Trading Base meme tokens has evolved from a niche hobby to a high-stakes, high-reward pursuit. As the Base network matures, traders are demanding smarter tools and unified platforms to capture opportunities before they vanish. Enter Higher Terminal: a visual, all-in-one trading solution purpose-built for Base chain memecoins. In this guide, I’ll walk you through how to use Higher Terminal to trade every Base meme token in one place, while managing risk and staying ahead of the pack.

The Rise of Base Meme Tokens: Why Traders Flock to One Platform

Meme coins on the Base chain are notorious for their volatility and viral potential. Their value is driven by community hype, social trends, and rapid liquidity flows rather than intrinsic utility. This makes the market both exhilarating and dangerous. Many traders have witnessed tokens surge within minutes only to crash just as quickly.

With so much noise and fragmentation across decentralized exchanges (DEXs), aggregators, and Telegram groups, it’s easy to miss out or fall victim to poor execution or scams. That’s why a unified platform like Higher Terminal is essential for serious meme coin traders on Base.

What Makes Higher Terminal Different?

Higher Terminal consolidates every tradable Base meme token into a single visual interface. Here’s what sets it apart:

Key Features of Higher Terminal for Base Memecoin Trading

-

Unified Trading Dashboard: Higher Terminal aggregates all major Base chain meme tokens into a single, intuitive interface, allowing you to monitor prices, liquidity, and trending coins in real time without switching platforms.

