Coinbase’s latest integration of Base chain tokens into its app is a watershed moment for onchain access, collapsing the gap between centralized convenience and decentralized breadth. As of today, with Coinbase Global Inc (COIN) trading at $319.85, the company’s strategic pivot toward DEX trading isn’t just a technical upgrade – it’s a direct response to user demand for instant, secure access to emerging digital assets.

Base Chain Tokens: Instant Access, Infinite Choice

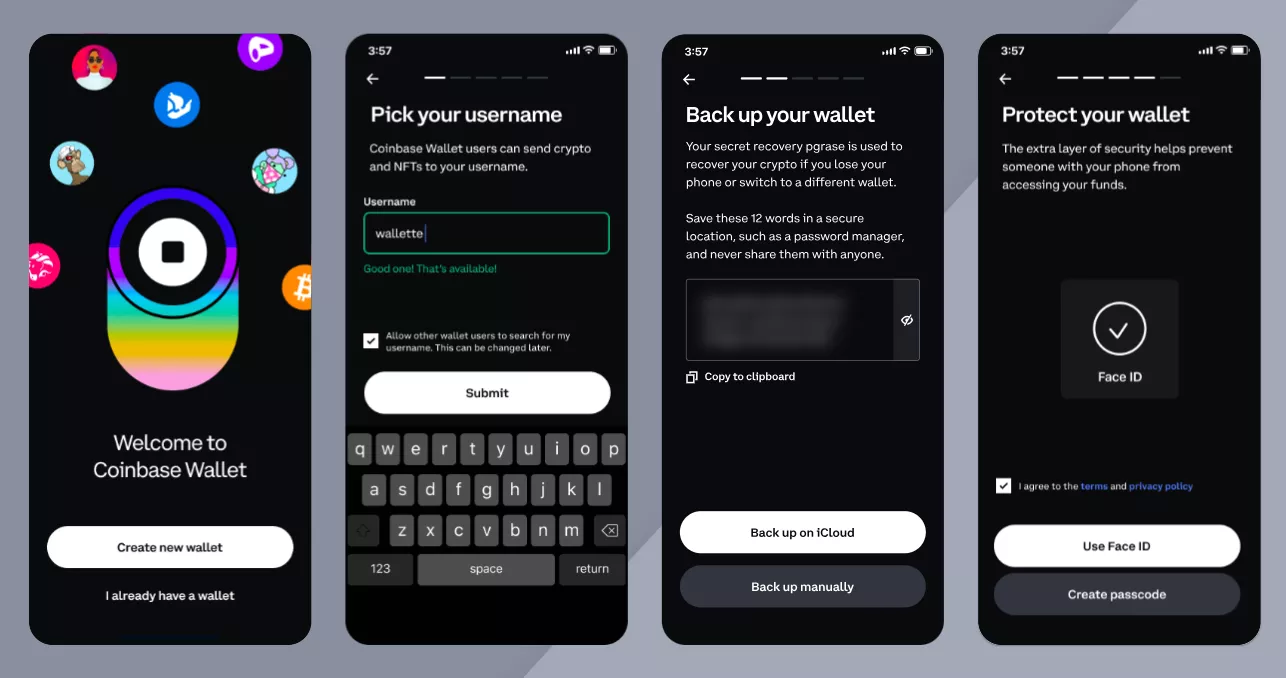

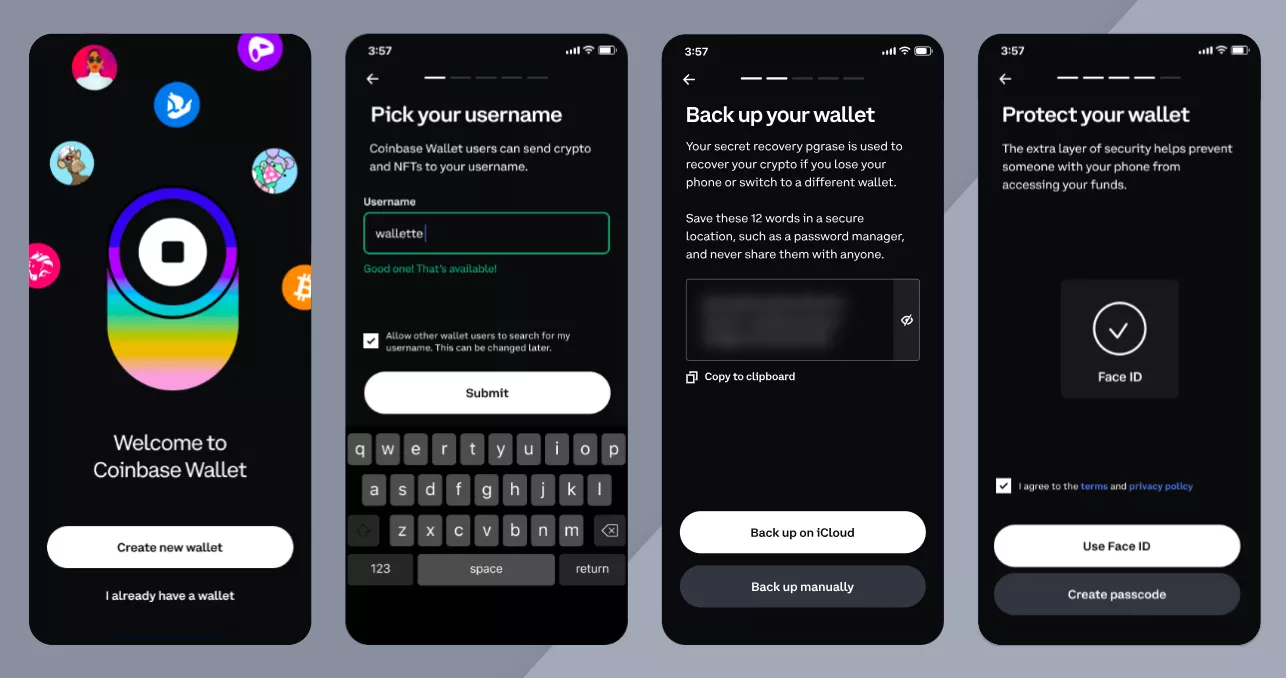

The Coinbase app now enables users to buy and trade any Base chain token instantly. This means that as soon as a token is live on Base – whether it’s a Zora creator coin, a viral memecoin, or an experimental DeFi asset – it’s available for trading within the familiar Coinbase interface. No more waiting for formal listings or jumping through hoops with third-party wallets. This is especially significant for those tracking new assets or looking to participate in early-stage opportunities.

The integration works by leveraging major decentralized exchanges like Uniswap and Aerodrome directly inside the Coinbase app. Users can swap, stake, send, and receive not just Base-native assets but also thousands of ERC-20 tokens and coins from EVM-compatible chains such as Avalanche C-Chain and Polygon. For those who want their portfolio in one place – collectibles, DeFi positions, and all – this is a game-changer.

How DEX Trading Works Inside Coinbase

This move isn’t just about asset coverage; it redefines user experience and risk management. With self-custody built into the Coinbase wallet, users maintain full control over their funds at all times. The platform covers network fees during trades on supported DEXs, removing a common friction point for retail participants unfamiliar with gas management.

Security remains paramount: Coinbase employs third-party threat intelligence to filter out malicious tokens before they hit the app interface. If an asset is flagged as risky or fraudulent by trusted vendors, it simply won’t appear as tradable within your dashboard.

This approach blends the best of both worlds: broad decentralized access without sacrificing centralized security standards.

