Base Chain, Coinbase’s Layer 2 scaling solution for Ethereum, has reached a critical inflection point on its second anniversary. With total value locked (TVL) at $4.5 billion, a user base now exceeding 1.25 million, and transaction fees plummeting by 97.7% year over year, Base is cementing itself as a key player in the modular blockchain ecosystem. This article unpacks the latest Base chain growth metrics, spotlights community-driven highlights, and presents a data-rich visual timeline of milestones that have shaped Base’s journey so far.

Base Chain Metrics 2025: By the Numbers

The hard data underscores Base’s exponential expansion:

Base Chain 2025 Growth Metrics at a Glance

-

Active Users: Surged to 1.256 million, marking a 1,280.6% increase year-over-year.

-

Transactions: Exceeded 9.869 million processed in 2025, reflecting a 2,049.6% rise from last year.

-

Total Value Locked (TVL): Reached nearly $4.5 billion, signaling robust investor confidence.

-

Transaction Fees: Declined by 97.7%, greatly improving cost efficiency for users and developers.

-

Onchain Summer Participation: Attracted 2 million+ unique wallets and 24 million onchain assets minted.

-

Daily Active Addresses: Peaked at 2.9 million, driven by Base-native memecoins like Brett and Base God (TYBG).

-

Shopify Partnership: Enabled 2 million merchants to accept USDC payments natively via Base.

- User Activity: Active users surged to 1,256,000 – a staggering 1,280.6% increase from last year (source).

- Transaction Volume: The network processed over 9.869 million transactions, up more than 2,049% annually.

- Total Value Locked (TVL): TVL reached nearly $4.5 billion, reflecting robust investor confidence and liquidity inflows.

- Transaction Fees: Average fees dropped by an industry-leading 97.7%, dramatically lowering barriers for both end-users and developers.

