In October 2025, Base Chain has become the most-watched Layer-2 in the Ethereum ecosystem. With a Total Value Locked (TVL) of $5.3 billion, Base is no longer just a new entrant – it’s a dominant force reshaping DeFi’s landscape. This rapid rise is not only reflected in the numbers but also in the energy of its community and the innovation of its protocols.

Base Chain TVL: From $10 Million to $5.3 Billion

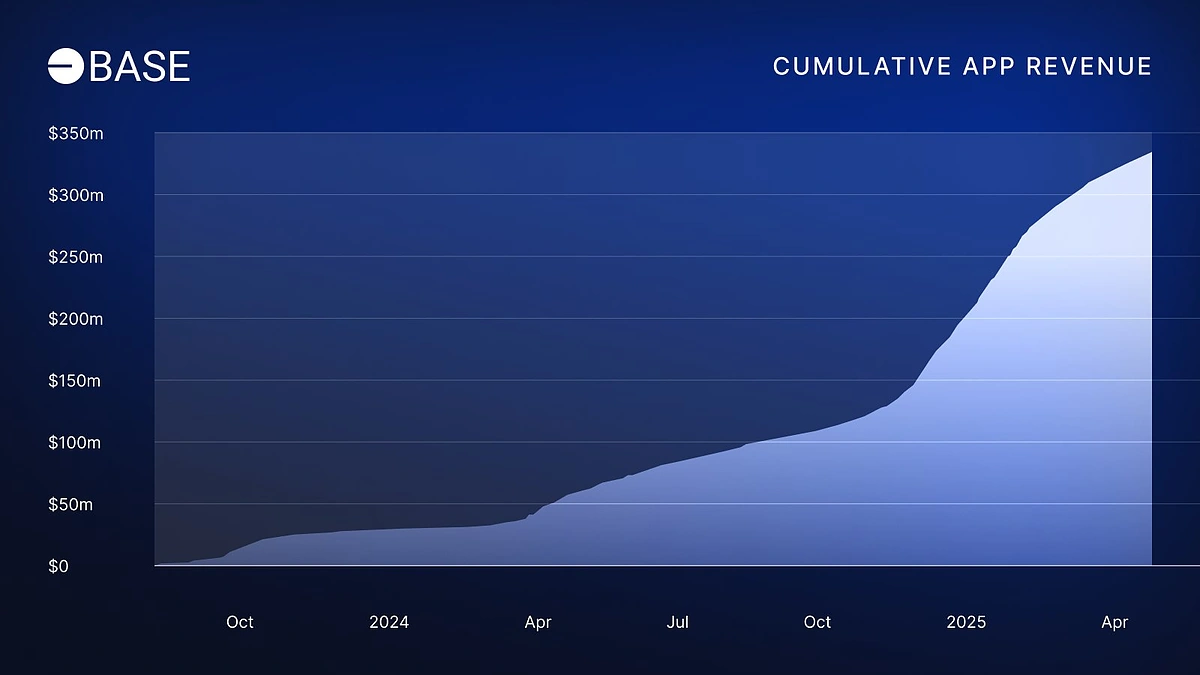

Launched in August 2023, Base Chain’s TVL growth has been nothing short of exponential. In just over two years, it has leaped from $10 million to $5.3 billion, outpacing many established Layer-2s and rivaling giants like Arbitrum and Optimism. The momentum was especially notable during “Uptober, ” when TVL surged from $445 million at the start of 2024 to $2.5 billion by October 2024 – a staggering 562% increase according to ChainCatcher. By March 2024, Base had surpassed $3 billion in TVL, with daily active users exceeding five million.

This growth isn’t just about deposits – it reflects deep user engagement and protocol activity across DeFi on Base. Protocols like Aerodrome have attracted over $1 billion in deposits alone, acting as liquidity magnets and onboarding new users at an unprecedented rate.

The Engines Behind Uptober’s Record Growth

Several factors fueled Base’s explosive rise:

- User Engagement: Daily active addresses on Base grew thirteenfold year-to-date by October 2024.

- Transaction Volume: Base reached an all-time high of 6.1 million daily transactions, surpassing other Layer-2 solutions and even mainnet Ethereum on some days.

- Protocol Performance: Flagship DeFi protocols like Aerodrome and innovative DEXs have become liquidity hubs for both traders and yield farmers.

- Revenue Generation: The network generated $51.4 million in revenue by October 2024, an impressive figure that signals real economic activity rather than speculative inflow alone.

This mix of high participation, robust infrastructure, and sustainable revenue puts Base ahead in the race for mainstream DeFi adoption.

Visualizing Growth: How Does Base Compare?

The numbers only tell part of the story – visual analytics reveal how quickly sentiment shifted toward Base as a preferred home for DeFi builders and users alike. In Q1 2025 alone, TVL surged by more than 150% quarter-on-quarter according to Gud Tech’s analysis on X, reflecting not just capital inflows but also growing developer confidence.

This meteoric rise is further validated by cross-chain partnerships (such as with Korbit and Phantom), which have amplified network effects beyond what most Layer-2s achieve within their first two years.

