35, more traders are leveraging Base’s efficiency for DeFi, NFT minting, and memecoin speculation. This step-by-step guide details how to bridge ETH to Base using trusted protocols and the latest wallet tools.

Why Bridge ETH to Base in 2025?

Base, developed by Coinbase, is engineered for high throughput and low cost. The network consistently offers transaction fees under $0.10 – a stark contrast to mainnet Ethereum gas spikes. As a result, moving your ETH to Base unlocks:

- Cheaper swaps on DEXs like Aerodrome

- Access to exclusive Base-native tokens and airdrops

- Faster confirmation times, ideal for active trading or minting events

This migration is not just about cost savings; it’s about positioning yourself where the liquidity and innovation are moving in the EVM ecosystem.

Step-by-Step: How to Bridge ETH to Base Securely

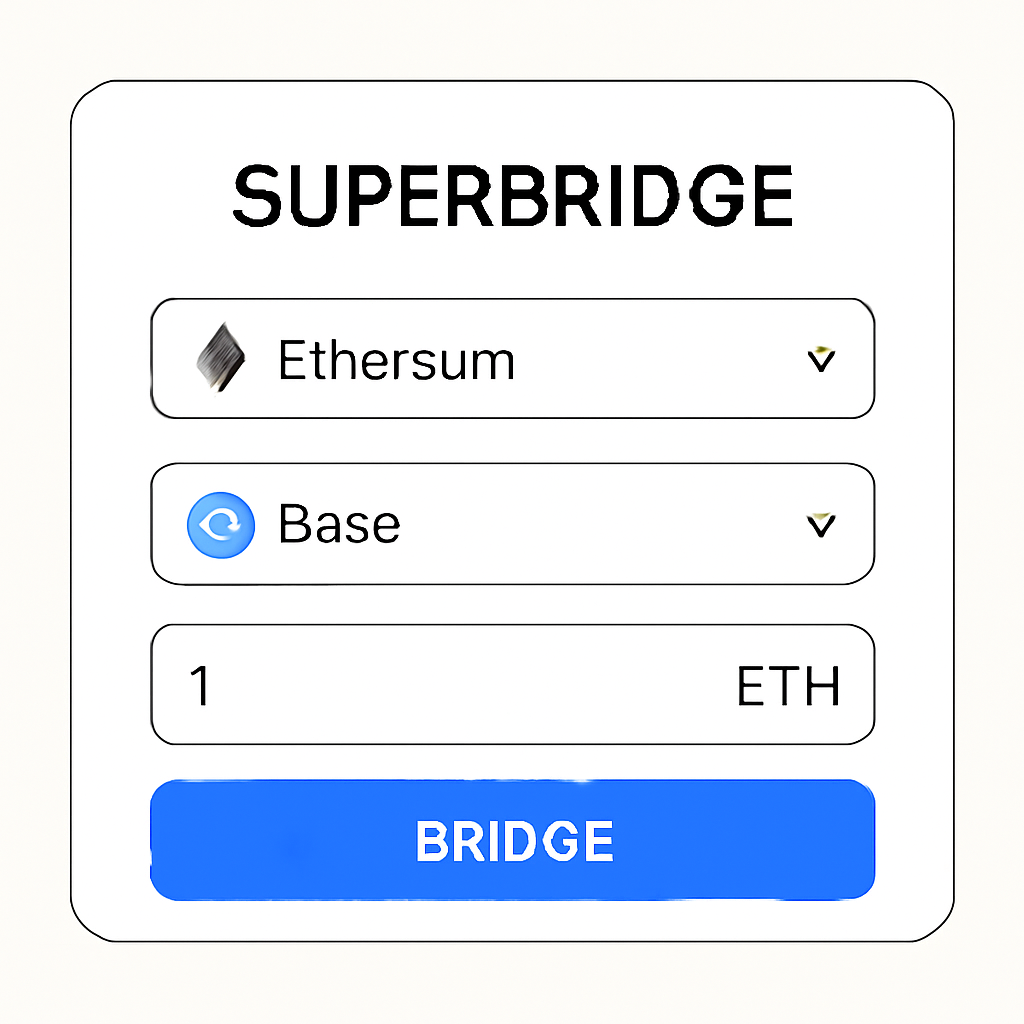

The process has evolved rapidly since early launches. In 2025, most users opt for aggregators or direct bridges that optimize for speed and cost. Here’s how you can bridge ETH from Ethereum mainnet to Base:

Preparation:

- Install MetaMask (or another EVM wallet) on your browser or device.