-

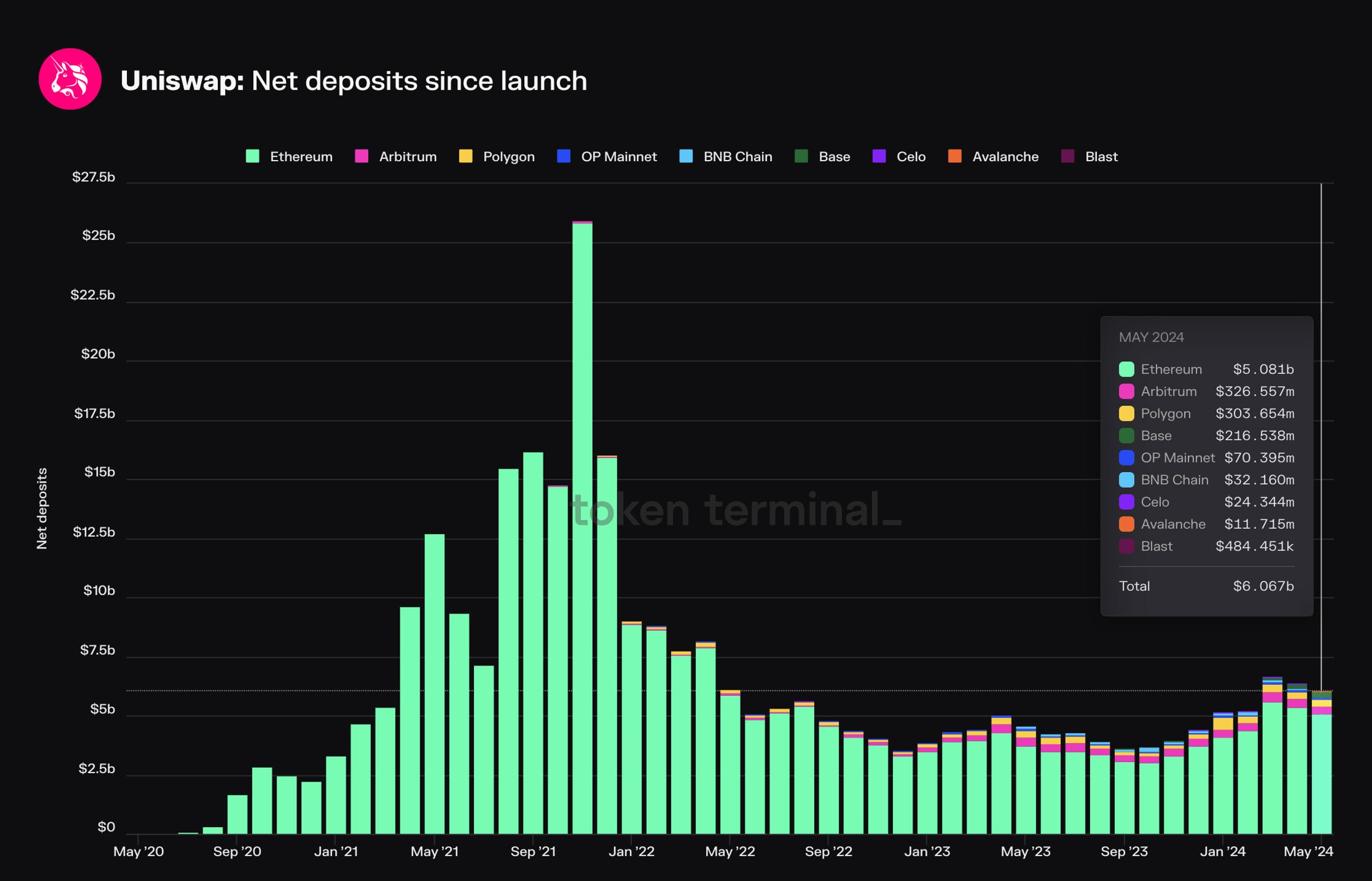

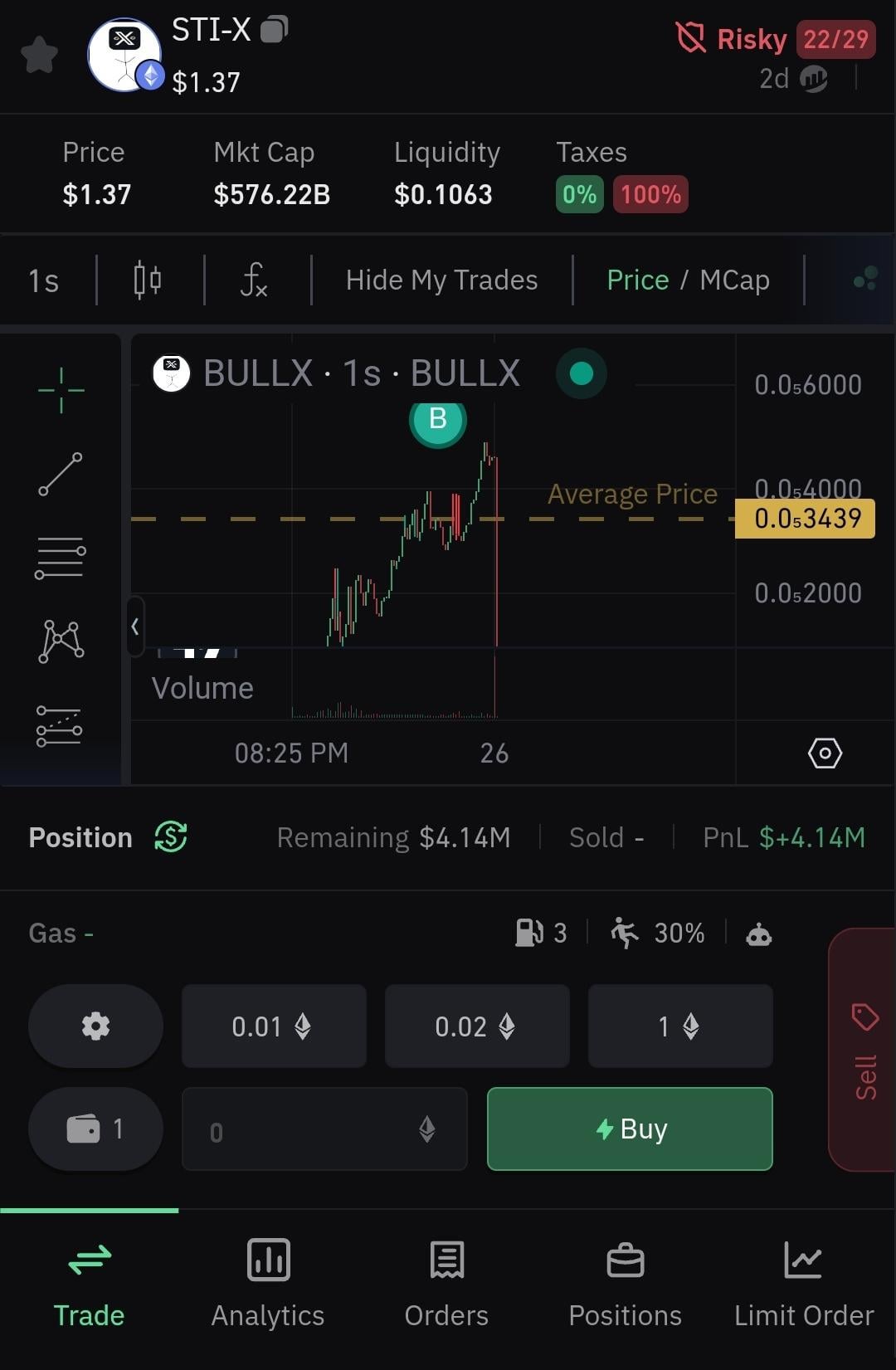

Integrated DEX Access: Seamlessly connect to leading decentralized exchanges (DEXs) like Uniswap and BullX directly from Higher Terminal, enabling instant swaps and liquidity checks for Base memecoins.

