The intersection of social media and blockchain is evolving rapidly, and the Base App’s new feature exemplifies this shift. Now, every post you create on the Base App can be instantly minted as a tradable ERC-20 token, transforming content into an asset class of its own. This mechanism, powered by Zora’s protocol, enables users to speculate on the popularity of posts in real time, essentially turning attention and engagement into liquidity. For creators and traders alike, understanding how to trade Base app posts as tokens is crucial for navigating this emerging landscape.

How Content Becomes a Coin: The Mechanics Behind Tokenized Posts

On the Base App, tokenizing a post is seamless. When you publish content, it is automatically minted as an ERC-20 token using Zora’s infrastructure. This process doesn’t require any coding or manual minting; the app handles all technical details behind the scenes. The result is a unique ‘content coin’ that represents your post on-chain.

Each content coin operates with bonding curve mechanics: as more users buy into your post, the price rises algorithmically according to demand. Early buyers benefit from lower entry points and potential upside if your content gains traction across social networks like Farcaster. Creators also receive royalties from every transaction involving their coins, a powerful incentive for producing high-quality or viral content.

Step-by-Step Guide: Trading Tokenized Posts on the Base App

To get started with trading posts as tokens, follow these essential steps:

- Create Your Post: Compose your message or media in the Base App interface.

- Tokenization: Upon posting, your content is automatically minted as an ERC-20 token through Zora.

- Share and Promote: Amplify reach by sharing across integrated platforms such as Farcaster to attract buyers.