- Add the Base network manually if it’s not listed (details below).

- Fund your wallet with enough ETH on Ethereum mainnet – keep extra for gas.

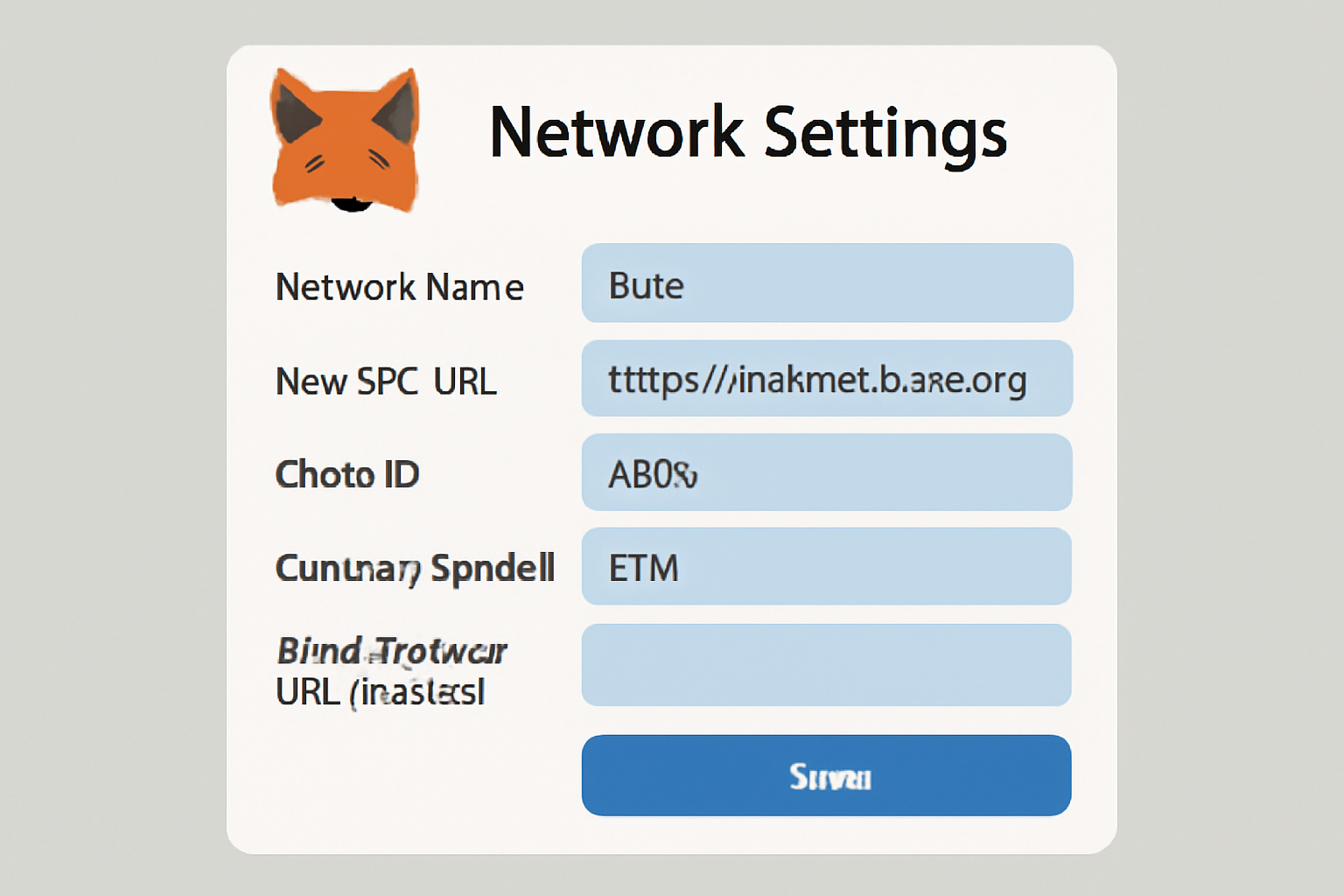

Add Base Network Manually:

- Network Name: Base Mainnet

- New RPC URL: https://mainnet.base.org

- Chain ID: 8453

- Currency Symbol: ETH

- Block Explorer URL: https://basescan.org

Select Your Bridge:

- Superbridge: Aggregates best routes by price/speed.

