October 2025 is shaping up to be a standout month for stablecoin rewards, especially for those looking to earn and maximize USDC deposit bonuses on the Base chain. With the current price of Multichain Bridged USDC (Fantom) sitting at $0.0430 as of October 15,2025, savvy investors are taking advantage of new high-yield opportunities and exclusive incentives across the ecosystem.

Why Base Chain Is the Hotspot for USDC Rewards in October 2025

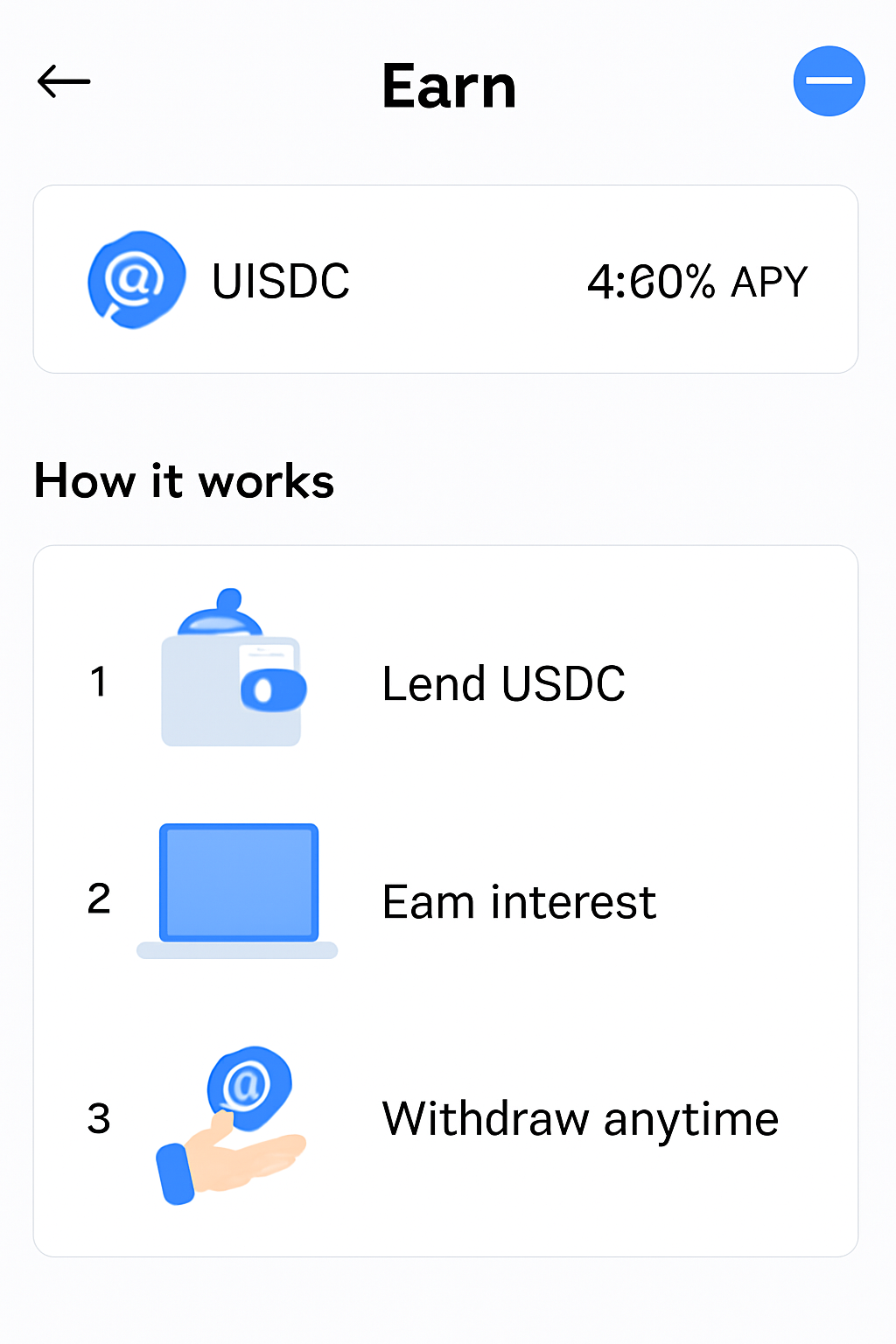

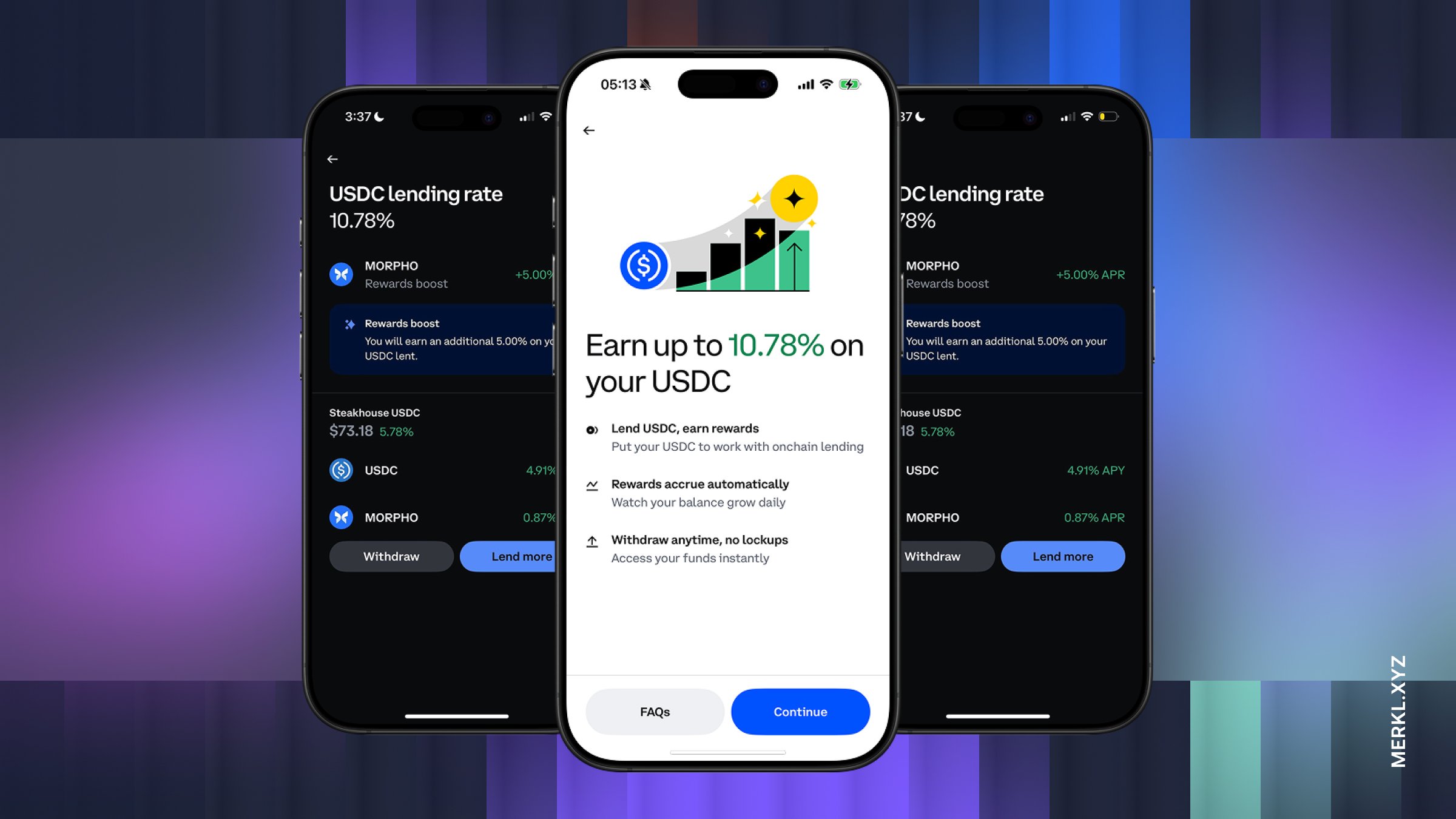

The Base chain has rapidly evolved into a major hub for stablecoin activity. Coinbase’s integration with the Morpho protocol now allows users to lend their USDC directly from the Coinbase app, unlocking yields as high as 10.8% APY: a compelling rate in today’s market. This move positions Base as a competitive alternative to traditional savings accounts or even other DeFi chains.