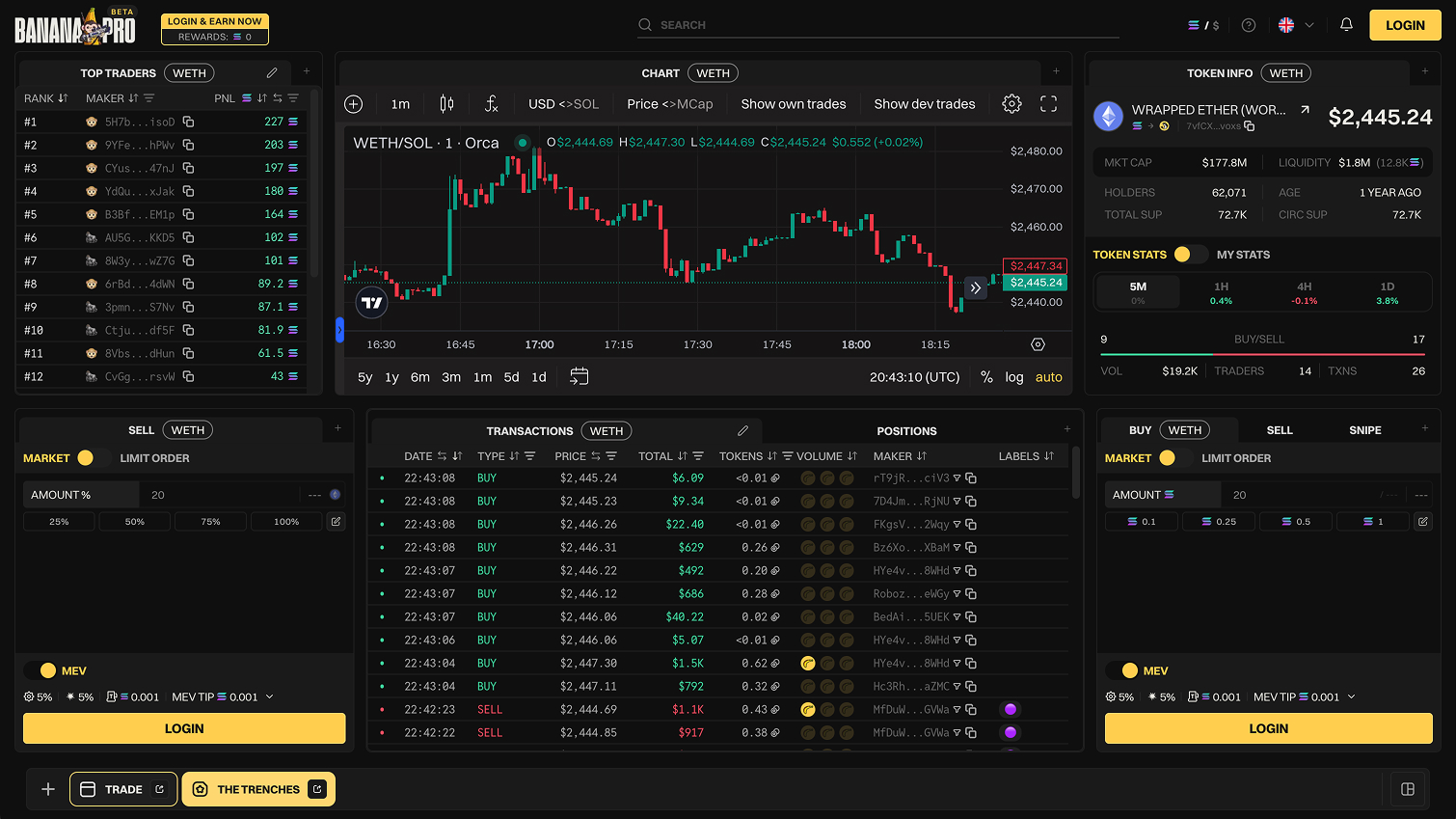

- Buy/Sell Content Coins: Use built-in analytics to monitor price action and community engagement before executing trades directly within the app.

This mechanism democratizes monetization, any user can speculate on which posts will trend or go viral, while creators earn from both initial sales and ongoing secondary trading activity. The process draws parallels with traditional DeFi liquidity pools but applies them to social engagement rather than pure financial assets.

Earning Potential: Monetize Attention with Social Tokens

The introduction of tradable content coins fundamentally alters incentives for creators and communities alike. As interest in a particular post increases, measured by trading volume and price appreciation, the creator benefits directly via royalties set at minting. Early supporters who identify promising posts can profit from subsequent demand surges as well.

Key Benefits of Trading Social Tokens on Base Chain

-

Direct Monetization for Creators: The Base App enables content creators to earn revenue instantly by tokenizing their posts as ERC-20 tokens. Each trade or secondary sale can generate royalties, providing ongoing income for creators.

-

Enhanced Community Engagement: Social tokens on Base allow audiences to invest in and support their favorite posts, fostering deeper creator-fan relationships and incentivizing high-quality content.

-

Seamless Trading Experience: Users can buy, sell, and swap content coins directly within the Base App using integrated DEX features and Coinbase Wallet support, streamlining the trading process.

-

Transparent Analytics and Performance Tracking: The Base App provides real-time analytics for each tokenized post, enabling users to track market performance and make informed trading decisions.

-

Lower Transaction Fees: The Base chain offers reduced gas fees compared to Ethereum mainnet, making frequent trading and microtransactions more cost-effective for users.

This dynamic creates a feedback loop where quality content is rewarded not just with likes or shares but with real economic value, aligning financial incentives between creators and their audience in novel ways. For those familiar with decentralized exchanges (DEXs) like Uniswap or swapping mechanisms within Coinbase Wallet (source), trading social tokens will feel intuitive yet distinctly community-driven.

Unlike traditional crypto tokens, the value of a Base app content coin is directly linked to audience sentiment and engagement. This means that timing, community trends, and even meme potential can dramatically influence trading outcomes. For example, a post that gains traction on Farcaster or Twitter may see its token price spike rapidly as users rush to buy in. Conversely, posts that fail to capture attention may see stagnant or declining prices. It’s a dynamic, high-velocity market where information flow and social signals are just as important as technical fundamentals.

Navigating Risks and Opportunities: What Traders Should Know

Trading tokenized posts introduces unique risks alongside its opportunities. Volatility can be extreme, with prices swinging on the back of trends or influencer endorsements. There’s also the risk of illiquidity for less popular posts, if few buyers show up, it may be difficult to exit your position without significant slippage.

Gas fees are another consideration. While Base chain is designed for lower costs compared to Ethereum mainnet (source), active traders should monitor fee levels before executing frequent trades, especially during periods of network congestion.

[price_widget: Live price feed for trending Base app content coins]

For those new to decentralized trading, using familiar tools like Coinbase Wallet’s swap feature can streamline the process (source). The principles remain the same: select your pair (e. g. , USDC/content coin), review quoted prices and fees, then confirm your trade. However, always verify you’re interacting with the official token contract generated by the Base App to avoid scams or copycat tokens.

Advanced Strategies: Maximizing Value from Social Token Trading

Experienced traders are already exploring advanced tactics such as:

- Sniping viral posts early: Monitoring trending topics and minting/buying content coins before they go mainstream.

- Diversifying across creators: Building a portfolio of content coins from multiple creators to spread risk.

- Community-driven pumps: Coordinating with others in Discords or Telegrams to spotlight promising posts and drive demand.

- Using analytics tools: Leveraging built-in metrics within the Base App or third-party dashboards for real-time sentiment analysis.

This ecosystem rewards agility and research, those who understand both social dynamics and DeFi mechanics will have an edge in identifying undervalued opportunities before broader adoption sets in.

Frequently Asked Questions

The intersection of decentralized finance and social media is still in its infancy but evolving quickly. By treating every post as a tradable asset, the Base App is catalyzing a new paradigm where both creators and their communities can share in economic upside, if they’re willing to navigate this fast-moving marketplace with care and insight.