- Across Protocol: Fast UI, competitive rates.

- deBridge: Instant settlement options.

The Best Bridges for Moving Ethereum to Base Chain Right Now

The original native bridge has been deprecated; third-party bridges now dominate flows due to better UX and pricing algorithms. Superbridge stands out as an aggregator that auto-selects the optimal path across protocols based on current liquidity and fee conditions. Across Protocol remains popular for its reliability and transparent fee structure.

If you want a deep dive into different bridge options, including user reviews and visuals of each step, check out this detailed resource: /how-to-bridge-to-base-a-step-by-step-guide-with-real-user-experiences-and-visuals.

Ethereum (ETH) Price Prediction vs. Bridging Costs to Base: 2026-2031

Projected ETH Price Ranges and Typical Bridging Fees Using Major Protocols (Q4 Data Each Year)

| Year | Minimum ETH Price | Average ETH Price | Maximum ETH Price | % Change (Avg YoY) | Typical Bridging Cost (ETH) | Typical Bridging Cost (USD) |

|---|---|---|---|---|---|---|

| 2026 | $3,400.00 | $4,050.00 | $5,100.00 | +4.5% | 0.0012 | $4.86 |

| 2027 | $3,150.00 | $4,320.00 | $6,200.00 | +6.7% | 0.0010 | $4.32 |

| 2028 | $3,700.00 | $5,200.00 | $8,100.00 | +20.4% | 0.0009 | $4.68 |

| 2029 | $4,250.00 | $6,400.00 | $10,000.00 | +23.1% | 0.0008 | $5.12 |

| 2030 | $4,800.00 | $7,300.00 | $12,500.00 | +14.1% | 0.0007 | $5.11 |

| 2031 | $5,100.00 | $7,950.00 | $14,200.00 | +8.9% | 0.0006 | $4.77 |

Price Prediction Summary

Ethereum is projected to experience steady price growth through 2031, with potential for higher volatility as adoption and Layer 2 scaling continue to evolve. The average ETH price could nearly double by 2031 compared to 2025, with minimum prices remaining strong even in bearish market cycles. Bridging costs to Base are expected to decrease in ETH terms due to improved scalability and competition, while USD costs may fluctuate with ETH price.

Key Factors Affecting Ethereum Price

- Ethereum network upgrades (e.g., further scaling, sharding) improving utility and demand.

- Broader adoption of Layer 2s like Base driving more activity and network value.

- Regulatory clarity in major markets (US, EU, Asia) impacting institutional adoption.

- Competition from other smart contract platforms (e.g., Solana, Avalanche, new entrants).

- Macroeconomic conditions and global crypto sentiment.

- Potential for new ETH use cases (DeFi, tokenization, RWAs, enterprise adoption).

- Security and stability of bridging protocols affecting user trust and cost.

Disclaimer: Cryptocurrency price predictions are speculative and based on current market analysis.

Actual prices may vary significantly due to market volatility, regulatory changes, and other factors.

Always do your own research before making investment decisions.

Security remains a top priority when bridging assets. Always verify that you are on the official bridge website and double-check wallet prompts before confirming any transaction. Phishing attacks have become more sophisticated, targeting users with fake bridge interfaces. Use browser extensions like Wallet Guard or enable MetaMask’s phishing detection to reduce risk.

Once your ETH arrives on Base, you’ll notice near-instant confirmations and dramatically lower gas fees, often less than $0.10 per transaction, even during periods of high network activity. This efficiency makes Base an attractive hub for swapping into emerging tokens, participating in NFT mints, or farming yields without the friction of L1 costs.

Troubleshooting Common Bridge Issues

While most bridges now offer reliable service, occasional hiccups can occur:

