Ever get the feeling that DeFi is moving at the speed of memes? Well, the numbers don’t lie: as of July 16,2025, Bitcoin-backed loans on Coinbase’s Base chain have officially smashed through the $1 billion mark in total loan volume (with $100 million in BTC collateral currently deployed). That’s not just a stat – it’s a seismic shift for both Bitcoin holders and Base chain believers. Let’s break down how we got here, what makes this market tick, and why everyone from OG maxis to DeFi degens is glued to their screens.

Bitcoin at $118,701: The Perfect Collateral?

First things first – Bitcoin is strutting at a cool $118,701.00 per coin right now. With that kind of firepower, it’s no surprise people want to borrow against their BTC instead of selling it. Enter Coinbase and Morpho: in January 2025, they teamed up to launch crypto-backed loans powered by Morpho onchain lending protocol on Base (source). Suddenly, anyone with cbBTC (Coinbase’s wrapped Bitcoin) could snag a USDC loan straight from the Coinbase app without triggering capital gains tax.

The catch? These loans require a minimum collateral ratio of 133%, and you can borrow up to $100,000 in USDC. If your loan balance creeps up to 86% of your collateral’s value – boom, liquidation time. It’s all about keeping the system solvent when markets get spicy.

Visualizing DeFi’s Latest Power Move

Let’s put this into perspective with some fresh stats:

Milestones in Base Chain Bitcoin-Backed Lending

-

January 2025: Coinbase Launches Bitcoin-Backed Loans on Base — Coinbase teams up with Morpho to offer USDC loans against Bitcoin, marking the largest DeFi integration on Base to date.

-

cbBTC Goes Live as Bitcoin Collateral — Coinbase introduces cbBTC, its wrapped Bitcoin product, enabling users to collateralize loans without selling their BTC.

-

First USDC Loans Issued via Morpho on Base — Early adopters borrow USDC against Bitcoin collateral, accessing liquidity with a minimum 133% collateral ratio and $100,000 loan cap.

-

April 2025: $50 Million in Bitcoin Collateral Locked — The platform hits $50 million in Bitcoin collateral, showcasing rapid user adoption and demand for onchain lending.

-

July 2025: $100 Million Bitcoin Collateral Milestone — As of July 16, 2025, Bitcoin-backed loans on Base reach $100 million in collateral, with Bitcoin trading at $118,701.

-

Market Projection: $45 Billion by 2030 — Analysts project the Bitcoin-backed lending market to surge from $8.5 billion in 2024 to $45 billion by 2030, driven by growing demand for non-taxable liquidity solutions.

This isn’t just another lending protocol – it’s the largest-scale DeFi integration ever attempted by a centralized exchange. And users are loving it! Borrowers get competitive rates and instant liquidity while holding onto their precious sats (source), while lenders earn yield on USDC with robust risk controls.

Fun fact: The market for crypto-backed loans is projected to explode from $8.5 billion in 2024 to $45 billion by 2030. That’s some serious rocket fuel for Base chain adoption!