What sets the current environment apart is not just the headline APY but also the layered bonuses and flexible earning structures available to both new and existing users:

- Up to $200 in Bitcoin bonuses via referral codes for new Coinbase sign-ups (NFT Plazas)

- 13% APY on your first 20,000 USDC deposited (split between flexible earnings and contract bonuses)

- No maximum holding limit for earning rewards on Coinbase-held USDC (Coinbase blog)

- Lending yields up to 10%, live across all launch markets, specifically tailored for Base users

How to Deposit USDC on Base: Step-by-Step Guide for Maximum Bonus Potential

The process of getting your funds onto Base and maximizing rewards is more streamlined than ever. Here’s a concise walkthrough:

- Fund Your Coinbase Account with USDC: Purchase or transfer USDC into your Coinbase wallet. Double-check that you’re using Multichain Bridged USDC (Fantom) at its current price of $0.0430.

- Select ‘Lend’ in the App: Navigate to the lending feature within Coinbase. The interface will clearly display current APY rates, up to 10.8% as of today.

- Lend Through Morpho Protocol: Follow prompts to allocate your desired amount of USDC into Morpho’s lending pool on Base.

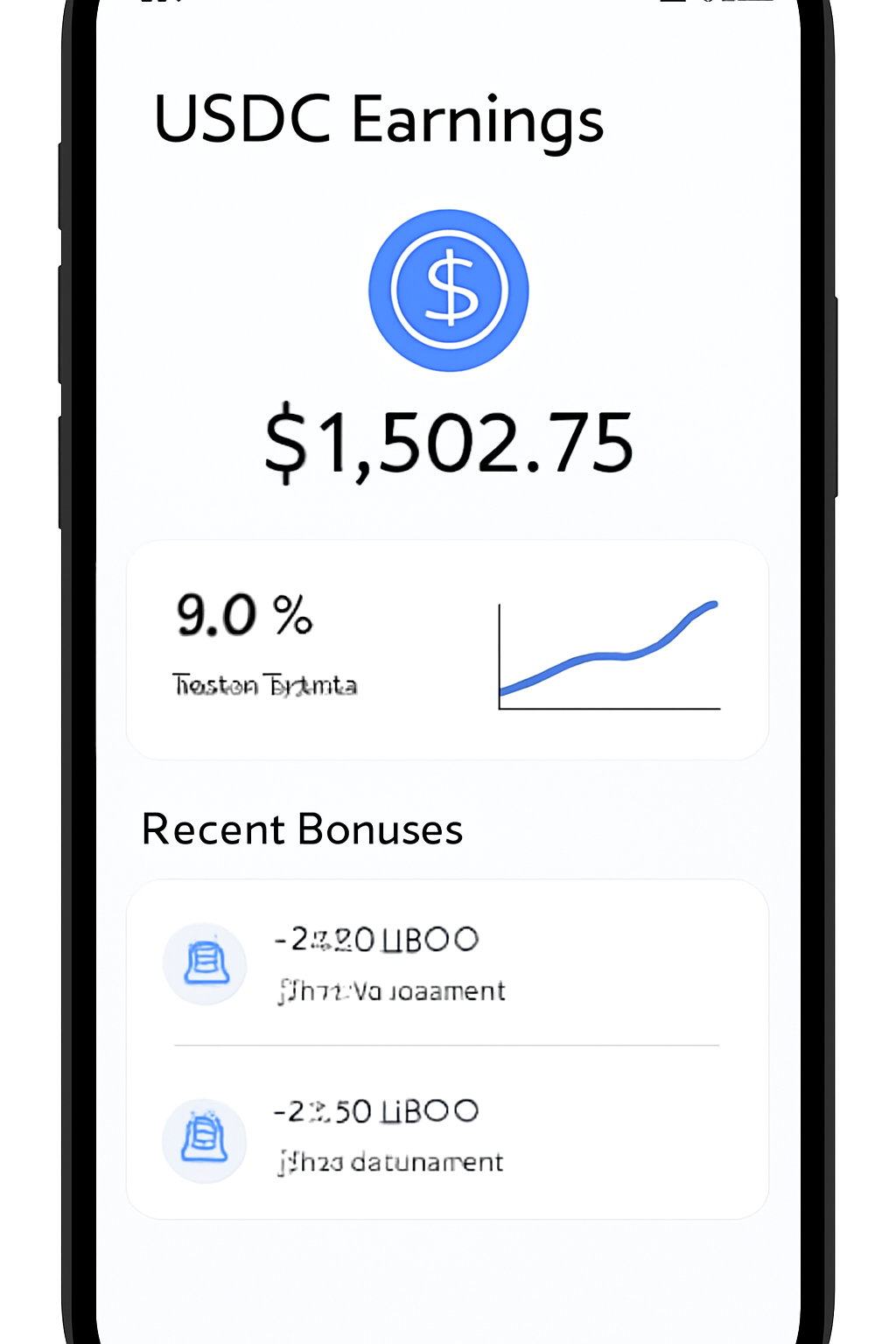

- Monitor Earnings: Track your interest accrual in real time via the app dashboard.

This user-friendly process means you can start earning within minutes, no advanced DeFi skills needed.

Tiers, Bonuses, and Flexible Earnings Explained

The reward structure is tiered for optimal flexibility:

- $0, 20,000 USDC: Enjoy up to 13% APY, which combines an 8% flexible base yield with a limited-time contract bonus of an additional 5%. This tier is especially attractive for new users or those testing out larger deposits without committing their entire portfolio.

- $20,000 and USDC: After your initial tranche, excess deposits continue earning at a competitive 4% APY. There’s no upper cap, ideal for high-net-worth individuals seeking stable returns.