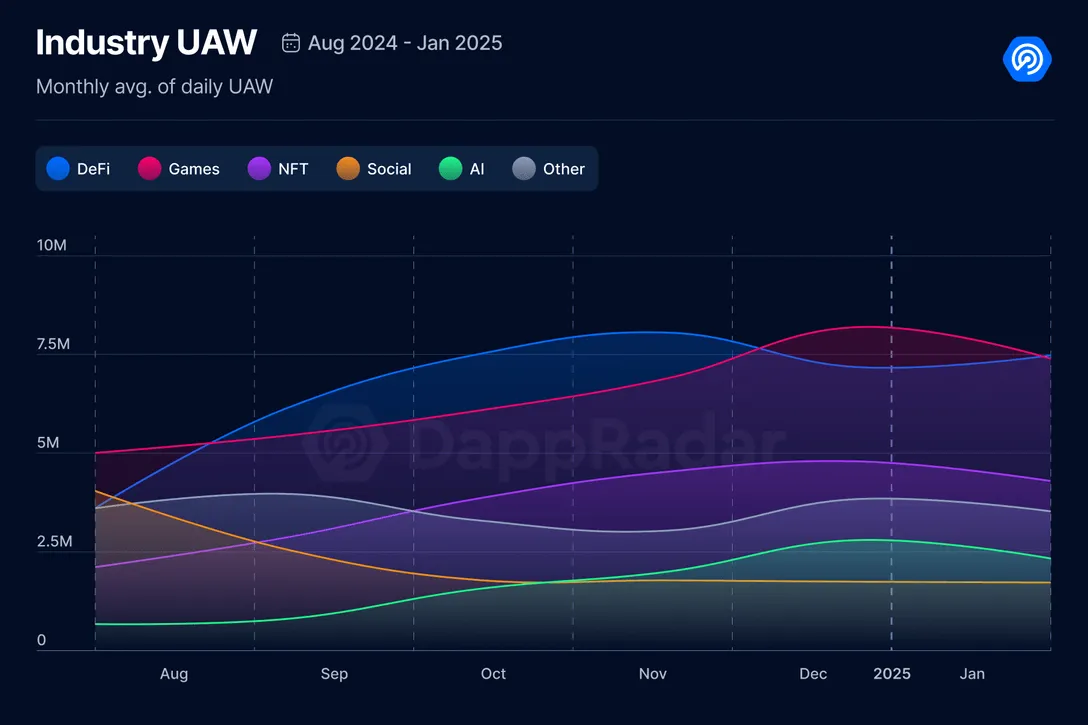

Pillars of Community Engagement: Onchain Summer and Memecoin Mania

The Base ecosystem’s momentum isn’t just technical – it’s cultural. The annual Onchain Summer event became a watershed moment in onchain participation, drawing over 2 million unique wallets. More than 24 million assets were minted on-chain, driving unprecedented levels of interaction and experimentation (source). This surge in activity translated to an all-time high of 2.9 million daily active addresses.

The rise of Base-native memecoins like Brett and Base God (TYBG) also played a pivotal role in onboarding new users and fueling speculative interest across social channels and trading platforms.

Ecosystem Expansion: Strategic Partnerships and Web3 Integration

A defining feature of Base’s second year was the bridge it built between traditional web infrastructure and decentralized finance. The landmark partnership with Shopify in June 2025 enabled roughly 2 million merchants to accept USDC payments natively on Base Chain. This move not only expanded real-world utility but also demonstrated how Layer 2 solutions can drive mainstream adoption by reducing friction at the point-of-sale (source).

A Timeline of Growth: From Launch to $4.5B TVL

The next section will delve deeper into technical innovations behind these achievements, as well as what these trends signal for the future trajectory of Layer 2 networks like Base.

