If you’ve been poking around the Base network lately, you already know it’s not just another Ethereum Layer 2—it’s a full-blown DeFi playground. Whether you’re hunting for the next memecoin moonshot or looking to swap blue-chip Base tokens, choosing the right DEX can make or break your trading experience. Liquidity, fees, and overall vibes matter. So let’s dive into a curated list of the 7 best decentralized exchanges (DEXs) for trading Base chain tokens, ranked by what actually counts: current volume, liquidity depth, trading fees, and user experience.

Meet the Top 7: Best Base Chain DEXs at a Glance

Top 7 DEXs for Trading Base Chain Tokens

-

Aerodrome: The current liquidity king on Base, Aerodrome boasts deep pools, slick UI, and some of the lowest trading fees you’ll find. It’s a favorite for swapping Base tokens with minimal slippage.

-

Uniswap (Base): The OG of DEXs, now turbocharged for Base. Uniswap brings its legendary AMM magic, high volume, and a familiar interface—plus, you get access to a massive range of Base tokens.

-

Alien Base DEX: Out-of-this-world yields and quirky branding make Alien Base DEX a unique spot for Base token traders. It’s known for innovative farming opportunities and a growing, loyal community.

-

SushiSwap (Base): SushiSwap’s Base deployment offers multi-token support, competitive fees, and all the DeFi bells and whistles you expect from this cross-chain veteran.

-

Baseswap: Built natively for Base, Baseswap delivers fast swaps, solid liquidity, and a user-friendly dashboard. It’s a rising star for Base chain traders looking for a smooth experience.

-

PancakeSwap (Base): PancakeSwap brings its signature low-fee swaps and playful style to Base. It’s a go-to for traders who want a familiar DEX with plenty of token options and staking pools.

-

Balancer (Base): Balancer’s smart pools and flexible trading options are now on Base, offering advanced liquidity management and dynamic fees for savvy DeFi users.

Let’s get acquainted with our contenders:

- Aerodrome: The liquidity kingpin on Base—think of it as the Uniswap of this chain but with its own twist.

- Uniswap (Base): The OG AMM now flexing on Base with its signature deep pools and intuitive UI.

- Alien Base DEX: Out-of-this-world branding meets solid memecoin action.

- SushiSwap (Base): Multi-chain veteran bringing sushiness and yield farming to your swaps.

- Baseswap: Community-driven and speedy—your go-to for fresh launches.

- PancakeSwap (Base): The BNB Chain legend now serving pancakes on Base—expect tasty rewards.

- Balancer (Base): Where portfolio management meets swapping; ideal for power users who like to get fancy.

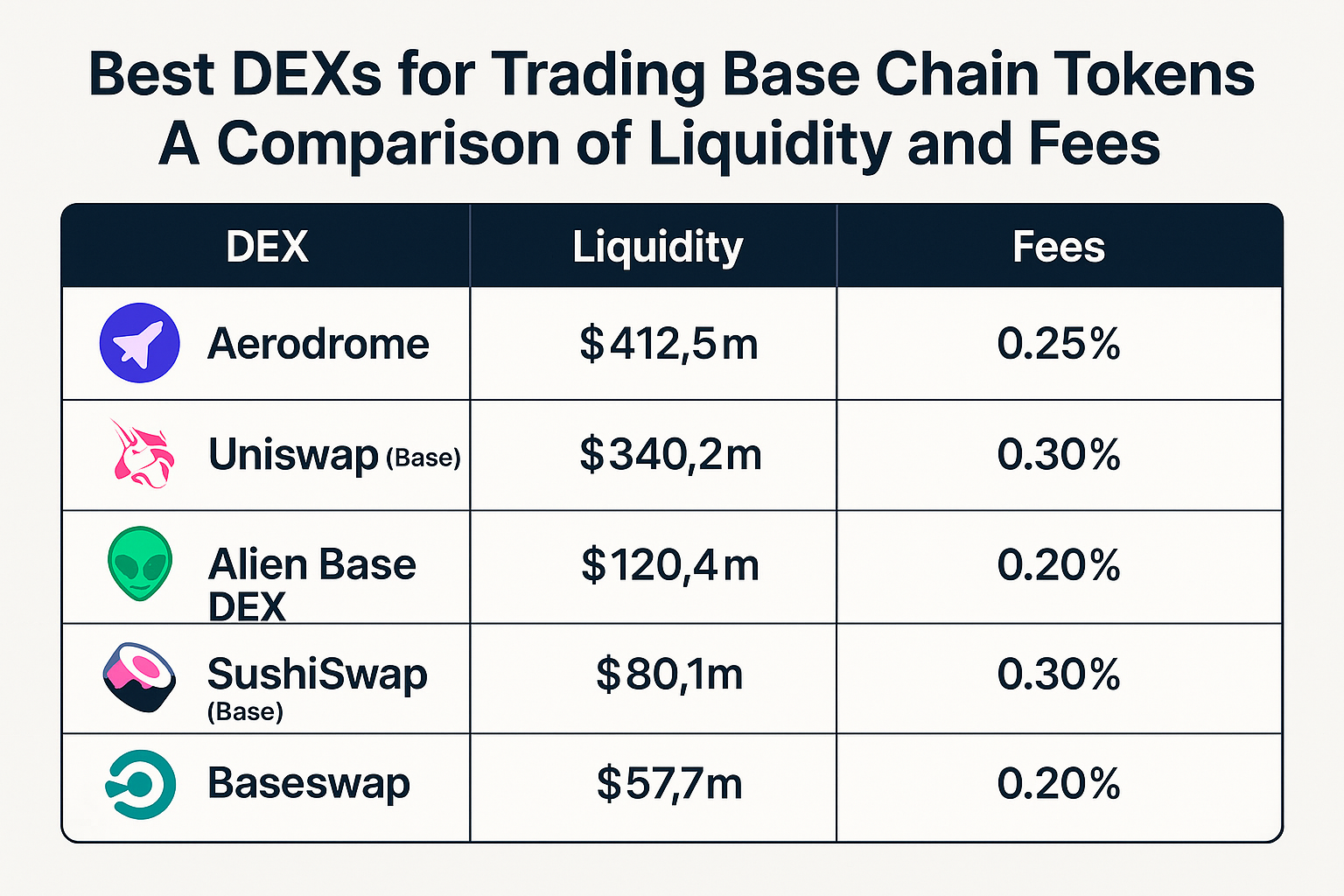

Liquidity Showdown: Where Are the Deepest Pools?