-

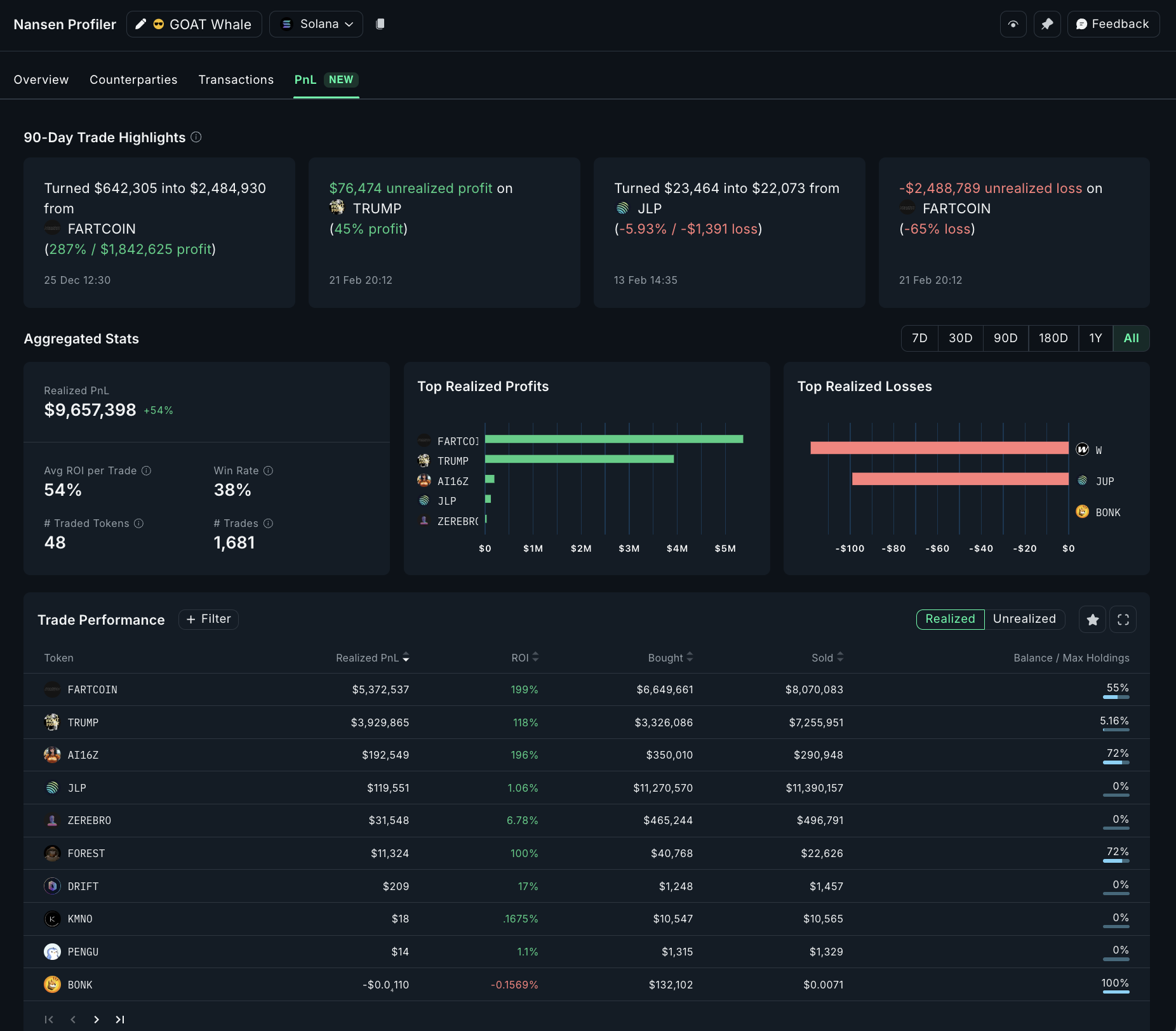

Advanced Analytics & On-Chain Data: Access in-depth analytics including wallet distribution, whale activity, and token flows using built-in tools powered by Nansen, Dune Analytics, and Bubble Maps.

-

AI-Powered Social & Market Insights: Leverage AI-driven tools such as Santiment and LunarCrush within Higher Terminal to track social sentiment, trending tokens, and potential market movers on the Base network.

-

Risk Management & Security Features: Higher Terminal offers customizable slippage controls, rug pull detection, and real-time alerts to help you avoid scams and manage volatile trades safely.

-

Wallet Integration & Portfolio Tracking: Easily connect your MetaMask or Phantom wallet, track your Base memecoin holdings, and monitor performance across all trades in one place.

This means no more juggling between DEXs or missing fast-moving launches because you’re stuck copying contract addresses from Twitter threads. Instead, you get real-time charts, order books, liquidity analytics, and even rug pull warnings – all in one place.

Setting Up: Tools You Need Before Trading on Higher Terminal

Your first step is wallet security. Use reputable wallets like MetaMask or Phantom with strong passwords and two-factor authentication enabled. Never store your seed phrase online or share it with anyone – scams are rampant in the meme coin space.

Once your wallet is ready:

- Connect your wallet directly to Higher Terminal’s interface.

- Add funds: Bridge ETH or USDC from mainnet if needed (always use official bridges).

- Review your balances: Ensure you have enough for both trades and gas fees.

If you’re new to bridging assets onto Base, refer to comprehensive guides before proceeding. Mistakes here can be costly and irreversible.

Navigating the Visual Interface: Spotting Opportunities Fast

The power of Higher Terminal lies in its ability to surface actionable data visually:

- Live trending tokens: Instantly see which meme coins are surging based on volume and price action.

- Bubblemaps and whale tracking: Identify suspicious activity or concentrated holdings that could signal a rug pull.

- Snipe launches: Get alerts when new tokens deploy liquidity so you can act before the masses pile in.

- Degen mode: For advanced users willing to take higher risks on ultra-new launches with minimal vetting.

The Importance of Vetting Every Token Before You Trade

No matter how slick your terminal is, due diligence remains non-negotiable in meme coin trading. Always check contract audits (if available), developer transparency, tokenomics (especially max supply), community activity on Telegram/Twitter/Reddit, and distribution (avoid tokens where whales control most supply).