This stacking of bonuses is unique among leading exchanges and protocols right now. Early adopters can further amplify their returns by leveraging referral codes or participating in special campaigns during October (BitDegree promo details here). Always read eligibility requirements closely before depositing large sums.

USD Coin (USDC) Price Prediction 2026-2031

Projected USDC Price Movement on Base and Broader Markets (2026-2031)

| Year | Minimum Price | Average Price | Maximum Price | Year-over-Year Change (%) | Market Scenario Insights |

|---|---|---|---|---|---|

| 2026 | $0.98 | $1.00 | $1.02 | +1300% (from Oct 2025) | USDC recovers to peg after 2025 depegging; increased regulation and improved collateralization |

| 2027 | $0.99 | $1.00 | $1.03 | +1.0% | Stablecoin regulation solidifies; more integrations across DeFi and payment platforms |

| 2028 | $0.99 | $1.00 | $1.03 | +0.0% | USDC maintains stability; competition from CBDCs increases, but utility remains high |

| 2029 | $0.98 | $1.00 | $1.03 | 0.0% | Market volatility causes brief depegs; overall, USDC holds its dollar peg |

| 2030 | $0.97 | $1.00 | $1.04 | +0.0% | Technological improvements and cross-chain expansion; minor volatility from regulatory changes |

| 2031 | $0.97 | $1.00 | $1.04 | +0.0% | Stablecoin market matures, USDC remains one of the top choices for on-chain transactions |

Price Prediction Summary

USDC is projected to return to and maintain its $1.00 peg after recovering from the current depegged state observed in late 2025. Minimum and maximum price ranges account for possible market volatility, regulatory shifts, and competition from new stablecoins or CBDCs. While short-term volatility is possible, especially after a significant depegging event, USDC’s robust backing and adoption in DeFi and payment networks suggest a stable outlook from 2026 onward.

