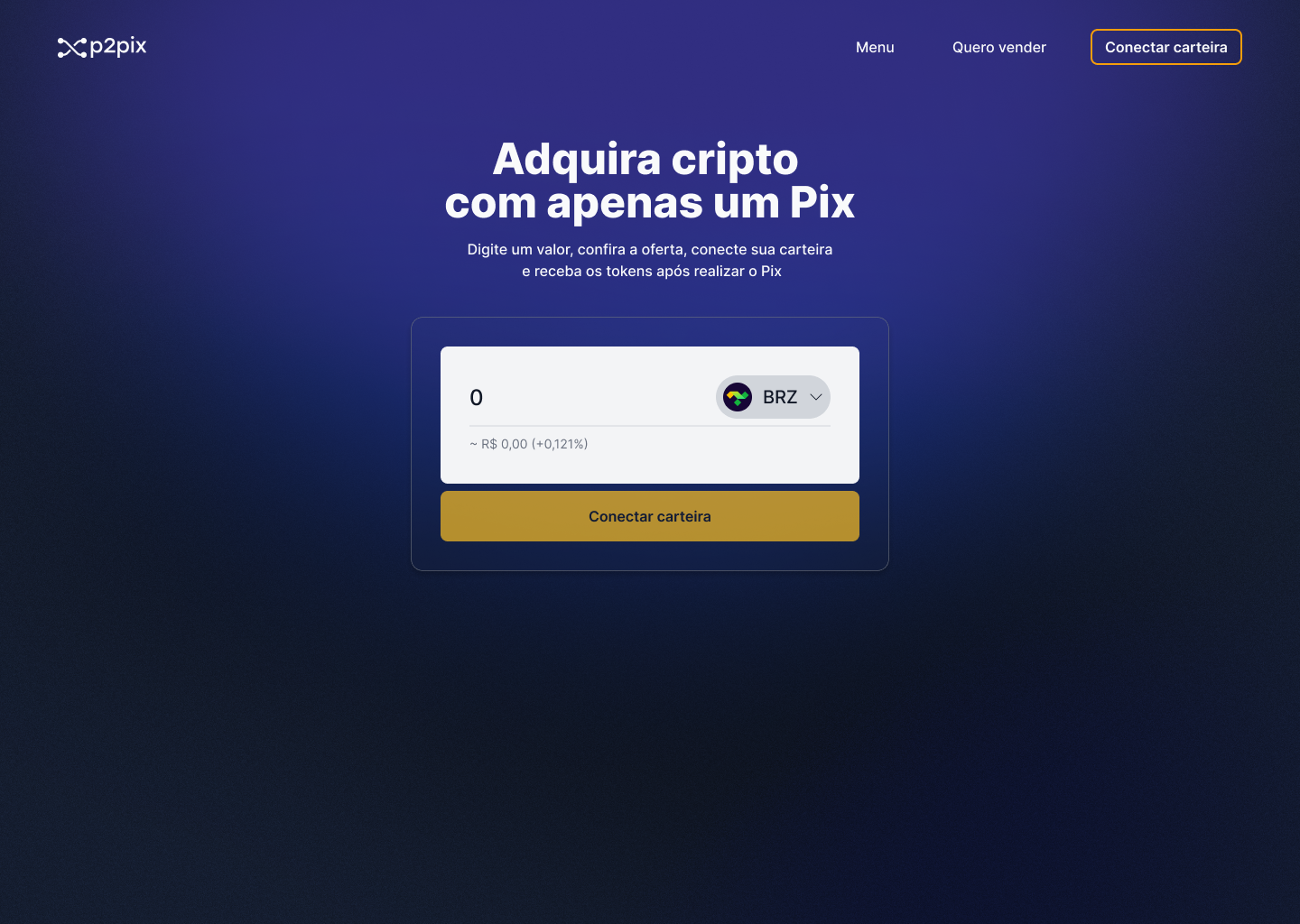

Brazil’s financial landscape is undergoing a rapid transformation, driven by the convergence of blockchain rails and the country’s dominant instant payments platform, Pix. For crypto-native users, the integration of USDC on Base with Pix via Emigro represents a leap forward for real-world stablecoin utility. This is not a theoretical use case: it’s live, frictionless, and has the potential to disrupt both remittance flows and local commerce.

