Staking Ethereum (ETH) on the Base network has become an attractive strategy for yield seekers and onchain solvers looking to minimize gas fees while maintaining exposure to a leading Layer 2 ecosystem. With ETH currently trading at $4,402.14, optimizing your staking approach is more critical than ever. This guide offers a precise walkthrough for using BasedSwap to stake ETH on Base for the lowest possible transaction costs, all while avoiding common pitfalls and maximizing your rewards.

Why Stake ETH on Base? Lower Gas Fees, Faster Settlements

Base, Coinbase’s Layer 2 rollup, aggregates transactions off-chain before settling them in batches on Ethereum mainnet. This architecture significantly reduces transaction fees compared to mainnet staking protocols. For users who want to stake ETH without incurring high gas costs or waiting through congested settlement times, Base is an excellent choice. The combination of low fees and rapid confirmation makes it particularly appealing for both retail and institutional participants.

Unlike some networks that require holding a native token (note: there is no official BASE token), Base uses ETH as its settlement currency. This simplifies the process and removes an extra layer of risk from potential scam tokens masquerading as official assets. According to recent discussions on Reddit’s r/ethereum, users can deposit ETH directly onto Base via Coinbase or bridge from Ethereum mainnet using trusted services such as the official Base Bridge.

Step-by-Step Guide: From Wallet Setup to Staking on BasedSwap

The following process will guide you through every step required to stake your ETH using BasedSwap, ensuring you pay only minimal gas fees throughout:

