Trading Base Chain tokens has entered a new era of accessibility and user experience, thanks to the latest evolution of the Base App. Coinbase’s all-in-one platform now enables users to buy, sell, and swap Base-native tokens directly within their social feed. This isn’t just an incremental upgrade – it’s a paradigm shift for on-chain activity, blending real-time trading with the pulse of crypto social engagement.

Base App In-Feed Trading: A Closer Look

The integration of in-feed trading into the Base App marks a strategic move to streamline how users interact with digital assets on Ethereum’s Layer 2. No longer do you need to toggle between multiple apps or browser tabs. Now, you can browse trending posts, discover new Base memecoins, and execute trades – all without leaving your feed.

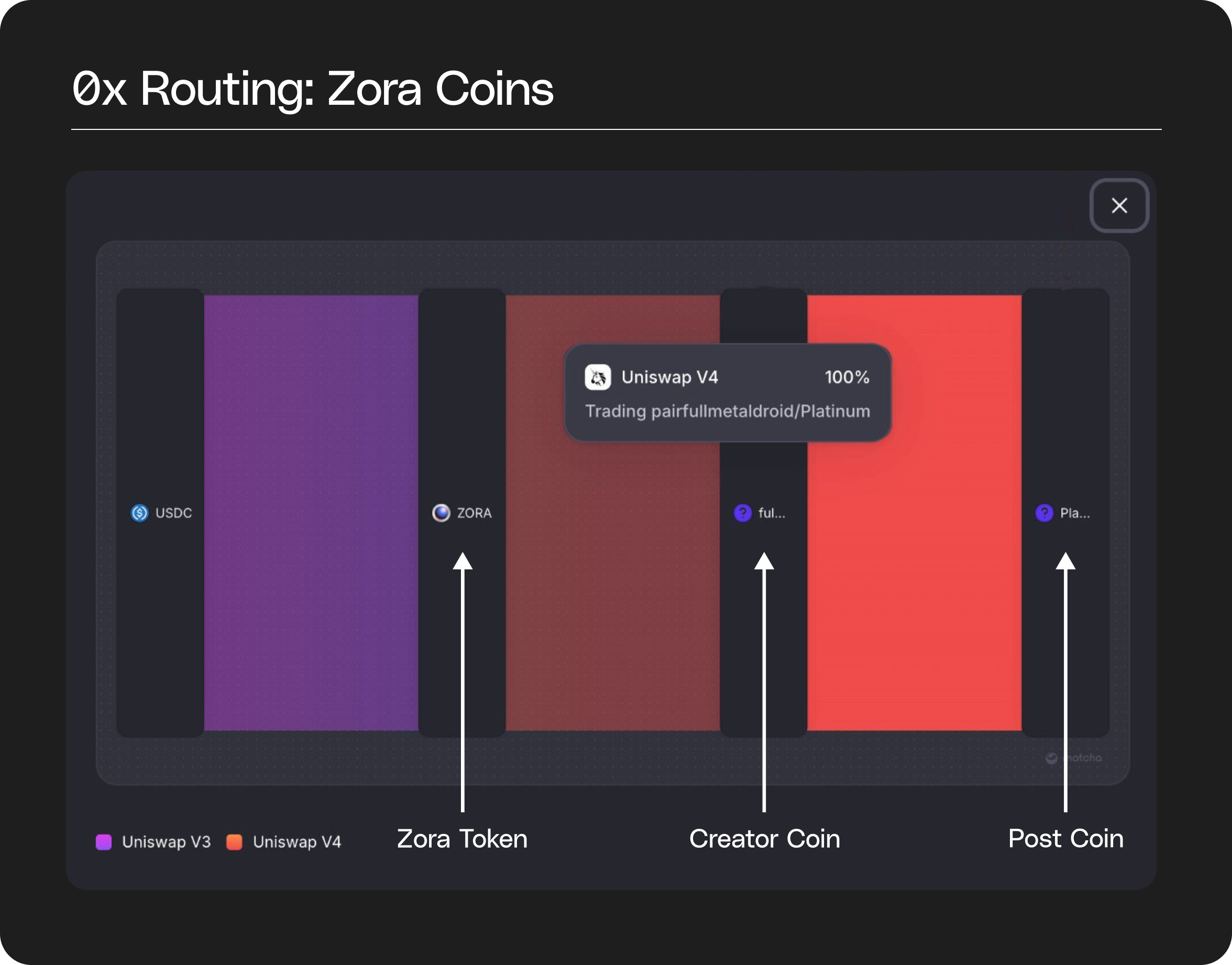

The app leverages decentralized exchange (DEX) technology under the hood. When you spot a token in your feed that piques your interest – whether it’s a meme token gaining traction or an innovative DeFi asset – you can trade it in just a few taps. DEX aggregators ensure optimal pricing by routing your order through the most efficient liquidity pools available on Base.

This level of integration is more than just convenience; it’s about empowering users to participate in market action as it unfolds socially. The current price of Base Protocol (BASE) sits at $0.4952, reflecting a 24-hour change of -0.9680%. With this information always at your fingertips, timing trades becomes far more strategic.

Key Features Transforming Crypto Engagement

- Social-Driven Discovery: The Farcaster-powered feed surfaces trending tokens and lets creators monetize posts using Zora. You’re not just trading; you’re engaging with creators, tipping, and earning rewards for participation.

- Integrated Wallet: Manage your portfolio seamlessly inside the app, funding trades directly from your Coinbase balance or USDC holdings.

- DEX Access Without Friction: Trade any newly launched Base chain token immediately after its creation, no centralized listing delays or manual contract lookups required.

This fusion of social activity and financial tooling is designed for both seasoned traders and newcomers seeking intuitive access to the fast-moving world of Base chain tokens.