Why USDC on Base? Unpacking the Technical Edge

USDC remains the leading regulated dollar stablecoin, and its deployment on Base – Coinbase’s Ethereum Layer 2 – brings three key advantages: low fees, fast settlement, and seamless interoperability with DeFi. As of September 2025, Multichain Bridged USDC (Fantom) trades at $0.0519, reflecting the ongoing demand for cross-chain liquidity. However, it’s USDC on Base that powers instant payments in Brazil through Emigro’s innovative wallet architecture.

The Emigro app is purpose-built for travelers and expats who need to transact in Brazil without local bank accounts or credit cards. By leveraging USDC on Base, users can bridge digital dollars into the Brazilian economy with minimal slippage or latency.

Paving the Way: How Emigro Bridges Crypto to Pix

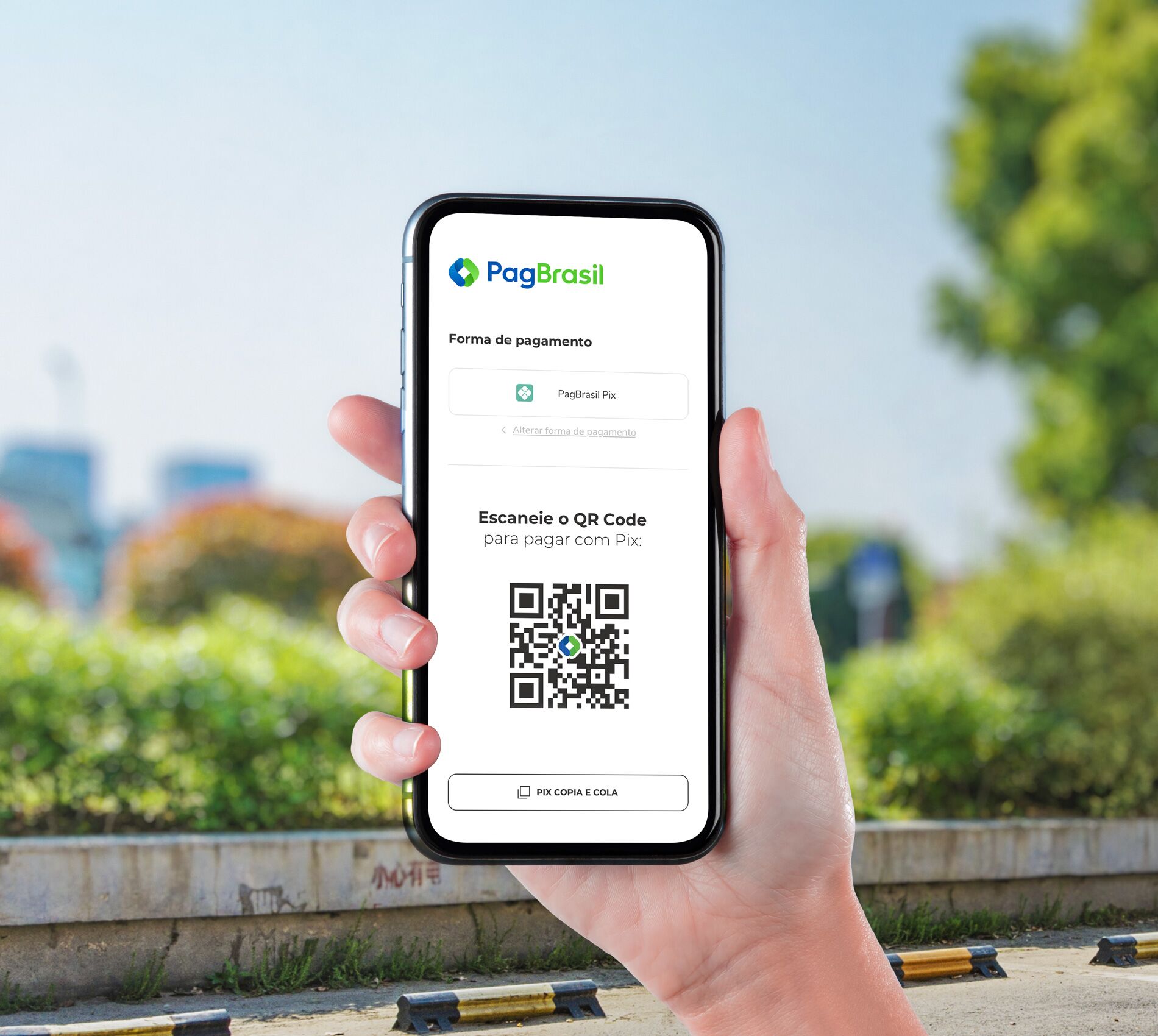

Emigro orchestrates a behind-the-scenes swap from USDC (on Base) to Brazilian Reais at the point of payment. The critical unlock is direct integration with Pix – Brazil’s central-bank-backed instant payment system that has reached near-universal adoption since launch. Whether you’re paying at a corner store or transferring funds to a friend, Pix QR codes are ubiquitous across Brazil.

The process is elegantly simple:

Steps to Use Emigro for USDC-to-Pix Payments

-

Download and Install Emigro: Get the official Emigro app from the Apple App Store or Google Play Store. This self-custody wallet enables international travelers to use digital currencies for payments in Brazil.

-

Complete KYC and Set Up Your Wallet: Open the Emigro app and follow the in-app prompts to complete the Know Your Customer (KYC) verification process. This step is required to activate your wallet and comply with local regulations.

