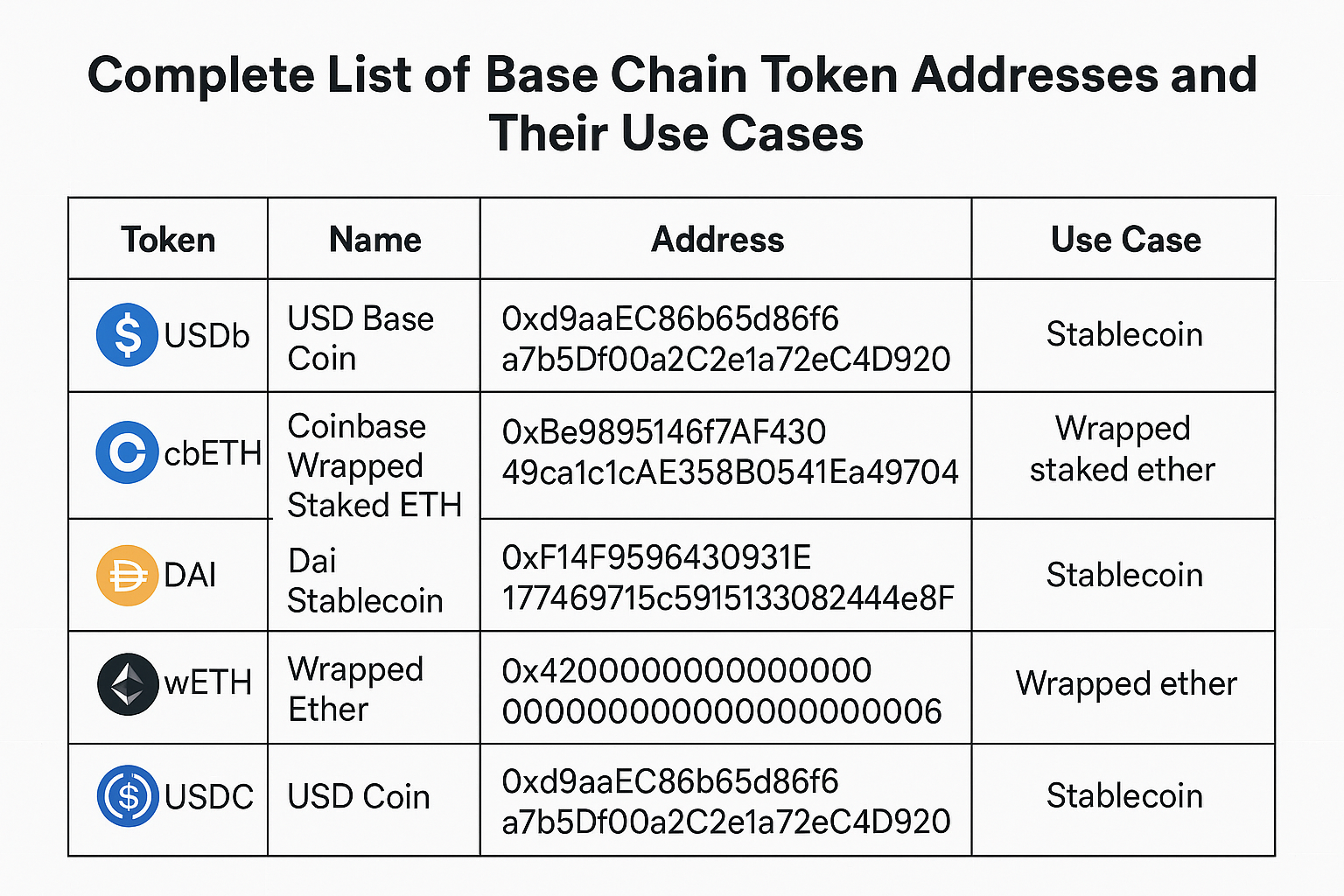

The Base chain is quickly establishing itself as a vibrant hub for decentralized finance, stablecoins, utility tokens, and a new wave of memecoins. With the ecosystem expanding rapidly, having an up-to-date and curated list of token contract addresses is essential for anyone looking to interact safely and efficiently with Base-based assets. Below, you’ll find a detailed breakdown of the top 20 Base chain tokens—ranging from DeFi blue-chips to viral memecoins—alongside their contract addresses and primary use cases.