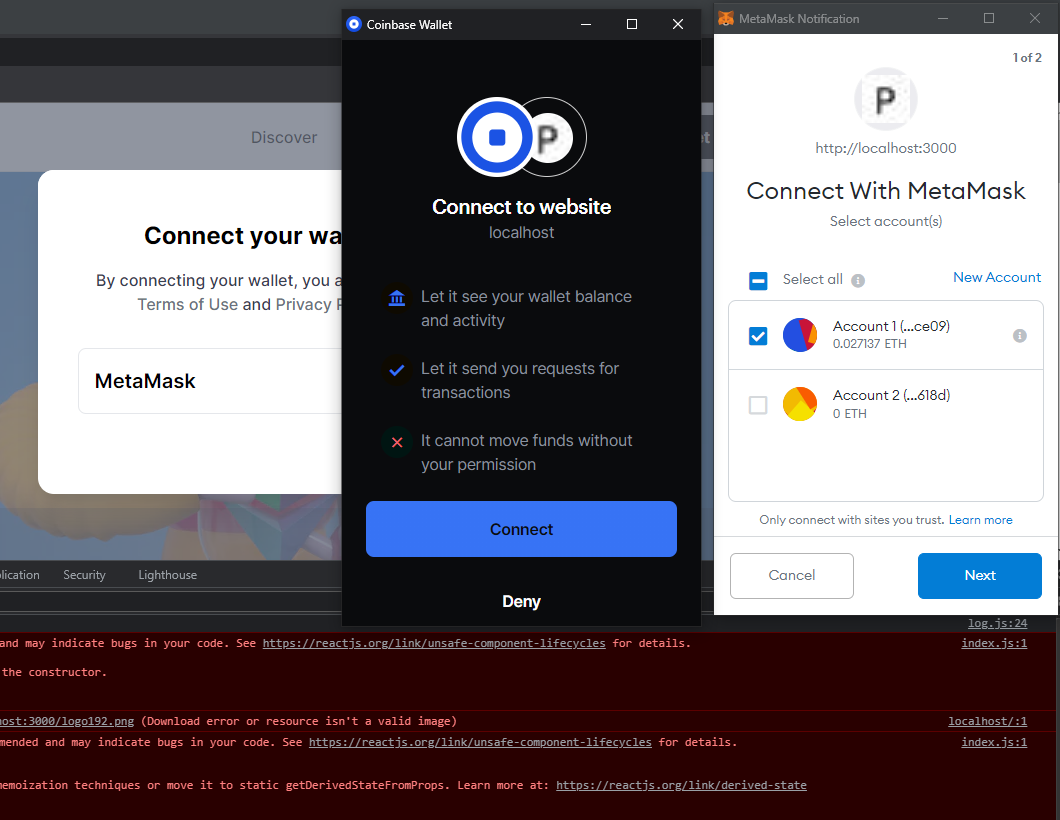

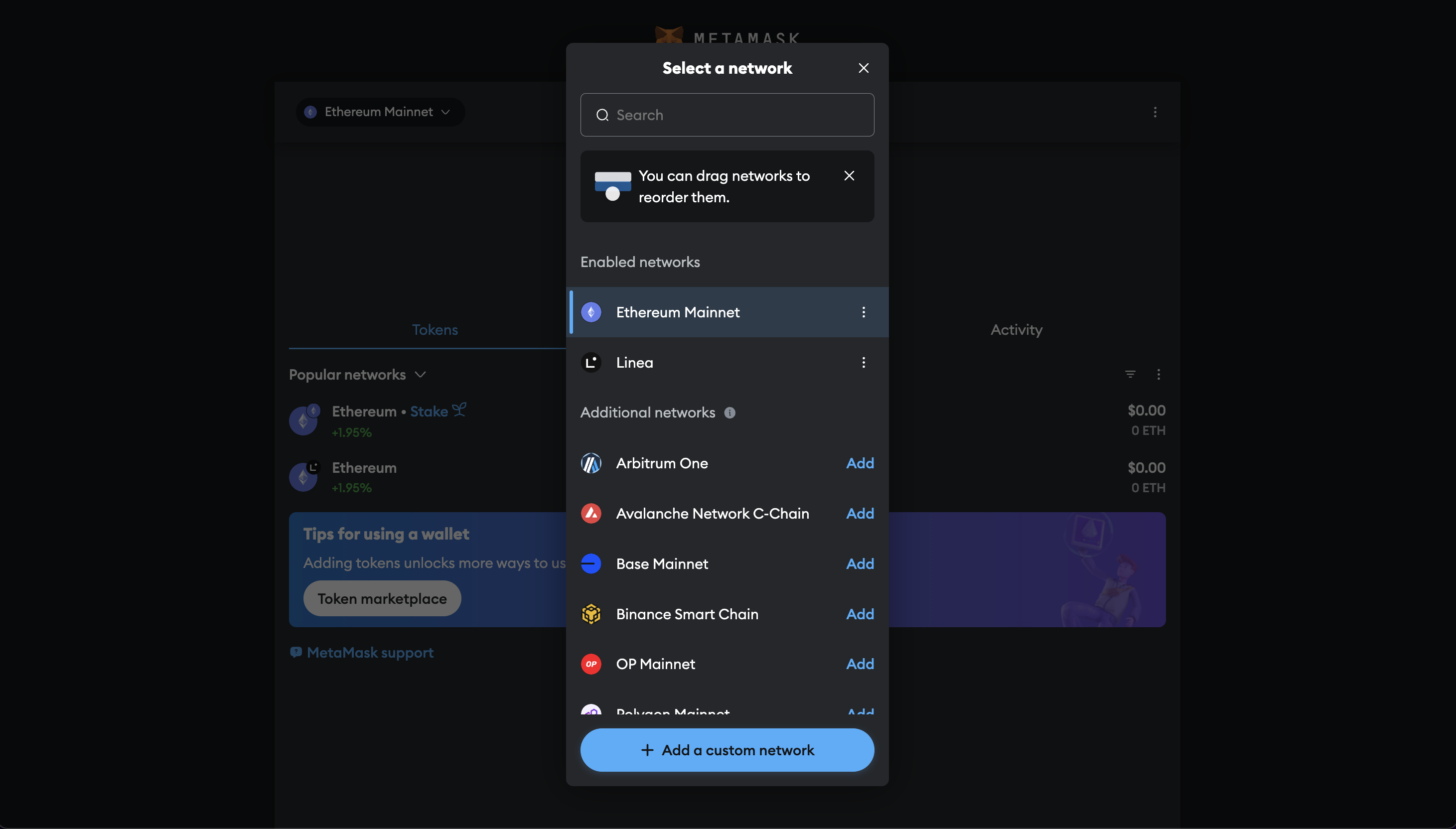

- Set Up Your Wallet: Use MetaMask or Coinbase Wallet and add the Base Mainnet with RPC URL https://mainnet.base.org, Chain ID 8453.