-

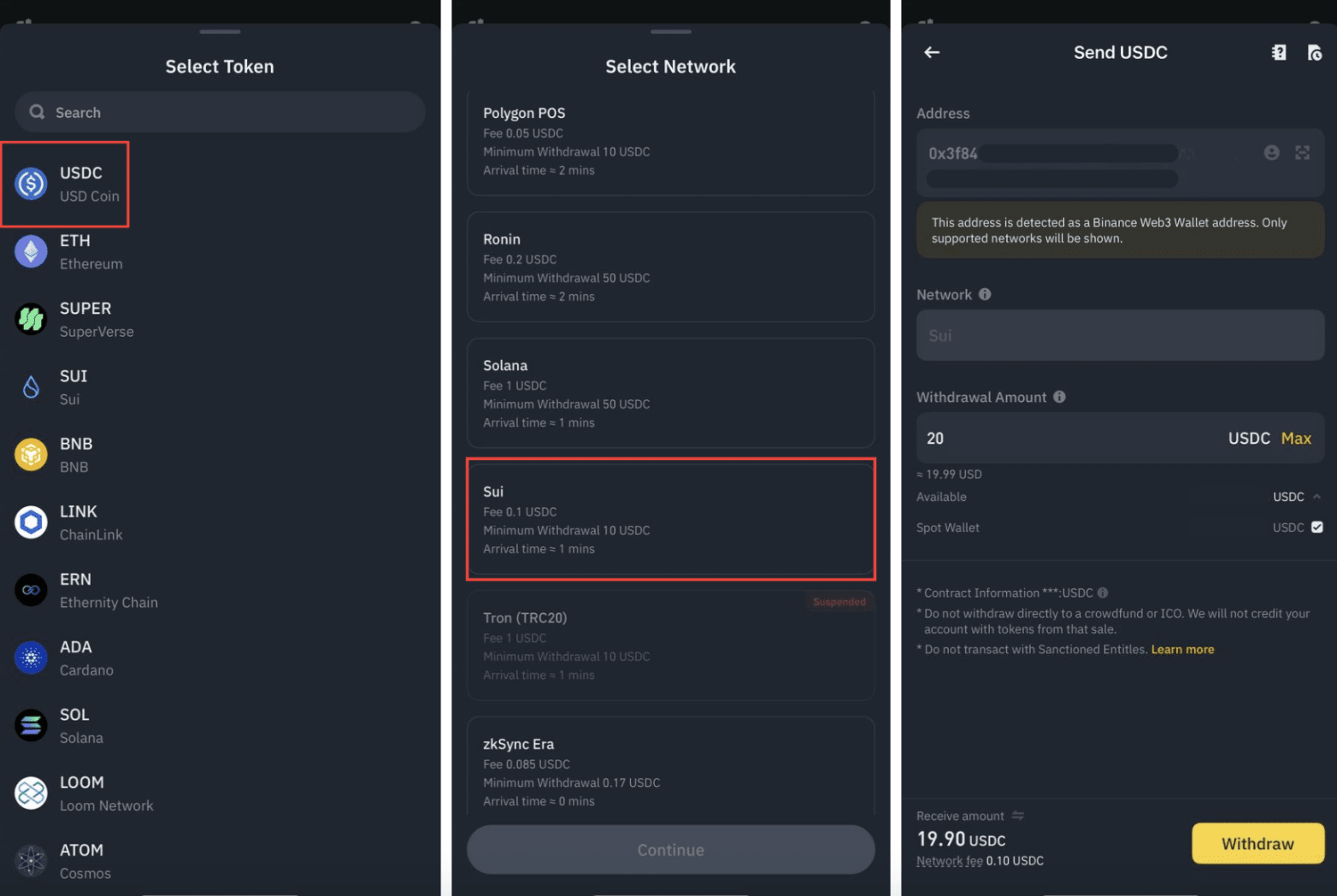

Fund Your Wallet with USDC on Base: Deposit USDC into your Emigro wallet by transferring from another digital wallet or supported bank account. Ensure you are using USDC on the Base blockchain. The latest market price for Multichain Bridged USDC (Fantom) is $0.0519 per USDC.

-

Initiate a Pix Payment: Use the Emigro app to scan a Pix QR code at the merchant’s point of sale or enter the recipient’s Pix key. The app will convert your USDC and send Brazilian Reais instantly via the Pix system.

-

Confirm and Complete the Transaction: Review the transaction details in Emigro, confirm the payment, and receive instant confirmation. No cash or credit card is required, and payments are settled in seconds through Pix.

This workflow abstracts away technical complexity for end users while maintaining self-custody and compliance standards (KYC within Emigro). Notably, there are no extra fees or ID checks at point-of-sale, as confirmed by early adopters transacting with USDC via Pix in Brazilian shops.

The Regulatory and Market Context: Why Brazil Is Leading Stablecoin Adoption

Banks and fintechs worldwide are watching as Brazil quietly becomes a proving ground for stablecoin-powered payments. The combination of Circle’s official support for Pix integration, regulatory clarity around digital assets, and an open API ecosystem has created fertile ground for projects like Emigro.

Brazilians have embraced Pix due to its zero-fee structure and real-time settlement – features that align perfectly with crypto ethos but have been delivered by traditional finance rails. By embedding USDC liquidity into this system via Base chain payments, new corridors open up for remittances, tourism spending, payroll disbursements, and more.

Key Benefits of Using Emigro and USDC and Pix:

- No local bank account required: International visitors can pay instantly at any merchant supporting Pix QR codes.