Even with Higher Terminal’s robust analytics, human judgment is irreplaceable. The platform can flag suspicious patterns, but only you can decide if a meme token aligns with your risk tolerance and trading goals. Use the terminal’s wallet distribution and transaction history features to spot red flags like developer wallets dumping tokens or sudden liquidity pulls. Remember: a single rug pull can wipe out days or weeks of gains.

Executing Trades: From Sniping to Scaling Out

Speed is everything in the Base chain memecoin ecosystem. With Higher Terminal, you can:

- Snipe new launches: Set up alerts for liquidity events and enter positions within seconds of a token going live.

- Set limit orders: Avoid overpaying by letting the system execute trades at your preferred price point.

- Monitor slippage and fees: Adjust these parameters directly in the interface to ensure transactions go through during volatile periods.

- Scale out profits: Take partial profits as your token pumps, rather than gambling on catching the absolute top.

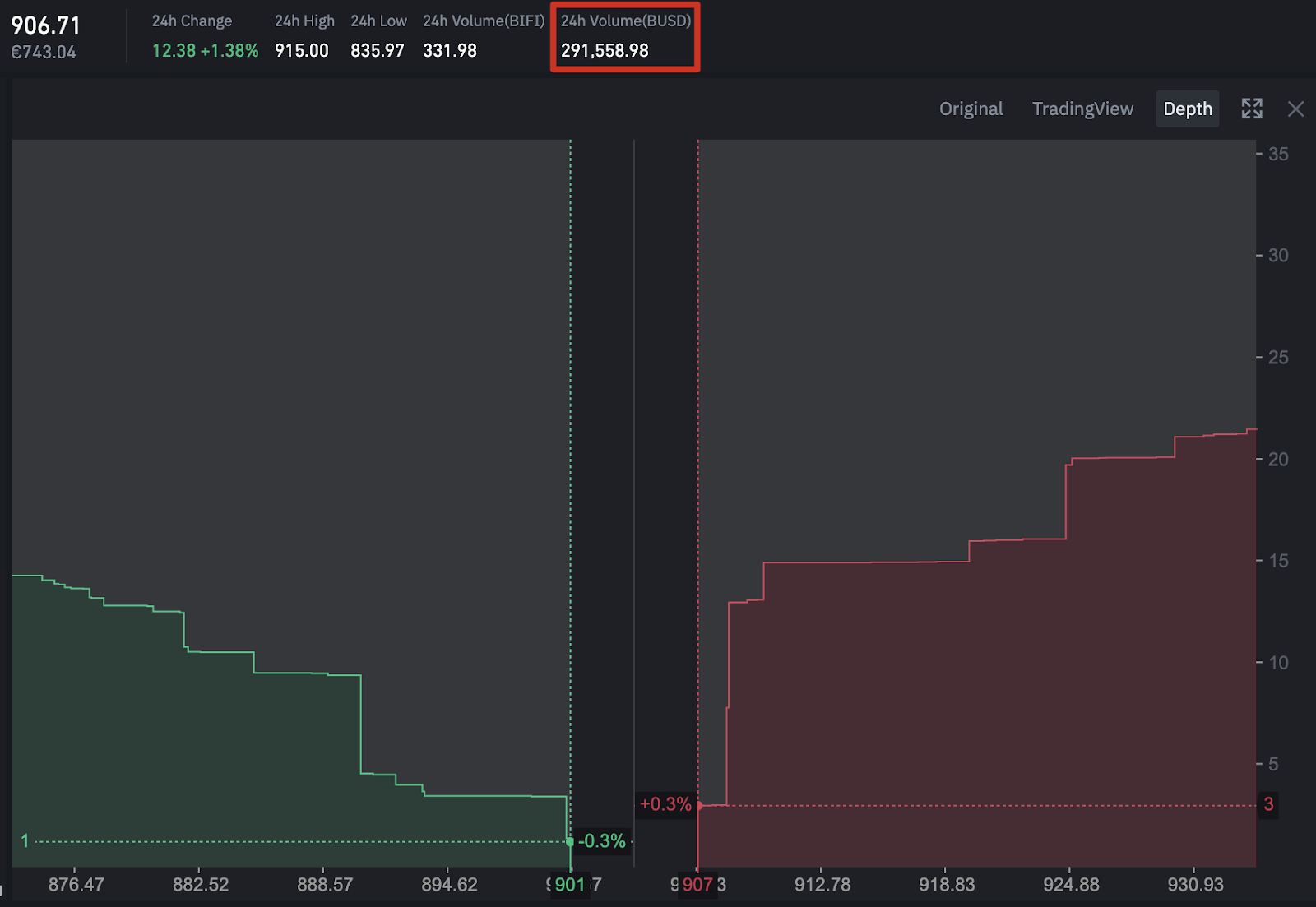

The visual order book and live charting tools give you clarity on when to enter and exit. Always double-check contract addresses before confirming any trade, even when using an aggregator like Higher Terminal.

Risk Management: Staying Safe While Chasing Gains

Meme coin trading is not for the faint-hearted. To protect yourself:

- Diversify: Don’t allocate more than a small percentage of your portfolio to any single meme token.

- Avoid leverage: Most meme coins are too volatile for margin trading, stick to spot trades on Base tokens.

- Withdraw profits regularly: Move gains off-platform into cold storage or stablecoins after big wins.

- Stay vigilant against scams: Ignore unsolicited DMs and double-check all project links via official channels.

If you’re ever unsure about a trade or a project’s legitimacy, step back. Letting FOMO dictate your actions is a recipe for disaster in this market. For more safety tips, check out practical guides on vetting meme coins at OKX Learn.

What’s your favorite strategy for trading Base meme tokens?

Meme token trading on the Base network is fast-paced and risky, but there are many ways to approach it. Which strategy do you rely on most when trading Base meme coins?