Base (BASE) Price Prediction 2026–2031

Forward-looking BASE price outlook based on TVL growth, adoption, and DeFi trends

| Year | Minimum Price | Average Price | Maximum Price | YoY % Change (Avg) | Scenario Insights |

|---|---|---|---|---|---|

| 2026 | $0.34 | $0.52 | $0.75 | +37% | Continued TVL growth; adoption by new DeFi protocols; some market volatility |

| 2027 | $0.45 | $0.70 | $1.05 | +35% | Strong developer activity; Coinbase ecosystem network effects; possible regulatory headwinds |

| 2028 | $0.60 | $0.98 | $1.50 | +40% | Mainstream DeFi use, scaling upgrades, increased competition from other L2s |

| 2029 | $0.80 | $1.32 | $2.10 | +35% | Potential for multi-chain integration; regulatory clarity; global macro impact |

| 2030 | $1.05 | $1.75 | $2.85 | +33% | Wider retail adoption; possible DeFi market expansion or consolidation |

| 2031 | $1.25 | $2.10 | $3.60 | +20% | BASE matures as a leading L2; further innovation or market saturation |

Price Prediction Summary

Base (BASE) is poised for significant growth over the next six years, supported by rapid TVL expansion, strong developer adoption, and integration with the broader Coinbase and Ethereum ecosystems. The average price is projected to increase steadily year-over-year, with bullish scenarios dependent on continued DeFi adoption and network effects, while downside risks include regulatory uncertainty and increased competition.

Key Factors Affecting Base Price

- Sustained TVL growth and DeFi adoption on Base chain

- Expansion of Coinbase ecosystem and user base

- Technological improvements (e.g., scaling, lower fees)

- Regulatory developments affecting Layer-2 networks

- Competition from other high-growth L2s (e.g., Arbitrum, Optimism)

- Market cycles and macroeconomic factors impacting crypto valuations

Disclaimer: Cryptocurrency price predictions are speculative and based on current market analysis.

Actual prices may vary significantly due to market volatility, regulatory changes, and other factors.

Always do your own research before making investment decisions.

It’s not just about numbers or hype cycles; it’s about sustained traction across every metric that matters – from daily active wallets to protocol revenues and transaction throughput.

As Base Chain’s TVL hit $5.3 billion in October 2025, the ecosystem’s expansion has become impossible to ignore. The unprecedented pace is a direct result of compounding factors: robust protocol launches, relentless user activity, and a developer community that now numbers over 25,000 strong. With its current trajectory, Base is not just catching up with competitors like Arbitrum, it’s setting the pace for Ethereum Layer-2 adoption.

Developer Momentum and Network Effects

The backbone of Base’s growth is its thriving developer ecosystem. Over 25,000 developers have deployed contracts or contributed to projects on Base since launch, a figure that dwarfs many rivals in the same timeframe. This influx has led to a rich tapestry of DeFi protocols, NFT marketplaces, and gaming dApps that keep users coming back daily.

Key partnerships have also played a critical role. Integrations with wallets like Phantom and cross-chain bridges such as Korbit have opened floodgates for capital and users from other blockchains. This strategy has accelerated composability, allowing assets and liquidity to flow freely into DeFi on Base without friction.

Top 5 DeFi Protocols by TVL on Base Chain (Oct 2025)

-

Aerodrome: The leading DEX and liquidity hub on Base, Aerodrome consistently tops the TVL charts, with over $1 billion in deposits, driving much of the chain’s DeFi activity.

-

Uniswap v3 (on Base): As the most popular decentralized exchange protocol, Uniswap’s deployment on Base has attracted substantial liquidity and trading volume, making it a core pillar of Base’s DeFi ecosystem.

-

Compound Base: The Base-native deployment of Compound, a leading lending protocol, enables users to supply and borrow assets efficiently, contributing significantly to the chain’s total value locked.

-

Curve Finance (on Base): Curve’s focus on stablecoin swaps and efficient AMM design has made its Base deployment a top choice for stablecoin liquidity providers and traders.

-

Balancer (on Base): Balancer’s flexible liquidity pools and innovative DeFi features have helped it secure a strong position among Base’s top protocols by TVL.

What Sets Base Apart?

Base isn’t just another Ethereum Layer-2 scaling solution, it’s uniquely positioned thanks to its Coinbase connection. The exchange’s backing brings unmatched credibility and access to a massive retail user base. Meanwhile, technical innovations like sub-cent transaction fees and Flashblocks ensure the network remains fast and affordable even during traffic spikes.

This focus on user experience has paid off: daily active addresses rose thirteenfold year-to-date, transaction throughput consistently outpaces peers, and protocol revenues are among the highest in DeFi. For traders, builders, and liquidity providers alike, these are signals of an ecosystem where growth feels inevitable rather than speculative.

Looking Ahead: Can Base Reach $20 Billion TVL?

The big question now is how far this momentum can go. With current trends pointing toward continued inflows, some analysts see $20 billion in TVL as an achievable target by end of 2026, especially if developer adoption continues at this pace.

For those tracking Base tokens analytics, it’s worth noting that BASE is currently trading at $0.3782, reflecting both recent volatility and long-term optimism about the chain’s prospects.

If you’re considering engaging with DeFi on Base or simply want to monitor its explosive ascent, keep an eye on real-time statistics and community sentiment, they’re often the best early indicators of what comes next in this rapidly evolving sector.