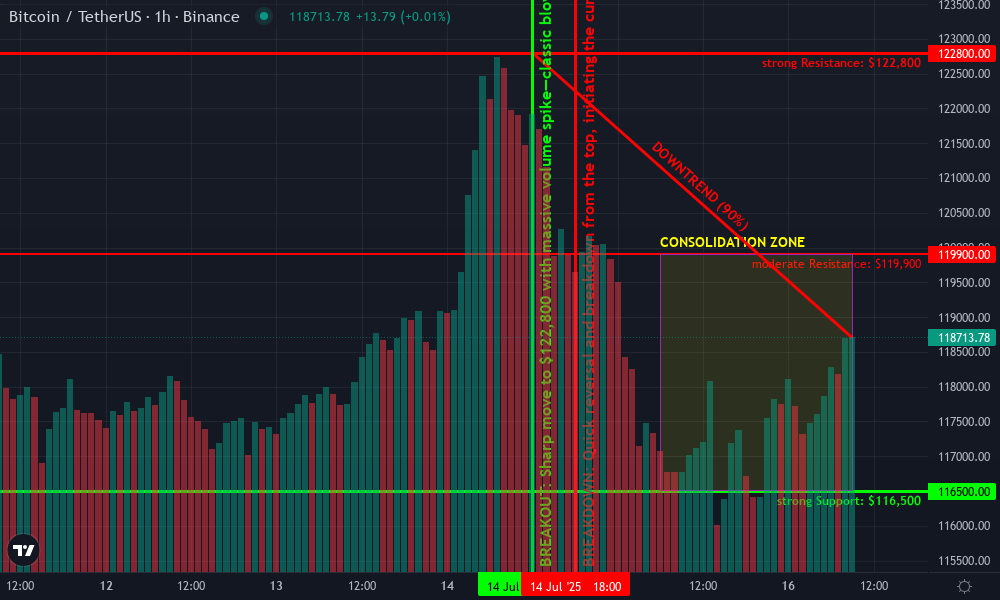

Bitcoin Technical Analysis Chart

Analysis by Lucas Pendleton | Symbol: BINANCE:BTCUSDT | Interval: 1h | Drawings: 7

Technical Analysis Summary

Draw a descending trend line from the peak at approximately $122,800 on July 14, 2025, down to the current price zone around $118,700 on July 16, 2025. Mark horizontal support at $116,500 (recent low) and resistance at $119,900 (recent failed retest area). Use a rectangle to highlight the consolidation zone between $116,500 and $119,900 from July 15 to July 16, 2025. Place a vertical line to mark the volume climax near the top (July 14, 2025). Add callouts to annotate the volume spike and note the breakdown from the local high. For aggressive entries, draw long position tools near the lower edge of the consolidation, and short position tools near the upper edge.

Risk Assessment: high

Analysis: Market is in high-volatility phase post-news, with aggressive moves and no clear direction after blow-off top. Plenty of opportunity for quick gains, but liquidation risk is elevated if support fails.

Lucas Pendleton’s Recommendation: If you’re riding the Base chain narrative and want action, trade the range aggressively with tight stops. Watch for trap moves around $116,500. If $119,900 breaks on volume, flip long for momentum chase. Otherwise, keep your stops tight and your memes tighter!

Key Support & Resistance Levels

📈 Support Levels:

-

$116,500 – Recent swing low and base of current consolidation zone.

strong

📉 Resistance Levels:

-

$119,900 – Recent failed retest after the volume spike, top of current range.

moderate -

$122,800 – Recent local high from July 14, 2025.

strong

Trading Zones (high risk tolerance)

🎯 Entry Zones:

-

$116,700 – Aggressive long entry on support bounce play.

high risk -

$119,800 – Aggressive short entry on resistance rejection in consolidation.

high risk

🚪 Exit Zones:

-

$119,900 – Profit target for long from range low.

💰 profit target -

$116,300 – Stop loss for long, just below the support zone.

🛡️ stop loss

Technical Indicators Analysis

📊 Volume Analysis:

Pattern: Volume spike on July 14, 2025, marks blow-off top and trend reversal.

Sharp increase and then decline in volume coincides with price reversal. Volume currently rising again in consolidation.

📈 MACD Analysis:

Signal: Not visible in this chart image, but implied bearish crossover after the peak.

After the volume/top, MACD likely showed bearish momentum. Look for bullish divergence if price holds support.

Applied TradingView Drawing Utilities

This chart analysis utilizes the following professional drawing tools:

Disclaimer: This technical analysis by Lucas Pendleton is for educational purposes only and should not be considered as financial advice.

Trading involves risk, and you should always do your own research before making investment decisions.

Past performance does not guarantee future results. The analysis reflects the author’s personal methodology and risk tolerance (high).

cbBTC vs Actual BTC: The Centralization Debate

A quick detour for the purists: these loans are collateralized with cbBTC, not raw Bitcoin. That means your assets are wrapped by Coinbase – handy for DeFi composability but not exactly trustless like native BTC. Some critics argue this introduces centralization risks (source). Still, most users seem happy trading a bit of decentralization for blazing-fast access and slick UX.