Stablecoins: The Backbone of On-Chain Liquidity

Stablecoins are the lifeblood of most DeFi ecosystems, providing price stability and easy on/off ramps for users. On Base, several major stablecoins have gained traction:

- USDbC (USD Base Coin) –

0xd9aaEC86b65d86f6a7b5Df00a2C2e1a72eC4D920

USDbC is a native stablecoin on Base that’s widely used across DeFi protocols for trading, lending, and liquidity provision. - DAI (Dai Stablecoin) –

0xF14F9596430931E177469715c591513308244e8F

Dai remains a decentralized favorite, offering algorithmic stability and broad acceptance. - USDC (USD Coin) –

0xD9AAEC86b65d86f6A7B5Df00a2C2e1A72eC4D920

This familiar centralized stablecoin is now available on Base via official bridges. - axlUSDC (Axelar Bridged USDC) –

0xeb466342c4d449bc9f53a865d5cb90586f405215

Brought over by Axelar’s cross-chain bridging solution, axlUSDC expands interoperability for USDC holders. - GHO (Aave Protocol Stablecoin) –

0xd14e01855cd62fd180483845ebdd4bee991ea97b

Aave’s native stablecoin brings decentralized borrowing power directly to the Base ecosystem. - FRAX (Frax Stablecoin) –

0x40280CE4Ac956E59436046064708Fd228725466A

The hybrid algorithmic/collateralized model of FRAX offers unique flexibility for traders seeking both stability and innovation.

The DeFi Powerhouses: Wrapped ETH & Staking Derivatives

No DeFi ecosystem would be complete without robust ETH derivatives. On Base, users can access several flavors:

- wETH (Wrapped Ether) –

0x4200000000000000000000000000000000000006

The go-to representation of ETH in ERC-20 format—crucial for swapping, liquidity pools, and lending markets. - wstETH (Wrapped Staked Ether by Lido) –

0xcAFcD85D8ca7Ad1e1C6F82F651FA15E33AEfD07b

Lido’s liquid staking derivative enables users to earn staking rewards while retaining liquidity on Base. - cbETH (Coinbase Wrapped Staked ETH) –

0xBe9895146f7AF43049ca1c1AE358B0541Ea49704

This asset allows Coinbase stakers to bring their staked ETH into the broader DeFi universe. - rETH (Rocket Pool ETH) –

0xa397a8c2086c554b531c02e29f3291c9704b00c7

An alternative staking derivative from Rocket Pool supporting decentralization in Ethereum staking.

The Pulse of DeFi: Governance & Utility Tokens on Base

The following tokens are at the heart of major protocols powering swaps, lending markets, governance decisions, and more:

Key Base Chain DeFi Tokens & Their Use Cases

-

Aerodrome Finance (AERO) — Base’s leading decentralized exchange (DEX) and liquidity hub. The AERO token (0x940181a94A35A4569E4529A3CDfB74e38FD98631) is used for governance, incentivizing liquidity providers, and earning trading fees within the Aerodrome ecosystem.

-

Velodrome Finance (VELO) — Major DEX and liquidity protocol on Base. VELO (0x3c8BF7e25E58Ae9BC09bAEd50102B5647E683870) powers governance, fee distribution, and rewards for liquidity providers, supporting efficient swaps and DeFi strategies.

-

Curve DAO Token (CRV) — Governance and rewards token for Curve Finance. The CRV token (0x0994206dfE8De6Ec6920FF4D779B0d950605Fb53) enables participation in protocol governance, boosts rewards, and is used to incentivize liquidity for stablecoin and DeFi pools on Base.

-

Uniswap Governance Token (UNI) — Governance token for the Uniswap protocol. UNI (0xb33Dc43Cf1049CaDb35460eBa262A8D9341Be3Ae) allows holders to vote on Uniswap protocol upgrades, fee structures, and community proposals, shaping the future of decentralized trading on Base.

If you’re looking to dive deeper into contract details or transaction histories for any token mentioned here, you can verify addresses using resources like Blockscout’s open-source explorer or Etherscan pages dedicated to these assets. For instance, you’ll find full analytics on the BASE Protocol Token at its official Etherscan page from the sources above.