- Transparent FX conversion: Users see rates upfront; no hidden markups or predatory spreads.

- KYC-compliant self-custody: Your funds remain under your control until payment execution.

- No extra fees at point of sale: Confirmed by recent user reports from Brazilian merchants.

- Real-time settlement: Payments clear instantly thanks to both Base L2 speed and Pix infrastructure.

For sophisticated users, the synergy between crypto payments Pix and Base’s Layer 2 infrastructure is not just about convenience. It’s a major step toward composable, programmable money in emerging markets. The ability to hold digital dollars on-chain and spend them at any Pix-enabled merchant means capital can move globally, yet settle locally, without friction or delay.

USDC Price Consistency Across Networks: Base, Ethereum, and Fantom (Bridged)

A real-time comparison of USDC and Multichain Bridged USDC (Fantom) prices to highlight stability and transparency for instant payments in Brazil via Emigro and Pix.

| Asset | Current Price | 6 Months Ago | Price Change |

|---|---|---|---|

| USD Coin (Base) | $1.00 | $1.00 | +0.0% |

| USD Coin (Ethereum) | $1.00 | $1.00 | +0.0% |

| Multichain Bridged USDC (Fantom) | $0.0519 | $0.0519 | +0.0% |

Analysis Summary

USDC on both Base and Ethereum networks has maintained a perfect $1.00 peg over the past six months, demonstrating strong price stability and reliability for payments. In contrast, Multichain Bridged USDC (Fantom) trades at a significant discount ($0.0519), reflecting a lack of parity with standard USDC and highlighting the importance of using native or officially supported USDC for transparent, predictable payments.

Key Insights

- USDC on Base and Ethereum both maintain a stable $1.00 price, ensuring predictability for users making instant payments in Brazil via Emigro and Pix.