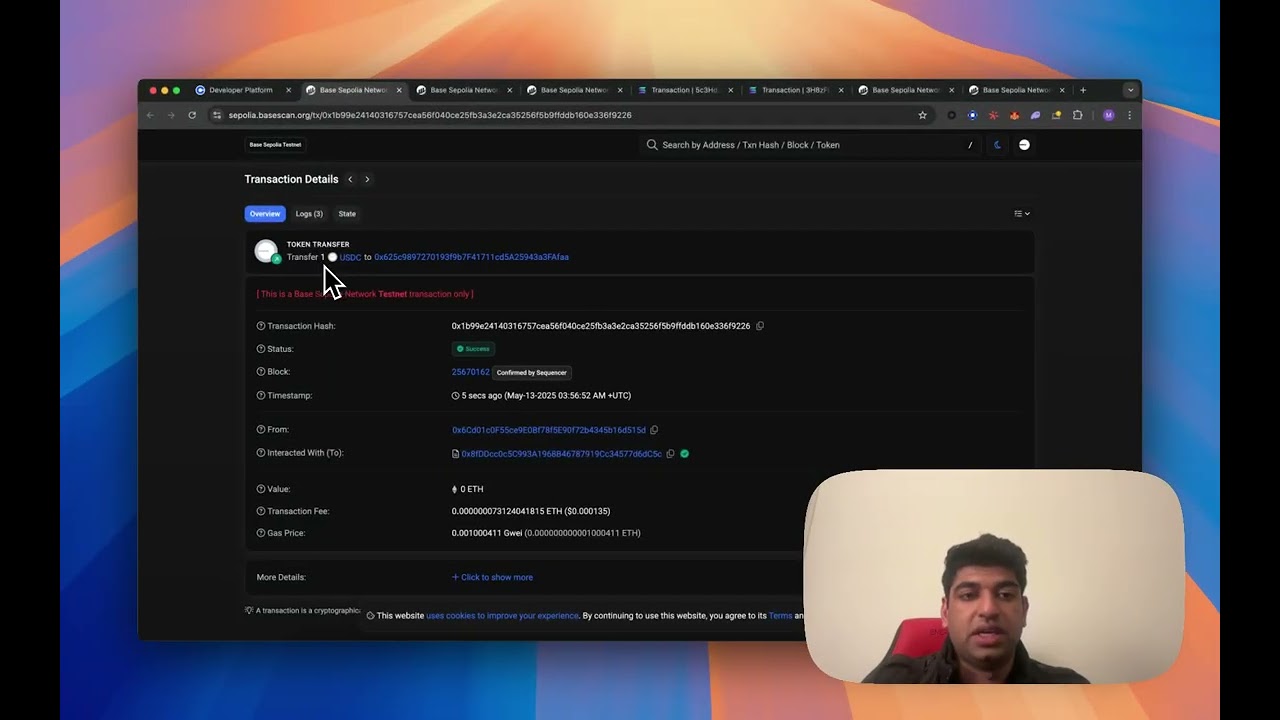

- Bridge Your ETH: Transfer your funds from Ethereum mainnet using the Base Bridge. Confirm all transaction details carefully.

- Connect to BasedSwap: Visit BasedSwap and connect your wallet securely.

- Add Liquidity: Select the desired pool (e. g. , ETH paired with a stablecoin) and deposit your tokens to receive LP tokens.

- Stake LP Tokens: In the “Farm” section of BasedSwap, choose your pool and stake your LP tokens to begin earning rewards.