Let’s be real: No one likes slippage. If you’re swapping more than pocket change or chasing trending memecoins, you want a DEX with serious liquidity. Here’s how our seven stack up right now:

Comparison of Liquidity Depth and Top Traded Tokens on Base Chain DEXs

| DEX | Liquidity Depth 💧 | Top Traded Tokens |

|---|---|---|

| Aerodrome | High | ETH, USDbC, AERO |

| Uniswap (Base) | High | ETH, USDbC, DAI |

| Alien Base DEX | Moderate | ETH, USDbC, ALIEN |

| SushiSwap (Base) | Moderate | ETH, USDbC, SUSHI |

| Baseswap | Moderate | ETH, USDbC, BASE |

| PancakeSwap (Base) | Low | ETH, USDbC, CAKE |

| Balancer (Base) | Low | ETH, USDbC, BAL |

Aerodrome consistently leads in daily volume and TVL on Base—especially if you’re after hot meme tokens or large-cap swaps. CoinGecko’s live stats back this up.

Uniswap (Base) comes in close behind, offering familiar reliability and deep pools for mainstream assets.

PancakeSwap (Base), while newer to Base, is quickly gaining ground thanks to its cross-chain audience.

Meanwhile,Alien Base DEX, SushiSwap, Baseswap, and Balancer each carve out their own niche—whether that’s supporting microcaps or offering unique pool mechanics.

The Fee Factor: Who Keeps More Crypto in Your Pocket?

Nobody wants their profits eaten by high trading fees. Here’s a quick breakdown of what you’ll pay at each DEX:

Trading Fees and Incentives on Top Base DEXs

| DEX | Trading Fee (%) | Rebates/Incentives |

|---|---|---|

| Aerodrome | 0.20% | Liquidity mining rewards |

| Uniswap (Base) | 0.30% | No direct rebates |

| Alien Base DEX | 0.20% | Trading rewards, yield incentives |

| SushiSwap (Base) | 0.30% | Occasional liquidity incentives |

| Baseswap | 0.20% | Trading rewards, staking incentives |

| PancakeSwap (Base) | 0.25% | CAKE rewards for LPs |

| Balancer (Base) | 0.20%-1.00% | veBAL incentives, liquidity mining |

Spoiler: Most major DEXs on Base hover around 0.3% per swap—but some offer rebates or yield incentives that can offset costs if you’re an active trader or LP. For example,Aerodrome‘s fee rebates are a hit among power users chasing yield boosts.

Baseswap often runs special promos for early adopters.

And if you’re into creative strategies,Balancer’s dynamic fee model can sometimes snag you lower rates during off-peak hours.

But don’t just focus on headline fees—look for hidden perks. PancakeSwap (Base) and SushiSwap (Base) both serve up extra rewards for liquidity providers, which can sweeten the deal if you’re planning to stick around and farm.

Alien Base DEX is a favorite among meme degens, thanks to frequent zero-fee events and quirky community incentives. If you like your swaps with a side of alien humor, this one’s worth checking out—just be ready for some volatility in both fees and tokens!

User Experience: Which DEX Feels Like Home?

The Base network is all about speed and low gas, but each DEX brings its own flavor to the table. Uniswap (Base) wins on sheer familiarity—if you’ve used Uniswap anywhere else, you’ll feel right at home here. The interface is slick, swaps are fast, and there’s no learning curve.

Aerodrome has a dashboard that’s both powerful and surprisingly easy to navigate—even if you’re new to DeFi. Their analytics make it simple to spot trending pools or track your LP positions in real time.

Baseswap stands out for its community-driven ethos: rapid support in Discord, frequent governance polls, and an interface that feels fresh without being overwhelming. SushiSwap (Base), meanwhile, brings multi-chain synergy—if you like hopping between networks, it’s a solid pick.

If you’re all about portfolio optimization or experimenting with custom pool weights, Balancer (Base) will scratch that itch. And for those who love a little fun with their finance, PancakeSwap (Base)‘s gamified features (and the occasional NFT drop) are hard to resist.

Final Thoughts: Picking Your Perfect Base DEX

The best Base chain DEX isn’t always the one with the lowest fees or deepest pools—it’s the one that matches your trading style. Are you a memecoin hunter craving action on Alien Base DEX? A blue-chip whale sticking with Aerodrome? Or maybe a cross-chain explorer splitting trades between PancakeSwap and SushiSwap? There’s no wrong answer—just different flavors of DeFi fun.

No matter which platform you choose from this list—Aerodrome, Uniswap (Base), Alien Base DEX, SushiSwap (Base), Baseswap, PancakeSwap (Base), or Balancer (Base)—you’ll find robust liquidity and competitive fees across the board. The real edge comes from digging into each platform’s unique perks and community culture.

Which Base chain DEX do you use most often?

We’re curious to know which decentralized exchange on the Base network is your go-to for trading. Pick the DEX you use the most!

The landscape is evolving fast as more projects launch on Base. Stay nimble—and remember: always DYOR before aping into new pools or tokens!