Your Step-by-Step Guide: Trading Tokens in Your Social Feed

The process is refreshingly straightforward:

- Install/Update the App: Make sure you have the latest version of the Base App on your device.

- Dive into Your Feed: Scroll through posts highlighting new tokens and market discussions.

- Select and Trade: Tap on any token mention to access trade options, specify amount, review DEX quotes, and confirm with one click.

- Track Performance: Monitor open positions and portfolio stats right within the app interface.

This user flow removes friction points that often deter less technical participants from engaging with emerging assets like trending memecoins or protocol launches on Base. For those looking for deeper insights into tool comparisons or broader network capabilities, resources like Bankless’ overview offer useful context (source).

Base (BASE) Token Price Prediction 2026-2031

Forecast based on current adoption trends, technology integration, and evolving market context (as of September 2025)

| Year | Minimum Price (Bearish) | Average Price | Maximum Price (Bullish) | Year-over-Year Change (%) | Key Market Scenario |

|---|---|---|---|---|---|

| 2026 | $0.43 | $0.56 | $0.82 | +13% | Further social trading adoption, gradual user growth |

| 2027 | $0.49 | $0.68 | $1.10 | +21% | DEX trading goes mainstream, increased USDC activity |

| 2028 | $0.58 | $0.82 | $1.39 | +21% | Potential regulatory clarity, improved Layer 2 scaling |

| 2029 | $0.70 | $1.01 | $1.85 | +23% | Base App ecosystem matures, institutional interest rises |

| 2030 | $0.86 | $1.26 | $2.32 | +25% | Broader integration with major DeFi protocols |

| 2031 | $1.06 | $1.58 | $2.90 | +25% | Widespread global adoption, possible Layer 2 market leader |

Price Prediction Summary

The BASE token is forecasted to experience steady growth through 2031, supported by the increasing adoption of the Base App, enhanced trading/social features, and integration with DeFi protocols. Growth is expected to be progressive, with volatility remaining due to broader crypto market cycles and regulatory developments. The average price could rise from $0.56 in 2026 to $1.58 by 2031, with bullish scenarios reaching as high as $2.90 if Base achieves major Layer 2 dominance.