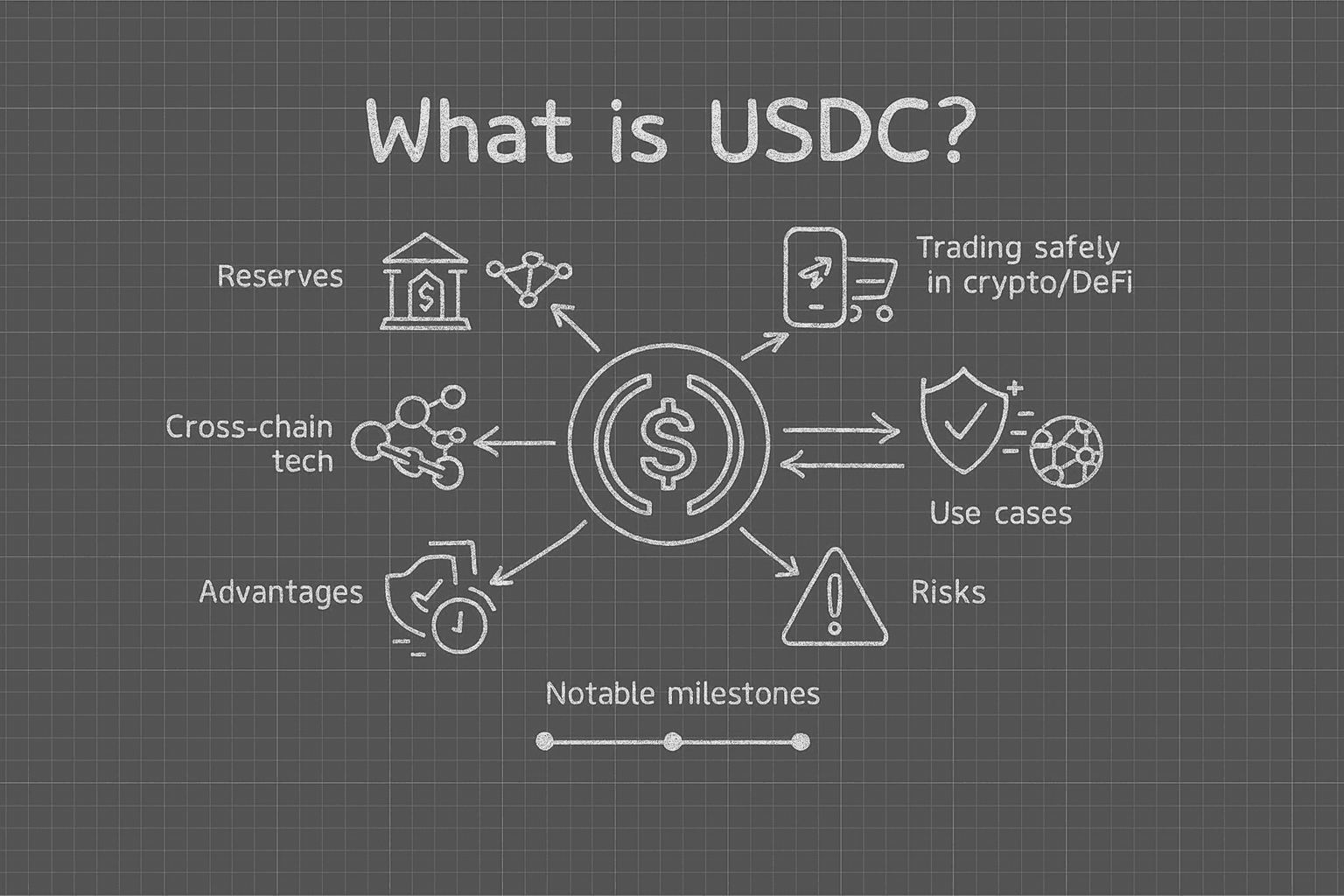

Key Factors Affecting USD Coin Price

- Regulatory clarity and enforcement on stablecoin reserves and operations

- Adoption of USDC in mainstream payments (e.g., Stripe, Coinbase integrations)

- Yield opportunities through DeFi protocols (e.g., Morpho, Base) attracting users

- Potential competition from central bank digital currencies (CBDCs) and new stablecoins

- Technological improvements enabling faster, cheaper, and safer transactions

- Market confidence in USDC’s backing and transparency after 2025 depegging event

Disclaimer: Cryptocurrency price predictions are speculative and based on current market analysis.

Actual prices may vary significantly due to market volatility, regulatory changes, and other factors.

Always do your own research before making investment decisions.