Market Impact: Price Action and Ecosystem Expansion

The addition of DEX functionality comes at a time when COIN shares are up $19.56 ( and 0.0651%) in 24 hours, reflecting renewed investor optimism around Coinbase’s ability to capture value from onchain activity. The seamless integration means users can trade millions of assets without leaving the ecosystem – an attractive proposition as new memecoins and creator tokens proliferate across Base.

Coinbase Global Inc. (COIN) Stock Price Prediction 2026-2031

Forecast Based on DEX Integration, Industry Trends, and Current Market Context (2025 Baseline: $319.85)

| Year | Minimum Price | Average Price | Maximum Price | % Change (Avg) vs. 2025 | Market Scenario Insights |

|---|---|---|---|---|---|

| 2026 | $270.00 | $340.00 | $410.00 | +6% | Volatility as DEX adoption matures, regulatory clarity improves, and Coinbase expands chain support. |

| 2027 | $295.00 | $375.00 | $460.00 | +17% | Further DEX integration success, growing user base, and crypto market cycle upswing. |

| 2028 | $320.00 | $415.00 | $520.00 | +30% | Sustained growth as onchain trading becomes mainstream; risks from competition and new regulations. |

| 2029 | $350.00 | $460.00 | $590.00 | +44% | Increased revenue from onchain services, potential for international expansion, and maturing DeFi ecosystem. |

| 2030 | $385.00 | $510.00 | $670.00 | +59% | Full realization of Base app and DEX ecosystem; possible entry into new financial products. |

| 2031 | $420.00 | $570.00 | $760.00 | +78% | COIN positions as a leading gateway for both retail and institutional crypto trading; macroeconomic risks remain. |

Price Prediction Summary

COIN’s outlook is positive, with the DEX integration likely driving user growth, fee generation, and expanded market reach. While volatility is expected due to crypto market cycles and regulatory shifts, Coinbase’s innovations position it for strong long-term growth. The stock could see an average price increase of 78% by 2031 versus its 2025 level, with upside potential if adoption outpaces expectations and downside risk from regulatory or competitive pressures.

