Base Chain, the Layer 2 solution incubated by Coinbase, is rapidly redefining the creator economy by enabling programmable, decentralized monetization models. In Q2 2025, Base’s creator-focused Total Value Locked (TVL) jumped 20% quarter-over-quarter to $120 million, with platforms like Base. tube and others seeing explosive adoption among digital creators. This shift is not just about higher earnings; it’s about control, transparency, and aligning incentives between creators and their audiences in ways that legacy platforms like Instagram or Patreon simply cannot match.

Base Chain vs Instagram: The Tokenized Creator Economy in Action

Instagram rewards content virality with exposure but keeps tight control over monetization rails and audience data. Creators often face opaque algorithms and high platform fees. By contrast, Base Chain’s ecosystem lets creators build direct economic relationships with fans via tokenized incentives and decentralized governance.

Let’s break down three leading case studies that illustrate how Base chain creator rewards are raising the bar for digital monetization:

3 Base Chain Case Studies: Creator Rewards & Monetization

-

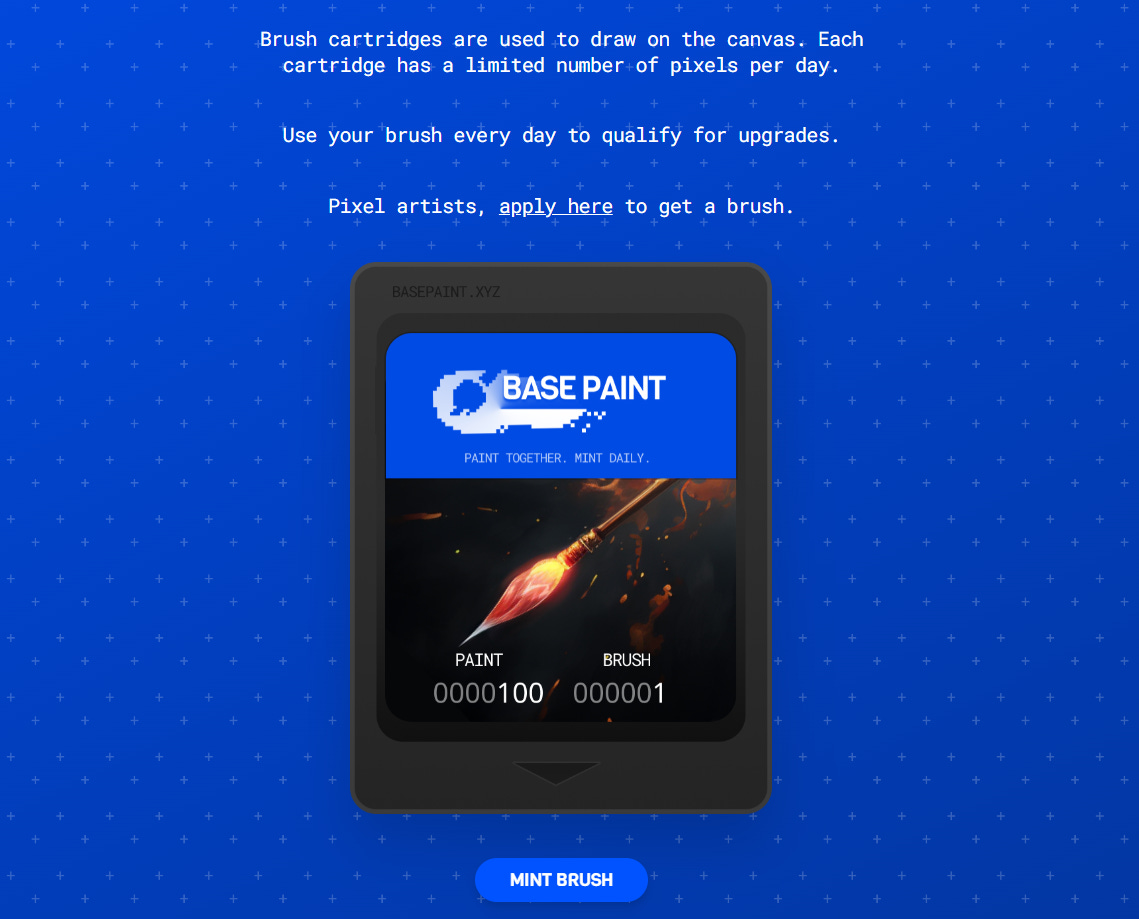

BasePaint: Collaborative Art Platform with Tokenized Creator RewardsBasePaint leverages Base Chain to enable artists to co-create digital artworks and receive tokenized rewards for their contributions. Each artwork is minted as an NFT, and proceeds from sales are transparently distributed among all participating creators via smart contracts. This decentralized model ensures fair, programmable revenue splits and immediate payouts, contrasting with the delayed or opaque monetization structures on platforms like Instagram.