Continuous Learning: Analyze Every Trade

The most successful Base chain traders treat every win or loss as data for future improvement. Use Higher Terminal’s exportable trade logs to review what worked, and what didn’t. Keep notes on why you entered each position, what signals you used, and how you managed exits. Over time, patterns will emerge that sharpen your edge in this chaotic market.

Top Mistakes New Traders Make on Higher Terminal

-

Neglecting Token Research: Jumping into trades without thoroughly researching meme tokens, including their creators, tokenomics, and community activity, can lead to losses from scams or rug pulls.

-

Ignoring Wallet Security: Failing to use secure wallets like MetaMask or Phantom, or not enabling two-factor authentication (2FA), increases the risk of losing funds to hacks or phishing attacks.

-

Overlooking Slippage and Fees: Meme tokens on Base can be highly volatile, requiring custom slippage settings and extra funds for transaction fees. Not adjusting these can result in failed or costly trades.

-

FOMO Trading: Letting Fear of Missing Out (FOMO) drive trades, instead of following a clear strategy and profit targets, often results in buying tops and selling bottoms.

-

Disregarding On-Chain Analytics: Not using tools like Bubble Maps, Nansen, or Dune Analytics to track large holders and whale activity can leave traders exposed to sudden dumps or manipulations.

-

Failing to Vet Community Signals: Blindly trusting social media hype without verifying sources or project legitimacy can lead to poor investment decisions. Always cross-check information from Twitter, Telegram, and Reddit.

-

Poor Risk Management: Trading with too much capital on a single token, or without clear stop-loss and take-profit levels, increases the risk of significant portfolio losses in the volatile meme coin market.

-

Not Keeping Trade Records: Failing to document trades, strategies, and outcomes prevents traders from learning from mistakes and improving over time.

If you’re ready to take control of your meme coin journey, commit to learning from each experience and staying disciplined, no matter how wild the market gets. The right terminal puts every tool at your fingertips, but it’s your mindset that determines long-term success in the world of Base chain memecoins.