Memecoins & Community Tokens: Culture Meets Crypto

Base isn’t just about serious DeFi—its memecoin scene is thriving, injecting humor and viral energy into the chain. These tokens often have little intrinsic value but can spark huge communities and surprising market action:

- BALD (Bald Token) –

0xBA11D2369b1c2EcA8cE09c8bE9C3F8e839E3DB6B

A tongue-in-cheek project that became a Base legend overnight, BALD is emblematic of how quickly memes can take root on new chains. - TOSHI (Toshi Memecoin) –

0xB5bEa8a26D587CF665f2d2D517B8863137211373

TOSHI’s branding nods to Satoshi Nakamoto and has garnered a loyal following among Base early adopters. - MOCHI (Mochi Memecoin) –

0x8ace6074d96cC46d1FCd67c7F2C9ab4535FbF7bE

This playful token rides the wave of food-themed coins, with a community focused on fun and experimentation. - DEGEN (Degen Memecoin) –

0x85A50F99CC461FA5EFaFF7C822DFbbFC29daD78F

Proudly embracing crypto’s risk-loving culture, DEGEN is both a meme and a rallying cry for Base speculators.

The Utility Edge: Trading Bots & Protocol Tokens

The Base ecosystem also supports innovative utility tokens that power trading automation, protocol incentives, and more:

- UNIBOT (Unibot Trading Bot Token) –

0xe36Df5BB57a53216Bd3196EBB03eA384C3c2bc32

The native token for Unibot, enabling advanced trading features like sniping and copy trading directly from Telegram. - BASE (Base Protocol Token) –

0x07150e919b4de5fd6a63de1f9384828396f25fdc

A synthetic asset tracking the total market cap of all cryptocurrencies—note this is not the official token of the Base chain itself but remains popular for speculation.

Quick Reference: Top 20 Base Chain Token Addresses Table

Top 20 Base Chain Tokens: Addresses, Categories, and Use Cases

| Token Name | Contract Address | Category | Primary Use Case |

|---|---|---|---|

| USDbC (USD Base Coin) | 0xd9aaEC86b65d86f6a7b5Df00a2C2e1a72eC4D920 | Stablecoin | Dollar-pegged stablecoin for payments and DeFi |

| cbETH (Coinbase Wrapped Staked ETH) | 0xBe9895146f7AF43049ca1c1AE358B0541Ea49704 | Staking Derivative | Liquid staking, DeFi collateral |

| DAI (Dai Stablecoin) | 0xF14F9596430931E177469715c591513308244e8F | Stablecoin | Decentralized stablecoin for payments and DeFi |

| wETH (Wrapped Ether) | 0x4200000000000000000000000000000000000006 | Utility Token | ERC-20 representation of ETH for DeFi |

| USDC (USD Coin) | 0xD9AAEC86b65d86f6A7B5Df00a2C2e1A72eC4D920 | Stablecoin | Widely used dollar-pegged stablecoin |

| AERO (Aerodrome Finance) | 0x940181a94A35A4569E4529A3CDfB74e38FD98631 | DeFi Token | Governance and rewards in Aerodrome Finance |

| BALD (Bald Token) | 0xBA11D2369b1c2EcA8cE09c8bE9C3F8e839E3DB6B | Memecoin | Community-driven meme token |

| TOSHI (Toshi Memecoin) | 0xB5bEa8a26D587CF665f2d2D517B8863137211373 | Memecoin | Popular memecoin for trading and community |

| BASE (Base Protocol Token) | 0x07150e919b4de5fd6a63de1f9384828396f25fdc | Utility Token | Synthetic asset tracking crypto market cap |

| MOCHI (Mochi Memecoin) | 0x8ace6074d96cC46d1FCd67c7F2C9ab4535FbF7bE | Memecoin | Community token, meme trading |

| DEGEN (Degen Memecoin) | 0x85A50F99CC461FA5EFaFF7C822DFbbFC29daD78F | Memecoin | Popular memecoin for speculation |

| UNIBOT (Unibot Trading Bot Token) | 0xe36Df5BB57a53216Bd3196EBB03eA384C3c2bc32 | Utility Token | Access to Unibot trading bot features |