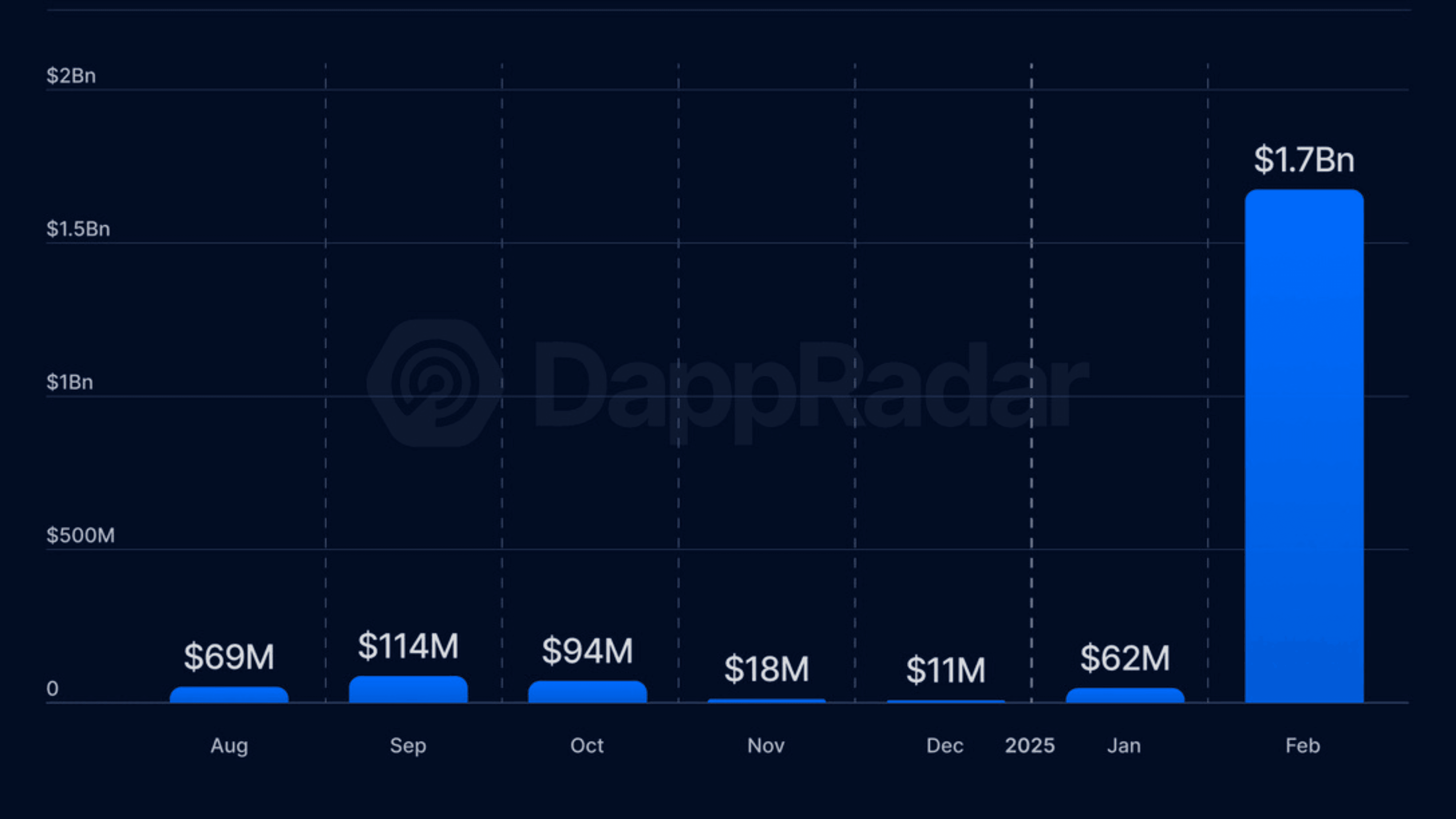

Technical innovation has been the backbone of Base Chain’s meteoric rise. The April 2024 Ethereum Dencun upgrade stands out as a catalyst, slashing transaction costs and enabling higher throughput for decentralized applications. This network-wide efficiency translated directly into surging user activity and developer deployment, as evidenced by the explosive growth in both new wallets and dApp launches.

Fueling Ecosystem Growth: Developer Adoption and DeFi Expansion

Base’s open architecture and compatibility with the Ethereum Virtual Machine (EVM) have empowered a new generation of builders. In 2025, developer activity on Base reached record highs, with hundreds of new protocols and NFT projects launching monthly. The chain’s low fees and robust tooling have drawn DeFi heavyweights and experimental teams alike, contributing to its nearly $4.5 billion TVL milestone (source).

- DeFi Protocols: Lending platforms, DEXs, and yield aggregators now account for a majority share of Base’s locked value.

- NFTs and Gaming: NFT minting exploded during Onchain Summer, while on-chain gaming dApps leveraged fast finality for seamless experiences.

- Compliance and Analytics: Enhanced metrics and compliance tools allow institutional players to monitor performance KPIs in real time (source).

What’s Next? Base Chain Outlook for 2025-2026

The question on every analyst’s mind is whether Base can sustain this velocity. Several factors point to continued momentum:

- Mainstream Onboarding: With Shopify integration live, expect further merchant adoption as USDC payments gain traction in everyday commerce.

- Cultural Scalability: Memecoin cycles, NFT trends, and community events like Onchain Summer will likely keep user engagement high.

- L2 Competition: As rival Layer 2 chains attempt to capture market share, Base’s head start in TVL ($4.5B) and user base offers a durable moat, provided it continues to innovate on cost efficiency and user experience.

The technical roadmap hints at further optimizations: zk-rollup integrations are rumored for late 2025, which could push throughput even higher while maintaining security guarantees. For traders eyeing Base-native tokens or DeFi opportunities, the data-driven trend is clear, user statistics and TVL are both up only.

The past two years have proven that Layer 2 solutions can deliver on scalability promises without sacrificing decentralization or composability. If current trends continue, and if the ecosystem remains responsive to developer needs, Base could set the standard for Ethereum scaling well into 2026.