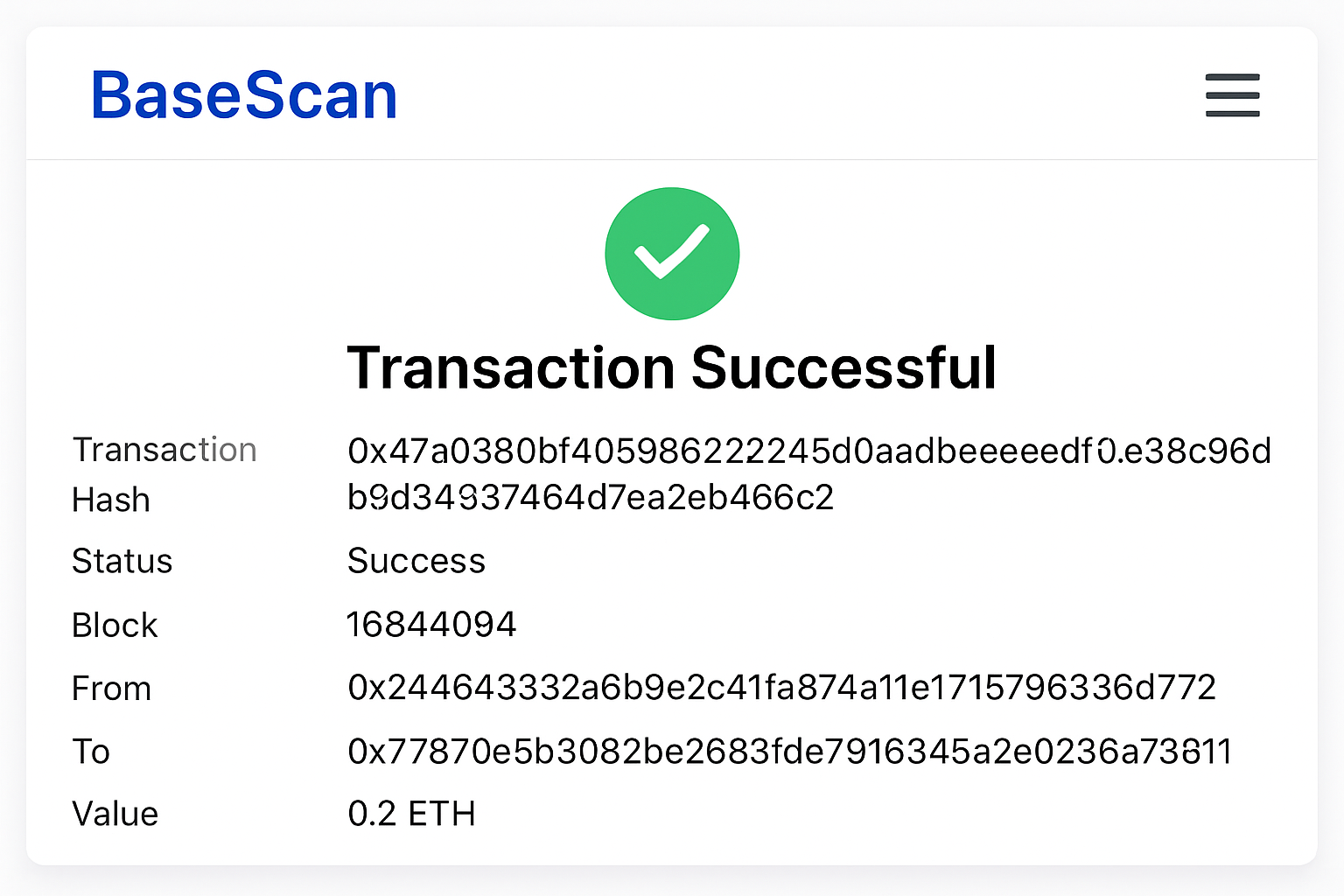

- Stuck transactions: If your transfer is pending for more than 30 minutes, check both Ethereum and Base explorers to confirm status. Delays can result from network congestion or insufficient relayer liquidity.

- Mismatched balances: Sometimes MetaMask may not auto-refresh your ETH balance on Base. Manually switch networks or restart the wallet to prompt an update.

- High fees: Gas spikes are rare on Base but can happen during major events. Consider bridging during off-peak hours for optimal pricing.

If issues persist, consult the bridge’s official documentation or support channels before attempting to re-send funds.

Maximizing Your Bridged ETH: What’s Next?

With your ETH now live on Base at $3,875.35, you’re positioned to tap into a rapidly growing ecosystem. Here are some next steps:

- Explore DeFi protocols: Platforms like Aerodrome and Seamless let you swap, provide liquidity, or lend/borrow assets natively on Base.

- Pursue airdrops: Many new projects reward early adopters who interact with their smart contracts, bridging ETH is often a key eligibility requirement.

- Dive into NFT launches: Lower minting costs mean greater access to exclusive collections launching first on Base.

If you’re looking for more practical guidance tailored to retail users, including screenshots and real user experiences, visit our comprehensive guide at https://basetoken.org/how-to-bridge-eth-to-base-for-retail-friendly-defi-step-by-step-guide-for-beginners.