| VELO (Velodrome Finance Token) | 0x3c8BF7e25E58Ae9BC09bAEd50102B5647E683870 | DeFi Token | Governance and incentives on Velodrome |

| axlUSDC (Axelar Bridged USDC) | 0xeb466342c4d449bc9f53a865d5cb90586f405215 | Stablecoin (Bridged) | Cross-chain stablecoin for payments |

| CRV (Curve DAO Token) | 0x0994206dfE8De6Ec6920FF4D779B0d950605Fb53 | DeFi Governance | Governance and rewards on Curve Finance |

| UNI (Uniswap Governance Token) | 0xb33Dc43Cf1049CaDb35460eBa262A8D9341Be3Ae | DeFi Governance | Governance of Uniswap protocol |

| wstETH (Wrapped Staked Ether) | 0xcAFcD85D8ca7Ad1e1C6F82F651FA15E33AEfD07b | Staking Derivative | Liquid staking, DeFi collateral |

| rETH (Rocket Pool ETH) | 0xa397a8c2086c554b531c02e29f3291c9704b00c7 | Staking Derivative | Liquid staking, decentralized staking |

| GHO (Aave Protocol Stablecoin) | 0xd14e01855cd62fd180483845ebdd4bee991ea97b | Stablecoin | Aave’s native overcollateralized stablecoin |

| FRAX (Frax Stablecoin) | 0x40280CE4Ac956E59436046064708Fd228725466A | Stablecoin | Fractional-algorithmic stablecoin for DeFi |

This table offers an at-a-glance reference for developers, traders, or anyone looking to confirm they’re interacting with authentic contracts. Always double-check addresses before transacting—phishing and fake tokens are an ongoing risk in fast-moving ecosystems like Base. For further verification or in-depth analytics on any address or transaction history, resources like Blockscout’s open-source explorer are invaluable (Base Blockscout). You can also cross-check governance token deployments via Uniswap’s documentation (Uniswap Docs: Base Deployments).

Spotlight: How to Use These Tokens Safely on Base

If you’re new to interacting with these assets on-chain, always start by importing the correct contract address into your wallet. Be wary of lookalike coins—especially when dealing with memecoins—and consider using only audited dApps or those recommended by trusted community members. Many users rely on social signals; Twitter threads often surface red flags or trending opportunities before they hit mainstream crypto news.

Community Pulse & Security Tips

The rapid expansion of the Base ecosystem means staying informed is half the battle. Watch for updates from official protocol channels and join community discussions to keep up with new launches or risks. The blend of blue-chip DeFi assets (like CRV, UNI), stablecoins (USDbC, DAI), staking derivatives (wstETH, cbETH), memecoins (BALD, TOSHI), and utility tokens makes Base uniquely dynamic—but also requires vigilance from participants.

Comparison of wETH, cbETH, wstETH, and rETH on Base

| Token | Contract Address | Type | Backing/Source | Primary Use Case | Key Features |

|---|---|---|---|---|---|

| wETH | 0x4200000000000000000000000000000000000006 | Wrapped Ether | ETH (Base chain) | Trading, DeFi, bridging | 1:1 with ETH, standard ERC-20, widely used |

| cbETH | 0xBe9895146f7AF43049ca1c1AE358B0541Ea49704 | Staked ETH Derivative | Coinbase staked ETH | Yield, DeFi, trading | Represents ETH staked via Coinbase, liquid staking |

| wstETH | 0xcAFcD85D8ca7Ad1e1C6F82F651FA15E33AEfD07b | Staked ETH Derivative | Lido staked ETH | Yield, DeFi, trading | Wrapped version of stETH, auto-compounding, liquid staking |

| rETH | 0xa397a8c2086c554b531c02e29f3291c9704b00c7 | Staked ETH Derivative | Rocket Pool staked ETH | Yield, DeFi, trading | Decentralized staking, liquid staking, trustless |

If you’ve got your eye on a new project or want to explore further token details—including historical data—you’ll find comprehensive analytics via Etherscan’s dedicated pages (BASE Protocol Etherscan page). Staying curious—and cautious—is key as this ecosystem continues its explosive growth.