This streamlined process leverages both the efficiency of Layer 2 scaling solutions and the composability of DeFi protocols like BasedSwap. Always double-check URLs before connecting wallets or signing transactions, security remains paramount in every DeFi interaction.

Navigating Market Conditions: Why Timing Matters with ETH at $4,402.14

The current price of Ethereum at $4,402.14, with a slight daily decline of $87.08 (-0.0194%), underscores the importance of cost-efficient staking strategies. In high-fee environments or during periods of network congestion, even minor savings per transaction can compound into meaningful differences in net rewards over time.

If you’re looking ahead for potential airdrops or new token launches in the Base ecosystem (as speculated by guides like RocketX), early adoption through platforms like BasedSwap ensures you’re well-positioned while keeping operational costs at a minimum.

For those prioritizing capital efficiency, staking ETH on Base via BasedSwap offers a compelling blend of yield and flexibility without the punitive gas costs seen elsewhere. The absence of an official BASE token eliminates confusion and risk, allowing you to focus squarely on optimizing your returns with ETH as the core asset.

Best Practices for Security and Maximizing Yield

Security is non-negotiable when interacting with DeFi protocols. Before signing any transaction or connecting your wallet, always verify that you are on the official BasedSwap site. Bookmark trusted URLs and avoid clicking links from unsolicited messages or unofficial social media accounts. For additional protection, consider using a hardware wallet for managing significant balances.

Essential Security Tips for Staking ETH on Base

-

Use Official Platforms Only: Always access BasedSwap, Base Bridge, and BaseScan via their official URLs. Double-check links to avoid phishing sites that mimic legitimate platforms.

-

Secure Your Wallet: Protect your wallet credentials by storing your seed phrase offline and never sharing it. Use reputable wallets like MetaMask or Coinbase Wallet with up-to-date security features.

-

Verify Network Details: When adding the Base network to your wallet, confirm the RPC URL, Chain ID (8453), and Block Explorer URL are correct to prevent connecting to malicious networks.

-

Beware of Fake Tokens: There is no official BASE token. Avoid any offers to buy or stake a “BASE” token, as these are scams.

-

Enable Wallet Security Features: Activate two-factor authentication (2FA) if available, and use hardware wallets for added protection when staking significant amounts.

-

Monitor Transactions on BaseScan: Regularly review your staking and liquidity transactions on BaseScan to detect any unauthorized activity promptly.

-

Stay Updated Through Official Channels: Follow BasedSwap Twitter and Telegram for real-time updates and alerts about security issues or platform changes.

Maximizing your yield goes beyond simply staking LP tokens. Monitor pool APYs regularly and be prepared to rebalance if more attractive opportunities arise within BasedSwap or across the broader Base ecosystem. As liquidity incentives shift, so do optimal strategies; staying agile is key.

Tracking Your Performance: Tools and Metrics

Once staked, tracking your rewards and portfolio performance is crucial for informed decision-making. BasedSwap’s dashboard provides real-time data on earned rewards, staked positions, and pool statistics. For more granular analytics or tax reporting needs, third-party portfolio trackers compatible with Base network can be integrated with your wallet.

Given the current market price of $4,402.14, even small improvements in fee efficiency or yield compounding can generate outsized benefits over time, especially if you’re actively managing a larger allocation.

Community Support and Staying Informed

The pace of innovation on Base is rapid, so staying connected with both the BasedSwap community and wider Base ecosystem will help you adapt to new features or emerging opportunities. Join official channels such as BasedSwap’s Telegram and Twitter for timely updates, governance votes, and support from experienced users.

If you encounter issues or want to optimize your strategy further, these communities are invaluable resources for troubleshooting or learning about upcoming protocol changes.

The Bottom Line: Efficient Staking in a Dynamic Market

Staking ETH on Base through BasedSwap represents a pragmatic approach to DeFi participation in 2025, one that emphasizes low gas fees without sacrificing security or composability. With Ethereum’s price at $4,402.14, every basis point matters; leveraging Layer 2 infrastructure like Base can help preserve more of your hard-earned yield while positioning you for future growth within this fast-evolving ecosystem.