-

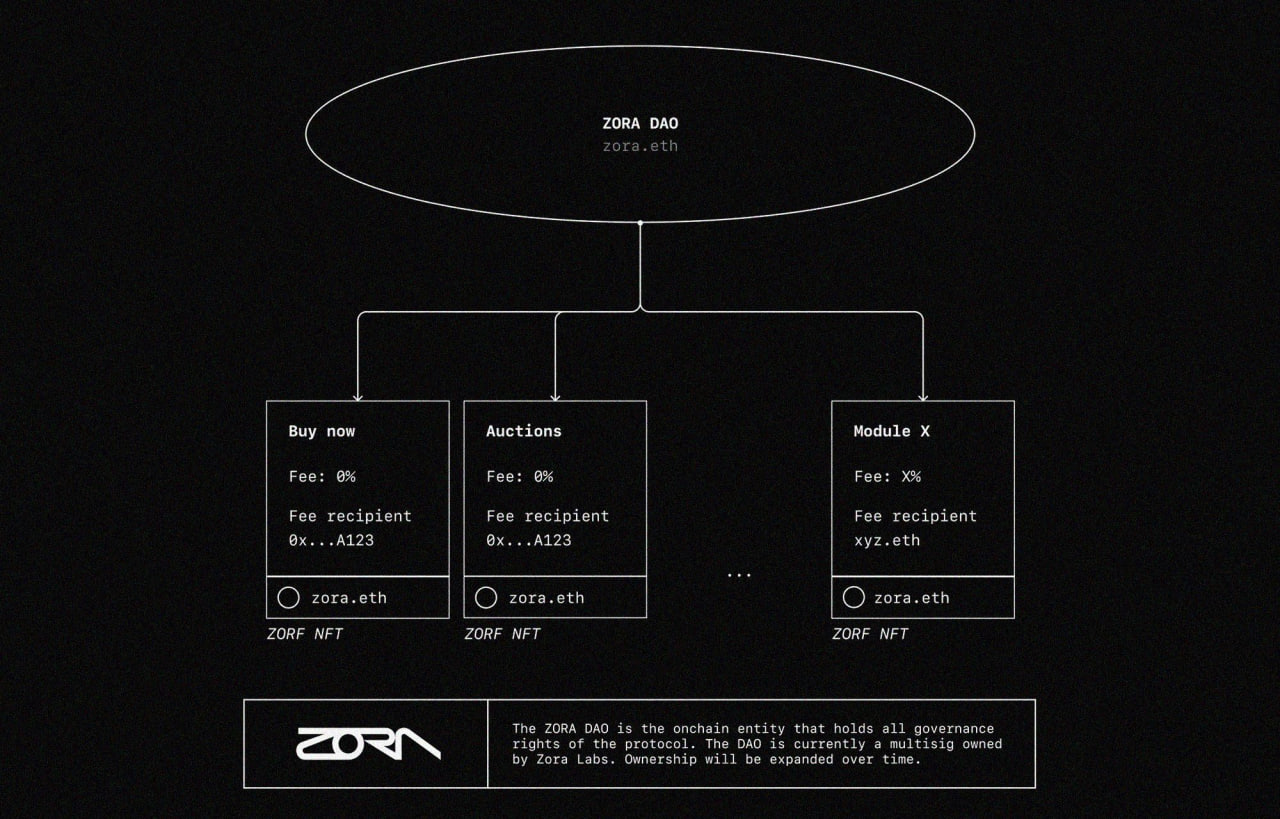

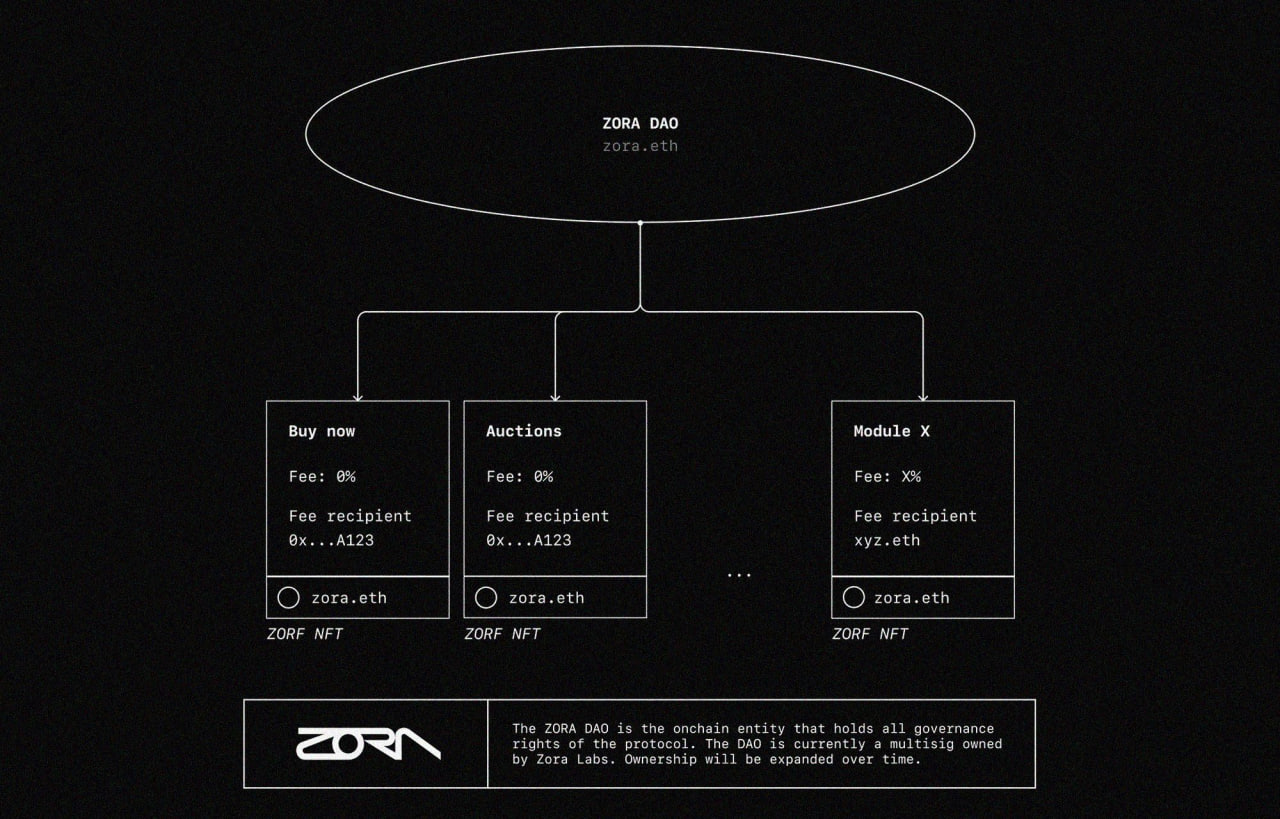

Zora on Base: NFT Minting and Marketplace Earnings vs Instagram Content MonetizationZora, deployed on Base, empowers creators to mint, sell, and trade NFTs with low transaction fees and transparent earnings. Unlike Instagram, where creators rely on ad revenue or brand deals, Zora on Base allows direct monetization of digital assets, with creators retaining a higher percentage of sales and benefiting from on-chain royalties. This model provides greater autonomy and revenue potential for digital artists and content creators.