Bitcoin (BTC) Price Prediction 2026-2031

Projected Bitcoin price ranges considering the impact of Bitcoin-backed loans, DeFi integration on Base, and evolving market conditions.

| Year | Minimum Price | Average Price | Maximum Price | Yearly % Change (Avg) | Market Scenario Insights |

|---|---|---|---|---|---|

| 2026 | $93,000 | $129,000 | $160,000 | +9% | Potential post-halving correction and global regulatory scrutiny; DeFi adoption continues. |

| 2027 | $105,000 | $146,000 | $190,000 | +13% | Mainstream adoption of crypto-backed lending; possible volatility from macroeconomic shifts. |

| 2028 | $120,000 | $164,000 | $220,000 | +12% | Layer-2 scaling and onchain lending mature; institutional demand strengthens. |

| 2029 | $140,000 | $185,000 | $260,000 | +13% | Bitcoin-backed loan market nears $40B; tax advantages fuel holding and borrowing. |

| 2030 | $155,000 | $208,000 | $300,000 | +12% | Base chain and DeFi lending reach critical mass; global Bitcoin integration accelerates. |

| 2031 | $170,000 | $230,000 | $340,000 | +11% | Bitcoin consolidates as a mainstream collateral asset; competition from alternative protocols. |

Price Prediction Summary

Bitcoin’s price outlook from 2026 to 2031 remains bullish, underpinned by the rapid expansion of Bitcoin-backed lending, mainstream DeFi integration, and increasing institutional and retail adoption. While volatility and regulatory headwinds may cause short-term corrections, the overall trend is positive, with the average price potentially surpassing $230,000 by 2031. Minimum and maximum ranges account for both bearish (macro shocks, regulatory crackdowns) and bullish (wider adoption, tech improvements) scenarios.

Key Factors Affecting Bitcoin Price

- Adoption and growth of Bitcoin-backed loans and DeFi lending protocols like Morpho on Base.

- Macroeconomic conditions and regulatory developments, especially in major markets.

- Technological advancements in Bitcoin scaling, interoperability, and security.

- Tax benefits and mainstream financial integration driving demand for holding and borrowing against Bitcoin.

- Potential risks from centralized wrapped Bitcoin products (e.g., cbBTC) and competition from alternative collateral protocols.

- Market cycles, including post-halving effects and speculative bubbles or corrections.

Disclaimer: Cryptocurrency price predictions are speculative and based on current market analysis.

Actual prices may vary significantly due to market volatility, regulatory changes, and other factors.

Always do your own research before making investment decisions.

The Numbers Don’t Lie: How Does Base Stack Up?

If you’re wondering how Base compares with other chains or lending protocols – let’s crunch some numbers:

6-Month Cryptocurrency Price Comparison: Bitcoin-Backed Loans on Base Chain

Real-time price performance of major assets relevant to BTC-collateralized DeFi lending (as of July 16, 2025)

| Asset | Current Price | 6 Months Ago | Price Change |

|---|---|---|---|

| Bitcoin (BTC) | $118,708.00 | $60,000.00 | +97.8% |

| Ethereum (ETH) | $3,163.86 | $2,000.00 | +58.2% |

| Tether (USDT) | $0.9999 | $1.00 | -0.0% |

| USD Coin (USDC) | $0.9999 | $1.00 | -0.0% |

| Wrapped Bitcoin (WBTC) | $118,431.00 | $60,000.00 | +97.4% |

| Dai (DAI) | $0.9998 | $1.00 | -0.0% |

| Morpho (MORPHO) | $2.07 | $1.50 | +38.0% |

| Base Protocol (BASE) | $0.3920 | $0.5000 | -21.6% |

Analysis Summary

Bitcoin and Wrapped Bitcoin have nearly doubled in price over the past six months, driving the surge in BTC-backed loan volumes on Base chain. Ethereum also posted strong gains, while stablecoins like USDT, USDC, and DAI maintained their dollar peg. Morpho, the protocol powering Coinbase’s BTC-backed loans, saw moderate growth, whereas Base Protocol declined.