Key Factors Affecting Coinbase Global Inc. Stock Price

- Success and adoption rate of Coinbase’s DEX and Base chain integration

- Broader crypto market cycles (bull/bear markets) and Bitcoin/Ethereum trends

- Regulatory developments in the US and globally for crypto trading

- Expansion into new chains (e.g., Solana) and additional DeFi products

- Fee revenue growth from new services and user base expansion

- Potential for increased competition from other exchanges or DeFi platforms

- Overall macroeconomic climate, including interest rates and tech sector sentiment

Disclaimer: Stock price predictions are speculative and based on current market analysis.

Actual prices may vary significantly due to market volatility, economic conditions, and other factors.

Always do your own research before making investment decisions.

This innovation isn’t limited to Ethereum-based chains either; future plans include extending support to Solana and other non-EVM networks, further expanding user choice. According to CEXFinder, this marks one of the most ambitious efforts yet by any major exchange to merge centralized UX with decentralized liquidity pools.

With this integration, Coinbase is signaling a new era for retail and institutional crypto users alike. The ability to access Base chain tokens instantly from within the Coinbase app dramatically lowers the barriers to entry for early-stage investments and onchain experimentation. For creators, memecoin enthusiasts, and DeFi builders, the platform’s reach means new projects can achieve liquidity and visibility with unprecedented speed.

Users no longer have to worry about navigating multiple wallets or bridging assets between chains just to participate in Base-native launches. Instead, everything from buying Zora creator coins to swapping trending Base memecoins is available under one roof. This frictionless experience is poised to attract both seasoned traders and first-timers who value simplicity without compromising on choice.

Key Benefits of Coinbase App Base Integration

Top Advantages of Using Coinbase for Base Chain Token Trading

-

Instant Access to New Tokens: Trade Base-native tokens immediately as they launch on-chain, giving users early entry to emerging assets before formal listings.

-

Seamless DEX Integration: Buy, sell, and swap millions of assets across major decentralized exchanges like Uniswap and Aerodrome directly within the Coinbase app.

-

No Network Fees: All network fees are covered by Coinbase, making trading more cost-effective and straightforward for users.

-

Self-Custody Security: Maintain full control over your funds with Coinbase’s self-custody wallet, ensuring assets remain in your possession at all times.

-

Enhanced Asset Safety: Assets flagged as malicious by trusted third-party vendors are proactively blocked, adding an extra layer of user protection.

-

Unified Experience for Onchain Activities: Store, manage, and trade all your coins, collectibles, and DeFi positions in one place, streamlining your onchain experience.

-

Future Network Expansion: Coinbase plans to support additional networks like Solana, broadening access to even more assets and opportunities.

Looking ahead, the expansion of DEX trading inside Coinbase could reshape how projects approach token launches and liquidity mining campaigns. By surfacing millions of assets instantly while maintaining robust security filters, Coinbase is effectively curating a safer onramp for mainstream users into the wilds of decentralized finance.

It’s also worth noting that network fees – typically a source of confusion and frustration for new users – are now covered by Coinbase during DEX trades on supported chains. This removes a major pain point for those unfamiliar with gas markets or who simply want cost predictability when moving between assets.

The strategic move toward an “everything app” aligns with industry trends: one portal for social activity, dapps, collectibles, payments, and trading. With COIN currently priced at $319.85, the market appears to be rewarding this innovation cycle.

For developers building on Base, the integration unlocks distribution channels that were previously out of reach. Appchains can now tap into Coinbase’s user base while customizing gas tokens or permissions as needed – a flexibility detailed in Base Documentation. As more projects leverage these tools, expect an uptick in unique use cases and cross-chain interoperability within the ecosystem.

What’s Next? Expanding Beyond EVM

The roadmap doesn’t stop here. According to recent updates from CryptoRank, support for non-EVM networks like Solana is already in development. This would make Coinbase one of the most comprehensive gateways for multi-chain asset management – all while retaining its core focus on security and user experience.

As decentralized finance matures and regulatory scrutiny intensifies, Coinbase’s dual approach – blending centralized compliance with decentralized access – stands out as both pragmatic and forward-thinking. For anyone looking to buy Base chain tokens on Coinbase or explore new asset classes as soon as they launch, this integration sets a new standard for speed, safety, and selection.