-

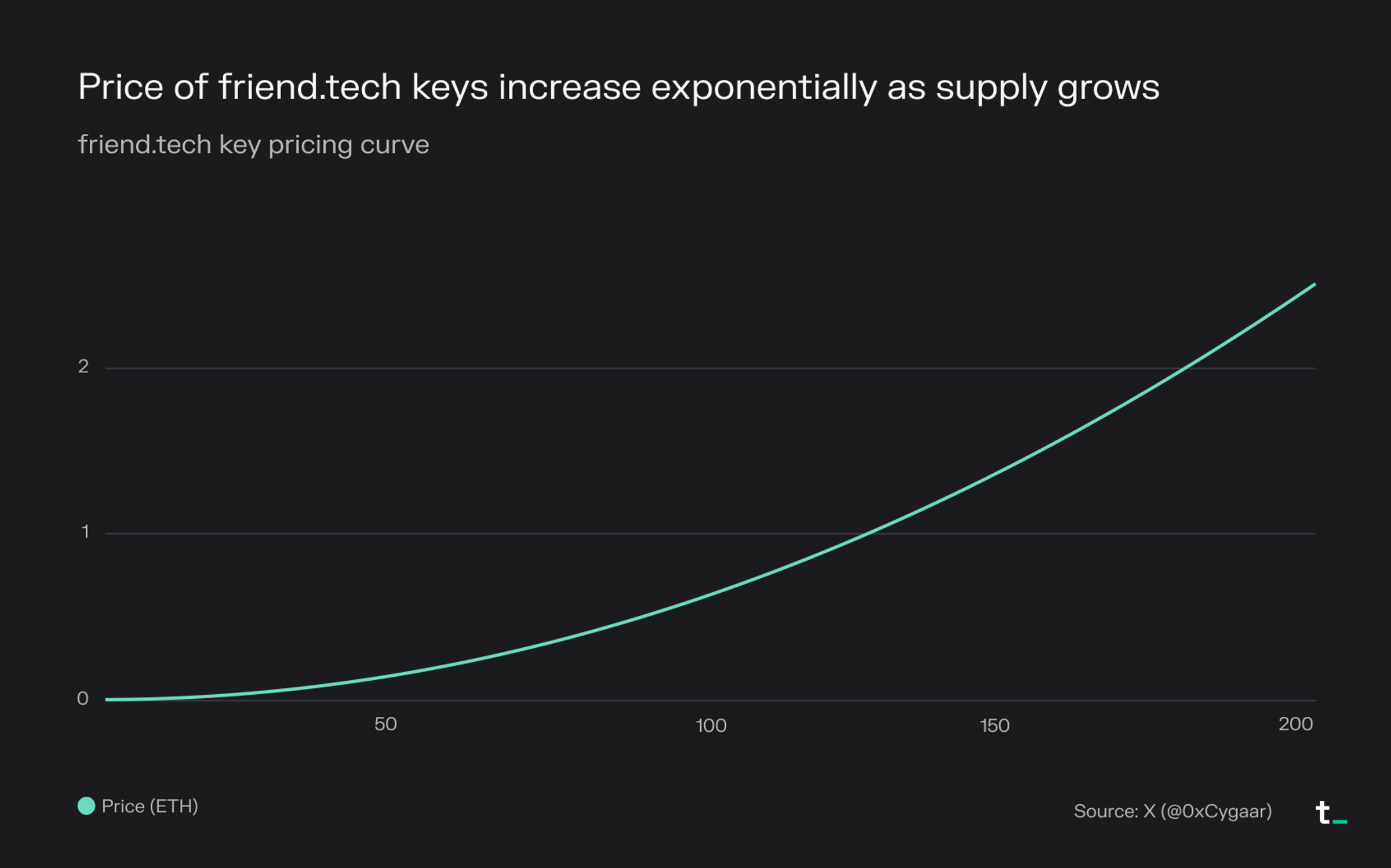

Friend.tech: Social Tokenization for Influencer Engagement and Revenue on BaseFriend.tech utilizes Base Chain to let influencers and creators issue social tokens representing access to exclusive content or communities. Fans can buy, sell, or trade these tokens, providing creators with a new, blockchain-native revenue stream. This approach enables dynamic pricing and direct fan engagement, offering more flexible and lucrative monetization than traditional Web2 platforms like Instagram, where revenue is often limited to fixed ad or sponsorship deals.

Case Study 1: BasePaint – Collaborative Art with Tokenized Rewards

BasePaint is a collaborative art platform native to Base Chain. Here, artists co-create digital canvases and receive tokenized rewards based on their contributions once each piece is completed. Each brushstroke is recorded on-chain for transparent attribution. When a canvas is minted as an NFT or sold on a secondary market (often via integrated protocols like Zora), revenue is automatically split among contributors according to their share of the work.

This model stands in stark contrast to Instagram where collaboration often means diluted credit or informal shoutouts rather than direct financial upside. On BasePaint, every participant has immutable proof of their input – and a share in the upside if the artwork gains traction.

Case Study 2: Zora on Base – NFT Minting vs Web2 Content Monetization

Zora’s integration with Base has supercharged NFT minting for creators who want more than just likes or followers. Creators mint works as NFTs directly on-chain; buyers support them transparently; royalties are enforced at the protocol level rather than relying on centralized enforcement (which can be inconsistent or bypassed entirely).

Earnings Comparison:

| Platform | Payout Model | Fees | Creator Control |

|---|---|---|---|

| Zora on Base | NFT sales and programmable royalties | ~5% protocol fee | Full ownership and direct payouts |

| Instagram (Web2) | Sponsorships and ad revenue share (if eligible) | Up to 30% cut and payment delays | No ownership over distribution; algorithmic throttling possible |

The result? On Zora via Base, creators consistently report higher net earnings per fan compared to traditional Web2 platforms, especially when factoring in global accessibility and lower friction for microtransactions.