Key Insights

- Bitcoin and Wrapped Bitcoin led the market with nearly 98% price appreciation, underpinning the growth of BTC-collateralized lending.

- Stablecoins (USDT, USDC, DAI) remained stable, reflecting their role as preferred loan assets and collateral.

- Morpho, the DeFi protocol enabling BTC-backed loans on Base, gained 38%, signaling increased adoption and protocol activity.

- Base Protocol (BASE) declined by over 21%, diverging from the broader market uptrend.

All prices and percentage changes are sourced directly from the provided real-time market data as of July 16, 2025. The comparison uses exact figures for both current and 6-month historical prices, ensuring accuracy and transparency.

Data Sources:

- Main Asset: https://www.coindesk.com/price/bitcoin

- Ethereum: https://www.coindesk.com/price/ethereum

- Tether: https://www.coindesk.com/price/tether

- USD Coin: https://www.coindesk.com/price/usd-coin

- Wrapped Bitcoin: https://www.coindesk.com/price/wrapped-bitcoin

- Dai: https://www.coindesk.com/price/dai

- Morpho: https://www.coindesk.com/price/morpho

- Base Protocol: https://www.coindesk.com/price/base-protocol

Disclaimer: Cryptocurrency prices are highly volatile and subject to market fluctuations. The data presented is for informational purposes only and should not be considered as investment advice. Always do your own research before making investment decisions.

The verdict? With Coinbase behind it, Morpho-powered lending on Base is outgrowing its rivals faster than you can say “when Lambo?” And as more users discover the tax benefits (borrowing isn’t taxable!), expect these numbers to keep climbing.

Of course, no DeFi story is complete without a dash of risk and a sprinkle of speculation. While the Base chain’s Bitcoin-backed loan machine is humming along, borrowers need to stay sharp. That 133% collateral requirement? It’s there for a reason. If Bitcoin dips from its current $118,701.00 price, your loan could get dangerously close to the liquidation threshold. It’s not exactly “set it and forget it” territory – more like “set alerts and check Discord. ”

Still, the upside is hard to ignore. For savvy users, this is a way to unlock liquidity in a bullish market without missing out on further BTC gains. You can pay bills, ape into memecoins, or even stack more sats – all while HODLing your original stash.

Community Pulse: What Are Users Saying?

The Base community is buzzing about this milestone. Some are calling it the “DeFi killer app” for 2025; others are already asking when cbETH and other assets will get similar treatment. The feedback loop between Coinbase’s mainstream user base and Base chain’s onchain natives has never been tighter.

But let’s be real: not everyone is convinced that wrapped assets like cbBTC are the future of decentralized finance. The debate over centralization isn’t going away any time soon (especially with purists lurking in every Telegram group). Even so, participation numbers keep climbing – suggesting most users value convenience and access over ideological purity.

How to Get Started with Bitcoin-Backed Loans on Base

If you want to ride this wave yourself, it’s pretty simple:

- Transfer BTC to Coinbase and wrap as cbBTC

- Navigate to the crypto-backed loans section in your app

- Select how much USDC you want to borrow (up to $100k)

- Confirm terms (collateral ratio, interest rate)

- Borrow instantly – just don’t forget about that liquidation risk!

What Comes Next for Base Chain Lending?

The $1B milestone isn’t just a flex; it’s a signal that hybrid CeFi/DeFi models can scale fast when UX meets security. Expect more innovation around credit scoring, dynamic collateralization (imagine using NFTs or memecoins as partial backing!), and cross-chain liquidity protocols.

If you’re tracking trends or just looking for your next DeFi yield farm, keep an eye on the stats – this market is only getting hotter as we march toward that projected $45 billion mark by 2030 (source). Whether you’re a tax-savvy HODLer or an aspiring degen chasing leverage, Base chain Bitcoin-backed loans just might be your new favorite playground.