Key Factors Affecting Base Price

- Adoption of Base App’s integrated trading and social features

- Expansion of DEX trading and DeFi integrations on Base

- Regulatory clarity in the US and other major markets

- Competition from other Layer 2 solutions (e.g., Arbitrum, Optimism)

- User growth and increased on-chain activity

- Potential for Coinbase to further promote and build on Base

- Macro crypto market cycles and sentiment

- Innovations in payment, monetization, and tokenization within the Base ecosystem

Disclaimer: Cryptocurrency price predictions are speculative and based on current market analysis.

Actual prices may vary significantly due to market volatility, regulatory changes, and other factors.

Always do your own research before making investment decisions.

The Bottom Line So Far

The convergence of social feeds and instant DEX trading inside the Base App signals a new chapter for crypto accessibility. With BASE trading at $0.4952 as of this writing and robust features rolling out to U. S. users (excluding New York), this is arguably one of the most significant steps toward mainstreaming real-time crypto participation on Ethereum Layer 2s.

For traders seeking to capitalize on the next wave of Base memecoins or to participate in viral token launches, the Base App’s in-feed trading is more than a novelty, it’s a competitive advantage. The ability to react instantly to social sentiment, discover tokens organically, and execute trades without leaving the context of the conversation brings a new level of agility and transparency.

This approach doesn’t just benefit active traders. It also lowers the barrier for newcomers who might otherwise find decentralized exchanges intimidating or cumbersome. By embedding trading directly into familiar social interactions, Base App helps demystify crypto markets and encourages broader participation across demographics.

Security, Transparency, and User Control

- Self-Custody First: With an integrated self-custody wallet, you retain control over your assets at all times. Trades are executed on-chain, no need to trust a centralized intermediary.

- On-Chain Transparency: Every transaction is recorded on Ethereum’s Layer 2 (Base), allowing for public verification and reducing counterparty risk.

- Real-Time Price Feeds: The app displays current market data, like BASE’s price at $0.4952, so you can make informed decisions based on live conditions.

While the app’s initial rollout targets select U. S. users (excluding New York), its architecture sets a precedent for how crypto platforms can merge social and trading utilities without sacrificing user agency or security. As adoption grows, expect further enhancements in analytics, discovery tools, and perhaps even AI-powered trade suggestions tailored to your engagement patterns.

Top Features That Make Base App In-Feed Trading a Game Changer

-

Seamless In-Feed Token Trading: Buy, sell, and swap Base Chain tokens directly within your social feed—no need to switch apps or platforms, making on-chain trading more intuitive than ever.

-

Integrated Decentralized Exchange (DEX) Access: Instantly trade Base-native tokens as soon as they launch, thanks to built-in DEX trading. This offers immediate access to new assets, with optimal pricing via DEX aggregators.

-

Farcaster-Powered Social Feed: Engage with a social feed where you can tokenize posts using Zora, receive tips, and earn weekly engagement rewards—all while trading tokens in the same interface.

-

Integrated Self-Custody Wallet: Securely manage your assets with the app’s self-custody wallet, enabling direct portfolio management and funding trades from your Coinbase balance or USDC.

-

All-in-One Platform for Trading, Payments, and Messaging: The Base App combines trading, payments, and messaging, creating a unified experience that streamlines your on-chain activities.

Beyond Trading: Building Community Value

The integration of tipping, creator monetization via Zora, and weekly engagement rewards transforms every trade into more than just a transaction, it becomes part of an ongoing community dialogue. This aligns with Base’s broader vision described in their documentation: supporting everything from micro-payments to creator-first monetization strategies (source).

The impact? A tighter feedback loop between market activity and community sentiment. Traders gain access to immediate liquidity while creators are rewarded for driving engagement and discovery within the ecosystem.

What Comes Next?

The fusion of real-time trading with social feeds is still evolving, and so are user expectations. As more features roll out and regulatory clarity improves, we’ll likely see increased support for advanced order types, deeper analytics, and cross-chain integrations within the same unified interface.

If you’re looking for an edge in today’s volatile markets, or simply want a more intuitive way to engage with Base chain tokens, the strategic move is clear: explore what in-feed trading can offer now while keeping an eye on future updates that could further shift how we interact with digital assets socially and financially.