Decentralized NFT minting also means creators retain perpetual royalties, with smart contracts ensuring revenue from every secondary sale. Instagram, in contrast, offers no built-in mechanism for creators to capture value from resales or viral content reuse. The ability to automate and enforce creator rights at the protocol level is a seismic shift in digital ownership economics.

Case Study 3: Friend. tech, Social Tokenization and Influencer Revenue

Friend. tech leverages Base Chain’s speed and low fees to let influencers tokenize their social presence. Each creator issues “keys” (social tokens) that grant holders access to private chats, exclusive content, or even governance decisions about future collaborations. Revenue accrues directly to creators as users buy, sell, or trade these keys, without intermediaries siphoning off a cut.

This model flips the traditional Instagram paradigm: instead of chasing algorithmic engagement for indirect ad dollars, creators monetize their most loyal followers directly. Friend. tech’s transparent on-chain accounting removes ambiguity around payouts and eliminates the risk of sudden demonetization due to platform policy shifts.

Reward Structures Compared: Base Chain vs Web2 Platforms

The following table summarizes how each case study’s reward structure stacks up against Instagram’s legacy model:

Comparison of Creator Earnings and Control: BasePaint, Zora on Base, Friend.tech, and Instagram

| Platform | Monetization Model | Creator Earnings Potential | Creator Control | Key Features |

|---|---|---|---|---|

| BasePaint | Tokenized collaborative art rewards | High (direct token rewards, low fees) | Full (on-chain governance, direct payouts) | Collaborative canvases, NFT rewards, decentralized payouts |

| Zora on Base | NFT minting & marketplace | High (primary & secondary sales, low fees) | Full (ownership of smart contracts, programmable royalties) | NFT drops, programmable royalties, open marketplace |

| Friend.tech | Social tokenization (shares in creators) | High (share trading, direct engagement) | Full (ownership of social tokens, no platform lock-in) | Tokenized access, direct fan engagement, on-chain revenue |

| Ad revenue, brand deals, subscriptions | Medium-Low (platform fees, limited direct monetization) | Limited (platform controls content & payouts) | Large audience, visual content, centralized payouts, algorithmic discovery |

Across all three platforms provides BasePaint, Zora on Base, and Friend. tech: the common thread is clear: tokenized incentives align creator and community interests with unprecedented transparency. Where Instagram monetizes attention through ads (often at the expense of user privacy), Base-powered dApps let creators define their own economics with programmable logic, enabling micro-rewards, community governance, and fractional ownership models that simply aren’t possible in Web2.

Case Studies: How Creators Succeed on Base Chain

-

BasePaint: Collaborative Art Platform with Tokenized Creator RewardsBasePaint enables artists to collaborate on digital canvases, with each contribution tracked and rewarded via on-chain tokens. Unlike Instagram, where monetization relies on brand deals or platform-driven ad revenue, BasePaint distributes rewards directly to creators based on community voting and tokenized ownership, ensuring transparent and programmable payouts.

-

Zora on Base: NFT Minting and Marketplace Earnings vs Instagram Content MonetizationZora, integrated with Base Chain, allows creators to mint and sell NFTs with programmable royalties. This model offers immediate, transparent earnings and secondary sale royalties, surpassing Instagram’s limited direct monetization (e.g., branded content, affiliate links). Zora’s on-chain approach gives creators full control over their digital assets and revenue.

-

Friend.tech: Social Tokenization for Influencer Engagement and Revenue on BaseFriend.tech leverages Base Chain to let influencers issue social tokens, granting fans exclusive access and interaction. This decentralized model enables creators to monetize community engagement directly, unlike Instagram’s centralized, ad-driven ecosystem. Friend.tech’s transparent, on-chain transactions provide both creators and fans with greater autonomy and revenue potential.

The data from Q2 2025 speaks volumes. With $120 million in creator-focused TVL on Base Chain (a 20% QoQ jump) and platforms like Base. tube recording a 40% surge in active creators, it’s clear that decentralized monetization is not just hype, it’s traction. As regulatory clarity improves and more mainstream brands experiment with tokenized loyalty programs (see recent DTC case studies), expect the delta between Web3-native rewards and traditional influencer marketing to widen further.

For creators tired of opaque algorithms and platform lock-in, Base Chain offers not only higher earnings potential but also true sovereignty over both audience relationships and creative output, a structural edge that legacy networks will struggle to match as we move deeper into the tokenized economy.