- Multichain Bridged USDC (Fantom) is priced at $0.0519, far below the $1.00 peg, indicating it is not suitable for payments requiring dollar parity.

- Price consistency across Base and Ethereum networks supports the transparency and trust needed for cross-border and local stablecoin payments.

- Users should verify the type of USDC they are using to avoid unexpected losses due to depegged or unofficial bridged tokens.

All prices and changes are sourced directly from real-time CoinGecko data as of 2025-09-03. Only official, up-to-date market data was used for this comparison, with no estimates or extrapolations.

Data Sources:

- Main Asset: CoinGecko

- USD Coin (Base): CoinGecko

- Multichain Bridged USDC (Fantom): CoinGecko

- USD Coin (Ethereum): CoinGecko

- Tether: CoinGecko

- Dai: CoinGecko

- Ethereum: CoinGecko

- Bitcoin: StatMuse Money

- Binance USD: CoinGecko

Disclaimer: Cryptocurrency prices are highly volatile and subject to market fluctuations. The data presented is for informational purposes only and should not be considered as investment advice. Always do your own research before making investment decisions.

Security, Speed, and Real-World Utility

The technical stack behind Emigro is engineered for both speed and security. By leveraging Base’s low-latency settlement layer, transactions are confirmed almost instantly while benefiting from Ethereum-grade security guarantees. All user funds remain in self-custody wallets until the moment of payment execution, eliminating counterparty risk common to custodial fintech apps.

Emigro Pix integration also addresses a persistent pain point for travelers: access to local currency without punitive FX fees or paperwork. With Emigro, users simply scan a Pix QR code and authorize payment in USDC; the app handles conversion and settlement natively. This is particularly powerful for digital nomads, expats, and business travelers who need reliable access to Brazilian Reais without opening local bank accounts.

Market Impact: Base Chain Payments in Brazil Gain Traction

The deployment of USDC on Base as a bridge to Brazil’s retail economy has implications beyond personal payments. For merchants, it means instant access to USD liquidity without exposure to crypto volatility, since funds are converted at the point of sale using transparent rates. For remittance corridors (for example, Brazilians working abroad), it streamlines cross-border transfers with minimal friction compared to legacy wire services.

Importantly, this model scales: as more wallets and onramps integrate USDC on Base with Pix rails, the network effect will drive down costs further while increasing usability across verticals including e-commerce, payroll, and B2B settlements.

Key Use Cases Enabled by USDC on Base with Emigro-Pix

-

Instant Merchant Payments: Users can pay at any Brazilian business that accepts Pix using USDC via the Emigro wallet, enabling rapid, cardless transactions with stablecoin settlement.

-

Peer-to-Peer Transfers: Individuals can send USDC on Base directly to Brazilian bank accounts through Pix, facilitating low-cost, real-time remittances and personal payments.

-

Cash Withdrawals via Pix: Emigro users can convert USDC to Brazilian Reais and withdraw cash at participating retailers using Pix, with no additional fees or ID required at the point of withdrawal.

-

Cross-Border Business Settlements: Businesses can leverage USDC on Base and Pix integration to settle invoices and make supplier payments instantly, bypassing traditional banking delays and FX fees.

-

Subscription and Recurring Payments: With the introduction of Pix Automático, users can authorize recurring payments in Brazil using USDC via Emigro, streamlining subscription-based services.

Risks and Considerations

While regulatory clarity has improved, thanks to Circle’s partnership with Brazilian financial institutions, users should remain vigilant about compliance requirements (notably KYC/AML within Emigro) and potential FX spreads during periods of high volatility. As always in crypto-native workflows, self-custody comes with operational responsibility; secure your wallet keys and verify all transaction details before confirming payments.

The current price for Multichain Bridged USDC (Fantom) stands at $0.0519, reflecting healthy cross-chain arbitrage opportunities but also underscoring the importance of verifying which version of USDC you’re transacting with inside your wallet interface.

If you’re serious about borderless payments or want a hedge against local currency swings while traveling or living in Brazil, leveraging Emigro’s integration with USDC on Base is now among the most technically robust options available.

This convergence of stablecoins and national payment systems isn’t just an incremental improvement, it signals a paradigm shift for how value can flow across borders with minimal cost or friction. For those watching global adoption curves for real-world crypto utility, keep an eye on Brazil: what’s happening here will set the template for stablecoin-powered commerce worldwide.