The Role of Automated Lending Protocols Like Morpho on Base Chain

Morpho’s integration with Coinbase unlocks decentralized finance yields while keeping things simple enough for mainstream users. By pooling liquidity across multiple platforms, Morpho helps stabilize returns even as market conditions shift, a critical advantage when chasing consistent yield in volatile times.

Security and transparency are also central to Morpho’s appeal. Users retain control over their assets, and all lending activity is recorded on-chain for full auditability. This minimizes counterparty risk compared to traditional CeFi platforms, while still offering the convenience of a familiar app interface. For those who have been hesitant to explore on-chain rewards, this hybrid approach is a strong entry point.

Another important aspect: Base chain’s low transaction fees. Moving USDC or interacting with lending pools on Base is notably cheaper than on legacy Ethereum mainnet. This means more of your earned interest actually reaches your wallet, rather than being eaten up by gas costs, a subtle but significant factor when maximizing returns over time.

Tips to Maximize Your USDC Rewards on Base

Top Strategies to Boost USDC Rewards on Base

-

Use the Official Coinbase Referral Link for Sign-Up BonusesNew users can sign up with the official Coinbase referral link to claim up to $200 in Bitcoin bonuses and access exclusive USDC rewards and trading fee discounts. This is a limited-time offer for October 2025.

-

Deposit USDC via Coinbase and Opt Into Lending on BaseEnsure your Coinbase account is funded with USDC, then access the USDC lending feature within the app. Lending through the Morpho protocol on Base can yield up to 10.8% APY as of October 2025.

-

Take Advantage of Tiered USDC Yield RatesFor new USDC users, the first 0–20,000 USDC earns a high 13% APY (8% flexible earnings + 5% contract bonus). Amounts above 20,000 USDC earn 4% APY. Maximize your deposits within these tiers for optimal returns.

-

Hold USDC on Coinbase for Effortless RewardsSimply holding USDC in your Coinbase account earns you 4.1% annual rewards with no fees, lock-ups, or extra steps. Rewards accrue automatically and can be tracked in-app.

-

Monitor and Adjust Based on Market APYThe APY for USDC lending on Base can fluctuate with market demand. Regularly check the current rates in the Coinbase app and adjust your lending or holding strategy to maximize returns.

-

Stay Informed About Exclusive Promo Codes and BonusesWatch for special Base chain promotions and Coinbase promo codes (e.g., GGS-30 for a 30% bonus on select offers) to boost your USDC bonus eligibility when available.

To take full advantage of October 2025’s bonus environment, consider these nuanced strategies:

- Time your deposits: Promotional APYs and contract bonuses are sometimes limited-time offers. Monitor Coinbase announcements and act swiftly when new campaigns drop.

- Utilize referral codes: If you’re a new user, sign up with an official referral code to stack additional Bitcoin or trading fee bonuses alongside your USDC yields (NFT Plazas).

- Diversify across tiers: Allocate some funds in the high-yield tier (first 20,000 USDC) and the rest in the standard 4% APY pool for balanced risk and reward.

- Reinvest earnings: Compound your returns by periodically reinvesting earned interest back into the lending pool.

- Stay informed about protocol updates: Follow official Coinbase/Base channels for news about rate adjustments or upcoming bonus windows.

If you’re already holding USDC on Coinbase, remember that simply maintaining your balance qualifies you for ongoing base rewards, no further action required. However, moving funds into the Morpho-powered lending feature unlocks those higher APYs specific to Base chain users.

Final Considerations Before You Deposit

The combination of flexible earning options, promotional bonuses, and decentralized security makes October an opportune time to engage with Base chain’s USDC ecosystem. Yet as always in crypto, risk management matters. Yields fluctuate based on supply-demand dynamics within Morpho pools. Stay alert for changes in APY or program terms, especially if you’re deploying significant capital.

Finally, keep a close eye on the current price of Multichain Bridged USDC (Fantom): it stands at $0.0430, reflecting recent market movements ( and $0.002120 in 24 hours). All yield calculations should be measured against this real-time value for accurate portfolio planning.

The evolving landscape of stablecoin rewards means opportunity favors the well-informed. Whether you’re a first-timer or a seasoned DeFi participant, October’s unique mix of high APYs and layered incentives makes now an ideal moment to optimize your Base chain strategy, and let your stablecoins work harder for you.